iambuff

Snowflake (NYSE:SNOW) is a leading Data Cloud and Data warehousing service provider. The company has recently announced a blockbuster quarter for fiscal Q2, where they surpassed analyst estimates for growth. The stock price popped by over 17% in pre market trading and the “snowball effect” may be taking hold as the company has shown signs of economies of scale benefits. In this post I’m going to break down what exactly Snowflake does, its super second quarter and even dive into its icy valuation.

What does Snowflake Do?

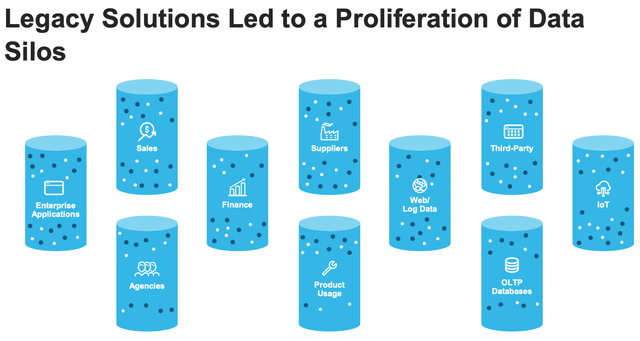

Companies historically have their data in “silos” spread across the organization. This could include Sales data in a Customer Relationship Management [CRM] database, Supplier data in another application, Product data in another database etc. The issue with this is as organizations get larger and they accumulate more “big data” they will want to bring it together in order to unlock new insights.

Legacy Solutions Silo data (Investor presentation)

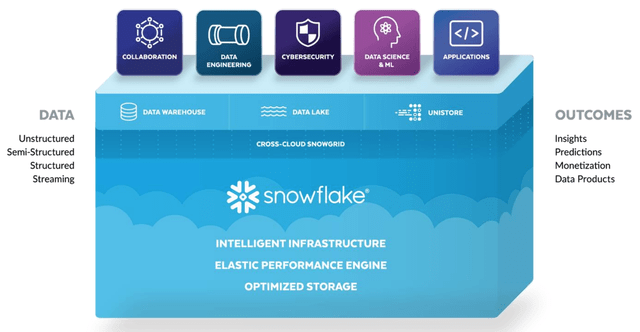

Enterprises can bring this data together in a variety of ways such as a via Data Lake, which contains unstructured data or a Data warehouse, which contains structured data. Companies can then run machine learning on the data inside their Data warehouse, in order to discover trends and new insights for business intelligence purposes. Popular data warehouses include Amazon Redshift (AMZN), Google BigQuery (GOOG) (GOOGL), Azure Synapse Analytics (MSFT) and of course Snowflake.

The key difference with Snowflake is its ability to operate seamlessly across multiple cloud providers (AWS, Google Cloud, Microsoft Azure). Thus it’s no surprise the platform is ranked as number one across multiple review websites. But that’s not all, Snowflake offers what is called a “Data Cloud” which offers solutions for a variety of applications from data warehousing to data science and even data sharing.

“The core idea behind the Snowflake Data Cloud is to enable work to come to the data and prevent data from having to be moved to the work.” – Snowflake Official statement

Prior to Snowflake, data would require itself to be copied transferred and replicated. If you’ve had ever transferred a large multi gigabyte video file to Google G drive or iCloud you will know it can take a long time. Now imagine trying to do this will “Exabytes” of data. Amazon Web Services even uses something called a “Snowmobile” which is effectively a massive truck which pulls up outside your organization and then downloads your data before putting it into the AWS cloud.

Snowflake’s data cloud even includes a Data Exchange which enables you to buy, sell and exchange data with others in order to leverage in business operations.

Snowflake (Snowflake Investor Presentation)

In the second quarter earnings call, Snowflake CEO Frank Slootman outlined the “next frontier” for the company:

“Our next frontier of innovation is aimed at reinventing cloud application development.

