David Ramos

Introduction

Recently I read an article about Sony Group Corporation (NYSE:SONY) (sorry for not remembering where I read it). This article did make me realize that Sony is a company that always feels a bit more distant in some way while making many different products for many different industries.

Sony is a huge company with a lot of history and high-tech technology and is a leader in innovation. The company is probably most known for its PlayStation game console, which is the most popular console in the world. Other parts you might know of Sony is that it also builds other hardware such as TVs and music equipment, and you might also know its pictures studio, which is known for the Spiderman films and many more. Yet, Sony does so much more, which seems to be ignored by the market.

I can tell you: Sony does not look expensive judged by its multiples. It seems to be seen as some Asian company by many, while it is Japanese, and I am very sorry to break it to you… but the Japanese are probably the most innovative. Most American companies still use car-building and organization techniques invented by Toyota (TM), and Japan remains the front-runner in robotics. A lot of people will probably not like this, but the Optimus robot Tesla (TSLA) presented most recently really is a joke compared to what they are already capable of in Japan (sorry, Tesla fanboys). Now, I am not here to sell you the Japanese, but to take a deep dive into Sony to see what this underrated company is all about.

In this article, I will provide a deep dive into Sony, including its fundamentals, future innovations, current products, growth possibilities, and risks. At this point, the outcome of this article is as much a surprise to me as it will be for you, the reader. I currently do not have any position in Sony.

This is a deep dive into Sony from top to bottom, so let’s get on with it.

(Sony reports in Japanese Yen, but I will use dollars to make it easier to understand.)

Sony

We’ll start with an overview of Sony Group Corporation. Or, well, Sony probably does not need an introduction. The examples I named in the introduction above are probably well-known to many people. I can’t imagine people not being familiar with the PlayStation, Sony TVs, Sony earphones (one of the best), Sony Pictures (Spiderman, Uncharted), etc. Sony creates many technological products we use in our daily lives.

Sony is a Japanese multinational corporation with its headquarters in Tokyo, Japan. As illustrated above, Sony is one of the largest manufacturers of consumer electronic products, the largest video game console maker, one of the largest music companies (largest music publisher and second-largest record label), and the third largest film studio. This might give you an idea of the moat that Sony has all around the world.

Funny thing is that I only just realized I did not once mention the camera products of Sony. It is the second-largest camera manufacturer and arguably sells some of the best on the market today.

Sony does not just build cameras, but they have a 55% market share in the image sensor market. It is a huge and promising market, which we will get into more detail later on.

To summarize the above, Sony does pretty much anything you can think of in the technology product segment, and on top of that, it has the number one or two position in about all of its businesses.

Now that we have an idea of the general overview of Sony, all the different products it manufactures, and just how strong it is, it is time to dive deeper. I feel that as an investor in any company you should be able to completely understand the business from top to bottom or don’t even think of investing at all.

An investor’s deep dive

Sony has six business segments. Sony is continuously investing in all these segments in order to support growth and this is proven by the fact that Sony has invested over $7 billion in strategic investments into three of its segments – Game & Network Services, Music, and Pictures – over the last three years. Growth in these three segments will play a vital role in expanding the Sony business as these three segments crossed the 50% of total revenue mark in FY21. The three segments accounted for two-thirds of operating income. Now let’s have a look at all the different segments in which Sony operates:

Game & Network services (G&NS)

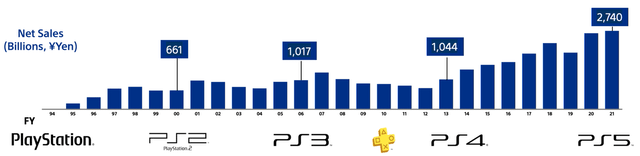

This segment includes all of Sony’s gaming activities and is run by Sony Interactive Entertainment. This segment is responsible for manufacturing and selling all products related to the PlayStation console and accessories, but also games, collaborations, and network services. This segment reported a record revenue of $19.39 billion in FY21. Sony is working hard on expanding production for this segment as it is still not able to satisfy all demand for its flagship PS5. I can confirm this because I am still not able to order a PS5 anywhere in the Netherlands.

