Prostock-Studio/iStock via Getty Images

Investment Thesis

Snap (NYSE:SNAP) delivers the results I expected and wrote about last week when I issued my sell rating.

To be absolutely clear, investing is a game of odds. Nobody can ever be 100% sure of a stock’s performance, even if they would know the results beforehand. It’s always a question of attempting to get the odds as much as possible in your favor and being humble enough to leave yourself a margin of safety.

I believed last week, as I do now, that Snap is overvalued and that paying 4x revenues for Snap is still too expensive.

There are multiple factors impacting its potential, from privacy changes, the macro environment, and too much competition. If I held Snap shares today, irrespective of the price I paid, I would sell them.

Revenue Growth Rates Fizzle Out

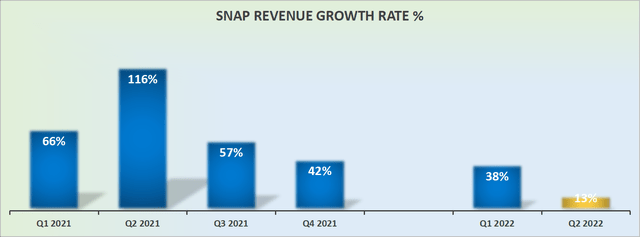

Snap’s revenue growth rates

One thing is now clear, Snap’s performance in 2021 will not be repeated any time again soon, if ever. Its strongest revenue growth rates are now in the rearview mirror.

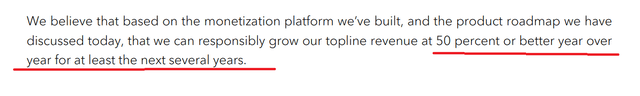

Investors that closely follow Snap, they’ll remember that back in 2021 Snap had its investor day where Snap said,

Snap 2021 Investor Day

Above you see Snap proclaiming that it could grow at a 50% CAGR over the next several years.

Yet, a year on from that statement and we can see just how erroneous that statement turned out to be. You can read the transcript yourself here.

Snap’s Prospects Look Dim

Last week, when I wrote that Snap was too risky to buy, investors clambered into the stock, with the stock rallying more than 19% in a short period of time. Why?

Because we had all been heavily indoctrinated to always buy the dip. Irrespective of the company’s near-term prospects, always buy the dip. That strategy had worked so well in the past 10 plus years, why would it all of a sudden be different this time?

After all Snap was already down 80% from its highs, and the company wasn’t going to go away, so surely down 80% means a huge bargain, right?

Not necessarily. In some cases, that’s a good time, but at other times, not really. When it comes down to it, investors must always be thinking about the next 12 months ahead, because that’s what the market is trying to price in.

To get to the next twelve months, Snap will have to go through the next twelve months. And there is a myriad of cross-currents at play that investors need to keep in mind.

Implications for Advertising Stocks?

During its shareholder letter, Snap admits that there’s increased competition for advertising dollars. That was probably the biggest takeaway that I believe investors haven’t been fully factoring into advertising stocks’ valuations.

Advertising stocks had already de-rated lower given the impact of geopolitical tensions combined with Apple’s (AAPL) iOS privacy changes. A strong storm was already underway.

However, I contend that investors had come to believe that the advertising sector was growing at a large enough pace that even when considering these headwinds, that the advertising sector would be resilient enough.

I no longer see how that’s possible. I make the argument that even though many advertising stocks are down materially more than 50% from their previous highs, the group as a whole will be very volatile throughout this earnings season. A strong storm is turning into a hurricane.

What You Need To Watch Out For

Snap announces a $500 million share repurchase program. They tell you in the press statement that the purpose of the repurchase program is to offset the dilution.

For Q2 2022, Snap’s stock-based compensation is up 25% y/y. Yet I make the case that the pace of increased stock-based compensation will be up even higher over the next twelve months, as a large portion of the stock-based compensation issued over the previous twelve months is now out of the money.

Said another way, Snap will have to increase its stock-based compensation, to retain talented executives that are now seeing their previous compensation package has significantly less value than previously believed.

And that does something for the company’s morale when you are getting paid a lot less for doing the same work that you were previously doing!

Snap’s balance sheet holds approximately $1 billion of net cash and equivalents. Yet, the business is unprofitable and doesn’t generate any free cash flow.

Consequently, I seriously question exactly how much of this announced $500 million share repurchase program will Snap actually execute? I suspect that Snap will exhaust less than 60% of this program.

Snap Stock Valuation – Not Cheap

Anyone thinking about buying Snap today are looking in the rearview and pricing anchoring to a higher price. But it makes no difference what journey the shares have taken to get here.

Whatever Snap was priced at last year, whether it was $70, $50, $40, or even $20, this doesn’t give investors any indication of where the share price will be over the next twelve months.

Looking ahead, Snap is priced at about 4x this year’s revenues. However, this is a business that simply struggles to be GAAP profitable. And the only reason why it’s able to occasionally make any free cash flow is since the bulk of its running costs comes in the form of stock-based compensation, which gets added back as a non-cash expense.

The Bottom Line

Snap has fallen from grace. There will be a time in the future when it will make a lot of sense to buy these shares. But I make the argument that the time to buy these shares is not now when the business is struggling to find its footing and report sustainable high growth.

The days of Snap reporting 30% CAGR in a sustainable fashion are now gone. And until investors come to believe that Snap is able to consistently and predictably generate robust profitability, investors will do very well to avoid this stock.

Be the first to comment