Our aim is to transform how cloud applications are built, deployed, sold and transacted. To help achieve this, we launched our Powered by Snowflake program. Today, we have 590 Powered by Snowflake registrants, representing 35% quarter-over-quarter growth. “

Snowflake’s Strong Second Quarter

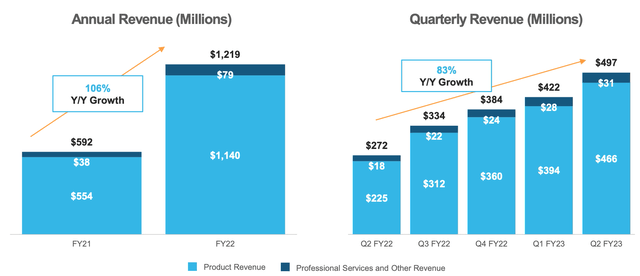

Snowflake generated strong earnings for the second quarter of fiscal 2023. Revenue was $497.2 million, up a blistering 83% year over year and beating analyst estimates by $30 million. Snowflakes management highlights Product Revenue as a key metric they focus on, this was $466.3 million in Q2, up a rapid 83% year over year.

Snowflake Revenue (Q2 Earnings Presentation)

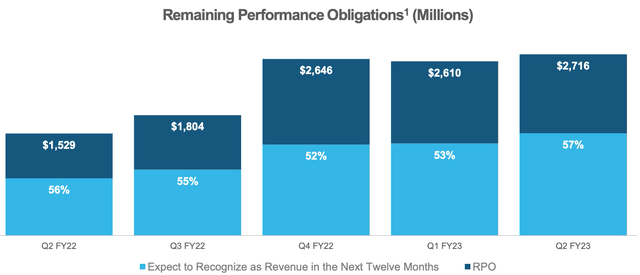

Remaining Performance Obligations [RPO] was $2.7 billion, which popped by 78% year over year. RPO is reliable indicator of future revenue as usually this is contracted but because the service hasn’t been delivered yet it goes into RPO. In this case, management expects ~57% of this RPO or $1.54 billion to be recognised as revenue within the next 12 months which is substantial.

Snowflake RPO (Q2 Earnings Presentation)

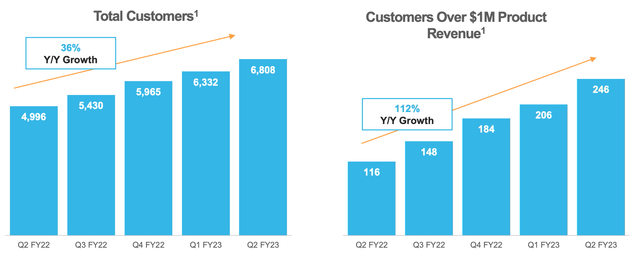

As of the second quarter snowflake has 6,808 customers which is up 36% year over year. This is the beauty of an enterprise level product as although the sales cycles can be longer and the buying process can be more complex, you only need a few thousand customers to make billions in revenue.

Snowflake customers (Q2 Earnings Presentation)

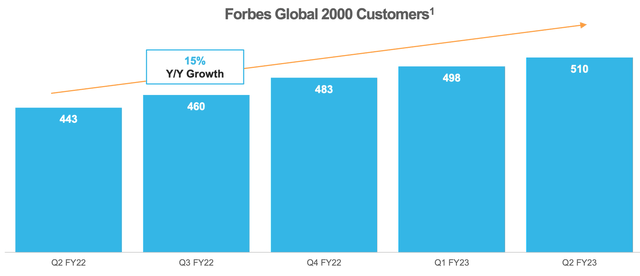

Snowflake is using a strategy of “growing upmarket” which involves targeting larger customers. For example, customers which contribute more than $1 million in Product Revenue has increased by more than double or 112% year over year to 246. Its Fortune Global 2000 customers have also increased by 15% year over year to 510 accounts with 12 new companies added in Q2 alone. This is a brilliant strategy as larger customers tend to have higher retention rates, higher budgets and more opportunities for upsells via a “land and expand” approach. Snowflake CFO Michael Scarpelli confirmed this in the Q2 earnings call, where he refers to the recent Global 2000 customer wins.

