Kandl/iStock Editorial via Getty Images

We rate Clear Channel Outdoor Holdings (NYSE:CCO) as a strong buy because it has a three-dimensional growth story: 1) Digitization of its out-of-home (OOH) infrastructures, 2) Revolutionary transition to programmatic buying mechanism, and 3) Deleveraging & post-pandemic recovery. This opportunity exists because CCO was losing money during 2020-2021 due to the pandemic disruption although it has implemented some cost cuts and digitization and the market is significantly overlooking those growth stories, each of which can make the stock a multi-bagger. We also believe it could be a two-digit bagger if all of the stories play out thus generating compounded results. CCO will host its first investor day on Sep 8th, which can be a potential short-term catalyst if they decide to educate the market about the huge tailwinds ahead. We think they are likely to do so given its history of being more and more open to investors: in 2018, CCO didn’t disclose any data about its digital assets but in 2020 and 2021 it disclosed the number and revenue of its digital displays.

Business

CCO is the second largest player in the OOH advertising industry. It primarily builds value by purchasing and renting OOH advertising mediums such as billboards, posters, transit displays (airports, public transportation, etc.), street furniture displays, and spectaculars/wallscapes (New York Time Square, etc.), to lease them to advertisers. CCO has three operating segments: Americas, Europe, and Others (Latin America). Its Americas segment is the best asset because it earns higher margins and has less competition/regulation compared to the Europe segment, which is being divested.

CCO’s Americas margins vs. Europe margins (Made by the author based on past 10-Ks)

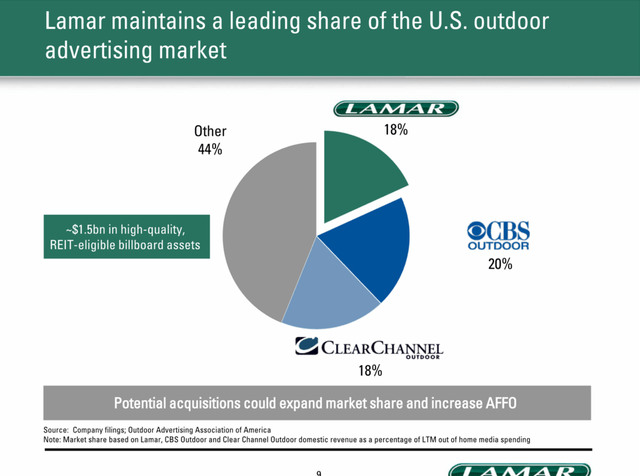

While we can’t find any presentation about market share on CCO’s website, I found this slide from a presentation of its competitor Lamar Advertising (LAMR) to support my statements above:

CCO’s market share (Lamar Advertising)

OOH is by nature a good market to be in because there are very high barriers for new entrants. Governments around the world have posed strict regulations such as the federal Highway Beautification Act (HBA) on OOH infrastructures and it’s very hard to get permits for new builds. According to CCO’s 2021 10-K:

In the past, state governments have purchased and removed existing lawful billboards for beautification purposes using federal funding for transportation enhancement programs… Local governments generally also include billboard control as part of their zoning laws and building codes, regulating those items described above, and include similar provisions regarding the removal of non-grandfathered structures that do not comply with certain of the local requirements.

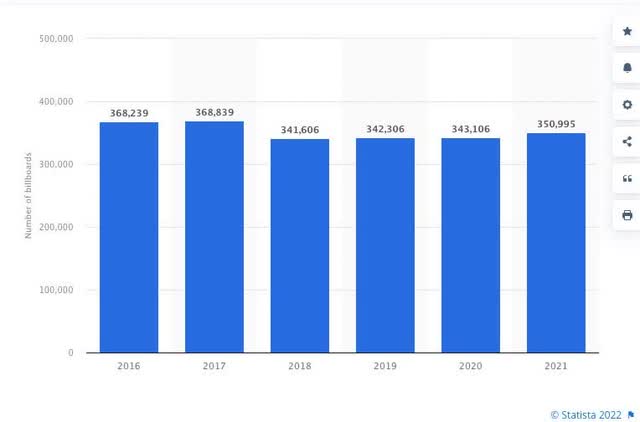

CCO’s competitor Lamar Media also said in its investor presentation that it is “nearly impossible” to replicate the OOH assets. The declining amount of billboards (chart below) indicates a less and less competitive environment which is extremely favorable to existing scaled players. OOH also inherently enjoys network effects, because the scaled players can offer more comprehensive packages and create ecosystem-like campaigns to satisfy large customers thus generating higher margins. The coming transitions to programmatic buying can only increase the network effect.

