iambuff/iStock via Getty Images

Investment Thesis

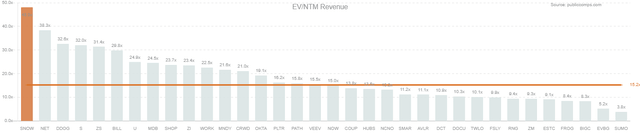

Snowflake Inc. (SNOW) continues to be the most expensive stock that we monitor in our high-growth SaaS peer set. However, SNOW is not your typical SaaS company as it relies mainly on consumption (93%) for its revenue model. Snowflake is also recognized as one of the two leading data lakehouse platforms in the market, alongside Databricks. Its partnership with the #1 hyperscaler AWS (AMZN) has also been constructive. Amazon also relies on Snowflake’s highly competitive platform to keep Azure (MSFT) and Google Cloud Platform (GOOGL) (GOOG) at bay.

SNOW stock has also been battered in the recent growth stocks sell-off. We are not surprised as it carries an expensive valuation. The market is marking down the valuations of growth stocks as a whole, and SNOW stock has also not been spared. Nonetheless, we believe that the company’s beat and raise quarter demonstrated the incredible momentum and growth opportunities ahead.

SNOW stock has dropped almost 30% below its November highs. However, as a strong momentum stock, we believe that the market reaction is overdone. Therefore, we believe that investors who previously missed buying SNOW stock should capitalize on the recent weakness to add.

Snowflake’s Data Sharing Model is Gaining Momentum Quickly

Snowflake has been gaining tremendous traction through its industry data cloud. CEO Frank Frank Slootman highlighted its momentum in the financial services data cloud and media data cloud. It’s part of the company’s strategic data sharing model. It enables companies to mobilize their data more effectively and collaborate in ways that they could not achieve on their own previously. Moreover, it has also allowed Snowflake to strengthen its relationship with its leading customers in these verticals, gaining deep insights into the inner workings of their business models. Notably, its media customers have also been relying more on Snowflake’s media data cloud in the wake of Apple’s (AAPL) new AppTrackingTransparency framework as they struggle for measurement and attribution. In addition, Apple’s IDFA changes have significantly impacted their abilities on their direct response ads. Therefore, what represented headwinds for many advertising tech companies, has become a tailwind for Snowflake. Slootman emphasized (edited):

We definitely see network effects. Because the industry and sub industry, they really induce and evoke the network effects because the entities have relationships and do business together. And advertising is under enormous pressure. So they are trying to enrich data for advertising yield and effectiveness. And when we’re trying to enrich data, that then triggers data sharing and data attribution type of strategy. So it’s very strong there. (Snowflake’s FQ3’22 earnings call)

Moreover, Snowflake added that retail companies have better understood the need to use their first-party data, moving closer to consumers. Therefore, Snowflake’s data-sharing model allows these companies to accelerate their momentum and use their data much more effectively. Notably, the company also explained that these gains have only started to gain traction and only represented the “tip of the iceberg.” Moreover, its highly scalable model can also be extended to more industry verticals moving forward as use cases continue to expand. Therefore, we believe that as more workloads migrate to the cloud, Snowflake’s cloud-agnostic platform will continue to play an extremely crucial role.

Snowflake’s Underlying Performance Has Improved Consistently

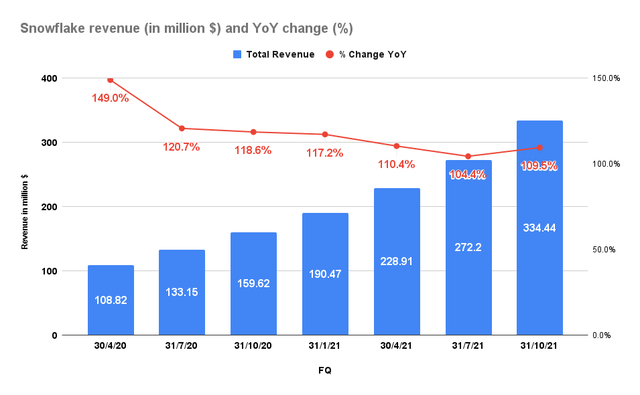

Snowflake revenue metrics S&P Capital IQ Snowflake profitability margins S&P Capital IQ, company filings

Readers can quickly glean the incredible topline growth Snowflake has achieved over the last two years, where YoY growth has consistently been above 100%. However, CFO Michael Scarpelli also reminded investors not to keep expecting such phenomenal quarters moving forward as Snowflake scales. He emphasized (edited):

I don’t think you’re going to see that same repeat of a beat. At least I’m not expecting that. I’m sure you guys would love it, but I just don’t see that happening in FQ4. As I said before, a 5% to 7% beat is a big beat for us with our model. So it was an exceptional performance in FQ3. I’m actually disappointed we outperformed that much, to be honest with you. (Snowflake’s FQ3’22 earnings call)