“We believe these accounts will grow to become our largest customers”

“A Global 2000 technology company is now a top 10 product revenue customer, less than 2 years after signing their initial deal”

Fortune 2000 Customers (Q2 earnings presentation)

Snowflakes strategy is to focus on industry verticals and then expand. Its core verticals are financial services, technology, media and entertainment, retail, advertising, CPG, healthcare and life sciences, with financial services being the fastest growing segment. Targeting via verticals is a great strategy, as the company can use an Account Based Marketing approach to target select companies and then use competitor case studies to cause a tipping point in sales. For example, if a large financial services company sees a competitor or peer company using the Snowflake service (via a case study). Then this will simultaneously give “social proof” or an endorsement to the product value, while also sparking “fomo” related to missing out on business optimization.

But Snowflake has also not forgotten about the little guy and its sales team which targets small and medium sized businesses, surpassed their new net booking goal for the quarter.

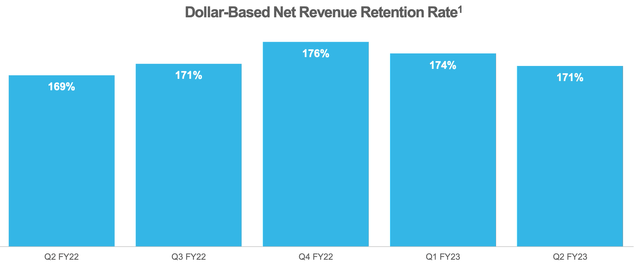

Snowflake has a world class retention rate of 171%, which means customers are finding the platform “sticky” and spending more through upsells and cross sells.

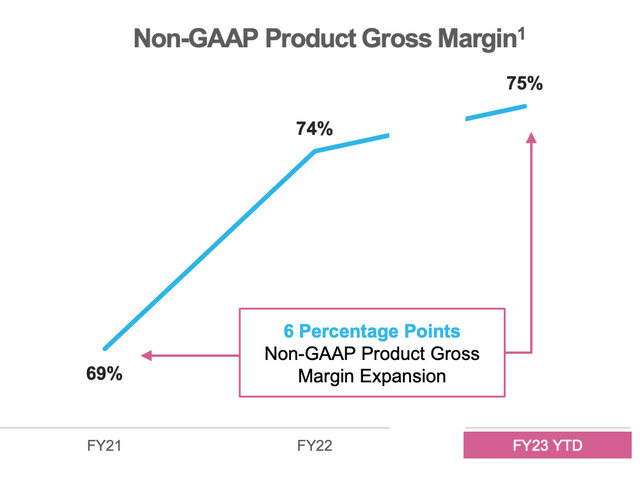

Gross Margins (Non GAAP) improved by 6% year over year to a high 75%. This was driven by cloud agreement pricing, economies of scale product improvements and enterprise customer success.

Gross Margin improvement (Q2 Earnings Report)

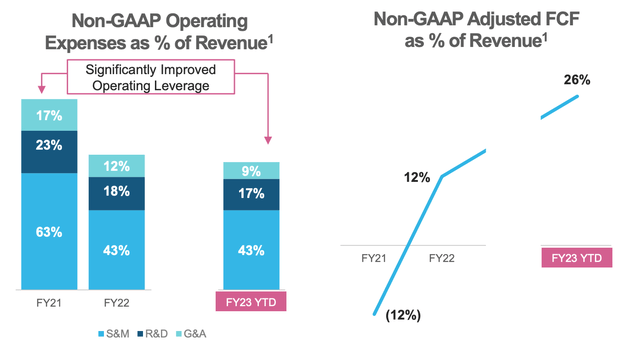

The company’s operating expenses as a % of revenue also showed significant improvement, which represented strong operating leverage. Software companies tend to have high operating leverage as once the platform is built they can scale easily with costs usually growing at a slower rate. The aforementioned larger customer relationships help with this, as it takes much less operational overhead to manage one large customer than 50 smaller ones.

