ko_orn/iStock via Getty Images

Snowflake (NYSE:SNOW) was and is arguably still considered one of the highest-quality stocks in the tech sector. Yet its stock has crashed amidst the tech crash as its valuation got overheated last year. The company held its 2022 investor day in mid-June – while it raised its long-term operating margin guidance, it did not raise its long-term revenue guidance. I had been expecting a sizable increase to the target, though the stock has fallen so much that it is finally cheap regardless – something that hasn’t been so easily said during its brief time as a public company.

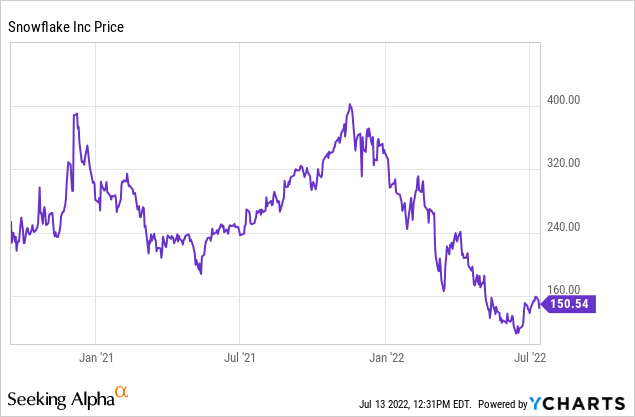

SNOW Stock Price

After doubling immediately on its first day of trading to around $230 per share, SNOW peaked above $400 per share. The recent tech crash has caused the stock to slide to around $150 per share.

I last covered SNOW in April when I rated it a buy on account of the likelihood for its long-term guidance to be increased at its investor day. That prediction did not pan out, but the stock is still looking compelling even with that disappointment.

SNOW Stock Key Metrics

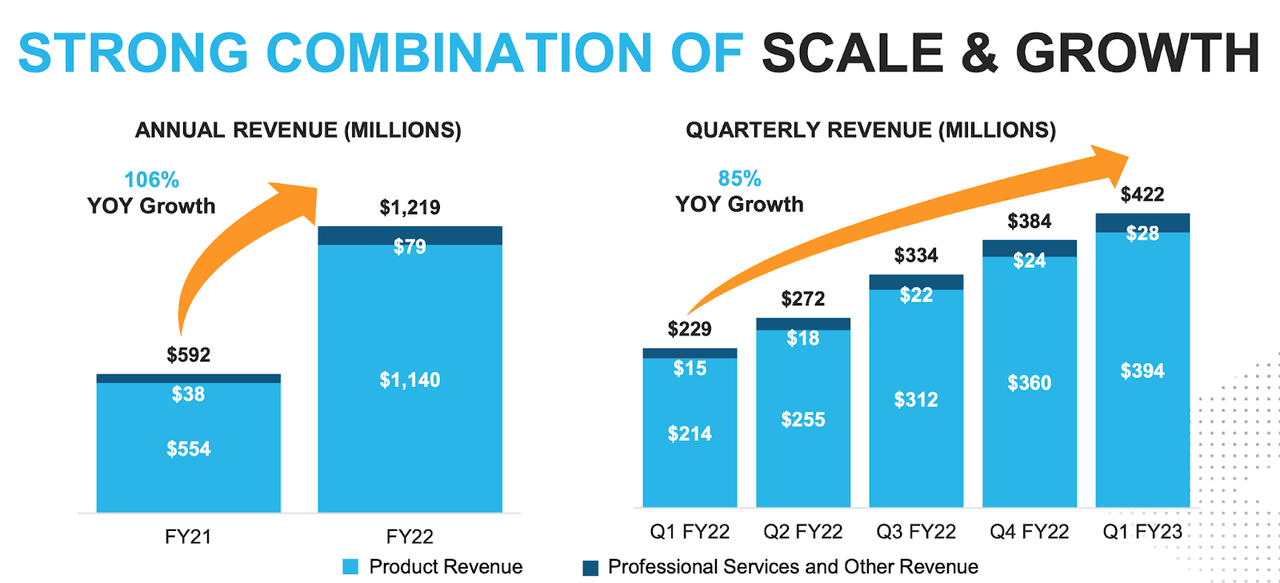

In the latest quarter, SNOW generated impressive 85% revenue growth which came on top of the 106% growth shown last year.

