Olemedia

The Artificial Intelligence (AI) industry is forecasted to grow at a rapid 20.1% compounded annual growth rate (CAGR) from $387 billion in 2022 to over $1.3 trillion by 2029. C3.ai (NYSE:AI) is a cutting-edge technology company that aims to capture economic value from this Artificial Intelligence revolution. The company was recently named a Forrester leader in AI and serves an elite list of enterprise customers. C3.ai has beaten top-line growth estimates in the recent quarter, and management has enacted a business model transition. In this post, I’m going to break down its financials and valuation, let’s dive in.

Business Model Recap

In my previous post on C3.ai, I covered its business model in more detail, here is a quick recap. C3.ai offers over 40 “turnkey” AI software packages which include the following:

- AI CRM Suite

- Reliability Suite

- Supply Chain Suite

- Sustainability Suite

- Defense and Intelligence Suite

- Financial Services Suite

- Oil and Gas Suite

- Public Sector Suite

The company also offers a “no code” AI solution (Machina) which enables the average knowledge worker to create AI solutions.

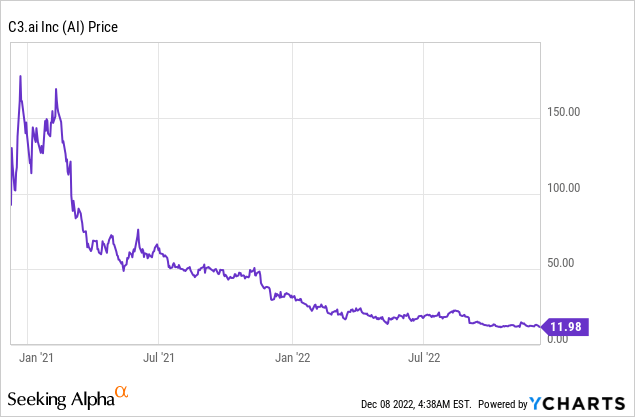

Mixed Financials

C3.ai reported mixed financial results for the second quarter of the fiscal year 2023. Revenue was $62.4 million, which increased by 7% year over year. This may not seem like a fast growth rate, and it is actually slower than the 19% growth rate reported between Q1 FY22 and Q1 FY22. However, a consolidation is this was expected as it beat analyst estimates by $1.59 million.

C3.ai Revenue (Q2 FY23 Report)

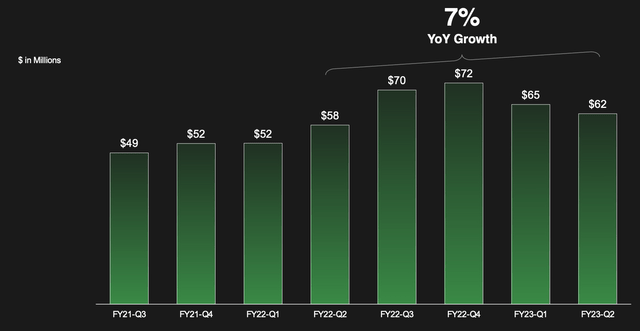

Subscription revenue increased by 26% and made up 95% of total revenue in the quarter. The number of completed contracts in the quarter increased to 25, up by a substantial 100% year over year. The company reported an average contract value [ACV] of ~$800,000, which is down substantially from the $19 million ACV in the prior year. This has been the result of the business’s new pricing model, as it switches from a subscription to a consumption-based model. This may seem like a risk, but this “pay as you use” model is the backbone of rapidly growing cloud providers such as AWS. In addition, the company has mapped out the transition to this model (as you can see on the chart below). In Phase 2 of early consumption, revenue actually dips below the subscription equivalent. In this case, we have seen a smaller number of deals, hence the lower average contract value mentioned prior. However, by phase 3 consumption accelerates as the applications are used by enterprises which enables the company to take advantage of the upside consumption.

Subscription to Consumption Model (Q2 FY23)

Management reported that the transition to the consumption-based model is now “complete”. Therefore, I expect positive results to show up in the next couple of quarters, but we may stay in the dip phase for a little time until the recessionary environment improves.

C3.ai has also reorganized its sales team with an emphasis on technical and domain expertise. The idea is that when speaking to enterprise customers, the sales team can be viewed as a helpful consultant as opposed to a pushy salesperson. We haven’t seen the full effects of this new sales team yet, and I believe it will take some time to ramp up.

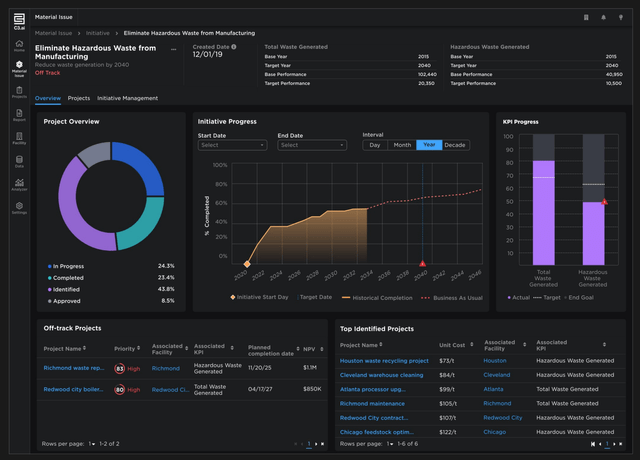

The company has also expanded its product to include an ESG (Environment, Social, Governance) platform. Ironically this has already been adopted by its existing customer oil giant Shell. The company is using C3.ai’s applications across its entire enterprise and has realized “massive” economic value.

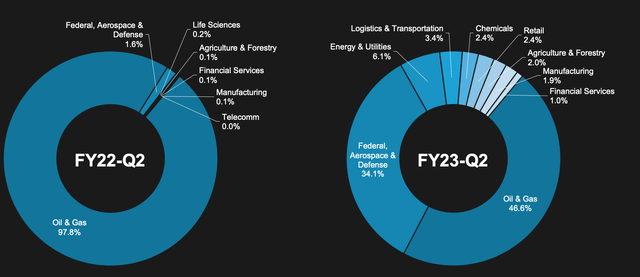

C3.ai makes a large portion of its “Bookings” (contracted revenue) from the oil & gas industry, 46.6%. Therefore, given the price of oil and highly profitable nature of oil companies in the current environment, this could be an opportune time to sell products to those target accounts. In the meantime, we can see the company has become more diversified with the Federal, Aerospace & Defense industry now making up 34.1% of total Bookings, up substantially year over year. This was driven by expansion with the U.S. Air Force, which leverages C3.ai to improve the readiness of over 3,700 aircraft. The business value proposition is simple, improve readiness rates by up to 20% and reduce the cost of maintenance by up to $4 billion per year.

Revenue by Industry Vertical (Q2 FY23 Report)

C3.ai has also expanded its business with Cargill one of the largest food corporations in the U.S.A. The company leverages C3.ai’s platforms to help optimize food production and distribution, which is a growing area of uncertainty in many parts of the world. This is due to a variety of factors from extreme weather conditions driven by global warming to the Russia-Ukraine war.

C3.ai has also gradually expanded its partner base which includes AWS, Azure, and many consultancies. Recently, the business expanded its sales and co-development partnership by three years. The two companies will work on pilot programs for Fortune 2000 companies, and leverage new technology such as Google Cloud’s Vertex AI. Despite the positive developments, C3.ai reported GAAP earnings per share (EPS) of negative $0.63 which missed analyst expectations by $0.10. A positive is non-GAAP EPS was negative $0.11 which beat analyst expectations by $0.05.

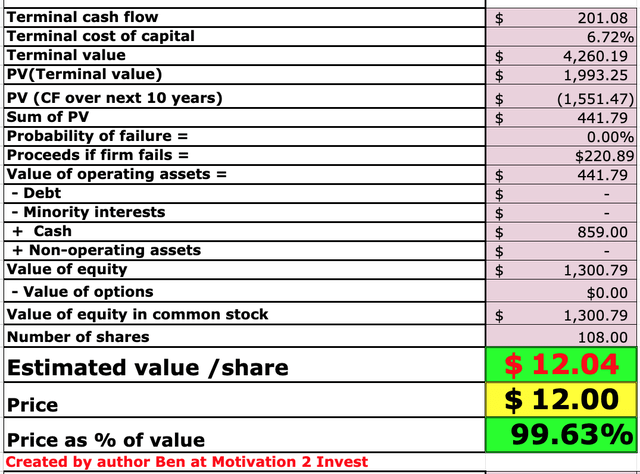

Moving forward, management has bold plans to become a “cash profitable” business with a return to its 30%+ revenue growth rate within the next 18 months. The company has a strong balance sheet with $859 million in cash and equivalents and minimal debt (~$29 million).

Advanced Valuation

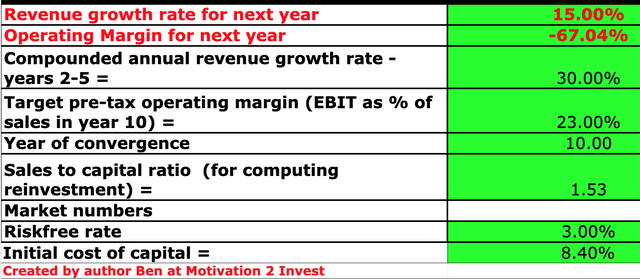

In order to value C3.ai, I have plugged the latest financial data into my discounted cash flow model. I have forecasted 15% revenue growth for next year and 30% revenue growth per year over the next 2 to 5 years. This is aligned with management’s bold estimates to return to at least a 30% growth rate.

C3.ai Stock Valuation 1 (Created by Author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted net income. In addition, I have forecasted the business will improve its operating margin to 23% over the next 10 years, which is the average of the software industry. I forecast this to be driven by continued product expansion, cross-sells, and operating leverage from its software platform.

C3.ai Stock Valuation 2 (Created by Author Ben Alaimo at Motivation 2 Invest)

Given these factors I get a fair value of $12 per share, at the time of writing the stock is trading at a similar level and thus is “fairly valued”.

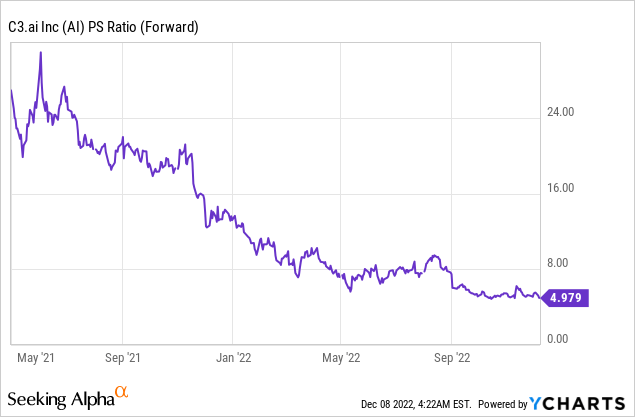

As an extra datapoint, C3.ai trades at a price-to-sales ratio = 5, which is significantly cheaper than its average since going public in 2020.

Risks

Lower Consumption/Recession

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. As the company has now switched to a consumption-based model, this could be a risk in the short term as, during tough economic times, consumption is likely to be less. We are already seeing these dynamics play out with a reduction in average contract value, and this trend could continue in the first half of next year.

Final Thoughts

C3.ai has great technology and an elite list of clients and partners. The company has continued to produce strong results despite going through a business model transition. The company is poised to benefit from the secular growth in the AI industry, and the stock is “fairly valued” at the time of writing.

Be the first to comment