D-Keine

In a recent article, we explained that a recession could be very good news for real estate investment trusts (“REITs”) (VNQ). It may sound counter-intuitive, but hear me out.

REIT investors are mainly concerned about rising interest rates at the moment, and this is the main reason why REITs dropped by 20% over the past months.

Interest rates are rising because inflation is high.

But a recession could resolve all of this. It would likely cause inflation to cool down and therefore, it would also stop interest rates from rising and quite possibly, even lead to a drop in interest rates.

In that sense, a recession could be a blessing in disguise. It would remove the primary concern of investors, which is rising interest rates. REIT investors don’t worry much about recessions anyway since REITs enjoy multi-year leases and they generally use low leverage.

That’s when bad news for the economy is actually good news for REITs, and this thesis has now begun to play out.

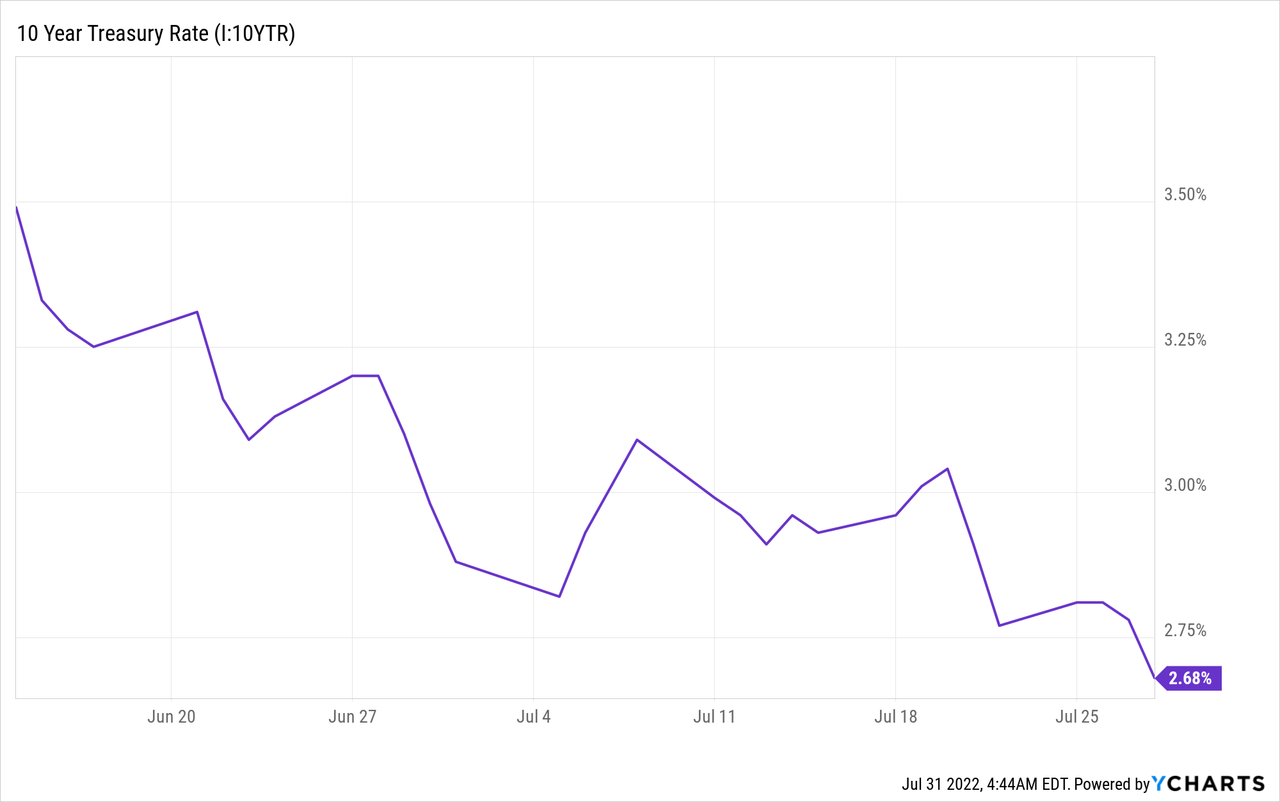

We have had the second quarter of declining GDP and therefore, we are now officially in a recession. It has caused inflation expectations to drop and the 10-year treasury rapidly came back down to 2.6%, the lowest level since mid-April:

How did REITs react?