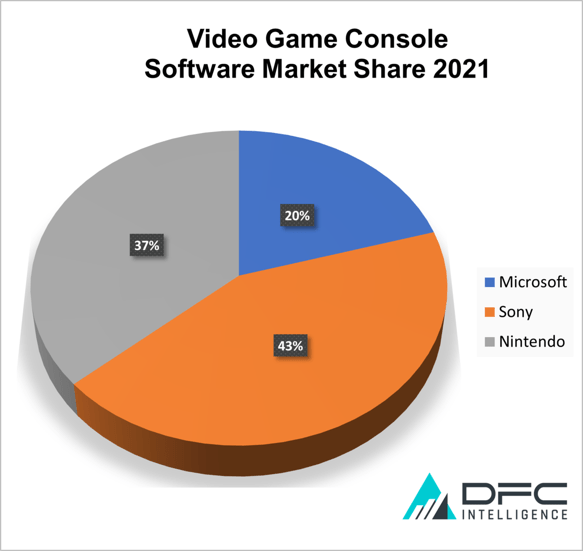

That the PlayStation is still a huge part of business for Sony is no surprise, as the gaming console is by far the leading console in the gaming market with a 43% market share. The PlayStation Network has over 100 million active users every month.

DFC Intelligence

We should also not forget that Sony has some very strong-selling games under its umbrella with Uncharted, Spiderman, Miles Morales, and The Last of Us. The segment is the largest by revenue for Sony and a very fast-growing one as well.

Music

I don’t think the music segment needs much explaining, as the name pretty much says it all. Sony is one of the largest players in the music industry, and I, for one, had no idea Sony was active in this industry. I just turn on my Spotify and listen, but the music industry is a huge one. The music industry has been growing ever since 2014 for Sony, mostly thanks to the expansion of streaming services. Sony is expanding quickly, within this segment by doing loads of M&A:

In addition to enhancing services for independent labels through The Orchard, we are offering more support to independent artists via AWAL, which we acquired in May 2021. To strengthen relationships with artists in specific regions, we acquired Som Livre of Brazil in March 2022, started a new label in India, and are investing in artists in Africa.

Just this year, Sony also acquired the whole catalogs of both Bob Dylan and Bruce Springsteen. Now, it is of course important to know how Sony makes its money from being a music producer and publisher; Sony makes profits from Album sales and does this mostly through digital sales to limit manufacturing costs. Every time a song is played on Spotify, Sony receives compensation for this and then pays a part of this compensation to the artist. In addition to this, Spotify (as an example) pays a large amount to acquire this album on their streaming service in the first place.

Pictures

Sony Pictures is one of the largest film studios in the world. It has an incredible content library with movies and series such as all Spiderman movies, Venom, Ghostbusters, Uncharted, and The Good Doctor. Sony Pictures is a leading independent studio that also makes lots of TV shows with 37 primetime Emmy nominations and 12 wins in 2021 alone.

One of the largest growth drivers might be Anime content, where Sony pictures is also a huge player. This market is expected to grow at an 8.8% CAGR through 2027 and will reach a market size of $43.7 billion.

Of course, Sony Pictures is working in a very competitive landscape nowadays, with more and more streaming giants working on their own content. This will put pressure on Sony as they do not have their own streaming service and earn most revenues from movie theatres and selling their rights to streaming services. Sony does still have a competitive advantage as they are already a huge player in the industry with a great number of blockbuster movie title rights and productions. Sony has a huge budget and a lot of internal collaboration options as shown by the recently released Uncharted movie, based on the Uncharted game from Sony. I do believe Sony will have a hard time keeping its advantage with the huge spending on video content nowadays. Growth will probably remain strong as box office spending is still recovering from the covid-19 pandemic and is still below 2019 levels.

Entertainment, technology, and services segment

This segment is responsible for pretty much all of the Sony hardware such as the Sony Bravia TVs, Earbuds, phones, Cameras, and other technologies. This segment is extremely broad as Sony has many products. Some of the most innovative products are within this segment such as many sports applications of Sony with the function of scanning player movement, but also robotics.

Imaging & Sensing Solutions Segment

This segment might be one of the most fascinating ones within Sony. The segment earned revenue of approximately $9.6 billion in FY21. The possible market for imaging and sensing is incredibly big and a fast-growing one. The image sensor market is expected to grow at a 9% CAGR until 2030. Some of the largest markets will be mobile, automotive, industrial, and security.

