Becart/E+ via Getty Images

“Everything old is new again.”Many stock market commentators and investors are upset about recent declines and poor performance this year. For instance, the S&P 500 Index (not including reinvested dividends) is down 8.6% since the beginning of the year.

Those negative returns, combined with COVID, rising interest rates, political unrest, supply chain disruptions, a slowing Chinese economy and potential international conflicts have caused many commentators and investors to predict a major stock market correction (a greater than 20% decline or “Bear” market). I will go further than that; a 20% or greater decline is definitely going to occur.

Usually, I never predict the stock market. So why am I comfortable predicting a major decline?

Historically, stock market corrections are always coming. There has never been a time when a market correction wasn’t in our future. It is easy to predict a decline – it is very hard to predict when the decline will occur. This year may be the beginning of a market crash or just a temporary blip. But the market crash will come.

Well, if a decline is coming, why stay invested in the stock market?

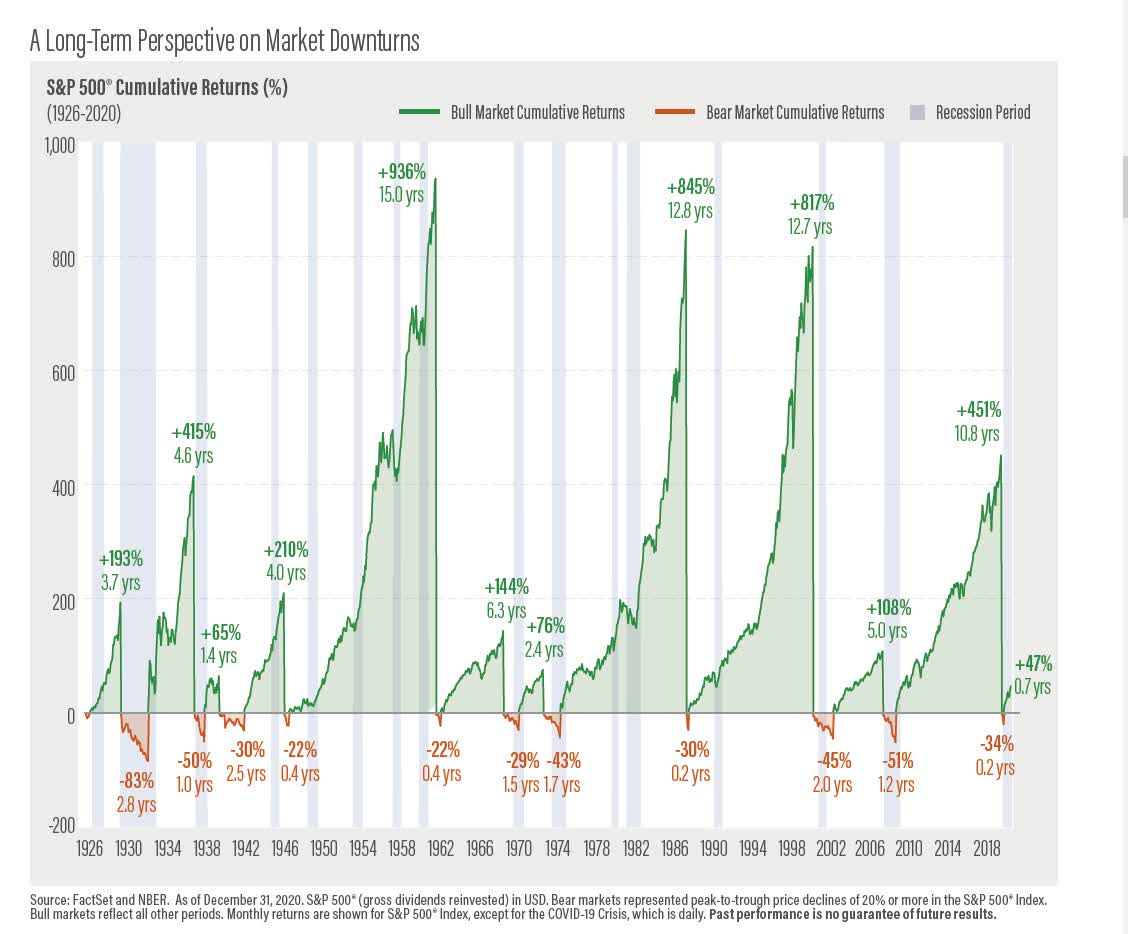

Investors need to take into account not just declines but also advances and long-term returns. Looking at the subsequent recoveries reveals that the average recovery increases in proportion to the decline that preceded it. Over long periods, investors who stayed invested and took the losses were compensated by increases in the value of their stock market investments.