FY23 Q1 Presentation

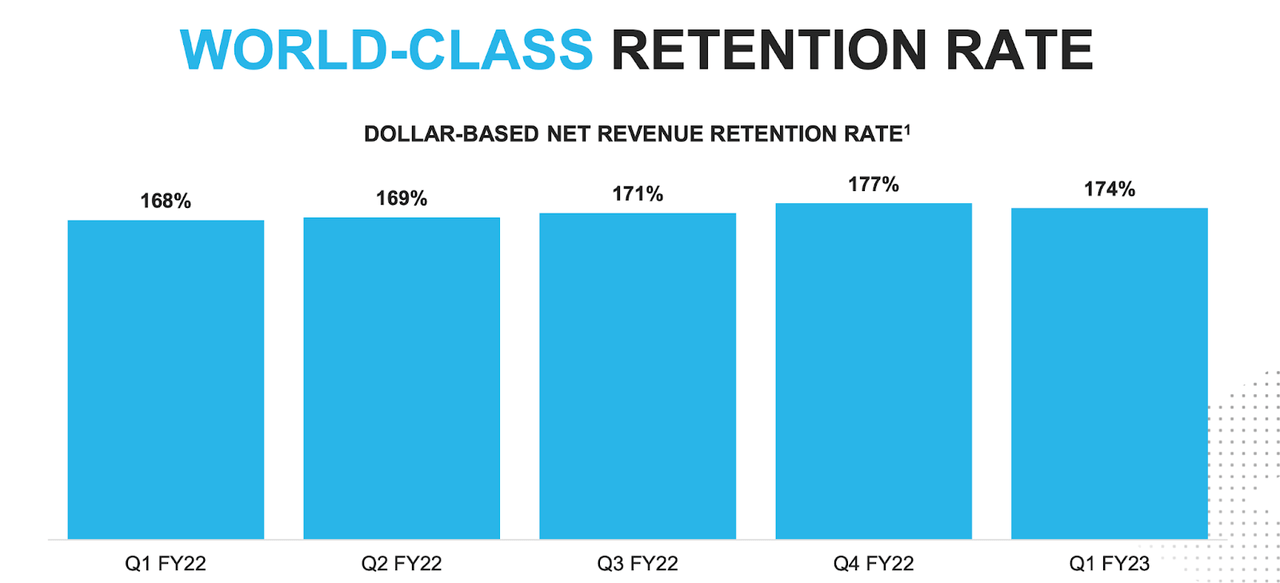

As usual, much of that growth was driven by the high dollar-based net revenue retention rate, which stood at 174%.