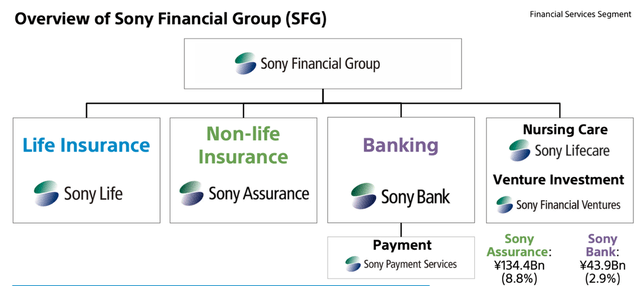

Financial services segment

The last segment of Sony is its financial services segment. Sony offers multiple different financing and insurance solutions with a focus on Japan. An overview of its services is seen below.

High conviction growth opportunities

Now that we have established the complete overview of Sony and its different segments & products, we can continue by looking at their highest conviction future opportunities. Sony has such an incredibly large number of products that is hard to summarize this all within one article, but let’s go give it a shot.

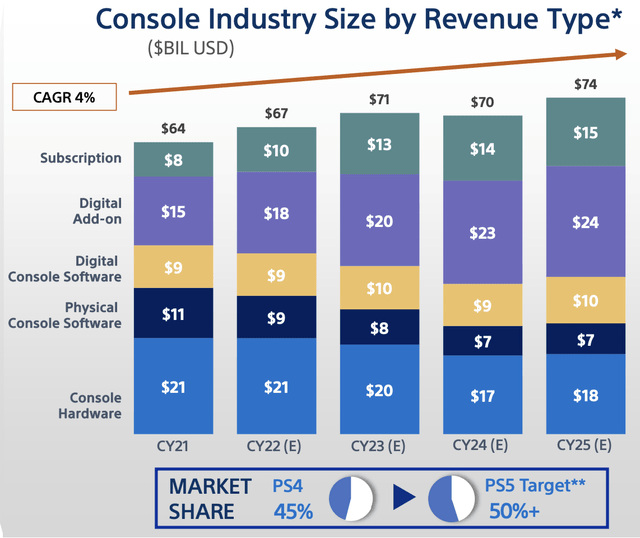

Gaming

I am a big fan of the gaming market as this is a very fast-growing industry with loads of future potential as the gaming market is expanding rapidly. I also described my enthusiasm for the gaming industry in a recent article on Microsoft (MSFT) I wrote.

According to Business Fortune Insights, the total gaming market is expected to grow at a CAGR of 13.2% between 2021 and 2028. The total market size will reach $545.98 billion by 2028. This growth in gaming will be a tailwind for Sony as a very dominant player. If Sony remains to be able to keep its market position, innovate, and expand its offering, this segment could be a huge future winner.

Another source of income growth is the PlayStation Plus subscription service. The subscription attach rate is 61% for PS4 players and 82% for PS5 players. This subscription is giving Sony a nice bit of annual recurring revenue. The subscription offers gamers on the PlayStation platform the ability to play online and together with friends, but also gets them free games every month.

Sony sees multiple growth vectors for this segment as well. Commercial expansion is one of these growth vectors and Sony plans on executing this by upgrading its PlayStation Plus subscription service. The new subscription service allows people to upgrade to higher tiers to receive more free headline games or even unlock cloud gaming. Cloud gaming allows gamers to play their PlayStation games wherever and whenever they want to. They can even play on other devices apart from their PlayStation console. Cloud gaming means your game is being played on a server of Sony’s somewhere and then streamed to your personal device. This means the hardware will be unnecessary and you can play whenever you want. I personally expect this to be a huge market going forward and Sony is in a good position to benefit. These cloud gaming platforms also mean gamers are not required to buy a game anymore, but they can play any game in the PlayStation catalogs. Sony has a very strong catalog as it has many PlayStation-exclusive games, which it develops by itself. That cloud gaming is a huge opportunity is also shown by recent research performed by Globe Newswire. According to their latest study, the cloud gaming market was worth $1.6 billion in 2021 and is expected to grow at a 42.5% CAGR until 2028 to reach a market size of $13.3 billion.

This segment of Sony has incredible potential and could for many already be a reason to buy Sony. Gaming will be a high-growth industry going forward, yet it sees some near-term pressure from less consumer spending and a potential recession. I do recommend investors to see through this near-term weakness and focus on the long-term potential. I believe Sony is pulling the right levers and making strong decisions by investing in cloud gaming (although I do believe that its main rival Microsoft is in front of Sony in cloud gaming) and increasing IP.

