AsiaVision/E+ via Getty Images

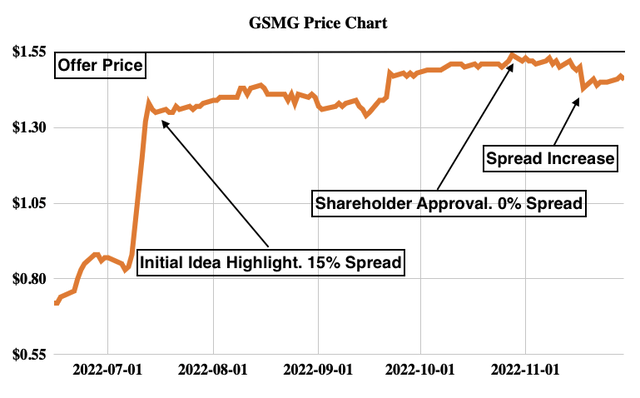

This idea attracted my attention when the spread was at 15%, and I highlighted it to Special Situation Investing subscribers. At the time of initial publication, I noted that:

I think this transaction has high chances of closing due to (1) US hedge fund rolling its 10% stake, (2) already increased offer price, and (3) a definitive agreement in place. Management is taking GSMG private at $1.55/share and hedge fund Shah Capital is rolling over its 11% stake. The offer has been raised after the initial $1.27/share bid was rejected by the conflicts committee (which I admit sounds strange for a fully controlled Chinese buyout). The transaction is expected to close in H2’22. Shareholder approval is guaranteed due to 73% ownership by the buyer’s group.

So, what happened? As expected, shareholder approval was received, the spread was eliminated and our members pocketed a 15% return in 3 months. At that point, with no other major hurdles left, this privatization seemed like a done deal.

However, recently, without any transaction-related news, the spread suddenly widened again and now stands at 5%. I’ve been surprised not only by the recent spread widening but by the fact that the market now apparently refuses to close the spread. Investors clearly got very anxious about the sudden price drop.

GSMG historical spread (Author’s calculations)

The setup is not risk-free by any means, but here are several points indicating the current spread should close:

- The buyer’s intentions seem serious. Minority shareholders are getting bought out by management, which owns 73%. The initial offer came at $1.27/share and was rejected by the special committee (sounds weird, I know). The buyers then upped it quite considerably to $1.55/share and a definitive agreement was signed.

- A definitive agreement is very important here. Historically, such Chinese privatizations with a definitive agreement signed have been closing with a very high success rate so far. Only two cases have failed over the last several years.

- GSMG’s business is a bit of a black box, and it is difficult to find reviews of their product/service or try them out for yourself. However, one US hedge fund (Shah Capital) owns 10% and has agreed to roll its take. Shah Capital runs a concentrated portfolio of around $400m and has also conducted a few activist campaigns before. The fund’s involvement and agreement to roll shares add confidence and credibility to this privatization.

- The financial performance of GSMG is unlikely to derail the deal either. Despite unfavorable macroeconomic conditions, financial performance has been pretty stable when compared to record-high 2021 results.

- Overall, are basically no hurdles left to detail the deal. There is no financing condition and the amount to buy out shareholders is quite small at $31m.

- Finally, random price swings are not uncommon in such micro-cap Chinese privatizations. For example, in another similar transaction, Gridsum Holding (GSUM), the spread also was eliminated after shareholder approval, but then suddenly widened and stayed at 6% right until the transaction closed.

Risks

The main concern here is a pretty substantial downside to pre-announcement prices – just over 40%.

The management has also been quite vague in their recent press release, which announced shareholder approval. It was stated that:

The parties to the Merger Agreement currently expect to complete the Merger as soon as practicable, subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement.

On the other hand, limited disclosures are not uncommon in Chinese privatizations either, and it seems that the only remaining conditions left are only customary.

Glory Star New Media And Privatization Background

GSMG is an ex-SPAC, with all investors having chosen to redeem funds from the trust account. The company creates traditional media through lifestyle TV shows and has expanded into social media as well as e-commerce with the launch of its Cheers app in 2018.

Initial take-private discussions took place in January 2022. In March, a non-binding $1.27/offer was made. After a lengthy review and subsequent rejection by the special committee, the offer was raised higher a few times. The last increase was to the current $1.55/share price.

Conclusion

It seems that GSMG arb is in play again. Despite the fact that the transaction looks like a done deal, the spread has recently increased, providing investors with another arbitrage opportunity here. With the expected deal closing in about a month, the IRR is worth consideration.

Highest conviction ideas for Premium subscribers first

Thanks for reading my article. Make sure to also check out my premium service – Special Situation Investing. Now is a perfect time to join – with today’s high equity market volatility, there is an abundance of lucrative event-driven opportunities to capitalize on. So far our strategy has generated 30-50% returns annually. We expect the same going forward.

SIGN UP NOW and receive instant access to my highest conviction investment ideas + premium weekly newsletter.

Be the first to comment