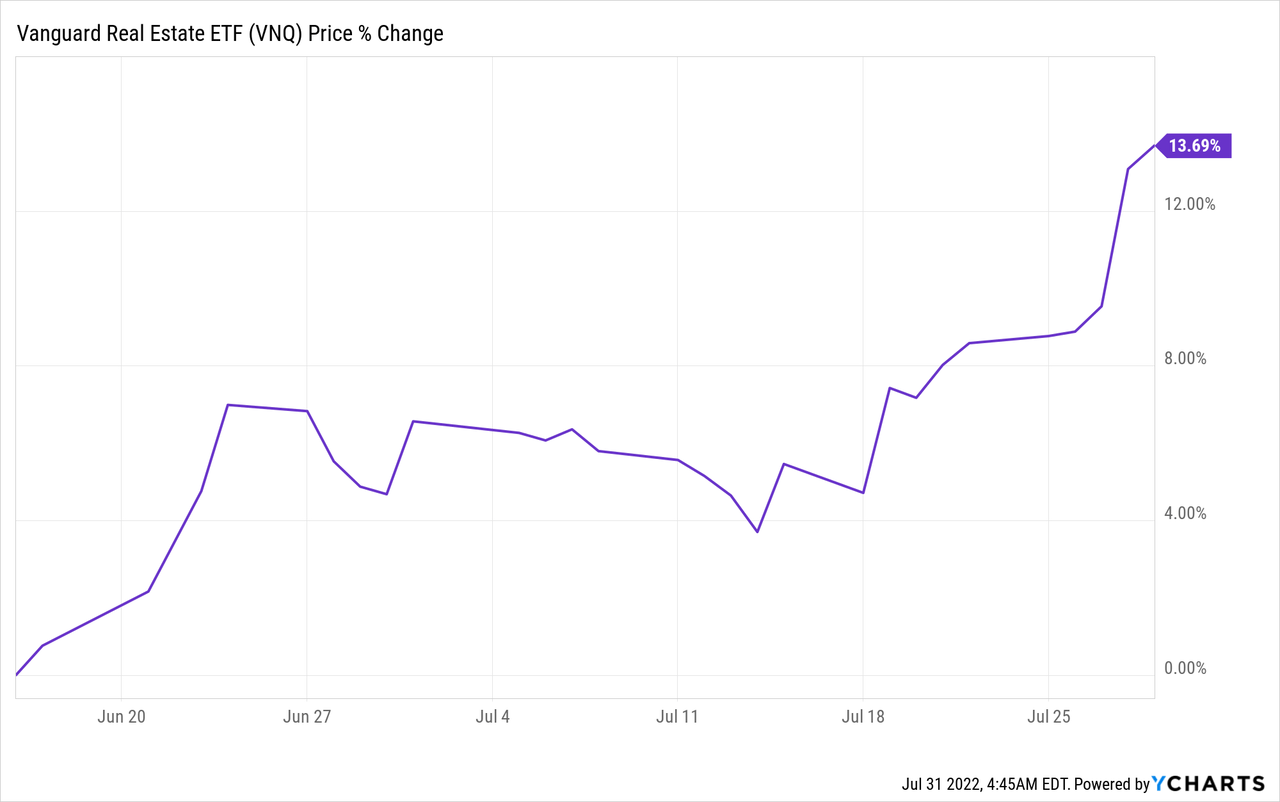

They rose by 13.7%:

So, a recession is in fact good news for most REITs.

But not all REITs are created equal.