Music

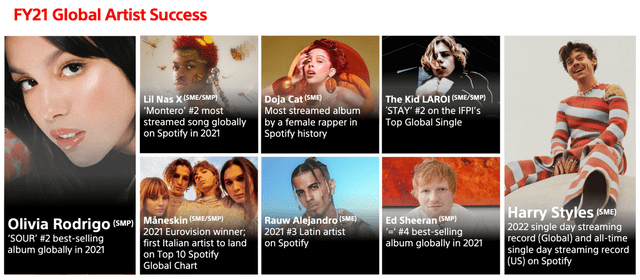

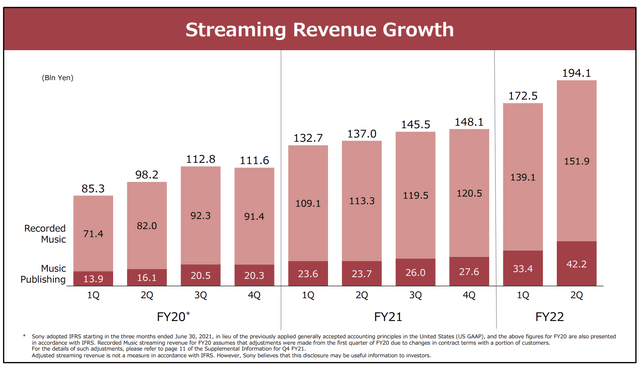

The music segment has been growing at a 15.5% CAGR between 2017 and 2021 as revenue increased by $3 billion over this timeframe. Streaming has grown at a 27.7% CAGR over the same timeframe and now represents 70% of revenues in the music segment. Sony has been the #1 music publisher since 2012.

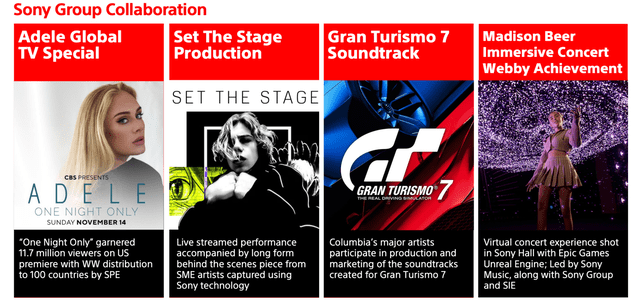

The music market, and mostly music streaming, is expected to see high growth. I like this market as it does not require high amounts of manufacturing costs and therefore has solid margins. Sony is one of the largest players to take advantage of market growth. Sony is growing rapidly within this segment as it had been able to grow both total artists and new signings with a CAGR of over 30% since 2017. Sony will continue investing in this segment and is looking for new ways of growth. One of the ways to promote their music and artists is by collaborating with other parts of Sony. This can be through digital concerts or soundtracks within games or movies.

Imaging and sensors solutions

Imaging and sensor solutions are a huge growth market. According to Fortune Business Insights, the global image sensor market is expected to grow at an 8.4% CAGR until 2026 to reach a market size of $30 billion.

For the smartphone market, growth comes mainly from the development of smartphone cameras. It is good to know that most smartphone cameras are also manufactured by Sony. Sony continues working on smartphone cameras and sensors as it sees this as the largest market. It continues to increase the number of pixels possible in a smartphone camera and already supports up to 8k video.

Where the smartphone industry might be the largest for Sony within the imaging and sensing solutions segment, the automotive is probably the fastest growing. The CAGR is expected to be 21% until 2025. Sony expects to deliver sensing solutions to 75% of the top 20 OEMs in the world. The largest possibility within automotive is ADAS systems (autonomous driving). Current ADAS systems need up to 8 cameras while future autonomous driving systems will need up to 20 cameras per vehicle. These need to be the highest quality cameras and sensors in resolution, Lidar support, and cybersecurity. Sony is investing heavily in this segment as the future possibilities are huge and Sony is already the most significant player.

The biggest upcoming industry for sensor solutions is probably the VR/AR market. Think of virtual displays, hand tracking, iris recognition, or AR glasses. A huge driving force here is the upcoming of the metaverse. According to GlobalData, the metaverse industry will grow from $22.79 billion in 2021 to approximately $1 trillion by 2030 at a CAGR of 39.8%. It is the next big theme in digital media, and VR & AR are crucial technologies driving its development. Sony sensors will play a crucial role in this technology.

In order to deliver on all these technologies Sony is currently expanding its Nagasaki facility for a fab. By building this fab Sony can keep a secure and stable supply of semiconductors and continue to increase the quality of the supply chain in Japan. Sony is in a collaboration with Taiwan Semiconductor (TSM) to enhance technical knowledge.

