CJ Rivera

Colgate-Palmolive (NYSE:CL) is hardly a business for risk-seeking and short-term oriented investors. While the management has given us a master class in long-term value creation, the share price is also unlikely to make anyone rich quickly. On the contrary, CL is an investment akin for anyone looking for steady value accumulation, superior risk-adjusted returns and a wide moat.

I first covered the company about four years ago when I emphasized the importance of having high and sustainable return on invested capital. My investment thesis has not changed materially since then, although for a period of time I did warn against the company’s high valuation.

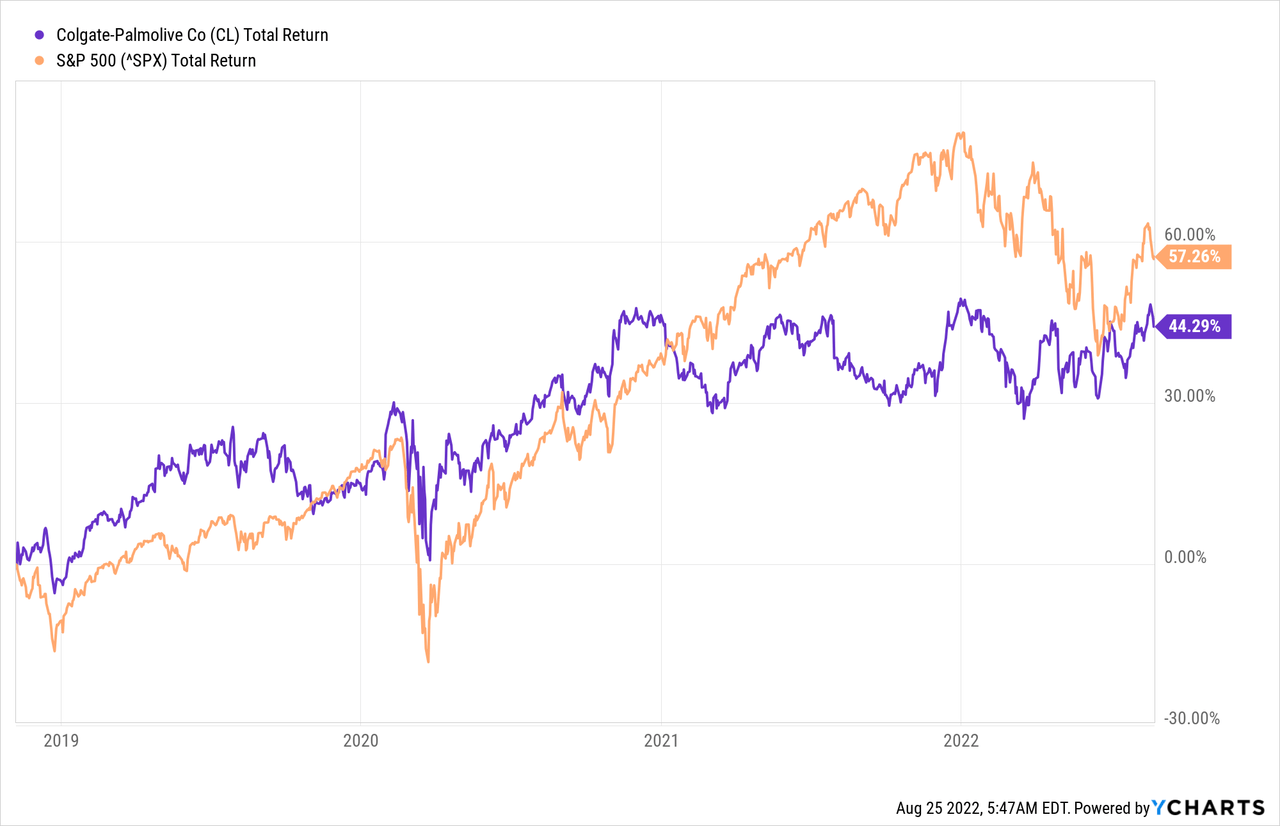

To put everything said above into perspective, CL has achieved a total return more than 44% since my first article on the company, while the broader equity market returned roughly 57% over the same period.

For the average retail investor, that would have meant significant underperformance at a time when returns of many high-risk technology names were making the headlines on a daily basis.

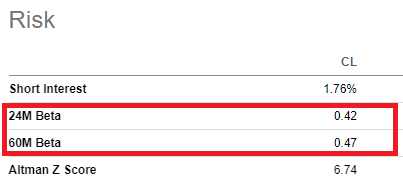

If we consider risk, however, things look rather different for Colgate-Palmolive. The company has a beta of below 0.5 and more specifically of 0.42 over the past two years and 0.47 over a 5-year period.