Some REITs are responding better than others to a recession / declining interest rates.

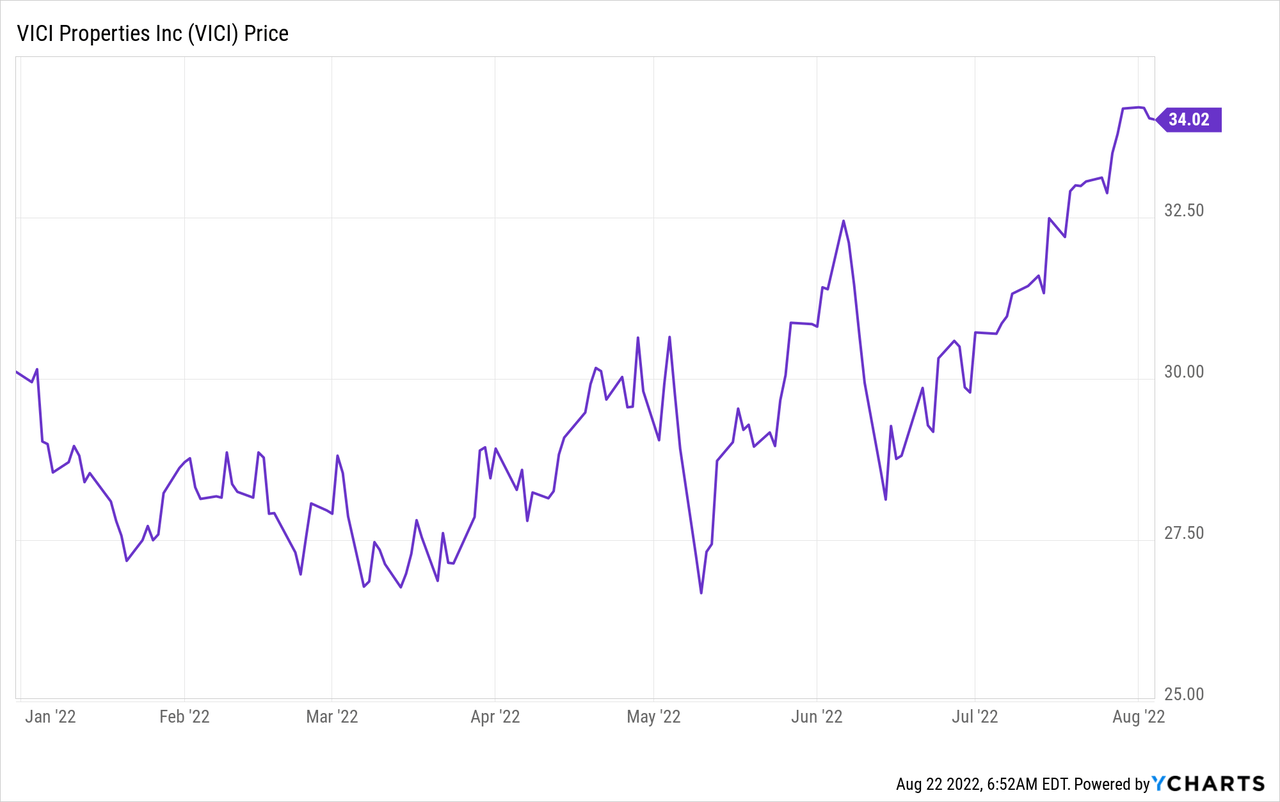

VICI Properties Inc. (VICI) is the best example here. Its share price has already recovered to new all-time highs and this is because it generates steady cash flow from leases that enjoy multi-decade long terms and CPI adjustments so there is little to worry about:

But there are still some fairly similar REITs that remain discounted and that’s what we are buying at the moment.

Below, we highlight 2 recession-resistant REITs that are ready to rise as the market recovers:

NewLake Capital Partners, Inc. (OTCQX:NLCP)

NewLake Capital Partners is one of just a few cannabis REITs.

