Drs Producoes/E+ via Getty Images

My bullishness of SoFi (NASDAQ:SOFI) is underlined by two facts. Firstly, SoFi is cheap. This is on the basis of its current low forward price to sales multiple of 3.8x despite forecasted compound annual revenue growth for the next three years up until fiscal 2025 set to be at least 34%. This isn’t a mature firm faced with anemic or sub-zero year-over-year growth rates but a fast-growing fintech company that just etched growth of 50% for its most recently reported quarter with membership growth of nearly 70%.

The second fact is that SoFi holds a dominant position in the market for refinancing student loans. This has long been held back by the now lifted student loan repayments moratorium. Whilst SoFi is more than just a student loan refinancing company, the impact of the commencement of long paused loan repayments will be multifaceted, but will critically centre around supercharging SoFi’s flywheel and helping grow the company’s membership. To put this another way, the pause entirely dissuaded millions of students from refinancing their loans over the two and a half years since its implementation. As SoFi has a leading position in this market, its membership growth has been constrained. The current membership of 4.3 million would be much higher had the moratorium not been implemented.

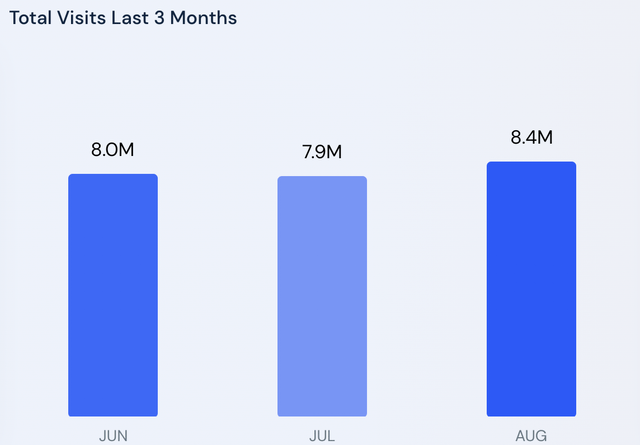

The impact of a return to normality was highlighted by the 5.7% month-over-month increase in visits to Sofi.com in August as some students move to get ahead of the loan repayments restart.

Similarweb

This is clearly the time for the company to put the accelerator on new marketing spend which management commenced with a new campaign featuring the Los Angeles Chargers quarterback. Overall, a previously core part of SoFi is coming back and will form a momentous catalyst. The moratorium has been in place for a long time. The US has since had two presidents, the pandemic has come and gone with stay-at-home orders now a faraway memory, and inflation has risen to multi-decade highs. The potential sheer volume of new users to the platform will drive a material uptake of products. This will include its banking service which brings in cheap retail deposits and helps differentiate SoFi from other fintech competition.

Bears would be right to state that there are a lot of other players in the space and that the forgiveness of up to $20,000 for some students will reduce the total volume of loans that will be refinanced.

Clear Pathway To 10 Million Members Opens Up

The comparison to a chain of fast-casual restaurants might seem strange. Chipotle (CMG) is a highly dominant company in its niche that went through a near existential reckoning that forced management to constantly innovate to prevent a forever slide into the abyss. SoFi’s largest and most dominant business function was turned into political theatre. The moratorium reality has still seen continued revenue growth on the back of new businesses and operational wins that have transformed the makeup of the business. The 2020 acquisition of Galileo was followed up two years later by the acquisition of Technisys with a banking license in tow.

| Year | Members | YoY % Growth |

| 2021 (Ac) | 3,460,000 | 87% |

| 2022 (Est) | 5,000,000 | 44.5% |

| 2023 (Est) | 7,100,000 | 42% |

| 2024 (Est) | 10,082,000 | 42% |

These estimates are not cognizant of the potential impact the end of the student loan moratorium will have. I’d assume that as a base minimum it would see year-over-year growth remain at over 50% for the next three fiscal years. This contextualises the current low PS ratio. Again bears would be right to state that a recession would set back these growth rates significantly and add further headwinds to the business model. Flagging the risk posed to some of their lending segments from higher interest rates would also be apt. The company has a diverse set of businesses some of which do well in a low rate environment, but some of which equally outperform in a high rate environment.

Down But Certainly Not Out

Softbank is also close, if not entirely done with offloading its stake in SoFi, the adoption of digital financial services continues to rise in the US, and sentiment seems to have reached a floor. I continue to be bullish on SoFi and have expanded my targeted full position with continued purchases in the $5 to $7 range.

Whilst cliche, the old adage to buy when there is blood on the streets rings true here. SoFi’s long-term future looks bright as continued membership growth and a low PS multiple drives up the propensity for significant alpha in the years following the end of the current inflation-induced malaise. Current investor sentiment has gone down too much, not just against historical multiples for nearly profitable companies growing at 50% year-over-year but against expected future growth. This will return at some point in the future, I’m just not sure whether that is in 2023 or beyond.

Be the first to comment