koto_feja/iStock via Getty Images

Snowflake (NYSE:SNOW) can be considered a sort of barometer for the tech sector because it often trades at premium multiples and a tech rally is unlikely without an associated rally in SNOW stock. The data warehouse company has proven to be resistant to macro headwinds as its products are proving to be mission critical. The stock isn’t trading cheaply even after the steep fall, but the company continues to grow rapidly with what appears to be a highly visible growth runway for many years to come. The stock is highly buyable here for those looking for a higher quality allocation in the tech sector, though they would have to be comfortable with the usual lack of GAAP profits.

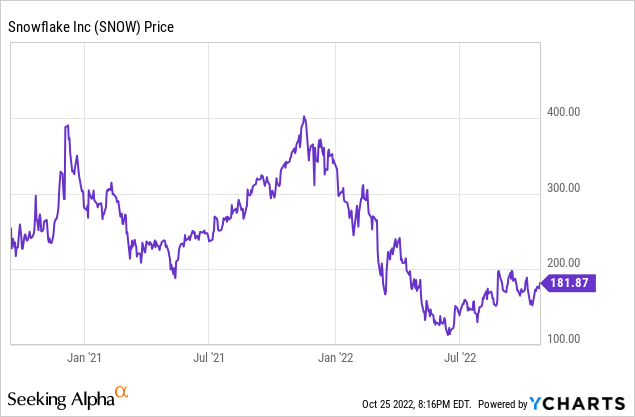

SNOW Stock Price

SNOW peaked above $400 per share in late 2021 but has since fallen around 55%.

I last covered SNOW in July where I rated it a buy even after the disappointing analyst day. The company’s incessant growth even in the current environment has only increased my confidence in the stock, which admittedly remains very rich.

SNOW Stock Key Metrics

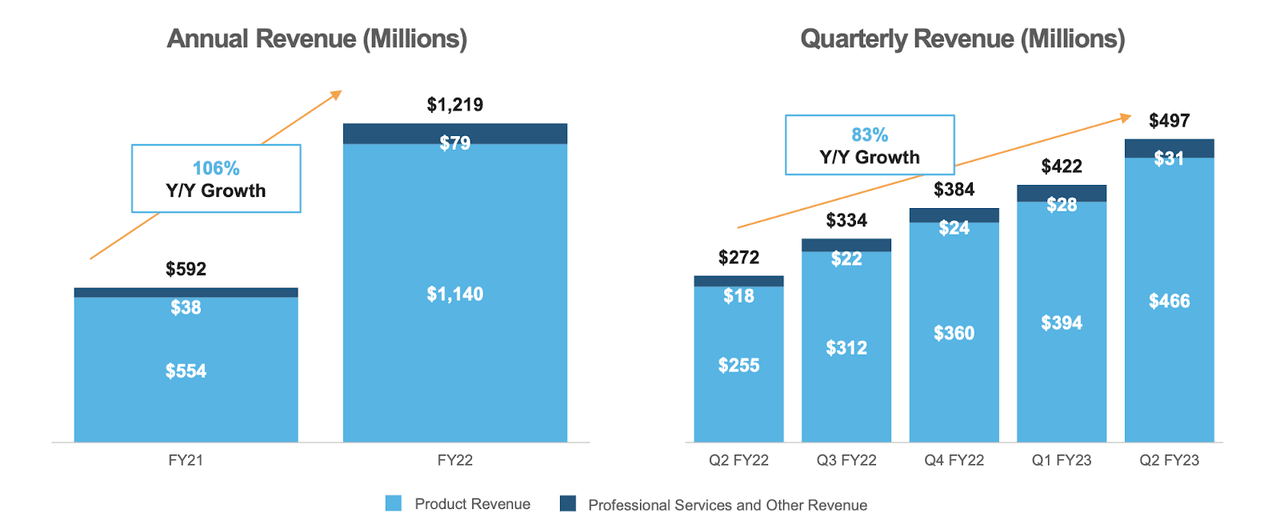

The latest quarter saw SNOW generate 83% revenue growth – an astounding achievement in itself but even more impressive when considering that SNOW had grown at a 106% clip last year. $466 million of product revenue comfortably exceeded guidance of $440 million.

FY23 Q2 Presentation

There aren’t many companies nowadays that are beating and raising guidance. How is SNOW able to buck that trend? Management stated the following on its conference call:

In general, I would say that Snowflake gets prioritized fairly high inside the enterprise. And the reason is we are sitting right on the intersection of cloud computing, artificial intelligence, machine learning, advanced analytics. Customers are – they have picked up the center of the opportunity that is in front of them and they are investing, they are hiring, they are buying, because these are things that are going to be big changes for the industry.