Number of billboards in the US (Statista)

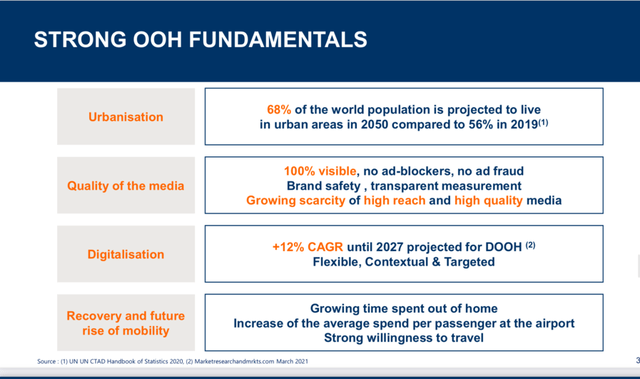

OOH advertising also has the following tailwinds:

OOH fundamentals (Zenith)

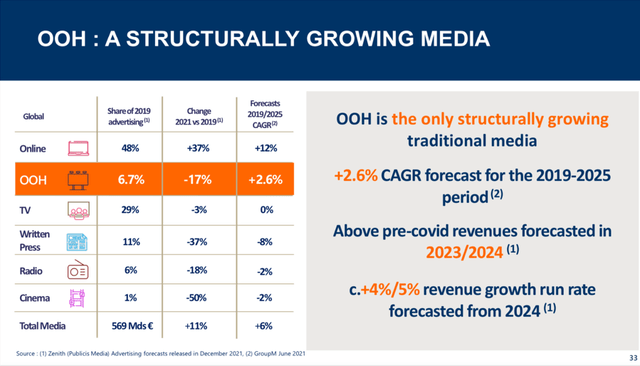

Tailwinds above made OOH the only grower among other traditional advertising medium peers:

OOH Growth (zenith)

It’s also worth noting that a large portion of CCO’s assets, namely its OOH permits, are indefinitely lived intangibles that are not subject to depreciation. As of the last 10-K CCO owns $717 million worth of permits. This portion of assets have high replacement costs (for reasons mentioned above) but was heavily impaired during the pandemic due to fewer outdoor activities. But in the long term, it’s almost impossible for people to continue to stay indoors. I believe these assets will be worth more as the pandemic fades away. This also shows us that CCO is not inherently a capital intensive business because the permits don’t require continuous capital expenditures.

Deleveraging Opportunities

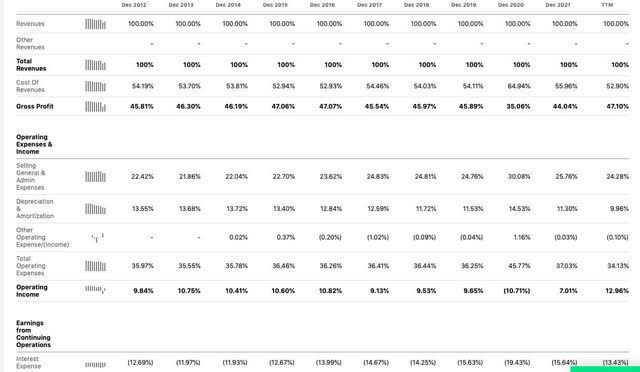

CCO is a special case among highly leveraged companies: For most companies with substantial debts (leasing companies, etc.), repaying debt can only reduce their ROE due to their low ROIC and capital-intensive natures. But for CCO, deleveraging can dramatically boost its ROE and share prices: As seen in the sheets below, CCO’s operating margin during the last 10 years has been steadily at ~10%. But all of the operating margins was eaten up by high interest expenses (~14% of revenue). Deleveraging enables CCO’s operating margin to drop directly to the bottom line, which indicates a run-rate net income of ~$270 million (pre-pandemic run-rate revenue was ~$2.8 billion), a 19% return on tangible assets, and an 11% ROIC.