FY23 Q1 Presentation

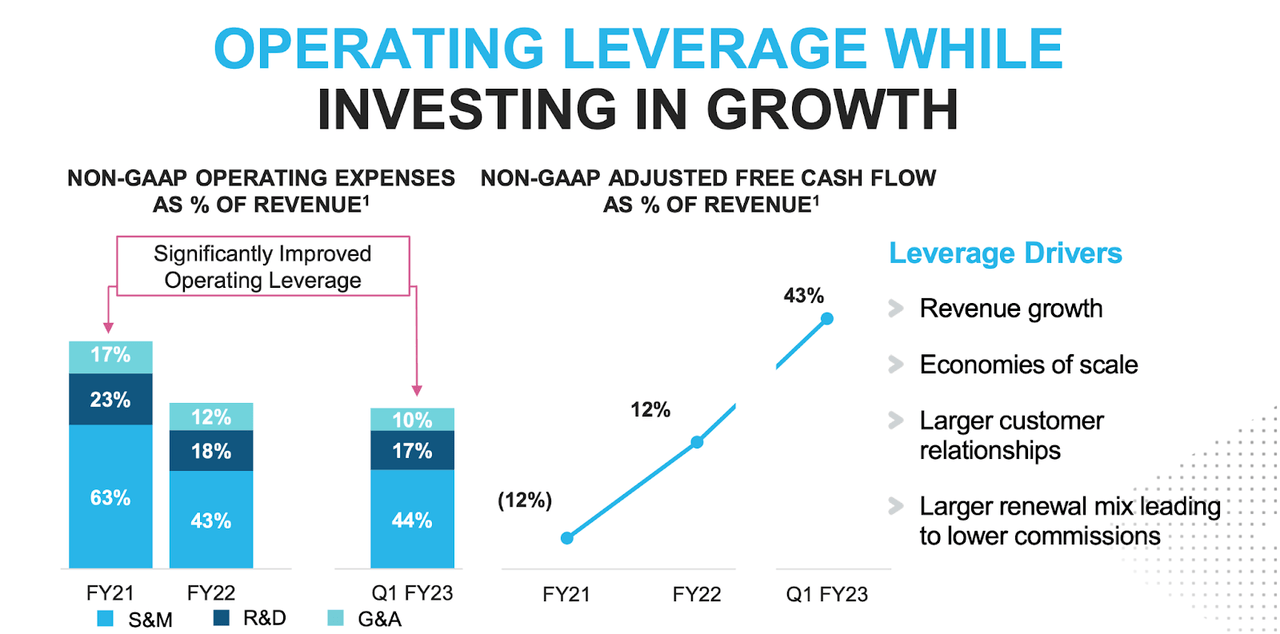

SNOW also saw some operating leverage, generating a slim non-GAAP profit, an improvement over the 16% non-GAAP operating loss in the prior year.

FY23 Q1 Presentation

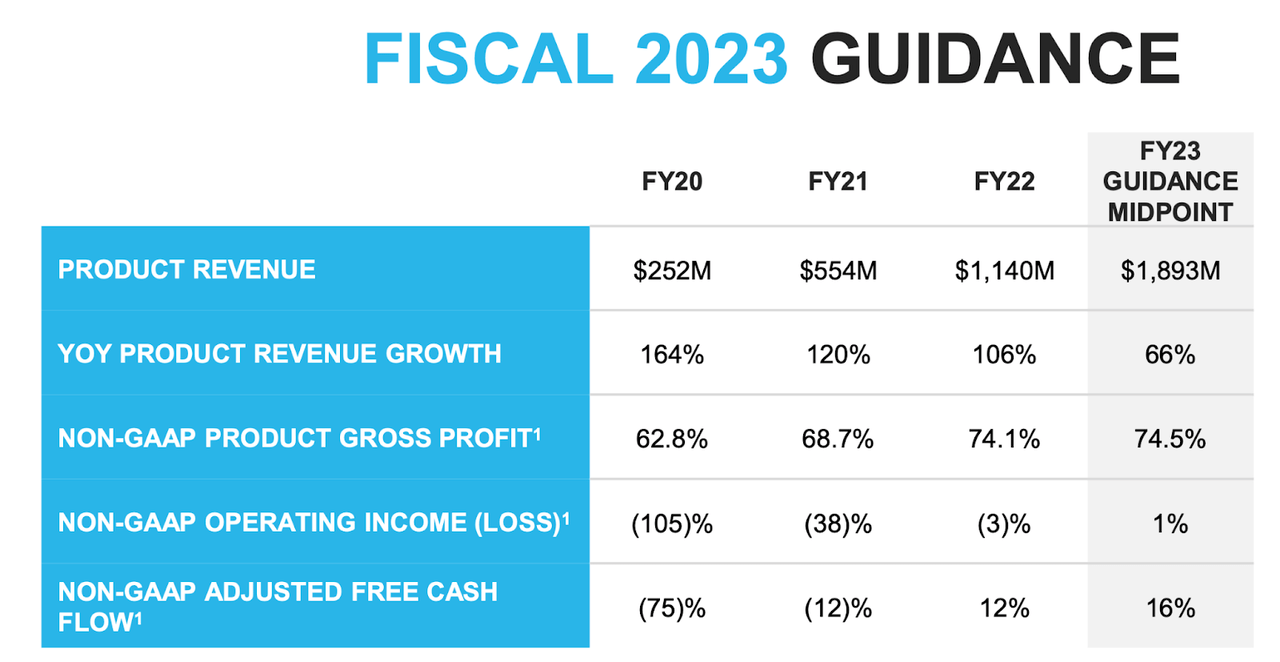

SNOW guided for the full year to see 66% product revenue growth and 1% non-GAAP operating margins.

FY23 Q1 Presentation

SNOW ended the quarter with $5 billion of cash vs. $1.3 billion of deferred revenues.

These were solid results, but my attention was focused instead on the annual investor day which would occur one month after the earnings release.