Operating Margin (Q2 Earnings Report)

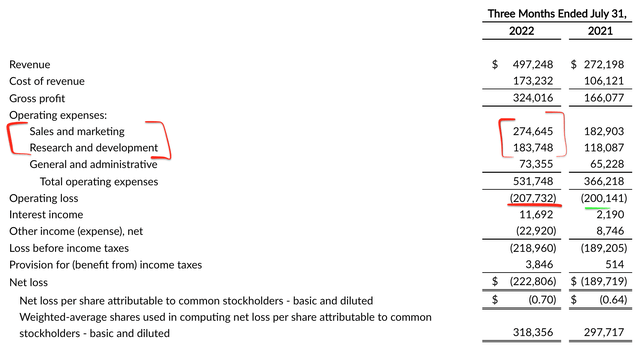

On a GAAP basis it should be noted that Snowflake is operating at a loss of $207.7 million. The good news is when we dive under the hood we see, this is primarily due to large investments into Sales and Marketing ($274.6 million). This makes sense as the company plans to invest for future growth and expand rapidly. Snowflake also invested $184 million in the past quarter into research and development. I also don’t deem this to be an issue as continual innovation of the product will be a key to future success. In addition, companies which invest more into R&D tend to produce greater shareholder returns long term. The key factor to watch for is operating leverage long term and as mentioned prior are signs of this which is a positive.

Income statement (author Screenshot Financial statements)

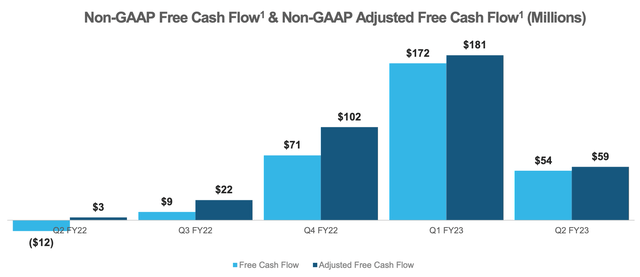

Free cash flow was $54 million in Q2 ’23 which increased from the negative $12 million generated in the equivalent quarter last year. However, it should be noted free cash flow was down from the prior quarter.

Free Cash Flow (Q2 Earnings report)

Snowflake is in a strong cash position with approximately $3.95 billion in cash, cash equivalents and short-term investments. With total debt of just $206 million which is very minimal.

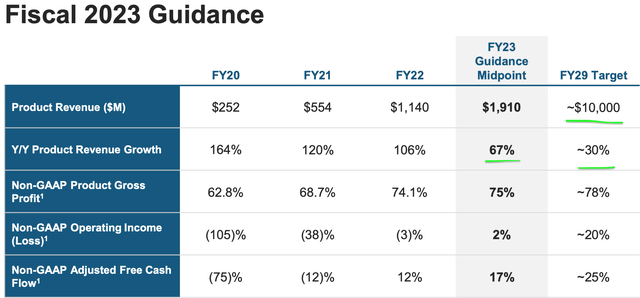

Moving forward the company is guiding for Product Revenue in the third quarter of between $500 million and $505 million, up ~60% year over year. With FY23 revenue of $1.9 billion, up 67% year over year. Amazingly management is forecasting an incredible $10 billion in revenue by the fiscal year 2029.