Enterprise tech companies have definitely seen greater resilience but the strength at SNOW is nothing short of incredible.

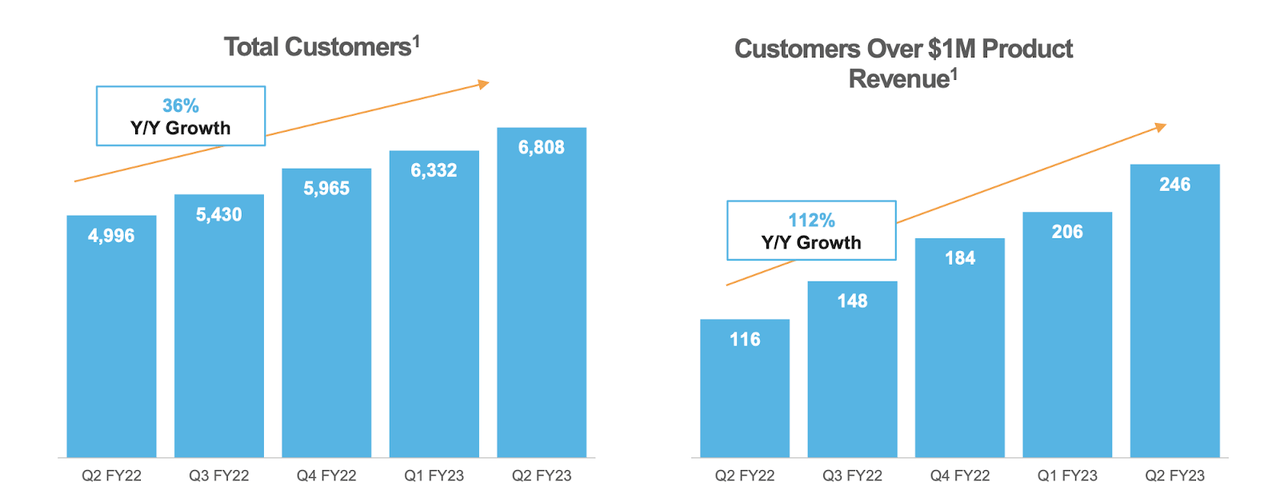

SNOW continued to rapidly grow its customer base, showing 36% growth year over year.

FY23 Q2 Presentation

Management notes that customers often take several quarters before they fully embrace the platform, meaning that the company won’t see the full benefits of those customer acquisitions until later – more to look forward to.

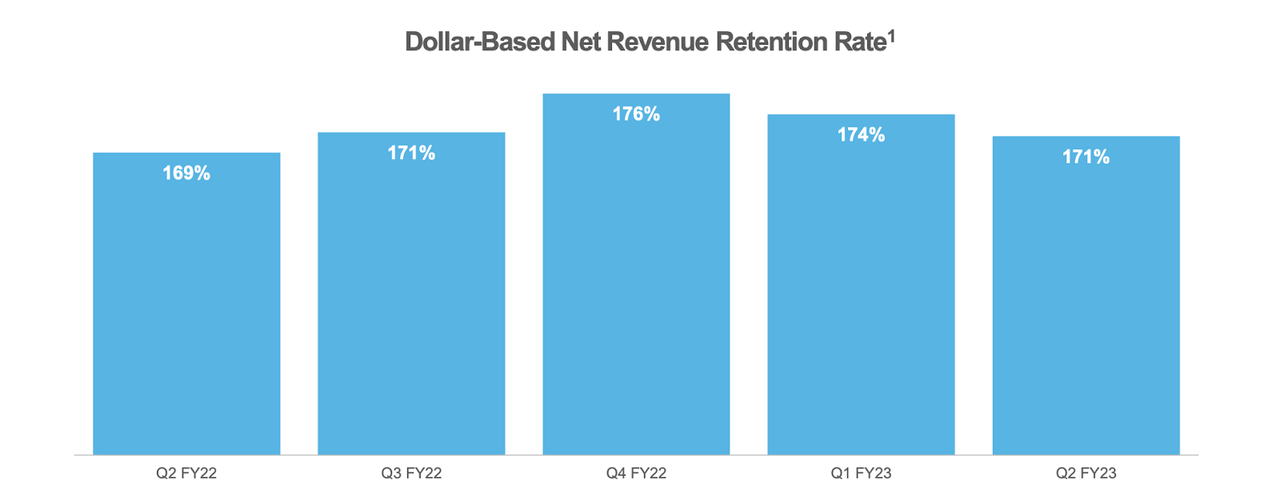

As typical, SNOW showed a best-in-class 171% dollar-based net revenue retention rate.