New initiatives

Sony keeps looking for new future growth areas which match its current segments. This is what Sony says about this:

We are exploring fields that can become growth centers in terms of creation and delivery of Kando. Among those fields, we are putting special focus on the metaverse and mobility.

Let’s see how these new fields might do for Sony.

Metaverse

As I mentioned earlier in this article, the metaverse industry will grow from $22.79 billion in 2021 to approximately $1 trillion by 2030 at a CAGR of 39.8%. This offers a huge opportunity for many technology firms and Sony is also aware of this. Sony believes the metaverse will create an intersection of multiple genres including games, movies, music, and Anime. Sony believes it can use its strength in these segments to boost its presence in the metaverse.

In games, Sony plans to enhance live service gaming by launching more than 10 live service games from their PlayStation Studios by FY25. Sony is also in a collaboration with Manchester City Football Club to reproduce the stadium and athletes to create new experiences. As for music, Sony works on creating new live entertainment experiences such as virtual concerts.

Mobility

Sony sees opportunities in safety through technology such as image sensors and Lidar technology, entertainment, and adaptability where Sony plans on using its cloud knowledge and services to support the evolution of a vehicle. Sony sees the functions of vehicles being defined by software and through services. Well, I agree with them on this subject as we can already see this happening at Tesla. Sony believes that to be able to contribute to the evolution of mobility, it needs to commercialize a vehicle and present it to the world. Of course, Sony is no car manufacturer and therefore can’t just decide to start building cars out of nowhere. The capital requirements are way too high. For this reason, they decided to partner with Honda Motor (HMC) to form a strategic alliance. In June of this year, Sony and Honda decided to form a new company named Sony Honda Mobility to offer high-value-added electric vehicles and services. Sony plans to begin selling a jointly-developed electric vehicle by 2025.

I for one would be very excited to see the result of this venture between Sony and Honda.

Financial results

Sony presented its 2Q22 results on November 1st. Revenue for the quarter came in at $19.5 billion, growing by 16% YoY. Operating income of $2.43 billion was 8% higher than a year earlier. Thanks to the strong results of this quarter, Sony increased its outlook for FY22 and now expects an operating income of $8.36 billion (¥1.16 trillion) compared to $8 billion (¥1.11 trillion) before. Sony also expects revenue to come in slightly higher at $83.57 billion (¥11.6 trillion). The increased outlook is 5% and 1% higher than the previous outlook and therefore a nice increase showing Sony is still performing strongly despite all economic headwinds. The key to getting to know where this outperformance is coming from is by looking at the results of each segment.

Let’s start by looking at the Game & Network Services segment. Revenue for this segment increased 12% YoY and came in at $5.2 billion (¥720.7 billion). This increase was mainly thanks to the FX impact as this was $676 million of additional revenue or 14.5%. This means that without the positive FX tailwind this segment would have posted lower revenue by 2.5%. Still, this is not bad at all compared to the drop in gaming seen all around the world and the impact it already had on companies like Nvidia (NVDA). This deterioration of the gaming sector did become clear in the operating income as this decreased by 49%. This was mainly due to the recent acquisition of Bungie and an increase in development costs.

The drop in the segment was no surprise as covid-19 impacts ease and more people go outside. This resulted in a 10% decrease YoY in total gameplay spend on PlayStation. Combine this with the fact that software sales dropped as people were less willing to spend money on new games, and a drop is inevitable. PlayStation Plus subscribers also decreased by 4% YoY.

Sony produced 6.5 million PS5 units over the quarter and is progressing slightly faster than planned thanks to easing supply chain problems. Demand remains strong, as every 100,000 units are being sold out in the U.S. within 17.5 hours. Sony is still working on increasing demand and aims to exceed its FY22 target of 18 million units.

The FY22 forecasts for this segment stayed relatively flat.

The music segment of Sony performed well as revenue increased 32% YoY. Revenue for the quarter was $2.6 billion (¥359.3 billion). This again was thanks to a strong FX tailwind of 20%. This means that the FX neutral growth for the quarter was still a strong 12%. This increase was mainly due to higher streaming income. Operating income was $576 million (¥78.7 billion) and increased by a whopping 56% YoY. Sony increased revenue and operating income for FY22 in this segment by 7% and 15%, respectively. The tailwinds for the music industry remain strong and Sony is performing very well as is shown by the 48 songs in the top 100 songs on Spotify (SPOT) which were recorded by Sony.