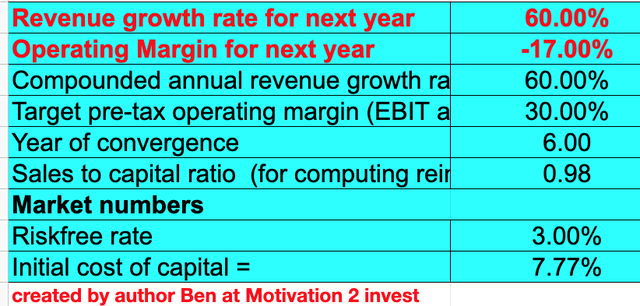

Advanced Valuation

In order to value Snowflake I have plugged my latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted an optimistic 60% compounded annual growth rate over the next 5 years, based on the company’s revenue targets and momentum.

Snowflake Stock Valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted its operating margin to increase over the next 6 years to 30% which is greater than the 25% average for the software industry. This increase is expected to be driven by the high operating leverage nature of the business and its high customer retention rate. For increased accuracy I have also capitalized the company’s R&D expenses.

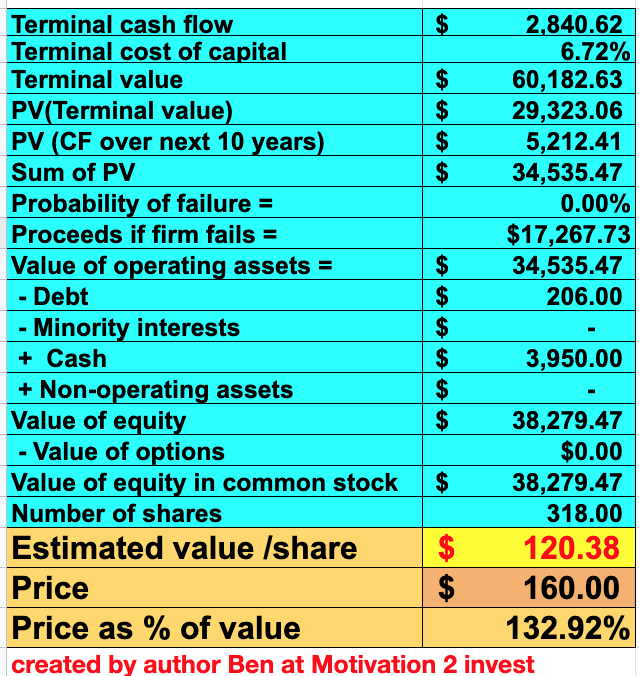

Snowflake stock valuation 2 (Created by Author Ben Alaimo at Motivation2invest)

Given these factors I get a fair value of $120/share, the stock price is ~$160 per share at the time of writing and thus is ~33% overvalued.

Snowflake is a one of those stocks which is infamously known for being “overvalued” but the company keeps performing well and they could live up to their valuation long term.