CCO’s operating margin history (Seeking Alpha)

Deleveraging also reduces 87% of CCO’s TEV (assuming zero net debts after deleveraging), which would boost market cap (share price) to make up the missing debts. Here is the math:

Run rate revenue = $2.7 billion; Pre-pandemic 10 yr average operating margin = 10%;

2021 EBITDA $ = $TEV = market cap (no net debts) = $781 million;

Average TEV/EBITDA multiple = 11x (below average),

Market cap= TEV = 11* 2021 EBITDA $550 million (lower than 2019’s $726 million and assuming no growth from digitization) = $5.5 billion.

Share price= $6 billion/476.15 million = $12.6 per share, indicating 725% upside.

Note that this valuation completely excludes any possible growth from digitization and assumes the EBITDA stays at the 2021 level forever (which is significantly lower than pre-pandemic run-rate.)

While nobody knows when CCO could reduce its net debts to zero, it’s definitely a clear path for the company’s growth which offers a huge return. Remember that the company doesn’t need to do anything other than pay off its debt. It could happen sooner or later depending on how fast the divestiture of the Europe segment is. CCO launched an official strategic review in 2021 for the sale of its Europe segment, which later sent the stock to $4. There are also multiple articles here, here, and here indicating that the sale is close. While the sale of Europe segment is not the main thesis, it is definitely a potential catalyst.

Also, the new CEO Scott Wells who just took over in Q3 2021 was once an operating partner at Bain Capital. I think it’s very favorable for CCO to have an executive that is good at capital allocation, given its large amount of debt but huge growth potential in the future.

Digitization

In the past, OOH advertising was a mediocre advertising medium because it couldn’t impress audiences as well as other mediums such as TV or the internet. It was also very stiff in terms of inventory management (customers were forced to buy all of the inventories of a specific display during the lease term due to the nature of traditional billboards, even though they don’t need that much). But according to data published by Magna Global in December 2021:

Global revenues in the out-of-home sector are expected to grow at a 4.3% CAGR from 2021 to 2026, significantly faster than other traditional mediums.

This is largely due to the current digitization of the OOH sector.

Digitization has the following advantages:

- Better inventory management: Compared to the traditional ones, a digital display can generate way more revenue sources and can better satisfy different customers’ special needs (e.g. a bar might need more advertising during nighttime while clothes shops need more daytime advertising). This is a win-win situation in which both CCO and its customers are satisfied.

- Lower operating cost: After an initial investment, the digital displays can be controlled through a central computer system. This reduces the labor cost of swapping advertising materials for traditional displays.

- Better impression on audiences: Digital screens allow more creative commercial designs, and videos are inherently more fun. Therefore, digital displays are more efficient in generating impressions than traditional displays.

The statements above are evident by the following statement in the 10-K:

We were an early adopter of digital displays, and we continue to diligently pursue the digital transformation of our business, both domestically and internationally. Digitization of the asset base has been a proven driver of growth in the out-of-home sector and for us in particular. Digital displays enhance the core proposition of out-of-home advertising by improving the quality of display, enabling greater utilization of our best advertising locations through sequential displays, allowing advertisers to plan campaigns around specific days or times of day, and enhancing creativity and contextual relevance of advertisements by tailoring messages according to specific locations, times or other inputs. Digitization of the asset base also provides highly attractive economics, and we believe we have established leadership in unlocking the full benefits of a digital portfolio, including improving sales force capability; developing sophisticated pricing and packaging, campaign delivery, and measurement tools; developing flexible propositions, which allow us to change content by time of day and quickly change messaging based on advertisers’ needs; and automation. Additionally, digital technology allows us to transition from selling space on a display to a single advertiser to selling time on that display to multiple advertisers, creating new revenue opportunities from both new and existing customers. As of December 31, 2021, we had more than 22,000 digital displays worldwide, and revenue from digital displays accounted for approximately 36% of our total revenue in 2021, up from 31% in 2020.