FY23 Q2 Presentation

Management noted that while some customers might reduce spending over time, the majority of their customers do increase spending over time – and by large amounts.

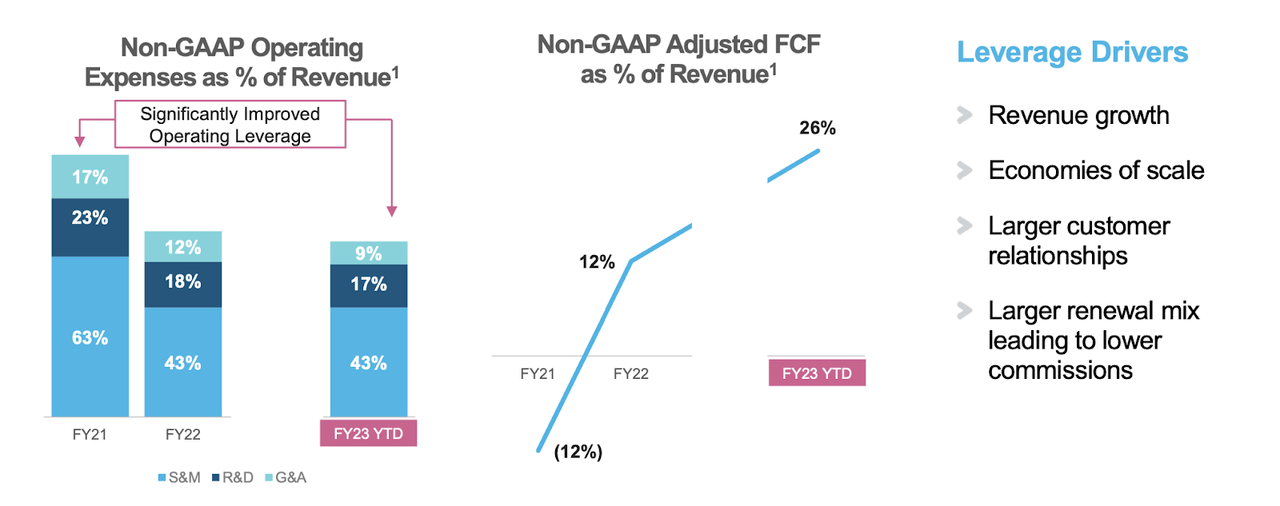

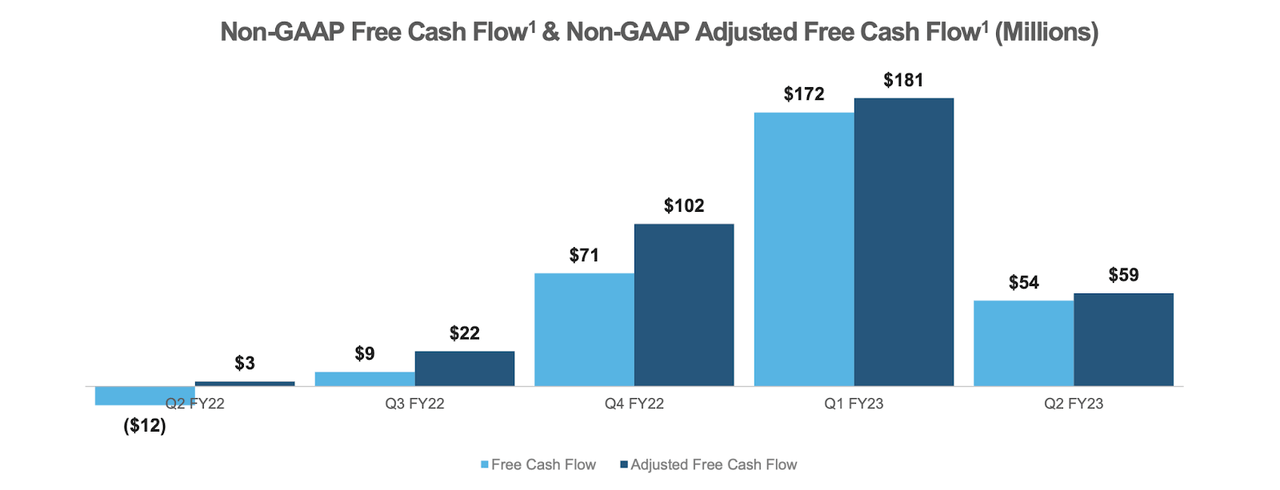

SNOW continued to show operating leverage, highlighted by a 26% free cash flow margin year to date.

