Justin Sullivan

SoFi Technologies (NASDAQ:SOFI) is one of retail investors’ favorite stocks. On the face of it, I can see the attraction, SoFi is seen as a real potential disruptor in financial services. Investors can clearly visualize a user-friendly super app that provides all types of banking services efficiently, and at a low cost with a digital acquisition channel.

I was also caught up in the promise and have acquired a small position. This is my usual playbook when I invest, I start with a small position that forces me to track the company’s performance and when I have the sufficient conviction I may size the position appropriately.

With SoFi, it is also very clear that the bull narrative is quite persuasive and powerful. There are plenty of ultra-bullish articles published on SA every month, but not so many bearish ones even though the share price declined by over 70% this year.

The fact is that SoFi in the last few quarters has shifted its business model and has predominantly become an unsecured personal lender. The one-stop-shop or super-app innovative bank is perhaps the long-term vision, I get it – but what Mr. Market is seeing right now is essentially an unsecured personal lending business that is leaning heavily on unsecured credit just as the economy is likely entering a recession. This is the reason why the share price has been under pressure.

Read across from the large U.S. banks

The recent Goldman Sachs Financial Services conference has given some insights as to what the big boys of banking are seeing and expecting in 2023.

JPMorgan’s (JPM) Marianne Lake the Co-CEO of Consumer & Community Banking remarked:

With that, updating our outlook for unemployment has unemployment moving higher in ’23, peaking in ’24 at or slightly above 5%, which in the context of any kind of stress or in the context of history is like really quite modest. So a shallow and short-lived recession at the end of next year, again, with all of the caveats around that.

JP Morgan CEO Jamie Dimon added in a recent CNBC interview that “Inflation is eroding everything I just said…..it may very well derail the economy and cause a mild or hard recession that people worry about.”

Bank of America (BAC) CEO, Brian Moynihan, had the following to say:

our team, your competitors, our research team, has basically got 3/4 of negative growth in the first part of next year, but mild, 1%, 2%, 1.5%, which means next year overall is negative, but then they have come back out positive 1% plus in the fourth quarter. So plus it really like a mild recession. So that’s the base case assumption…..But right now, the reserve we set in the third quarter, weighted average unemployment for 2023, 5% plus….

So in summary, the large banks are seeing a base case of a mild recession in 2023, an increase of unemployment to 5+ percent but with a possibility of a more adverse scenario.

In spite of carrying high levels of loan provisions, being very profitable (ROE ~ mid to high teens) and diversified, having the cheap cost of funds, and benefiting greatly from rising rates – even so, these large banks’ stocks are being sold off.

SoFi and Loan Losses In A Recession

SoFi, on the other hand, is in a much more challenging position:

1) SoFi does not carry any reserves for loan losses in its personal lending portfolio as I explained in a previous article. This is due to the accounting treatment of Held For Sale (“HFS”) which means that it is not required to reserve under the life expected losses model (aka “CECL”). This is different from how its peers (including LendingClub (LC)) account for their portfolio. Now you may ask, what is the benefit to designate the loans as HFS? well, it is about the deferral of the recognition of the provision for accounting purposes, so a timing difference only. This means that any loan losses will get reflected later on in the capital and earnings of the firm compared with the large banks and peers (such as LC) which are booked on day 1.

2) SoFi is currently not profitable on a GAAP basis. This means there is no offsetting income or profits to absorb any material losses should they arise. So in a nutshell, my concern is that even in a mild recession, SoFi will book higher losses and deplete its capital. Based on a coverage ratio of 7% to 8%, where most other banks reserve their loan portfolio currently (the best comparable is LC), SoFi is short approximately $500m. If a recession plays out, these losses may be higher and manifest quite rapidly, perhaps over several quarters and consequently depleting its capital resources.

Capital position is key in banking

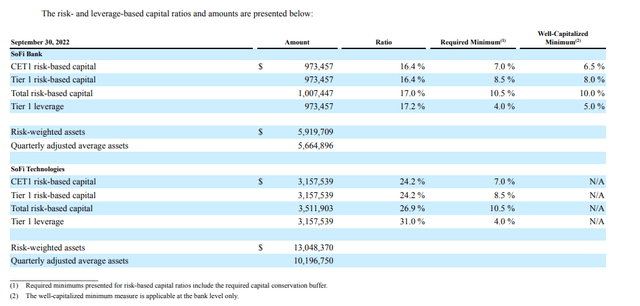

It is important to consider the capital position of the entity as per SoFi’s latest 10-Q:

SOFI Investor Relations

As you can see, if SoFi needs to book a provision of ~$500 million, it will be in breach of its capital ratios given that its total allocated capital resources are only $973m and thus will need to recapitalize the banking subsidiary. So, the incentive is clearly there for SoFi not to recognize these as HFI and continue to sell these prior to maturity.