Digital displays are also highly profitable:

Digitization of the OOH industry is not like those fly-up-high technologies that take forever to generate income. As of the last 10-K, CCO has 22,000 digital displays and 499,000 traditional + digital displays around the world. The digital displays are only 4.4% of the whole portfolio, but they generated $770 million in revenue, accounting for 34% of the total revenue of $2.241 billion. In terms of margins, while CCO doesn’t disclose digital margins directly, we can tell from the other financial numbers that the digital displays have significantly higher margins than the traditional ones. For example: In Americas segment, digital revenue increased 35% (excluding growth in revenue from transit displays such as airports to best eliminate post-pandemic recovery noises) while the non-digital revenue grew 11% including transit displays. During the meantime, the direct operating expenses only increased 5.7%.

Although this can’t tell us the exact margins of digital displays, we can clearly see that digital displays don’t have a crazy high cost but can generate way more revenues than traditional displays.

The estimate above can be supported by this excerpt from 2021 10-K:

We believe cash flow from operations will generally be sufficient to fund these expenditures because we expect enhanced margins through lower costs of production as digital advertisements are controlled by a central computer network, decreased down-time on displays as digital advertisements are digitally changed rather than manually posted, and incremental revenue through more targeted and time-specific advertisements.

About the economics of the digital displays, the management said the following during the 2Q22 earnings call:

…so Q2’21, we had 16,600 screens; Q2’22, 18,800. So 13% increase in screens…the digital revenue growth is far in excess with the digital screen growth…as we get to scale across different markets, it becomes a stronger and stronger proposition.

So far, only 4% of CCO’s displays are digital. There is a very long runway ahead for the digitization growth story. Also, the digital transitions will impact the P&L statements quickly since the costs will be capitalized.

Programmatic Buying

It used to be very hard for the customers to quantize the contribution from OOH to the campaign, but it’s no longer the case. The OOH industry has been investing heavily in data and technologies and it is now more advanced than most investors would think. The iconic product of this development is RADAR: a platform that allows customers to track their campaign’s performance and offers the customers better flexibility for their inventories. Most of internet ads are done programmatically and OOH’s transformation would definitely attract more customers and deliver more value. The development and advantages of programmatic buying can be found in the 2021 10-K:

We are redefining how outdoor media is bought and sold, working closely with customers, advertising agencies and other diversified media companies to develop more sophisticated approaches to delivering the right audiences in the right locations at the right time. One example is our programmatic effort to sell digital billboard advertisements using automated advertisement sales technology to introduce ease and efficiency to the out-of-home advertising sales process and enable better targeting of digital billboard advertising. Another example is our Proposal Team, which provides proposal preparation and marketing support for our key multi-market sales efforts. A third area is our proof-of-performance delivery platform that is leading the industry in providing transparency when the ad is delivered, accessible via an application programming interface to allow partners to pull proof-of-performance information into whichever system they choose. Additionally, in light of the effects of COVID-19, we have expanded our client-direct selling initiatives with a focus on selling creative ideas as opposed to specific billboard locations as advertisers work to realign their advertising campaigns.

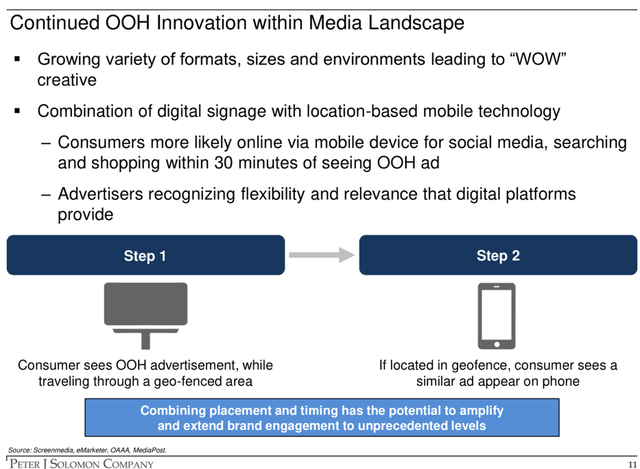

We also like the fact that the digitization and the programmatic buying reformation combination can create compounded results if they happened together. Programmatic operations can’t be efficient if most of the billboards are traditional ones. In comparison, digital displays match perfectly with programmatic operations due to features such as instant commercial deployment and “personalized” advertisement strategies. One example can be seen in the slide below:

Programmatic buying illustrated (Peter J Solomon Company)

Balance sheet

The large amount of debt used to be a big problem for CCO, but the management successfully refinanced at lower rates during the pandemic. As of the last 10Q, CCO has $5.6 billion in debt ($5.29 billion excluding cash), including $2 billion of term loans, which “amortizes in equal quarterly installments in an aggregate annual amount of $20.0 million”, with the balance due in August 2026; $1.25 billion of 5.125% Senior Secured Notes due 2027; $1.0 billion of CCOH 7.75% Senior Notes due 2028; $1.05 billion of CCOH 7.5% Senior Notes due 2029; $375.0 million of CCIBV Senior Secured Notes due 2025. We think the one due 2025 is of no trouble to CCO because its cash position alone can cover it. If CCO’s EBITDA can return to the 2019 level ($726 million), it could generate at least ~ $4.6 billion from today to 2028, which is 83% of the debts. Now if we count in the growth digitization brings, and secular growth, CCO can easily pay off its debt. Don’t forget that repaying debt itself can make the stock a seven-bagger. If digitization also plays out well, the debt repayments would then accelerate therefore realizing compounded return. CCO can carry out very high returns with pretty low risk due to its multi-dimensional growth story.

Valuation

I see CCO as a deep value opportunity with a long runway. While it’s impossible to predict the incremental return over the long term because the magic of compounding (deleveraging + digitization) can create unbelievable results, I will do a relatively short-term valuation based on growth rate. Also, I will exclude the possibility of deleveraging from the following valuations since I already did one above, and it’s impossible to calculate the real return if all of the stories play out.