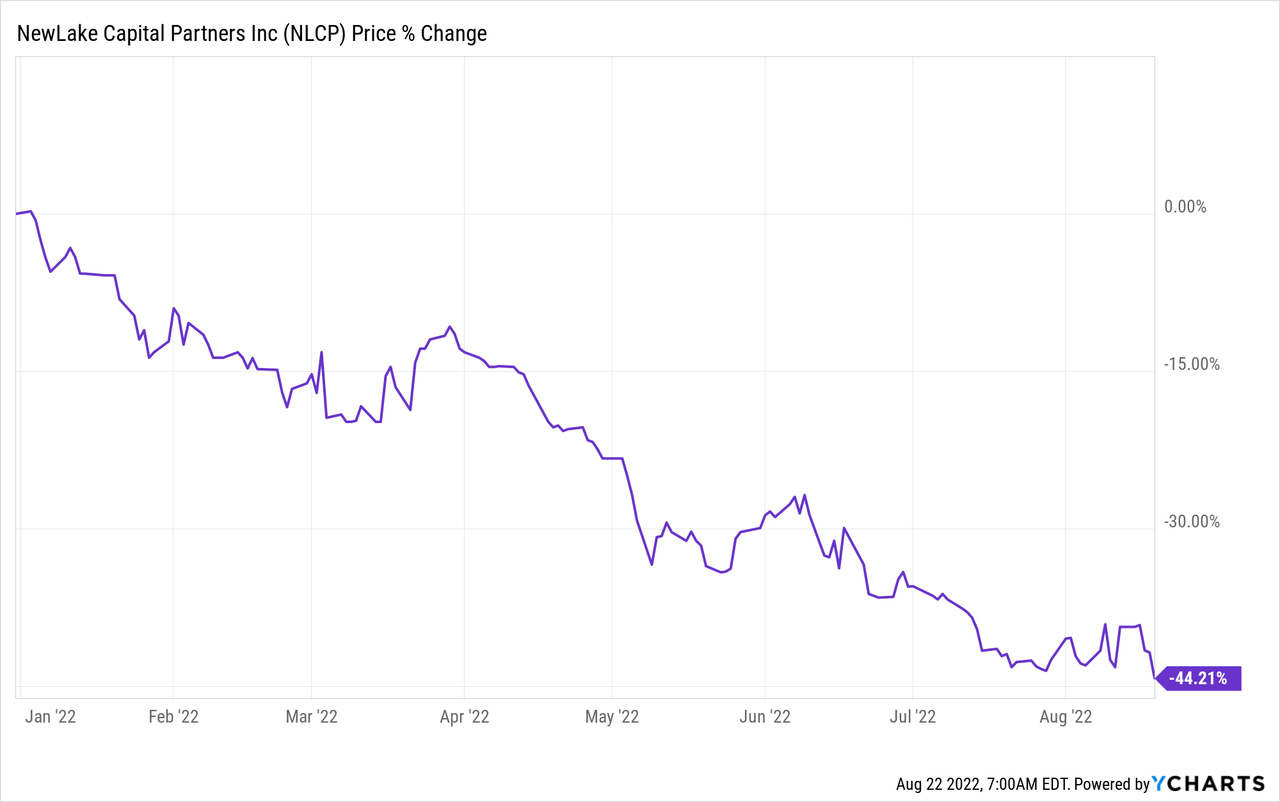

NLCP missed out on the recent recovery because the cannabis sector is currently out-of-favor and as a result, its share price is still at near an all-time low:

But here’s why we think that this is an opportunity:

NLCP trades as if it was a cannabis cultivator or retailer, but in reality, it is much more resilient since it is a landlord that generates steady and predictable cash flow from 14-year-long leases with pre-set rents, 3% annual rent bumps, and no landlord responsibilities.