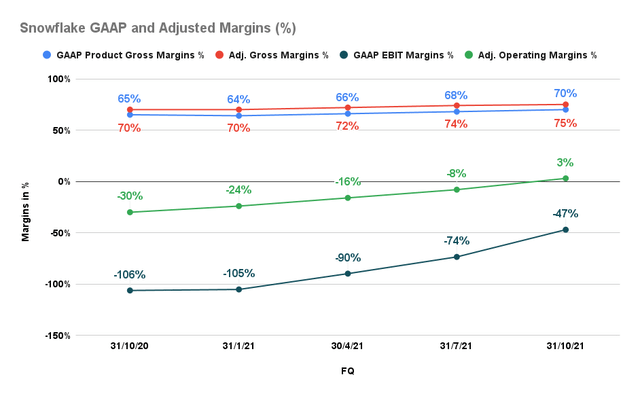

Despite the phenomenal beat, Snowflake is still an unprofitable company. Moreover, given its premium valuation (47.4x NTM revenue), some investors may be extremely wary of paying the premium asked by the market. But, investors should also note that Snowflake has gained operating leverage remarkably as it scales. Notably, its product gross margins have continued to improve, demonstrating its pricing power as use cases and consumption increase.

Considering that the company’s network and infrastructure costs are embedded in its cost of product revenue, it seems pretty impressive. However, Snowflake was also quick to emphasize that investors should not expect best-in-class SaaS-like gross margins of 80%. Moreover, Snowflake’s long-term (LT) operating model indicated an adjusted product gross margin of 75%, given its infrastructure costs.

However, its EBIT margin of -47% showed that the company was still deeply mired in the red. Nonetheless, the company preserves its cash flow by using stock-based compensation (SBC) heavily in its business model. Given SNOW stock’s premium valuation, we believe it’s astute for the company to capitalize on using SBC to drive growth. Consequently, it helped the company register an adjusted operating margin of 3% in FQ3’22 for the first time. We mentioned before that we favor SBC for high-growth companies if managed well, and if it consistently delivers solid leverage over time. We believe Snowflake’s tremendous improvement in its leverage demonstrated the competence of management in driving robust topline growth with an eye towards long-term profitability. Moreover, Snowflake achieved its positive adjusted operating margin one year ahead of consensus estimates. The company had guided for an LT adjusted operating margin of 10%, which we are confident that it’s well on track.

Nevertheless, Investors Must Monitor Databricks Momentum

Its arch-rival Databricks famously highlighted in November that it has “set the official world record for the fastest data warehouse with [its] Databricks SQL lakehouse platform.” Even though Snowflake went on to refute Databricks claim, Databricks countered by emphasizing that:

We stand by our blog post and the results: Databricks SQL provides superior performance and price performance over Snowflake, even on data warehousing workloads (TPC-DS). (Databricks)

The intense competition between these two rivals is not unexpected. Databricks’s business model started as a data lake platform and moved to data warehousing capabilities. In contrast, Snowflake initially focused on the data warehousing aspect and then moved on to semi-structured and unstructured data, competing in the realm of Databricks. Both companies believe that the data lakehouse will be the evolution of the data warehouse. Thus, investors should not be surprised that SNOW and Databricks will continue to compete aggressively for customers as more workloads are moved into the cloud.

Why is Snowflake Stock a Buy Now?

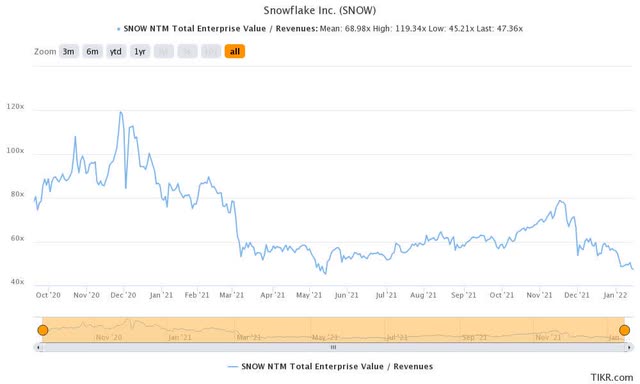

Snowflake Stock EV/NTM Revenue TIKR High-growth SaaS peer set Public Comps

As mentioned, SNOW stock is not cheap. Nevertheless, we believe that the company has thrived on its premium valuation. It’s trading at an EV/NTM Revenue of 47.4x, near its trough valuations in May’21. We have also revised our internal fair value estimate downwards to reflect the compressions in peers’ multiples. Following our revision, we observed that SNOW stock has also dropped back into our fair value zone (+/- 10%).

Snowflake stock consensus price target Vs. price performance Seeking Alpha

Moreover, investors can also observe that the consensus price target remains optimistic about the company’s prospects. It also represents the largest valuation gap since the stock bottomed out previously in May’21.

Therefore, we believe that if you missed the opportunity to add SNOW stock back in May’21, don’t miss this golden opportunity again.

As such, we reiterate our Buy rating on SNOW stock.

Be the first to comment