hapabapa/iStock Editorial via Getty Images

Introduction

XPEL, Inc. (NASDAQ:XPEL) (“Xpel”) is a distributor of automotive and architectural paint protection film and window tint (collectively, “PPF”). The company runs asset-light, outsourcing the manufacturing of its films and mostly partnering with third-party installers for installation.

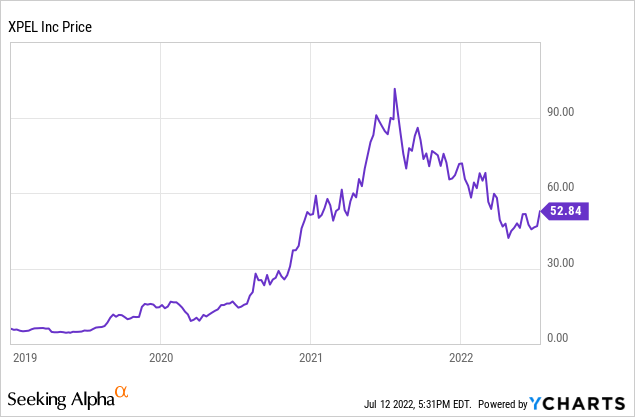

The business has done well, and so has the stock, running up to just over $100 per share last year before pulling back around 50% to where it is today.

But all this is old news.

On July 12, 2022, Xpel announced a partnership with Rivian (RIVN) to provide pre-installed PPF options for end customers at the time of order. The vehicles will be delivered from Rivian’s factory to a nearby Xpel-operated installation center before going to the final vehicle purchaser.

Although Rivian is in the beginning stages of ramping its business, having delivered only a few thousand vehicles, I believe this partnership is indicative of things to come for Xpel with more large OEMs. In fact, Xpel has disclosed on earnings conference calls that they are also working on at least one other OEM project located in Europe.

How the Partnership Works

Xpel has secured an exclusive partnership with Rivian, meaning that no other PPF company can provide PPF directly to Rivian (however, if the owner of a Rivian vehicle did want another brand of PPF aftermarket, they would be able to do so).

Rivian will provide customers with the option for two PPF packages, Front Gloss Paint Guard or Full Body Satin Paint Guard at the time of order for the R1T and R1S models. If a customer were to select one of these two options, the vehicle would then be delivered from Rivian’s factory in Illinois to a nearby Xpel installation center, where Xpel would do the installation work. Rivian would likely pass the cost of the PPF and installation on to the end-vehicle purchaser. The vehicle would then move from Xpel’s installation facility back to Rivian for final delivery to the end purchaser.

Why This is Unlikely to Disrupt Xpel’s Pre-existing Installer Base

Traditionally, Xpel has worked with dealerships and third-party installers on an aftermarket-only basis. One of Xpel’s strengths has been their installer relationships. By moving toward working with OEMs directly, dealers and installers may be concerned that Xpel is taking away business from them. However, I think Xpel’s management recognizes this and is smart enough to ensure that the new OEM model does not disrupt the traditional model. Xpel can ensure this by limiting the PPF options or amount of coverage available through OEMs. In fact, we already see this in the Rivian partnership, with Xpel offering just two packages, one full coverage in a satin film, and one front coverage only in a gloss film. Should the customer desire a different film and/or configuration, they would still need to go to a third-party installer.

Xpel Will Likely Partner with other OEMs

We know that Xpel is working on at least one other OEM project in Europe. There are many European vehicle brands, so I won’t speculate as to whom it could be, but it is likely that it’s a more significant partnership than this Rivian partnership given that Rivian is only in the beginning stages of ramping production. I would expect to hear more about this European partnership over the next 6-12 months.

If Xpel is successful with these early projects, I would expect more OEMs to be interested in similar projects.

Refreshing the Investment Case and What This All Means for Xpel

Partnering with OEMs for PPF packages at the time of purchase is a significant opportunity for Xpel to increase the attach rate for PPF on new vehicles sold. I believe the current global PPF attach rate is under 15% on new vehicles. With more deals like this, and the potential for a PPF package to be the “default” (meaning it is auto-selected while ordering and the customer would have to actively de-select the option if they don’t want it), I could see the global PPF attach rate on new vehicles climbing substantially higher. This would obviously be good for a company like Xpel.

In my previous Xpel article, XPEL: The Case For $80 Per Share, I suggested that fair value for Xpel was in between $80-100 per share. I think the model holds up for the most part still remains my target range for fair value, although it looks like my 2022 numbers may have been a bit high as the automobile chip shortage continues to hamper supply. Nonetheless, I believe Xpel will continue to be able to successfully navigate shortages caused by the automobile supply chain.

Risks

All investments have risks, including XPEL. Here are the main risks today:

- Automotive supply chain issues persist for longer than expected, and car sales do not rebound to normalized levels for several years.

- Another wave of COVID-19 potentially shutting down automotive manufacturing plants, especially in countries with stricter COVID rules such as China.

- Although XPEL has dominated the competition from 3M (MMM) and SunTek (owned by Eastman Chemical (EMN)), these are much larger companies with greater resources than XPEL.

- Recession talks may impact new car sales and in turn Xpel negatively.

Conclusion

Xpel has once again proved management’s competency with this Rivian deal, and I would expect more similar partnerships to materialize over the next few years, including with other electric vehicle manufacturers. In my opinion, Xpel remains the best way to play the electric vehicle revolution, as Xpel is a capital-light and profitable company with plenty of room for growth left. The Xpel brand is popular with Tesla (TSLA) owners as well. Xpel’s management is once again making the right moves, and this only reinforces my estimate of fair value for Xpel.

Be the first to comment