Here is one of the properties that it owns:

NewLake Capital Partners

Moreover, its properties are all in limited license states and with tenants that enjoy strong rent coverage for the most part. Therefore, NLCP’s cash flow should remain stable, regardless of near-term headwinds facing the cannabis sector, or even a recession. On the contrary, people typically drink and smoke more during recessions as it gives them an escape and helps them cope with the harder times.

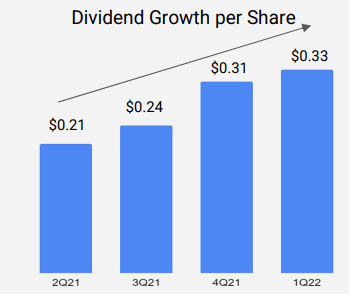

To prove my point: consider that NLCP just hiked its dividend by another 6% to $0.35 quarterly, and that’s after already hiking it significantly over the past quarters. This is not indicative of a REIT that’s struggling.

NewLake Capital Partners

The REIT just announced that it had invested the remaining $50 million that it still had from its IPO proceeds across three properties. It also announced that it had managed to triple the size of its credit facility from $30 million to $90 million. The facility has a fixed interest rate of 5.65% for the first three years and a floating rate thereafter.

This will result in significant additional growth since the company only has a $350 million market cap!

The rising rates don’t have much of an impact on NLCP since it barely has any debt on its balance sheet at the moment. In fact, it could even benefit NLCP because it will push its tenants to do even more sale & leaseback transactions, potentially at even more attractive terms, as their cost of capital rises.

So to recap: this is a REIT that’s growing rapidly, enjoying recession-resilience, and it isn’t materially affected by interest rate hikes.

And despite that, it is down 45% year-to-date, which is far more than the average of the REIT sector, which is down 15%. In a rational marketplace, you would expect NLCP to have actually outperformed the REIT market averages since its business is less affected by rising rates.

The only reasonable explanation that we find for this drop is that the cannabis sector is out-of-favor. It also does not help that NLCP’s closest peer, Innovative Industrial Properties (IIPR), recently reported that one of its tenants had failed to pay its rent, but this appears to be an isolated case based on the discussions in their latest earnings call.

At the current share price, NLCP is priced at 9x FFO and an 8.4% dividend yield, a valuation that makes little sense given how well the company is performing. We expect 50%+ as it recovers from the recent sell-off and while we wait, we collect an 8.4% dividend yield, which on its own, provides us a nice return. If you fear potential tenant issues (a la IIPR), keep in mind that NLCP’s rents also automatically rise by nearly 3% each year, it has little debt, and it has large capacity to keep pursuing highly accretive acquisitions to grow externally. This should easily make up for any potential issues.

Medical Properties Trust, Inc. (MPW)