The pictures segment saw revenue increase by 29% YoY to $2.43 billion (¥337.5 billion) and was also driven by FX tailwinds. Operating income saw a 13% decrease due to some other costs compared to the year-ago quarter. Sony did raise FY22 guidance for both revenue and operating income by 5% and 15%, respectively. This raise was mainly due to positive foreign exchange tailwinds.

The entertainment, technology & services segment saw a significant increase in revenue of 16% YoY. Revenue was $4.88 billion (¥677 billion) and was mainly driven, yet again, by FX tailwinds. FX had a positive impact of approximately 14%. Sony also managed to ship more digital cameras YoY, which contributed to the increase in revenue. Operating income saw a growth of 7%. Sony is expecting severe headwinds for this segment in the second half of their fiscal year as they expect less demand for expensive products such as cameras or smartphones. Yet, Sony did not lower their expectations and even raised their FY22 guidance for revenue for the segment by 2%. Sony is seeing an easing in the supply chain, but this is being offset by a weakening demand, mainly from Europe.

Imaging and sensing solutions revenue increased significantly by 43% YoY and came in at $2.87 billion (¥398.4 billion). Again, 22% of this YoY increase was due to FX effects, but also the increase in imaging sensors for smartphones shipped. Operating income increased by 49%, despite the increase in Capex. Sony upward revised the operating income outlook for this segment by 10%, while keeping revenue expectations flat. It is of course expected that Sony will feel the impact of the slowdown in smartphone sales currently being witnessed. Yet, management stated that the outlook did not change as the slowdown is still within the expected window. Sony does admit that for the ongoing quarter they have made a conservative forecast as there is still a big chance of more economic deterioration. Sony saw no inventory problems as of yet.

The financial services segment saw a 17% decrease in revenue to $2.19 billion (¥304.5 billion). This drop was mainly due to losses on investments in Sony Life. The revenue forecast for this segment has been revised upwards as well by 9%.

Valuation and Quant

Sony currently trades at a forward P/E of 15.6 and receives an F for valuation from Seeking Alpha Quant. I believe the company is currently fair value by looking at historical metrics and valuations for peers. Yet, I see significant potential for Sony and am therefore comfortable with buying Sony, based on valuations and prospects, at current prices as I still see a lot of upside potential. Sony is down by 34% so far this year and this does offer investors a possible buying opportunity as growth remained strong so far this year.

Sony receives a B for its growth. For profitability Sony receives an A as the EBITDA margin of 19.47% is very strong and cash from operations even receives an A+.

Risks

An investment in Sony is not without risk. As is already visible in the latest quarter’s results, we can see the economy is getting worse for Sony and this is being reflected in their financial results. The gaming segment of Sony will probably have a few difficult quarters ahead as the slowdown in gaming continues to worsen and covid tailwinds disappear further. The same goes for the imaging segment, where the slowdown in smartphone sales will have a significant impact on sales as can be seen by the 33% higher inventory buildup in the latest quarter. Of course, right now this is not such a bad thing as inventory is not above 2019 levels and Sony is still recovering from supply chain disruptions, but I am afraid that the easing of the supply chain in combination was lesser demand will result in inventory buildup. The hardware segment of Sony will probably continue to see a slowdown as consumers are being careful with their money and might not be buying that new tv, smartphone, or camera right now.

Note that all the above-mentioned problems are short-term and are no threat to the long-term potential of Sony as I described above. These short-term issues might cause some weakness in share price, and I expect growth to slow drastically as the currency tailwind will also disappear.

In the long-term is do not see many issues for Sony as I see incredible potential in the business segments of Sony, and I believe they have a very strong dominating position in all of them. Gaming will remain to be the most crucial part for Sony, and they will need to be alert to act on the latest trends within this industry such as cloud gaming, but I believe management is very well aware of this.

Conclusion

I started this article completely blank and with no idea of what I would find. I end up very impressed by the business of Sony and their moat. I remain to believe Sony is very underrated and it might be due to the company being Japanese instead of European or American. Sony has a very broad portfolio of products and services and I believe they are very well positioned for the future.

To keep it short now, I think Sony is a buy at current levels, as I see very much upside for the company as they are well positioned to grow the business and build on global trends within multiple segments. The metaverse opportunity is obviously a very big one and I will be keeping a close eye on how management approaches this opportunity.

I do recommend starting with a smaller position and adding as time passes because there is still some downside risk in the price from near-term economic problems.

I rate Sony a buy.

Be the first to comment