FY23 Q2 Presentation

SNOW has been free cash flow positive for several quarters now. While this is an environment in which GAAP profitability is more significant, SNOW’s cash flow generation is a risk-mitigating factor from potential complications.

FY23 Q2 Presentation

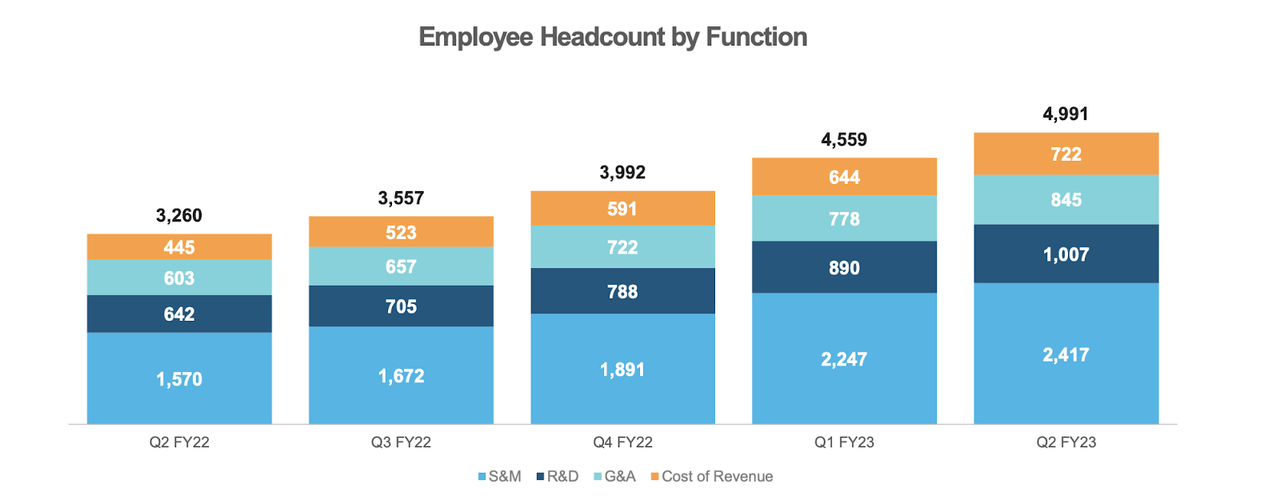

Amidst soaring revenues, SNOW continues to invest heavily in growth with headcount increasing rapidly.

FY23 Q2 Presentation

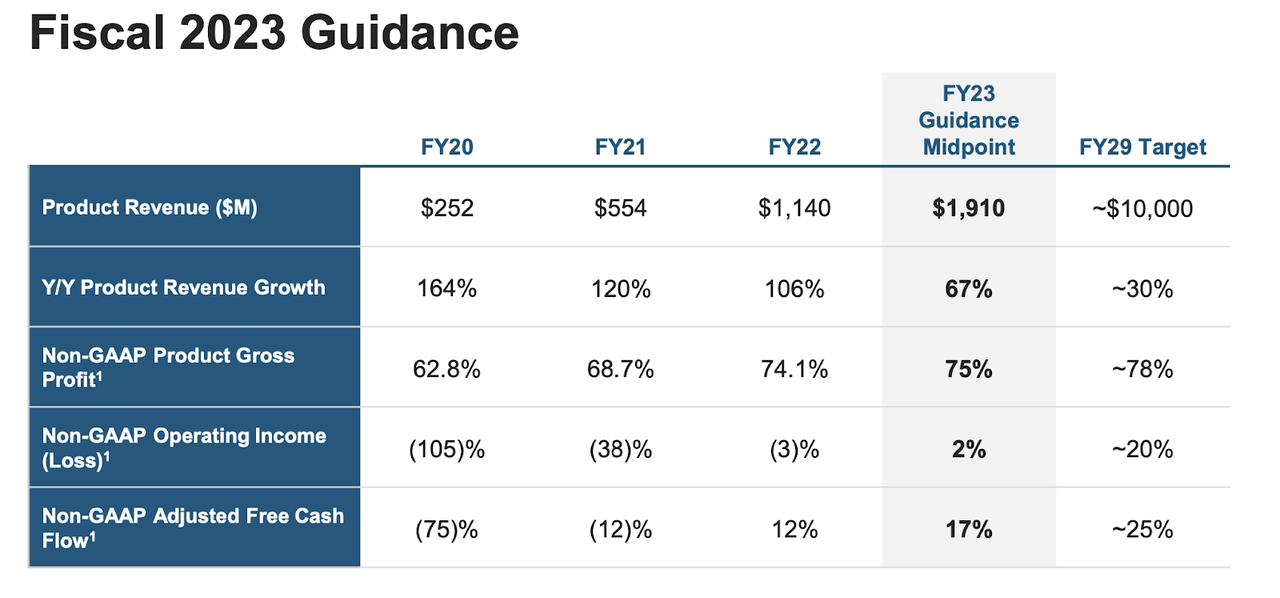

The company has increased full year guidance to see 67% revenue growth and 17% free cash flow margin.