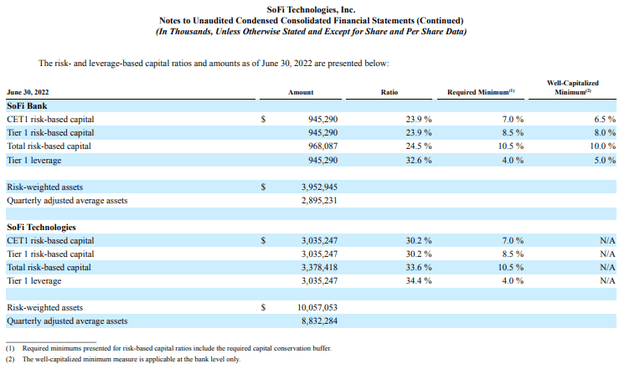

Even if you look back recently at the Q2 capital position (see attached below), SoFi’s regulatory capital ratios declined materially sequentially, whereas Tier 1 leverage ratio has almost halved quarter on quarter. This is in large part due to the ramping up of the balance sheet with personal loans but that pace does not look sustainable at all. This begs the question though, where will growth come from in the near term if it becomes capital constrained?

SoFi Investor Relations

Given SoFi is loss-making on a GAAP basis, it is likely to deplete its capital resources in the banking subsidiary rapidly and thus require to be recapitalized from elsewhere. There is no clarity on how much spare capital capacity SoFi has that can be redeployed. Regulators will certainly get involved. So in short, if we were to experience a recession in 2023 that is coupled with higher unemployment, SoFi’s capital position is likely to come under pressure. LC as an example has agreed to maintain a capital ratio minimum of 11%. I expect regulators to focus on SoFi capital requirements and increase these sooner or later, as their business model substantially evolved now to a riskier profile.

In my view, it does not make sense for SoFi management to accumulate risk rapidly on the balance sheet in this part of the cycle especially given macro uncertainties. This is not how prudent banks typically operate or should operate. Others like LendingClub are taking a more cautious approach to credit risk.

Finally, SoFi’s credentials in assessing and managing credit losses from unsecured personal loans are completely unproven at this stage. This is unlike LC which has been doing this for 15 years and is now treading cautiously. Notably, LC has delivered credit loss outcomes that are 30% better than the industry during the pandemic through active management of loan portfolios.

The only explanation I have is that SoFi is currently reaching for growth at the expense of risk management discipline. It may work out fine if there is a soft landing, otherwise, it may end up in tears.

The 50% revenue growth question?

Many of the bulls proclaim that SoFi should be ascribed a much higher valuation trading at just above tangible book yet growing at 50% CAGR. Therefore the conclusion is that SoFi is significantly undervalued.

So where is that 50% growth coming from and is it sustainable?

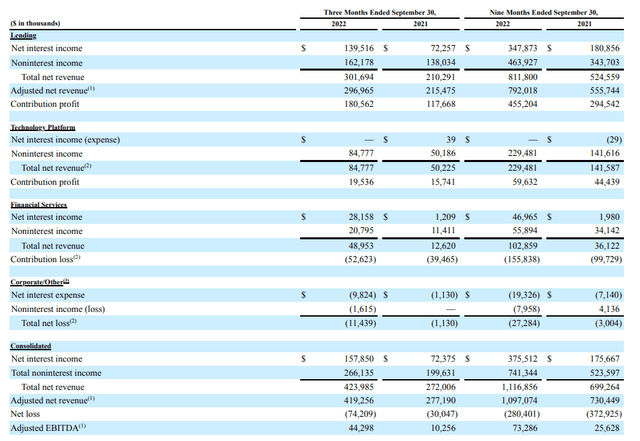

Investor Relations

A quick glance at the above will demonstrate that most of the contribution profit (there are no GAAP earnings) is coming from the Lending segment.

SoFi is now (by assets and revenue) a predominantly unsecured personal lender with EOP loans outstanding of $6.9 billion. This has also driven a large proportion of the year-on-year revenue growth, as highlighted in the 10-Q:

Loans interest income increased by $101.7 million, or 113%, primarily driven by increases in non-securitization personal loan and student loan interest income of $94.1 million (202%) and $10.0 million (43%), respectively, which were primarily a function of increases in aggregate average balances for personal loans and student loans of $2.9 billion (179%) and $1.2 billion (57%), respectively. The personal loan average balance increase was primarily attributable to higher origination volume combined with a higher weighted average interest rate earned on whole loans and longer loan holding periods.