Seeking Alpha

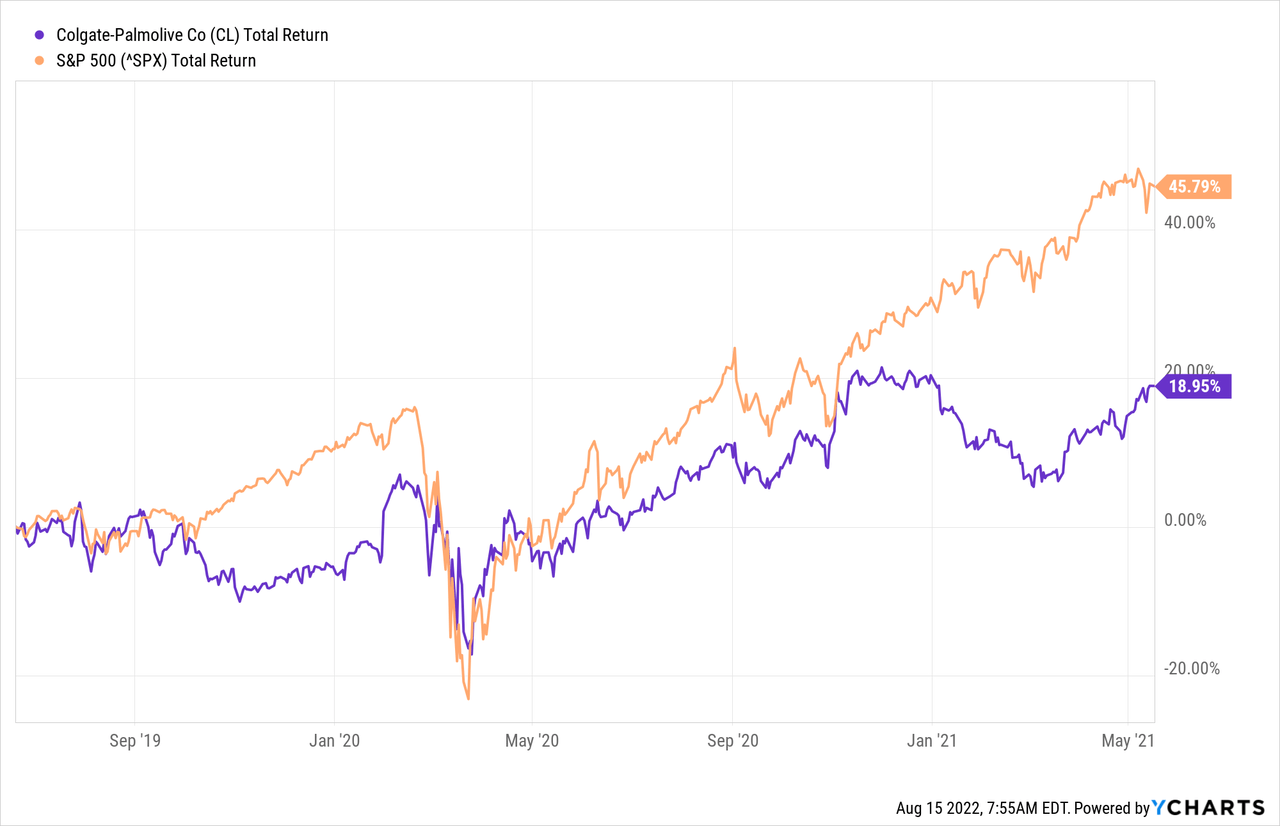

Therefore, on a risk-adjusted basis, Colgate-Palmolive has been a far superior investment over the period. Moreover, during the period when I rated the company as a ‘Hold’ and warned against short to medium term risks, CL did underperform the overall market.

The Power Of Strong Global Brands

As inflationary pressures are raging through the economy, consumer staples are at risk of declining volumes and margin pressures. These effects, however, are more pronounced for companies operating in lower valued added segments and those having weaker brands.

In that regard, Colgate-Palmolive brand portfolio is well-positioned with many of the global strongest brands in their respective categories.

Colgate-Palmolive Investor Presentation

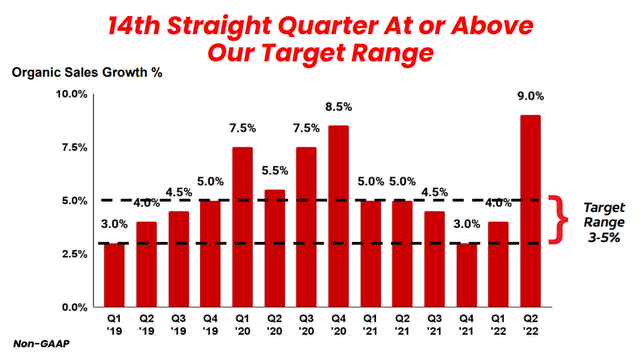

That is why, the company has recently surprised the investment community by reporting one of its strongest quarterly organic sales growth numbers in more than a decade.