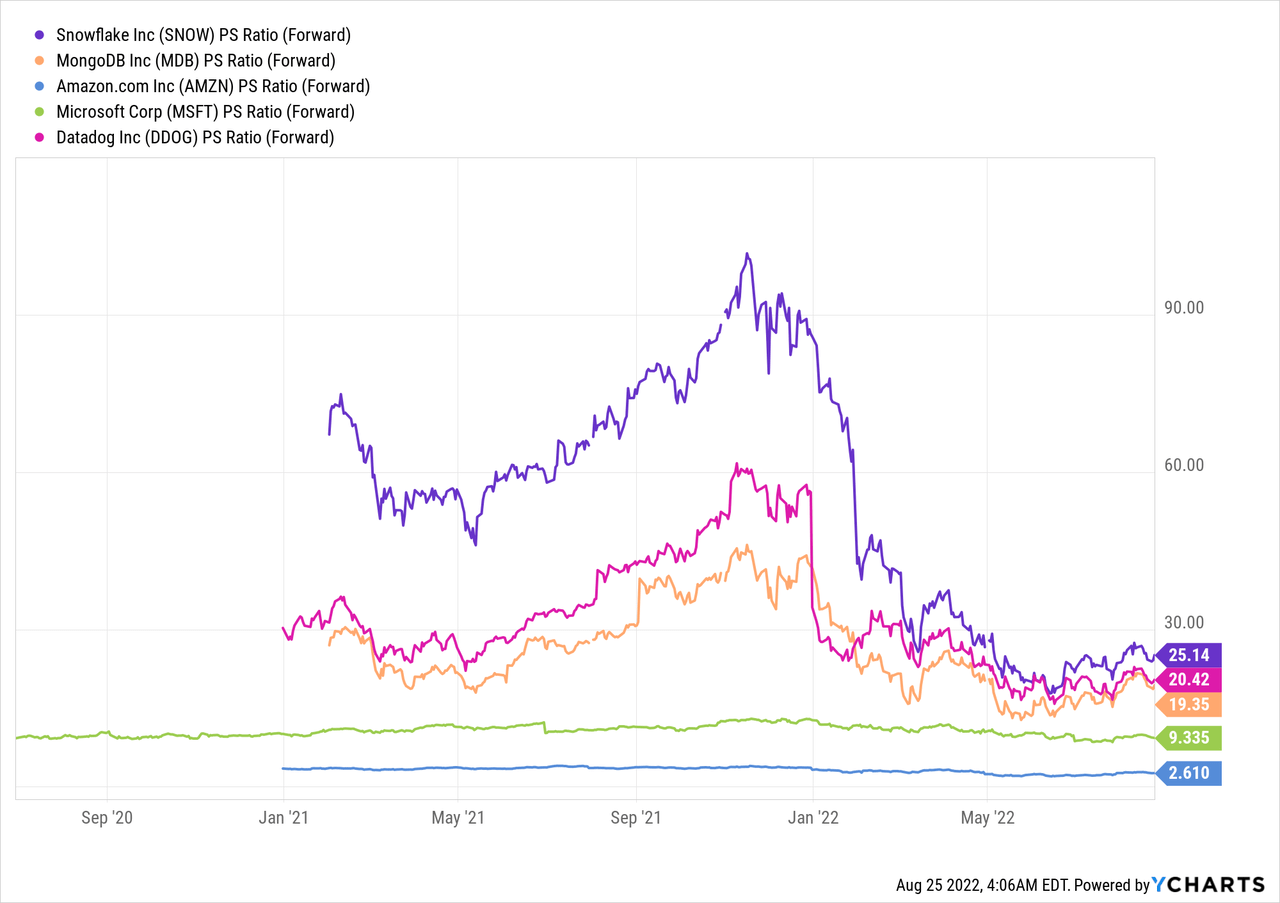

As an extra data point, Snowflake trades at a Price to Sales Ratio (forward) = 25, which is cheaper than historical levels over 90 in 2021, which was incredibly high. When I compare Snowflake to other database/data warehouse/cloud companies, Snowflake is more expensive, but also offers a fairly unique product as it’s a multi-cloud solution.

Risks

High Valuation

As mentioned prior Snowflake has high valuation and large future expectations baked into the stock.

Recession/Lower IT spending

Many analysts are forecasting a recession and thus we could see a temporary delay in IT spending moving into the next quarter.

According to Snowflake CFO Michael Scarpelli during the earnings call:

“Last quarter, we called out customers that were negatively impacted by headwinds specific to their businesses. The Q2 results from these customers were mixed. Some saw the weakness we expected while others outperformed. We are monitoring our key business metrics, which we believe are leading indicators of the macro economy impacting our business. We are not seeing these metrics soften across the customer base”.

Final Thoughts

Snowflake is an innovative technology company which is offering a world class big data solution to many large enterprises. It’s growing at a blistering rate and management has high confidence in future projections due to its revenue model. The only issue for me has been the valuation of Snowflake which has come down substantially but is still slightly above my intrinsic fair value estimates. However, I will label the stock as a “buy” due to the business quality and its “cheap” valuation relative to history. But prudent value investors may wish to wait for a pullback or some “bad news” before entering. We know “winter is coming” and also a possible recession. Thus if the company faces a short term headwind, then that could offer a stronger buying opportunity for the long term.

Be the first to comment