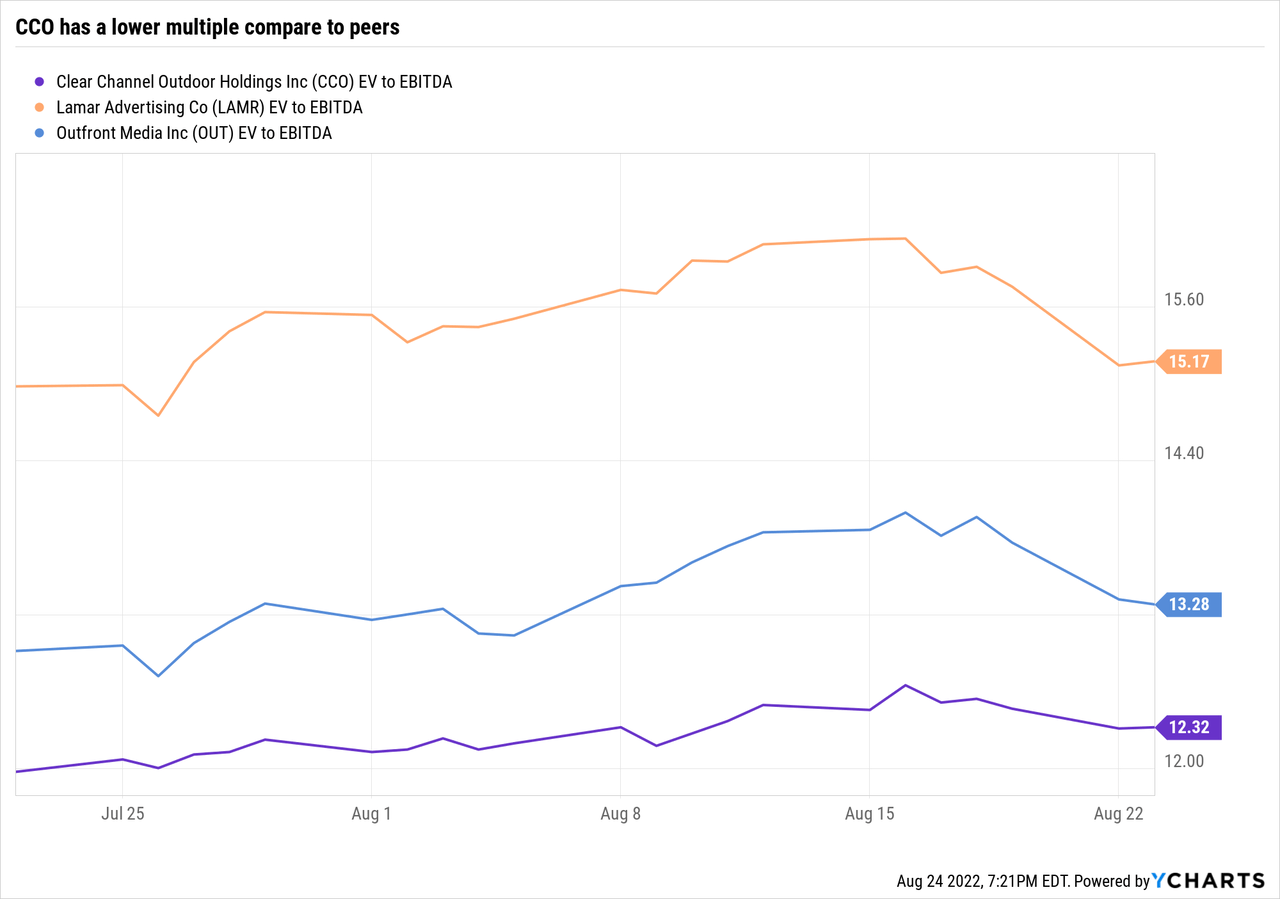

Bull Case: 2025 EBITDA = $980 million (20% annual growth rate from 2019 $568 million level due to digitization), TEV/EBITDA= 15x (align with Lamar comp); TEV= 15* 980= $14.7 billion; Market cap =14.7 – 5.29 (net debt)= $9.4 billion; Share price =$9.4 billion/476.15 million= $19.7, indicating ~1139% incremental return, 125% CAGR.

Base Case: 2025 EBITDA = $756 million (10% annual growth from 2019 level); TEV/EBITDA= 13x (align with Outfront Media (OUT) comp); TEV= 13* 756= $9.8 billion; Market cap= 9.8-5.29= $4.51 billion, Share price= $4.51 billion/476.15 million= $9.47, indicating 548% incremental return, 76% CAGR.

Bear Case: No growth from digitization; TEV/EBITDA multiple remains at the current level; The company does nothing other than repaying its debt: 725% incremental return in 2028 (see the valuation in “Deleveraging Opportunities” section, 39% CAGR.

Risk

1. Digital displays’ margins are not as high as Pro-forma: We see this as unlikely because the advantages of digital plays are solid and tangible. Customers are also likely to allocate more promotion budgets to OOH from other traditional mediums like TV since they are losing market shares while OOH is self-disrupting to increase its impact on audiences.

2. Funding issues: Digitization requires a large amount of capital to fund the layout of digital infrastructures but CCO has lots of debt. While this might slow down CCO’s growth, we don’t think it would bring the company in trouble because even if CCO cut Capex to repay its debt it would still generate 39% CAGR (see bear case). CCO is a strong buy because it has a multi-dimensional growth story which dramatically reduces the risks.

Conclusion:

As Warren Buffett said during an annual meeting, “It just requires a certain amount of common sense.” Compared to the popular “next big things” that burn several billion a year, OOH’s technology transformation is very simple. It’s not hard to imagine a future in which all the billboards are digital and can deliver “personalized” advertisements (like the internet does) to outdoor audiences in a way more efficient manner than in the past. Bolder imagination would be things like interactive displays etc. When that day comes, the stock can be a double-digits (or even triple-digits since tech progress always delivers unbelievable results) bagger. This is a technology that has a real foreseeable future that is very profitable (unlike most other meme tech stocks). However, it is overlooked by the market due to the pandemic disruptions, high leverage, and the lack of understanding of the business. I recommend holding the stock as long as the digitization is going on and/or the debt is being paid off.

Be the first to comment