Colgate-Palmolive Investor Presentation

For comparison, Procter & Gamble’s (PG) most recent results were still below that number which clearly illustrates the pricing power of Colgate-Palmolive’s brands.

Procter & Gamble Investor Presentation

Yet another reason why CL’s most recent results were so impressive, was that the company achieved that in spite of its high exposure to markets outside of the United States (see below) at a time when the U.S. dollar index reached new highs.

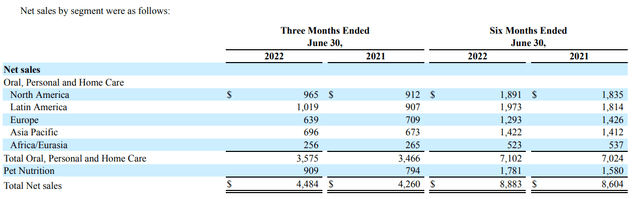

Colgate-Palmolive 10-Q SEC Filing

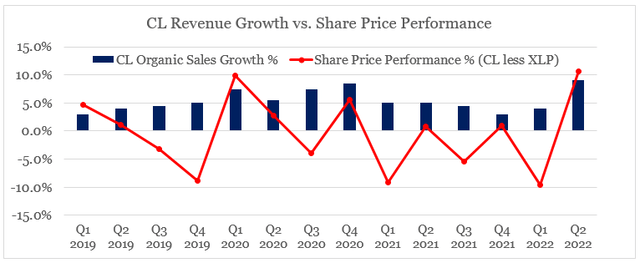

The market has also been fixated on topline growth numbers, as Colgate tends to outperform the Consumer Staples Select Sector SPDR Fund (XLP) during quarters when organic sales growth is at high single digits.

prepared by the author, using data from Seeking Alpha and Colgate-Palmolive Investor Presentation

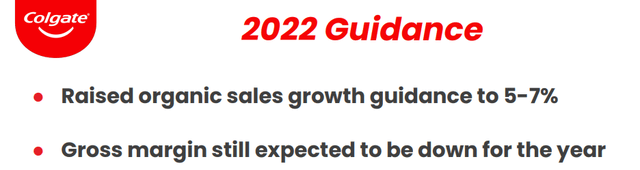

The impressive topline growth, however, was not a one-off deal as CL increased its full year guidance to 5-7%.

Colgate-Palmolive Investor Presentation

Profitability In The Spotlight

Although sales growth is highly important for large cap consumer staples, which are severely limited in their growth potential, profitability is where long-term investors should be focused.

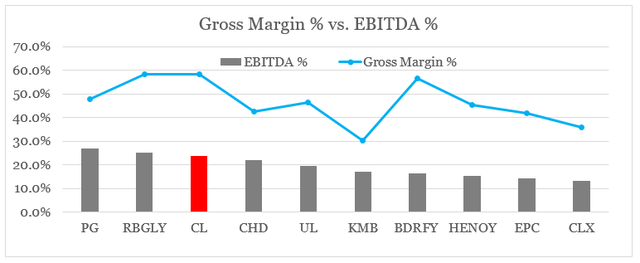

Colgate-Palmolive has been one of the most profitable businesses in the Home & Personal Care space, both on gross profit and EBITDA basis.

prepared by the author, using data from Seeking Alpha

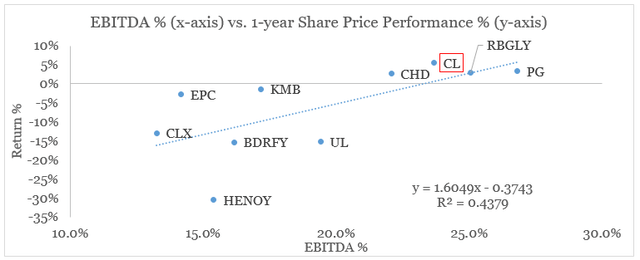

As the graph below clearly illustrates, more profitable businesses have fared far better in past year, when inflationary pressures returned.

prepared by the author, using data from Seeking Alpha

Not only are more profitable businesses better positioned to weather the rising commodity prices, but also have much better reinvestment opportunities and stronger competitive advantages. Having said that, gross margins are usually a good starting point since they indicate the price premium achieved by the company’s brands.