Whereas the non-NII revenue line in the lending segment is as per the 10-Q commentary.

An increase of $43.8 million (53%) in personal loan origination and sales income, which was attributable to increases of $45.8 million related to personal loan interest rate swap positions primarily driven by increases in interest rates, and $26.9 million related to fair value adjustments primarily driven by higher origination volume in the 2022 period. These increases were partially offset by $21.8 million higher loan write offs, which were primarily attributable to a higher average loan balance and elevated charge off rates in the 2022 period

So essentially most of the growth derived by SoFi is from growth in NII due to higher personal loan balances and one-off hedging income due to interest rate movements.

This is clearly not sustainable for the following reasons:

– SoFi capital ratios would not allow it to continue growing at this clip. SoFi cannot just increase the size of the balance sheet and RWAs.

– the one-off hedging income will not recur given interest rates are no longer rising rapidly

– SoFi loan losses should increase as loans season

I am not certain where the exceptionally high growth will come from in the next few quarters. There is a limit (imposed by capital requirements) on how far SoFi can grow the balance sheet further without internally generating significant organic capital.

So what is really going on?

I think it is relatively straightforward. SoFi is under pressure to grow quickly. Given its cost structure, it has to grow really fast to justify the investment thesis. The only plausible growth option in the short term is personal loans and generating high yields by holding these on the balance sheet. There are clearly material risks with this strategy.

If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck. SoFi is predominantly an unsecured personal lender now. It is also loss-making with a very high-cost structure. The other businesses (brokerage, savings accounts, etc) are really sub-scale and won’t move the dial any time soon (and believe me, the big banks are not worried about SoFi at all, it is not even rounding error for them and they are fully aware of the flaws in the SoFi business model).

I suspect this is what Mr. Market has sniffed out and valuing it accordingly.

Student Lending

Many of the bulls highlight the growth opportunity in the Student Loans refinancing area. I am not convinced the prospects are that bright for the following reasons:

- The high-interest rates environment makes it much less attractive for student loan refinancing especially given a large proportion of loans are fixed rate

- The gross interest rate on student loans are much lower than personal loans and thus are presumably much less profitable. Hence, holding these on the balance sheet may not make sense given SoFi’s capital constraints on growth

- I cannot see the moat for SoFi in this area. Others like LC and other FinTechs can easily compete in this space if the economics are indeed compelling. I suspect not many do now, since it is not as profitable as personal lending where there is plenty of margins to derive high gains on sales or hold on the balance sheet.

Maybe I don’t get the full picture and I am sure some of the commenters will educate me on this.

Membership growth

A key metric often highlighted by the bulls is strong membership growth. the definition in the 10-Q is as follows:

We refer to our customers as “members”, which we define as someone who has a lending relationship with us through origination and/or ongoing servicing, opened a financial services account, linked an external account to our platform, or signed up for our credit score monitoring service. Once someone becomes a member, they are always considered a member unless they violate our terms of service.

This is a very wide definition of member and appears to be measured on a cumulative basis rather than an active user basis. So for example, the growth in members accelerated as SoFi generated a significant number of high-yielding deposits by paying above-market interest rates.

Many bulls also point out the growth in members compared to LC’s members’ growth. That’s clearly not an apple-to-apple comparison. LC, for example, does not include depositors in their members count.

As such, investors are reminded to exercise caution in how they interpret membership growth and always look under the hood (e.g. active users versus dormant ones). The so-called lifetime value of a personal lending member is also probably very different to someone with $50k in high-yield deposits (the latter is very easy to acquire if you pay high interest and I am pretty sure they would not subscribe to a personal loan at a 13% interest rate).

Final thoughts

I understand SoFi’s vision of a one-stop shop or super-app that is convenient to use and has the potential to disrupt traditional banking players.

However, I see significant issues with its execution, capital management, risk management, cost efficiency, and reporting of financial and non-financial metrics. I think this management team is somewhat overly promotional and reaches out for growth at the expense of risk and cost management discipline.

I listen to management’s articulation of members’ lifetime value but I am not convinced by this management’s narrative. For example, if a customer has a personal loan with an interest rate of 14%, SoFi should not want them to gamble in cryptos or the stock market. Likewise, the real value in deposits is low-cost operational deposits as opposed to paying above-market rates for high-yield savings accounts. The latter is very easy to acquire and not necessarily sticky.

Having said that, I am not necessarily a permabear and happy to be convinced otherwise. I will continue to track the stock, watch the facts on the ground and update my thesis accordingly.

Be the first to comment