Snowflake 2022 Investor Day

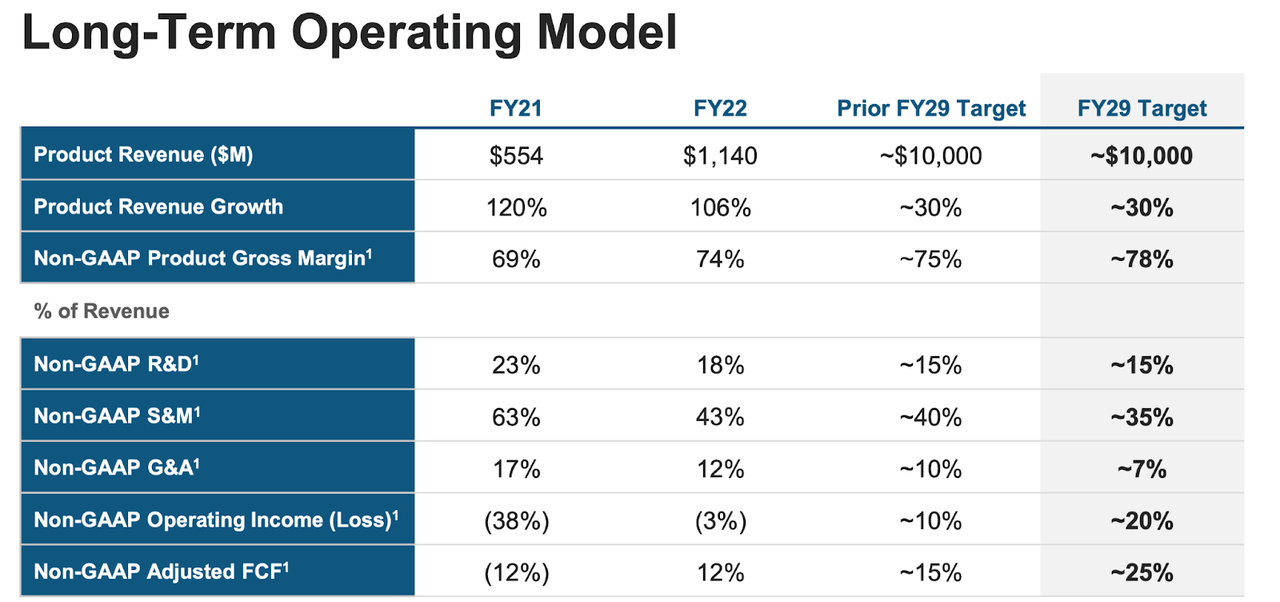

On June 14, SNOW held its 2022 Investor Day. I was focused mainly on one key metric: FY29 target product revenue. SNOW left its original target unchanged at $10 billion, but raised its non-GAAP operating margin target from 10% to 20%.

2022 Investor Day

Considering the commentary in the earnings calls leading up to the investor day, I was taken aback that the company did not raise the guidance. I suspect that the poor sentiment in the tech sector weighed on their decision – in particular, what would the purpose be of raising guidance now when Wall Street has apparently refused to reward tech stocks on the basis of good news?

Is SNOW Stock A Buy, Sell, Or Hold?

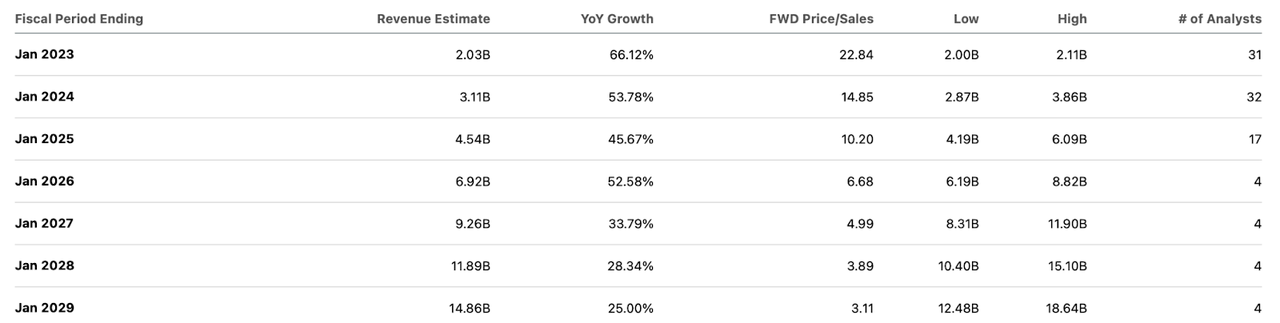

Wall Street consensus estimates have come down as a result. While analysts were previously expecting $17 billion in revenues by FY29, they now are calling for less than $15 billion.