A Long-Term Perspective On Market Downturns Author

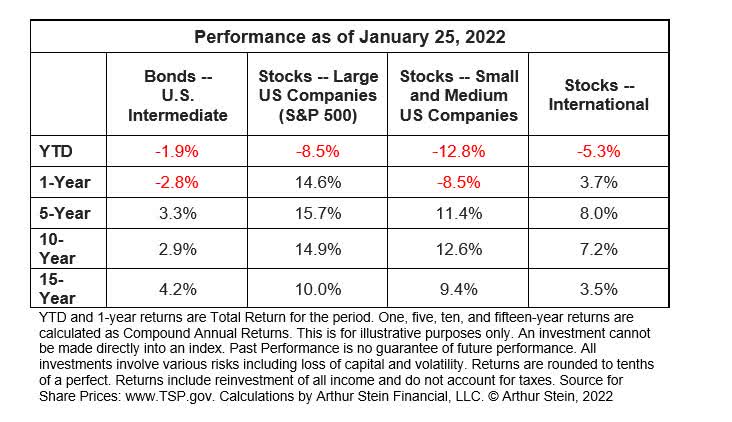

Even the current declines may not be as bad as portrayed. Despite this year’s decline, investors in S&P 500 index funds saw their investments increase 15% over the last 12 months.

The last 15 years included the greatest stock market decline since the Great Depression. Yet, the markets still showed solid gains for long-term investors. The average annual return for S&P 500 Index Funds over the last 15 years was 10% per year. Bonds returns over the last 15 years were in the 4% range.

Stocks And Bonds Performance As Of January 25, 2022 Author

It is important to note that past performance is no guarantee of future performance. This information is not a complete summary or statement of all available data necessary for making any decisions and does not constitute a recommendation.

Stock market volatility (the constant increases and decreases) is not a risk; it is a certainty. There will always be volatility, often by large amounts.

Trying to profit by selling stocks before market declines and then buying after they declined produces more losers than winners. Investors who try to buy before a market advance or sell before a decline are called “market-timers.” Those content to stay fully invested are “buy-and-hold” investors.

Buy-and-hold investors usually outperform market timers. Market timers don’t know in advance what day the stock market will peak or hit bottom. Those dates are only known afterward. If someone does sell at the peak or buy at the bottom, it is usually luck – not skill.

Market timers often sell before or after the market peaks, missing some part of the gain. They buy back before the market bottoms or after the market begins recovering, incurring some part of the market loss. Frequently, they never reinvest in stocks.

Market timing causes other problems. Being out of the market also means missing dividend payments. At today’s prices, an S&P 500 Index Fund pays dividends equal to 1.2 percent of its value, a 1.2 percent “dividend yield.” A market timer’s investment could be in a money market fund earning less than 1 percent. The buy-and-hold investor continues to benefit from dividends, which don’t automatically decline because of declines in stock prices.

Finally, market timers are incurring expenses to buy and sell. In taxable accounts, they pay taxes on their gains. Buy-and-hold investors don’t incur expenses and don’t pay capital gains taxes until sales are made.

Historically, stock investors did not need to buy and sell to make a profit. They only needed to buy and hold a well-diversified portfolio for a sufficient period of time.

Notes:

This is for educational purposes only. To learn more about the topics mentioned and if they are suitable for you, consult an appropriate professional. Tax laws can change at any time.

Any information provided in this presentation has been prepared from sources believed to be reliable, but is not guaranteed and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for information purposes only and does not constitute a recommendation.

Keep in mind that:

- Past performance is no guarantee of future performance;

- Investments involve the risk of loss of principal and earnings;

- Stocks, ETFs, mutual funds, etc. are not guaranteed in any way by the US Government, the FDIC, a bank or anyone else.

- “Average annual return” evens out variations in the actual year-to-year returns.

- ETFs, mutual funds and individual stocks and bonds fluctuate in value and there will always be times when they lose value.

- None of the information provided by Arthur Stein is necessarily relevant to anyone’s particular situation. Situations differ among individuals and you should not assume that these generalizations or information applies to you.

- Investments mentioned may not be suitable for all investors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment