Justin Sullivan

Since SoFi (NASDAQ:SOFI) reported earnings on November 1, there have been a bevy of articles on the company and stock. This article is nothing like those. A lot of those copy a couple of slides from the earnings presentation and mostly just regurgitate the numbers without providing much insight into the company’s performance. I seek to present analysis that goes beyond the numbers, explains why things are happening the way they are, and try to identify strengths, weaknesses, and risks as we get new information. I try to dive deep enough to provide real value to those who read my work.

SoFi’s Q3 earnings were the most crucial earnings they have had as a public company. That isn’t hyperbole. This quarterly earnings showed more about the company and their ability to endure through an entire cycle than any earnings that have come before. SoFi is still a young publicly traded company. It was founded in 2011, went public last year, and this is the first true downturn it has faced. Seeing how the company holds up through the downward portion of the business cycle is a real stress test of its business plan and execution. I can think of no more difficult environment for a company whose revenue and margins are so dependent on lending than three straight 75 basis point hikes from the Federal Reserve.

Author

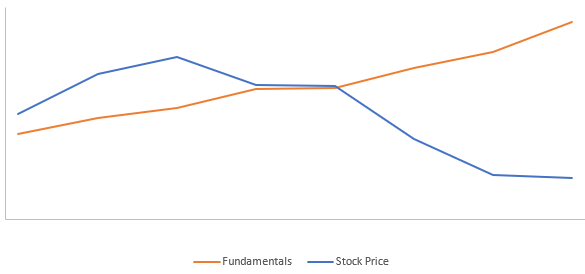

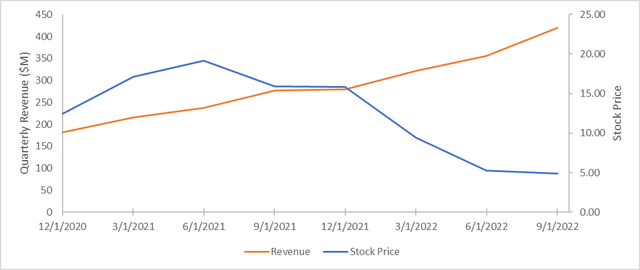

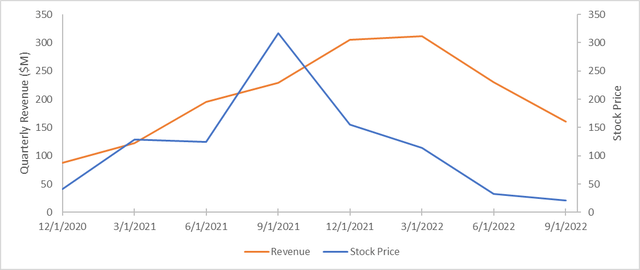

Outsized returns are made in bear markets by investing in businesses whose fundamentals continue to thrive in spite of significant headwinds and as their stock price retreats, just like the chart above. Companies who can continue to grow and execute during both boom and bust cycles are exactly the type of companies whose stocks I am looking to invest in because they will result in significant returns in the long run. I am going into each earnings season with my eyes wide open trying to find them. Let’s see if SoFi is one of them.

Lending is SoFi’s engine

I thoroughly believe that there will be a time when SoFi will have built their financial services and technology segments to rival their lending business. In fact, the technology segment is undoubtedly the part of the company with the highest upside. However, that is not SoFi’s reality right now. Lending is the engine of their business. The numbers from 3Q22 make it obvious.

|

Revenue |

Contribution Profit |

Contribution Margin |

|

|

Lending |

$296,965 |

$180,562 |

61% |

|

Technology |

$84,777 |

$19,536 |

23% |

|

Financial Services |

$48,953 |

-$52,623 |

-107% |

Personal loans lead the way

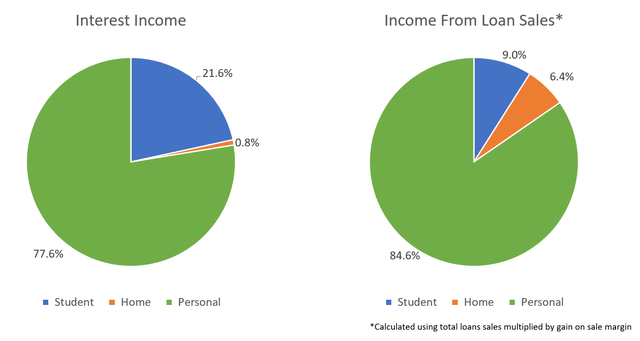

SoFi makes money on their loans in two ways. They hold the loans on their balance sheet for a while, collect interest, and then sell them. In Q3, personal loans made up more than three-quarters of interest income and even more of the noninterest income (see pie chart below). All told, this means that personal loans make up around 55% of SoFi’s revenue and an even greater portion of their bottom line. I am as excited as anyone for SoFi’s future and will be discussing their technology segment in great detail in the future, but this article is about right now, and for now and at least the next few years, lending will be their cash cow.

Breakdown of SoFi’s lending interest income and noninterest income into loan type (Author)

Fintech lenders are seeing funding dry up

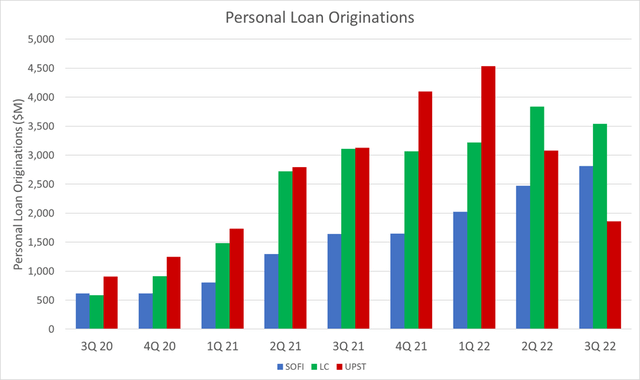

As rates rise, debt investors and capital markets, whether in the form of hedge funds, banks, or other wholesale loan buyers, demand a higher yield to accept the risk of buying debt. When their cost of capital is low they are willing to take bigger risks. As rates have increased, demand has pulled back, starting with the riskiest and proceeding up the risk chain. You can absolutely see this as you look at the risk profiles and origination volumes of other fintech lenders Upstart (UPST) and LendingClub (LC).

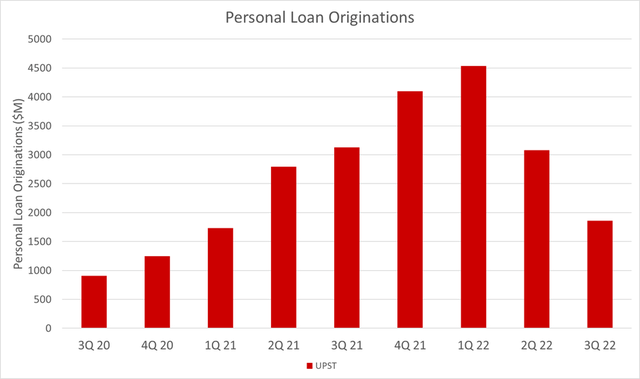

Upstart faded first

Upstart’s target market is near prime and subprime candidates who they believe are higher quality borrowers than their FICO score would indicate. They do not disclose the average FICO score of the loans they fund or refer to their partners. Upstart has two cohorts of buyers of their loans. The first is the banks and credit unions who use Upstart as the de facto credit check service for their own customers and buy some of their loans. This cohort has stayed fairly strong as rates have risen. The second cohort are the capital markets. Because of the risk profile of Upstart’s loans, the capital market demand (mostly hedge funds) dried up very quickly as rates began to rise. Originations were only positive QoQ in 1Q22 because Upstart stepped in and used their balance sheet to fund the loans. While they have continued to use their balance sheet, it hasn’t been enough and demand to buy their loans has completely collapsed. Originations plummeted 32% QoQ in 2Q22 and then dropped an additional 40% in 3Q22.

Upstart personal loan originations by quarter (Author)

LendingClub faltered next

LendingClub targets near-prime, prime, and prime plus customers who are serial users of credit. Their average customer, as of 2Q22, had an average FICO score of 730 and an average income of $113,000. In their 3Q22 earnings, the average FICO stayed at 730 and average income increased to $115,000. These are the stats on the loans that they hold for investment on their balance sheet, not for all loans originated.

LendingClub also has two cohorts for the loans. The first is themselves. LendingClub, as a bank, takes a portion of their loans (they guide for 20%-25% of total originations) and put them in their “Loans Held for Investment” (HFI) portfolio. These are loans that LendingClub intends to hold on their books through maturity. The remaining 75%-80% of the loans are sold on what they refer to as their Marketplace, which is comprised of the same type of debt investors referred to above.

In their 2Q22 earnings call, LendingClub warned that the Marketplace demand might soften as rates rise. LendingClub CEO Scott Sanborn explained, “For certain investors, their funding costs will move based on the forward curve, meaning where the fed is expected to go. These investors are seeking more yield to cover their increased costs.” Investors know that rates in the future will be higher than they are right now and some would rather wait for that higher yield to manifest before buying the loans.

This is exactly what happened. During 3Q22, marketplace originations dropped 15% from $2.82B to $2.39B, correspondingly dropping their revenue from those loans from $213.8M to $181.2M. LendingClub had some additional cash available and put 33% of total originations onto their balance sheet, which is much higher than the high end of their 20-25% guide. Despite this injection of liquidity, total originations decreased 8% QoQ. Part of the reason for the Marketplace drop is because they keep the highest quality prime and prime plus loans their HFI portfolio and sell the lower quality prime and near prime loans to investors.

LendingClub and Upstart personal originations by quarter (Author)

Macroeconomic backdrop

LendingClub’s explanation from their 3Q earnings call is important to understand the dynamics that are at play here. Most of their personal loan demand is coming from customers who are refinancing the high variable rate debt on their credit cards into a fixed rate personal loan. Their CFO, Drew Labenne, put it this way, speaking about the bps of rate movement, he said, “At this point, the Fed has moved 300. Credit cards have moved roughly 250, we’ve moved, as of today, roughly 200. So this is proceeding as we had indicated we thought it would.”

This provides context for the slowdown. Let’s look at this first from the perspective of the borrower. When the Federal Reserve moves the funds rate, banks react by increasing the APR on credit cards. Consumers are not motivated to refinance until they start to see the interest rate, balance, and payments on their credit card increase, which is usually a lag of at least one month. This increases demand for personal loans. Once demand has increased, then LendingClub can start to raise prices. Therefore, personal loan interest rate increases lag credit card interest rate increases, which lag the Fed funds rate increases.

Now look at this from the perspective of the marketplace investor. Let’s say that before any rates moved, they were getting 12% yield on the loans that they were purchasing. Their funding costs move with the forward curve. Let’s say it was 2% before the Fed starting raising rates. The spread between their cost of capital and yield is 10%, which was their profit margin.

Fast forward to today, and their cost is now 5% (the original 2% plus the 300 bps movement from the Fed), but LC has only moved their loans to 14% (the original 12% plus the 200 bps they’ve raised their coupons). That has squeezed the investor’s profit margin to 9%. Not only that, but delinquency rates are increasing fast, so they are making less money and taking on higher risk now than they were before. Overall marketplace demand will therefore remain suppressed until the spread catches up and risk goes down. Only then will demand for LendingClub’s loans return to where it used to be. Remember this discussion, it will come up again.

SoFi remains strong

Now let’s move on to SoFi. SoFi employs a slightly different model to Upstart and LendingClub. Rather than have two separate cohorts for their loans, SoFi holds all originated loans on their own balance sheet for a period of time (they guide for 6-7 months) before selling them on to debt investors. In this way, SoFi’s balance sheet acts more like a shock absorber, giving them liquidity and optionality. SoFi can absorb or release loans as needed. As CEO Anthony Noto put it in the earnings call:

We run to where the opportunity is. And in some quarters, that opportunity may be driven by being able to raise WACC. In some quarters, the opportunity would be driven by a really strong securitization market. And some quarters are going to be driven by a really strong wholesale market.

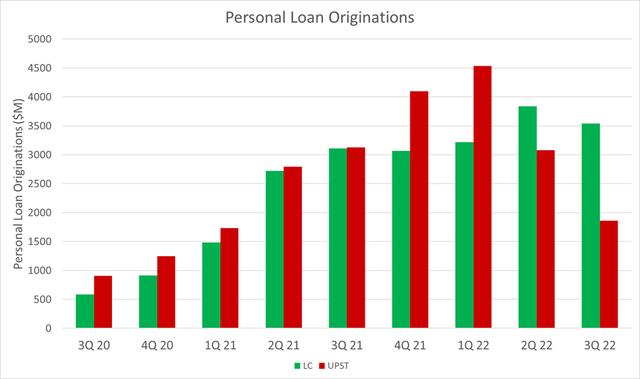

Right now, the opportunity lies in gobbling up market share of their core target demographic – high-earning, high-quality customers not well served by the current banking system. As Upstart and LendingClub are slowing originations, SoFi has continued to increase them. At this point last year, SoFi was only originating half the volume of personal loans as LendingClub and Upstart per quarter. Now they are originating 50% more than Upstart and only trail LendingClub’s originations by 20%.

SoFi, LendingClub, and Upstart personal loan originations by quarter (Author)

SoFi originated 14% more loans in 3Q22 than in 2Q22. The ability to continue to grow originations comes from three key structural advantages that SoFi displays over their competition: member growth, access to funding, and quality of borrower.

Member growth

Upstart has no ecosystem to maintain customers. Some repeat customers do return for more loans in the future, but Upstart’s product is nowhere near as sticky as LendingClub or SoFi. Upstart is signing up additional bank and credit union partners (as well as car dealers for the auto loan business) each quarter, which will help with their capital problems in the long term. Most of their loans are still sold to capital markets and the growing partnerships have not offset the loss of demand from capital markets. LendingClub meanwhile, guided for 400,000 new members in this calendar year on their 3Q22 earnings call. SoFi, by contrast, has added more than 400,000 new members each quarter for each of the last four quarters and targets 400,000+ new members per quarter moving forward.

SoFi is growing the pool of potential borrowers by significantly higher amounts than the competition. Most of these members arrive via lower customer acquisition cost channels in SoFi’s financial services sector. These products include their checking & savings, brokerage, and credit card offerings. SoFi can then cross sell a portion of these members into their much more lucrative lending business.

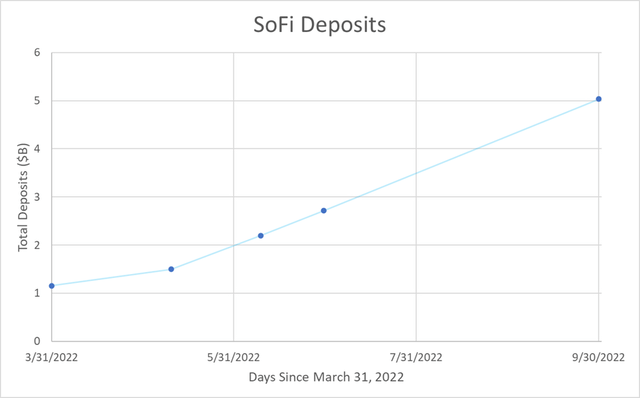

Access to funding

The other competitive advantage that SoFi’s outsized member growth gives them is access to more and lower sources of capital. After becoming a bank, SoFi has done an incredible job of growing their deposit base. This is important because as of the 3Q earnings call, loans collateralized by deposits cost 125 bps less than those drawn from warehouse facilities. While a 1.25% difference might not seem like much, their current deposits of around $5B translates that 1.25% to extra $62.5M in net interest income every quarter. After an initial ramp period, SoFi has steadily grown deposits by about $170M per week since May of this year (see chart below). The result is that their annual projected net interest income increases by $2.1M each week, and will continue to do so until all loans held on the books are fully collateralized by deposits.

SoFi deposit growth since becoming a bank (Author)

The increased deposits also mean a deeper source of capital to lend from. SoFi has three buckets of capital from which they can originate loans: deposits, warehouse facilities, and their own cash. Here is the quarterly breakdown of how much of their total loans can be attributed to each source (the bottom three rows sum to equal the total loans):

|

4Q21 |

1Q22 |

2Q22 |

3Q22 |

|

|

Total Loans |

$ 6,068,884 |

$ 7,222,001 |

$ 8,212,494 |

$ 11,204,403 |

|

Warehouse Facilities |

$ 2,307,358 |

$ 3,272,806 |

$ 2,078,257 |

$ 2,919,331 |

|

SoFi Capital |

$ 3,761,526 |

$ 2,793,273 |

$ 3,421,973 |

$ 3,253,442 |

|

Deposits |

$ – |

$ 1,155,922 |

$ 2,712,264 |

$ 5,031,630 |

SoFi has approximately $7B total of warehouse facilities available and another $935M in cash to draw from, meaning they still have room for about $4.5B of additional originations (keeping $500M in cash, which is about the lowest they have gone in the past) if needed. Even assuming a large slowdown in their deposit growth to only $125M per week, that would add an additional $1.5B in capacity every quarter moving forward. In the shock absorber analogy, this means there is still a lot of spring left to compress if needed. Liquidity is not an issue for now.

Borrower quality

SoFi’s borrower quality is the highest of the fintech lenders. SoFi has their own proprietary risk models that utilize machine learning to determine credit worthiness. Those models are the main determining factor in deciding to accept or deny a loan application. LendingClub and Upstart use similar models for their decision making. FICO scores still provide a good proxy for the rest of us to judge the overall risk profile of each company’s loan portfolio. Here is SoFi’s weighted average FICO since coming public, compared with LendingClub’s portfolio FICO where applicable. Upstart does not disclose FICO scores, so they are removed from this analysis, but they would undoubtedly score lowest of the three companies in my view. These are slightly different metrics as SoFi’s numbers are only for loans originated in that quarter whereas LendingClub’s numbers are averaged over their entire portfolio at the time of reporting. LendingClub only began releasing their numbers this calendar year:

|

SoFi Originated FICO |

LC HFI Portfolio FICO |

LC Servicing Portfolio FICO |

|

|

2Q21 |

754 |

n/a |

n/a |

|

3Q21 |

749 |

n/a |

n/a |

|

4Q21 |

754 |

n/a |

n/a |

|

1Q22 |

746 |

727 |

722 |

|

2Q22 |

748 |

730 |

721 |

|

3Q22 |

746 |

730 |

718 |

The quality of SoFi’s borrowers has come down slightly but remains well above the competition. I am continuing to monitor the slight downtrend in SoFi’s FICO scores to see if they are boosting originations by moving down in borrower quality.

SoFi usually sells their loans via whole loan sales, but occasionally they do securitize them in the ABS markets. Before the securitization is released for investment, third parties give it a rating based on the risk profile of the loans. SoFi’s first personal loan ABS deal of 2022 was given a AAA rating by DBRS Morningstar and American Banker just reported that Moody’s “anticipates rating the notes Aaa” and that “KBRA expects to assign ‘AAA’ ratings to the notes.” AAA is the highest possible rating. SoFi’s personal loans have been recently verified by three different third-party credit rating companies the highest quality available.

What about the macro?

SoFi participates in the same macro environment as everyone else. They are not immune to recession and the risks that come with it. This includes the risk of higher delinquencies on their loans. Delinquencies on their loans that go beyond 120 days get immediately written off as losses that weigh on revenue and earnings. Offering loans to high-quality borrowers insulates them from a lot of the macro headwinds, but does not guarantee they will come through unscathed.

With that in mind, let me share what I consider the most important development in the third quarter. SoFi discloses the weighted average interest rate earned in each quarter for each type of loan they hold (student, personal, and home). The weighted average interest earned from personal loans went from 11.62% to 12.22% from 2Q to 3Q, an increase of 60 bps. They benefited from a 25 bps improvement from the spread between their deposits and their warehouse facilities (in Q2, they were only saving 100 bps by using deposits as collateral instead of warehouse facilities, but that increased to 125 bps in Q3). That leaves 35 bps in improvement just from raising the rates they are charging for their loans.

Remember the discussion above about why LendingClub is struggling in their marketplace? LendingClub’s rate increases lag the macro shifts by months. With these lower prices for borrowers, investor demand was weak and their originations decreased 8% QoQ. SoFi, on the other hand, is frontrunning the federal funds rate. They are raising their rates before their customers are seeing increased credit card interest rates while simultaneously continuing origination growth. SoFi is simultaneously:

- Increasing their margins even faster than the fed is moving rates

- Maintaining excess demand to grow originations 14% QoQ

- Keeping a higher quality borrower than the competition

That is called pricing power, and SoFi has proven it has pricing power during three straight 75 bps hikes from the Federal reserve. There is probably no harder environment you can imagine to have pulled this off, and yet they just did. And this is not just a one-off event, as weighted average interest income expanded 60 bps between Q1 and Q2 as well. In the fastest rate hike cycle that has ever happened, SoFi is flexing on the competition and improving margins. That is an incredible validation of both their business model and their execution.

Risks

There are two risks that need to be discussed. First, there is a real risk that delinquencies will rise, resulting in a material hit to the top and bottom line through charge-offs. SoFi’s borrowers are high earners, but that doesn’t make them immune from being laid off or putting their money into the FTX crypto exchange for a guaranteed 8% yield that blows up in their face. Second, if debt markets really seize up and SoFi cannot sell their loans, they will not have liquidity to continue to originate new loans. This will result in decreases in the fair market value of their loans, decrease their noninterest revenue because they’ll have to drop prices to sell them, and the loss of liquidity would mean less originations. Any or all of those things would be detrimental to the company.

Delinquency and charge-offs

SoFi’s delinquency rates are outperforming the market at large (LendingClub’s are as well I might add). In their 3Q earnings call, Upstart said, “highly affluent borrowers are now roughly back to being in line with pre-COVID impairment levels, although they continue to be on the rise.” One would expect, therefore, for SoFi’s loans to be roughly in line with pre-pandemic levels. However, as reported in their earnings call by CFO Chris Lapointe, “Our on-balance sheet delinquency rates and charge-off rates remain healthy and are still below pre-COVID levels.” Both delinquencies and charge-offs are ticking up, which is to be expected, but if they can remain at or below pre-pandemic levels until rates peak, that would be a huge win for SoFi. This is absolutely something to keep an eye on, but for now it remains a strength.

Demand destruction and decreasing gain on sale margin

The biggest risk, in my opinion, to SoFi’s lending portfolio is a dislocation between perceived present fair value and future actual value of their current assets. Any long tail event that causes demand destruction across the whole loan sales channels and ABS markets could result in a lack of liquidity or lack of appetite for perceived risky assets such as unsecured personal loans. Again, SoFi is insulated from this by their high-quality borrowers, but they are not immune.

This would result in them having to drop the prices they charge to sell their loans. Noninterest income is primarily from selling loans, changes in fair market values, and performances of SoFi’s hedging strategy. Noninterest income accounts for a good portion of their lending revenue and will only increase as a fraction of revenue over the next few quarters. SoFi is getting back to neutral on their holding periods which have been extended after receiving the bank charter. The hedges are a deep topic that I will save for another time, but fair market value and gain on sale margin (GOSM) still rely on liquidity and demand for their loans.

GOSM is the amount they make when they sell the loan. If they sell $100M of loans at a 4.5% GOSM, that means they make $4.5M of noninterest revenue from the sale. The fact that SoFi is frontrunning interest rates is good news because it makes their loans more palatable to investors who move based on “the forward curve” as LendingClub put it.

That would be manifested by maintained GOSM. The data suggest that there might be some weakness in demand. In both Q1 and Q2, personal loan GOSM was 4.5%. However, in 3Q, it decreased to 4%. This might be the first manifestation of softness in demand for their loans. The good news is that the bulk of the large rate hikes are almost assuredly behind us, and as the pace of the rate hikes eases, debt markets ought to normalize. I would like to see at least one more quarter to determine if the drop from 4.5% to 4% is just a one-off event or more indicative of a wider trend. Nevertheless, it is something that I will be watching closely.

Conclusion

At the beginning of the article, I shared a graph of the type of company that I want to invest in during a bear market. That graph is SoFi’s quarterly revenue and its close-of-quarter share price. Yes, I know that is a very unconventional way to show share price and doesn’t account for all the peaks and valleys, but I couldn’t make it too easy to guess. Here is that same graph again, only with properly labeled axes:

SoFi revenue vs SOFI stock price (Author)

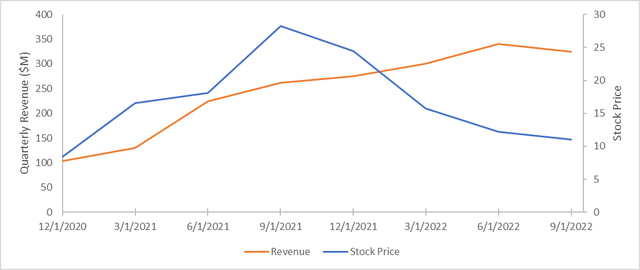

For comparison, here is the same graph of quarterly revenue compared with close-of-quarter share price for LendingClub and Upstart.

LendingClub revenue vs LC stock price (Author) Upstart revenue vs UPST stock price (Author)

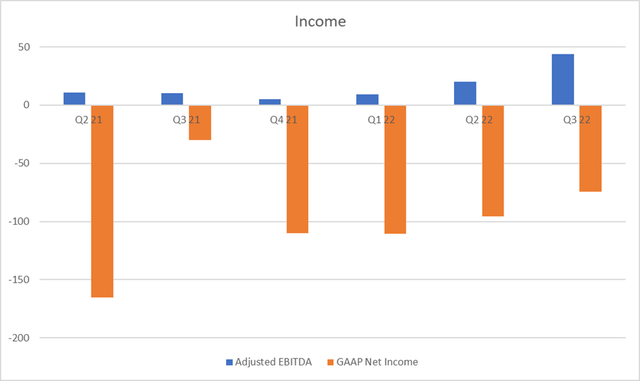

It isn’t just SoFi’s revenue that is improving. Their policy is to drop 30% of incremental revenues to the bottom line while reinvesting the other 70% back into the business. Now that revenue growth is outpacing fixed and operating costs, adjusted EBITDA is really starting to ramp and GAAP net income, while still negative, is consistently improving. Analysts project the first quarter of GAAP profitability occur in 3Q23. My own projections agree. The 3Q21 GAAP net income can be ignored as an outlier. That particular quarter was severely affected by changes in fair market value of warrants (a.k.a. SPAC nonsense).

SoFi adjusted EBITDA and GAAP net income (Author)

Lending is SoFi’s financial foundation for the time being. It provides the revenue that funds the financial services hypergrowth and the technology platform’s R&D. The financial services segment then feeds SoFi’s lending business new low-acquisition cost members to reinforce the virtuous cycle. Lending is a typically a cyclical industry, but SoFi’s focus on member growth, robust access to capital, high-quality borrowers, and their excellent execution have led to them growing through the down cycle and distinguishing themselves as the most robust fintech lender in the current rising rate environment.

If the business maintains momentum through the down portion of the credit cycle, it positions both the business and stock to come flying out of the gates with incredible results when the inevitable up cycle comes again. If the student loan payment moratorium ends at the end of the year as currently planned, increased student loan originations through refinancing will add significant acceleration to both revenue and income growth. While I am keeping an eye on the risks mentioned in the article, most of the evidence I’ve laid out points to the company continuing to outperform and outgrow the competition. I will continue to DCA in my own personal portfolio and rate the stock a strong buy.

Be the first to comment