FY23 Q2 Presentation

That 17% margin outlook is not far from the 25% long-term target. An analyst asked management about that detail on the call – management stressed that while operating leverage is a critical part of their business, they intend to continue prioritizing long-term growth. That means the company is willing to continue increasing headcount even if it holds back margins. Again, this isn’t the kind of environment to look kindly on such a stance, but long-term tech investors might instead appreciate such a strategy as it may lead to greater long-term returns.

Is SNOW Stock A Buy, Sell, or Hold?

SNOW has never been a cheap tech stock (and some readers might contend that tech stocks have never been cheap). But the recent slide has made the stock far more interesting. The $5 billion net cash position makes up around 9% of the current market cap. Many tech stocks nowadays trade with significant net cash positions.

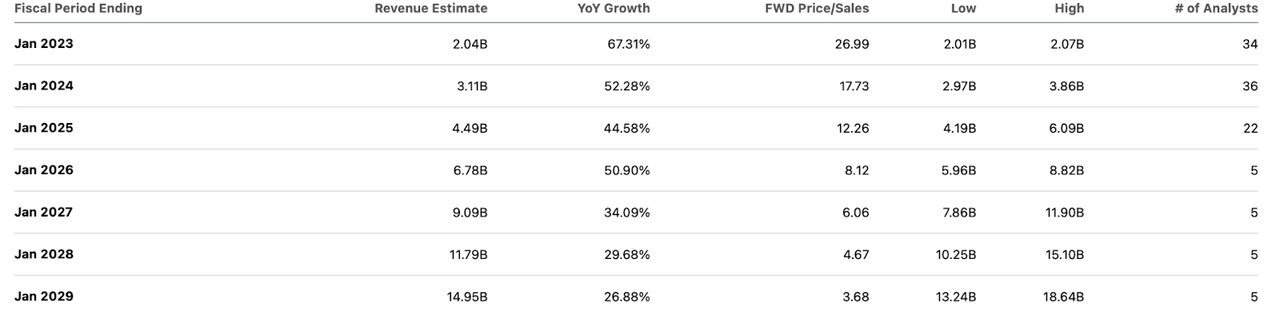

SNOW is trading at 27x forward sales – a steep multiple. The company has guided for $10 billion in product revenues by fiscal year 2029. Consensus estimates expect around $15 billion in total revenues by then (implying around $14 billion in product revenues).

Seeking Alpha

SNOW’s long-term guidance was already aggressive, implying 32% compounded annual growth through 2029 – consensus estimates take it up another notch. To be conservative (somewhat) we can use management’s guidance instead. Assuming $10 billion of product revenues by fiscal 2029, 25% long-term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), SNOW might trade at 11.3x sales by then, representing a stock price of $351 per share. That presents compounded annual returns of 13% over the next 6 years. There is some conservatism built into that – SNOW has typically traded at multiples well in excess of the assumed 1.5x PEG ratio – a 2x to 2.5x PEG ratio may be more appropriate given the attractive secular opportunity. If SNOW ends up beating guidance as consensus expects, then there’s even more upside there.

On the flipside, counting on 6-year guidance is a slippery slope in itself and there’s no guarantee that SNOW will even match its own guidance. From the outside looking in, one must wonder how sustainable the 171% dollar-based net retention rate is. The 32% projected compounded annual growth does imply some reversion to the mean.

The longer-term risk is that of competition. The mega-cap tech giants have thus far not been able to offer a compelling product alternative to SNOW, but that might change in the future. Given the attractive economics of SNOW, it would make sense to expect competition to emerge. Will SNOW have the moat of switching costs, or would customers switch providers at the first chance they get? It is hard to tell and I am doubtful that the 6-year forecast incorporates such factors.

As I discussed with subscribers of Best of Breed Growth Stocks, a diversified basket of beaten down tech stocks may be the perfect strategy in the current environment. SNOW can fill a higher-quality allocation in such a bucket.

Be the first to comment