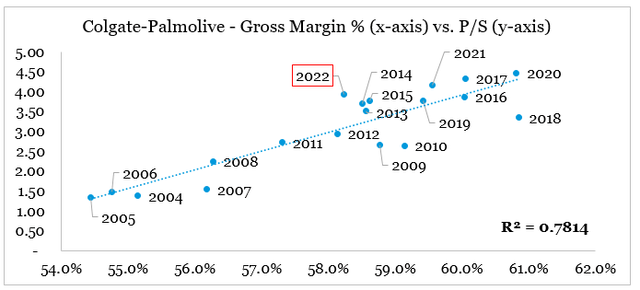

That is why, on a historical basis, gross margin is a very good indicator of Colgate’s price-to-sales multiples.

prepared by the author, using data from SEC Filings and Seeking Alpha

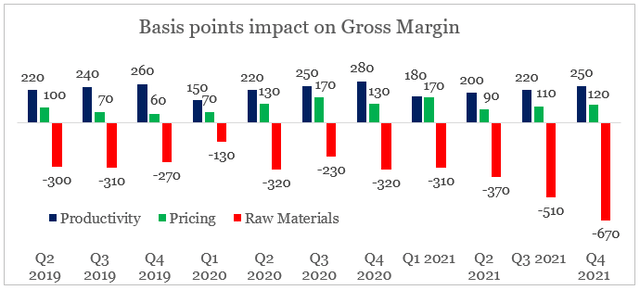

Following the tailwinds during 2020, Colgate’s gross margins have quickly fallen back to pre-pandemic levels and are now at one of their lowest levels for the past decade. As we see in the graph below, rising costs of raw materials were the major driving force of this decline.

prepared by the author, using data from Earnings Transcripts

Although CL’s management has done a good job at improving productivity and the strong brands allowed for pricing action, inflationary pressures were far stronger and eventually margins fell. Interestingly, the management seems to have discontinued the practice to report the segmented basis points impact on gross margin since the first quarter of 2022.

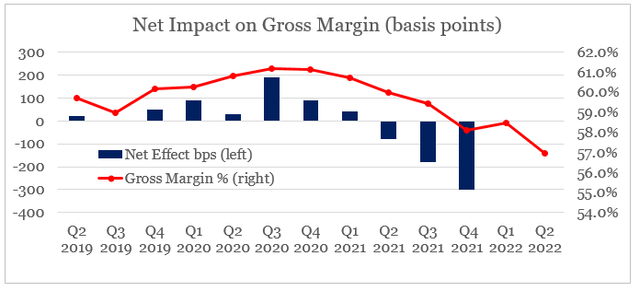

Not surprisingly, since then gross margin fell sharply.

prepared by the author, using data from Seeking Alpha

As dire as the recent historical results might seem, Colgate’s valuation multiples seem to suggest that this downward trajectory in margins is unlikely to continue. That is why CL’s P/S multiple is far higher than it was back in 2012, even though gross margins are roughly in-line (see the graph above).

To understand why that is, we should take a look at the major raw materials used in production of Colgate’s products.

The Company is exposed to price volatility related to raw materials used in production, such as essential oils, resins, tropical oils, pulp, tallow, corn, poultry and soybeans.

Source: Colgate-Palmolive 10-K SEC Filing

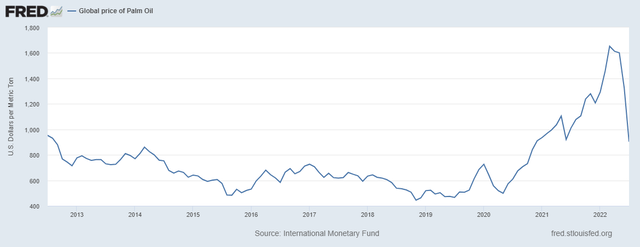

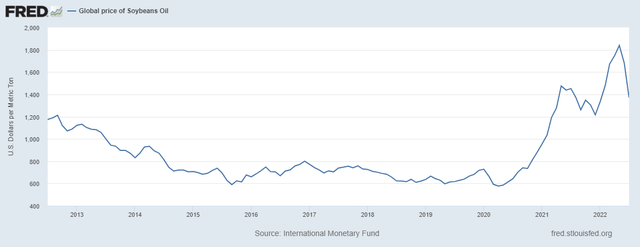

As prices of all these rose sharply in recent years, major commodities, such as palm oil and soybeans oil, are already back to 2021 levels.

This does not necessarily mean that pricing pressures will continue to ease, however it is a major relief for Colgate’s margins going forward. At the same time, price increases of CL’s products are most likely permanent and with that would soon allow the company to regain its profitability provided that supply chain issues do not persist.

Conclusion

Colgate-Palmolive is hardly a company that will make the headlines with spectacular shareholder returns over brief periods of time. Nevertheless, CL continues to quietly generate alpha and deliver superior risk-adjusted returns for those who care not only about returns but also about risk. As inflationary pressures continue to dominate today’s narrative around the company, long-term holders should look beyond that and take advantage of any short-term noise.

Be the first to comment