Seeking Alpha

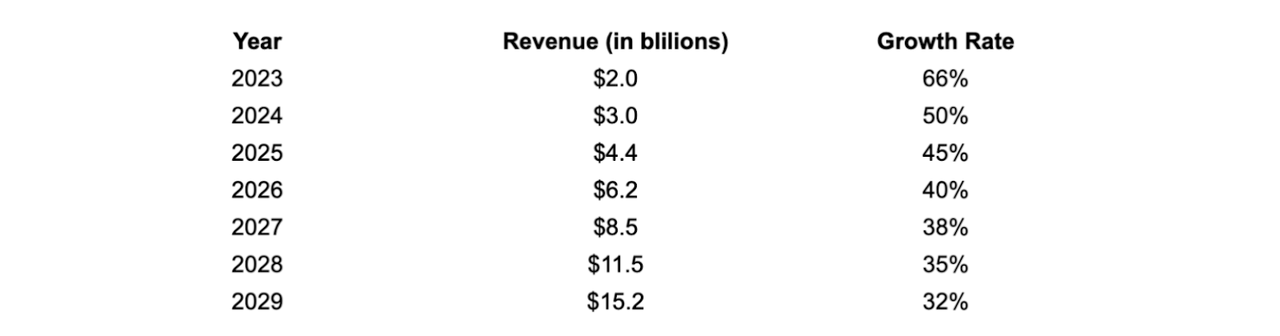

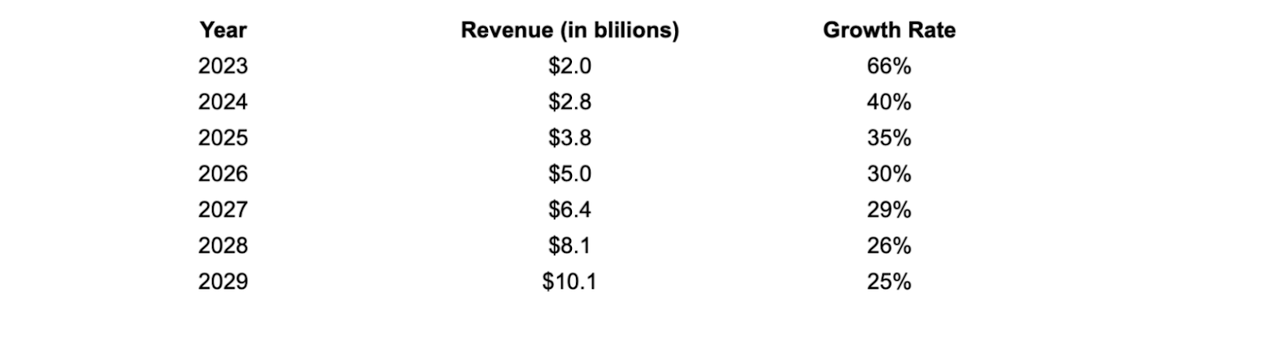

That $14.9 billion estimate is still notably higher than the $10 billion guide, but is arguably not so unrealistic considering that SNOW has also guided for FY29 to see 30% top-line growth. Assuming reasonable deceleration in growth rates, it’s not a stretch for SNOW to reach $15 billion in revenues by FY29, as seen below:

Julian Lin

I can see SNOW earning a 30% net margin over the long term and sustaining a 1.5x price-to-earnings growth ratio (‘PEG ratio’). That could place SNOW at 13.5x sales by 2029, representing a stock price of $665 per share, or 24% compounded upside over the next seven years. If we instead assume that SNOW merely matches its $10 billion guidance, then its forward growth rate might look like this:

Julian Lin

I view that pace of deceleration to be overly pessimistic considering the 174% net retention rate posted in the latest quarter. Even so, SNOW might trade at $442 per share in 2029 under such a scenario, representing 17% compounded upside over the next seven years. That still reflects a market-beating return. The key risks here revolve around SNOW’s inability to meet FY29 guidance (after all, there are nearly seven years between then and now) as well as its ability to sustain 30% growth at that point. While SNOW has a net cash balance sheet and is operating at cash flow breakeven, it may experience financial difficulties in the near term if its customers decide to reduce technological spending during a recession. I’d argue that SNOW’s products are mission-critical, but even the strongest companies can suffer near-term pressures. Another long-term risk is if the cloud titans like Amazon (AMZN) or Microsoft (MSFT) are able to develop their own data warehouse product (they already have a product today, but it’s thus far not quite comparable), at which point SNOW may face difficulties sustaining growth and margins. At current prices, I see SNOW delivering market-beating returns from here alongside an attractive secular growth story. I rate shares a buy for long-term investors.

Be the first to comment