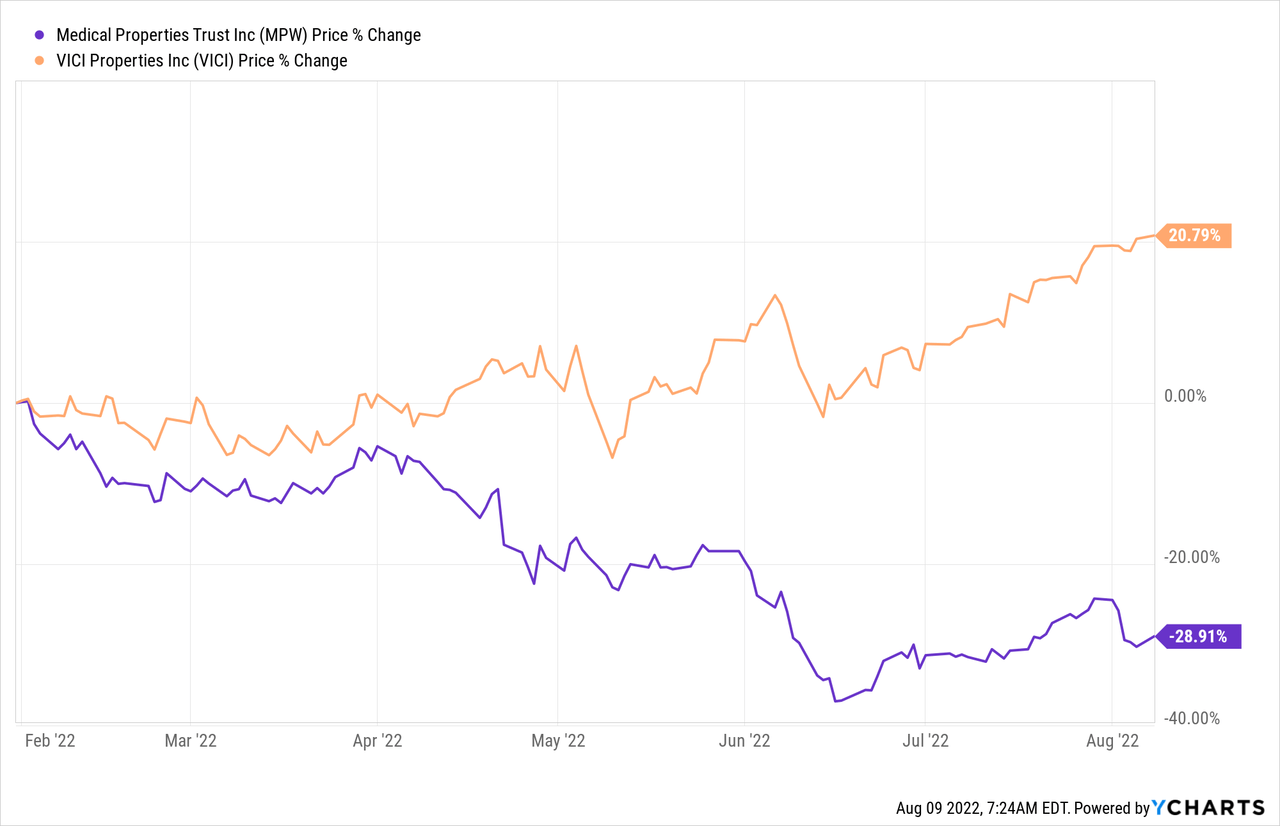

Medical Properties Trust is quite similar to VICI Properties in many ways.

They both enjoy multi-decade long leases with tenants that are recession-resistant.

They both also have CPI adjustments in their leases that provide inflation protection. In fact, MPW has even better ones than VICI.

And they both focus on specialty assets that lack a strong institutional following. MPW focuses on hospital property investments, whereas VICI focuses on casinos.

The main difference is that VICI has fully recovered as the market recognizes that its business is recession and inflation-proof, but MPW failed to recover and still trades at a deeply discounted price:

YCHARTS

You could even argue that MPW should have outperformed VICI given that hospitals are even more resilient to recessions than casinos, and MPW has even better inflation protection provisions in its leases.

But MPW performed so poorly in large parts due to fears over the health of some of its biggest tenants.

Short sellers argue that MPW’s tenants are in distress. MPW argues that they are healthy and enjoy strong ~2.5x rent coverage which is very good, so where is the confusion coming from?

The management focuses on property-level rent coverage, whereas short sellers focus on company-level rent coverage, which is of course a lot weaker if a tenant has a lot of debt and high corporate-level overhead.

Both metrics matter, but ultimately, the most important metric is the property-level rent coverage for a triple net lease landlord. That’s because it demonstrates how profitable the assets are. If a tenant is overleveraged and/or has too much overhead at the corporate level, it can push it into bankruptcy, but it is unlikely to walk away from profitable leases just because it has to reorganize its debt. This is why most net lease REITs focus on property-level rent coverage. It is the profitability of the profit-center (the property) that really determines the sustainability of its rents and value.

Medical Properties Trust

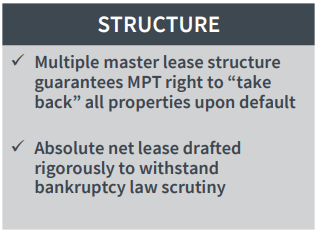

MPW is well aware that as it buys properties that are managed by heavily leveraged operators, it is inevitable that it will need to occasionally deal with tenant bankruptcies. This is why this is taken into account when underwriting its investments. MPW only buys highly profitable facilities that are identified as a necessary infrastructure for local hospital delivery systems and it then structures leases that can resist even bankruptcies:

Medical Properties Trust

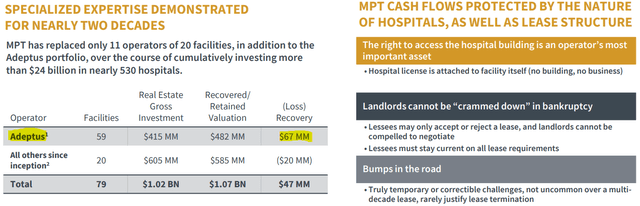

A great example is how MPW dealt with the bankruptcy of Adeptus a few years back. This was a fairly large tenant as it represented 6.5% of its rent back then. The properties were profitable but the tenant went bankrupt anyway due to overleverage and other issues.

Unfortunately, in this case, MPW had no luck and it was faced with the worst-case scenario. The tenant walked away from the properties as it could not reorganize its finances. Even then, MPW managed to release most properties at materially identical rents and it then sold some other properties at large gains.

Virtually all of MPW’s assets enjoy similar careful planning and foresight in case they run into difficulties with tenants down the line.

Remember that MPW is buying real estate first and foremost, and not a tenant. If a tenant goes away, MPW still owns profitable real estate that it can and will release to another tenant.

This also explains why MPW was able to recently sell a JV interest in a portfolio of Steward hospital to a sophisticated institutional investor at a low 5.8% cap rate. They understand that while Steward’s corporate-level finances may be questionable, it is the property-level profitability that really matters to a triple net lease landlord. So this explains why I believe that the fears are overblown. MPW’s properties are profitable and necessary to the communities they serve.

While the short sellers make some interesting points, I also think that they exaggerate concerns related to the management quality and alignment, which in my view, are unwarranted. They are always particularly quick to criticize the management for being non-transparent and trying to hide the finances of their tenants. A remark that often comes up is the following:

“In this case, I would add that not only has MPW simply IMPLIED that this tenant is doing okay, but there has been a refusal to release the 2021 financial statements of Steward. Why is this?” –

Short sellers are heavily pushing this narrative, but it is quite disingenuous because it just isn’t that simple.

Seeking Alpha author, Beyond Savings, provided a very comprehensive answer to this question in a recent comment section (emphasis added):

—— beginning of quote ——

Because Steward is a privately owned company and generally, private companies don’t release their financials publicly. That’s one of the perks of being PRIVATE. MPW doesn’t have the authority to release the financials on their own without the permission of the other 90% of stakeholders in Steward. It would be illegal and they would be sued for doing so.

Most REITs lease to privately owned companies, and most REITs do not release a quarter of the clarity that MPW has released on Steward [emphasis added by Jussi]. Most REITs don’t even disclose rent coverage by company. MPW had to twist some arms to get permission to publish that. And about 1/3rd of their investment portfolio refused to give it to them and told MPW to pound sand (as is entirely their right and would be my advice if a company asked my opinion). Simply put, these are private companies whose financial business doesn’t belong in the public domain. Non-disclosure agreements preventing the landlord from disclosing financials are standard operating procedure in leases. Find me a REIT that has disclosed more info than MPW on their non-public tenants…

Steward is owned by a bunch of doctors. Maybe they don’t want their neighbors, patients, and acquaintances knowing their business. That is entirely reasonable. Steward has absolutely nothing to gain from releasing its financials, so why should it? I’m a bit surprised they allowed the release of 2020, which was apparently just an effort to reassure people they aren’t going out of business.

That was discussed on the earnings call, and was why they disclosed 2020’s (the SEC made them). Now, Steward is under 20% (they are 25% gross assets, but the rule uses GAAP asset value which is lower because of depreciation). Now MPW is no longer required to disclose it, so they can’t without permission from Steward, which in the call Aldag seemed to imply that wouldn’t be likely, but it really sounded like he had no interest in even asking.

Worst case, Steward files bankruptcy. So what? Steward has two lenders, their revolver and MPW. That’s an advantageous negotiating position for MPW. If it happens at some point in the future, MPW will deal with it. The only reason to sell now is if you think Steward is going bankrupt soon. Which the evidence of their actions strongly suggests is not even slightly likely. [Jussi’s addition: Beyond Savings is here probably referring to the fact that Steward has been buying more hospital operations from other operators, which is typically the opposite of what you would expect of a company in distress. All the evidence also suggests that the MPW properties of Steward are highly profitable and MPW also noted that they expect Steward to generate substantial and sustainable positive free cash flow at the corporate level beginning in Q4 2022.]

The evidence that Steward might go bankrupt or might have any financial problems at all?

1. A balance sheet from 2020, which wasn’t great but neither were the financials of any public hospital company, and probably not a single private hospital in the world. Something happened in 2020… I can’t seem to remember what it was.

2…. speculation using the lack of evidence as evidence. “We haven’t seen the financials, so the MUST be horrible!” Well you haven’t seen the financials for 7-eleven. OMG, they might go bankrupt. Why hasn’t O disclosed them!!! O hasn’t even bothered to tell us what their rent coverage is. Sunrise Senior Living, what do their financials look like? OMG WELL hasn’t disclosed them. Must be because they are going bankrupt!

La Vie OHI’s largest tenant FKA Consulate. What do their restructured financials look like? We have no idea. Again, they haven’t even told us their EBITDAR, that’s 10% of rent. They restructured to dodge $258 million in False Claims Act judgements against them. We do know that Steward had a judgement against them, and they just paid it.

Like I said, not having this disclosure is standard in the REIT sector. I’m not sure why people think it is a big deal for MPW, but not for every other REIT that does the same thing (and in most cases, provides materially less disclosure). When investing in a REIT, you are trusting management to underwrite their investments. You aren’t going to have anywhere near enough information to make an informed decision. So far, I’ve seen no reason to question MPWs ability to underwrite. The few tenant problems they’ve had over the years were resolved with minimal overall impact to the company. [Jussi’s addition: As we have noted in our full investment thesis (click here to read it), MPW has a long track record of significant market outperformance which is reflective of high management quality.]

—— end of quote ——

Does this mean that Steward is risk-free or that MPW’s management is perfect?

Of course not, but the point is simply that MPW appears to be getting a lot of unfair criticism, which is likely caused by the short sellers whose interests are to scare other investors away from the company.

MPW has suffered similar short attacks in the past and they have always revolved around the same points: tenant health, management quality, etc., and yet, the share price has always recovered as eventually, the narrative shifted back to the cash flow, which has continued to rise over time.

Right now, MPW is priced at a 33% discount from its recent highs, and you get paid a 7.2% dividend yield while you wait for the recovery. The dividend was also hiked by 4% earlier this year, which is not exactly indicative of any distress… If the management was hiding something and was aware that Steward was at high risk of bankruptcy, it surely wouldn’t have hiked the dividend.

The bottom line is that MPW is not risk-free, but I like the risk-to-reward from the perspective of a long-term-oriented investor who has the stomach to handle the volatility.

We are buying profitable real estate leased on a triple net basis, not the consolidated financial performance of its tenants. We earn high and predictable cash flow that’s growing at a good pace and we are getting it at a discounted price.

Bottom Line

NLCP and MPW are two examples of recession-resistant REITs that enjoy significant upside potential, pay high dividends, and continue to grow.

At High Yield Landlord, we have historically managed to outperform the broader market by targeting such REITs.

Be the first to comment