Sundry Photography

When it comes to investing in tech stocks, I’m typically more inclined to invest in mid-cap, value-oriented growth stocks that are lesser-known than the cloud giants. This year’s rout in tech, however, has decimated the entire sector rather indiscriminately, and appealing buy opportunities exist both in small and large caps as we look forward to a potential year-end market rebound.

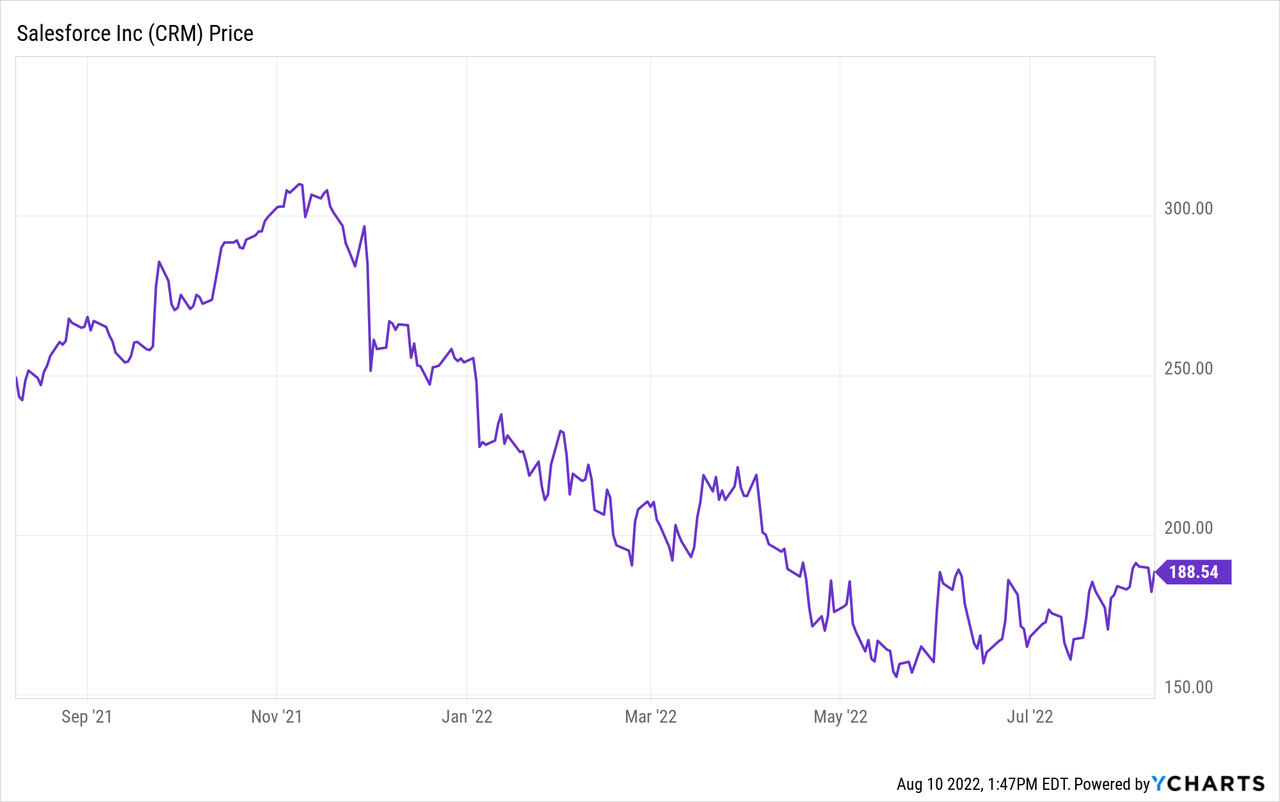

One company that I’m changing my tune on is Salesforce (NYSE:CRM). Salesforce needs no introduction – most in Silicon Valley consider Salesforce to be the “original” SaaS company that blazed the trail to delivering enterprise software through the internet and charging a monthly or annual fee for usage instead of installing it as a one-time license on corporate servers. Salesforce’s reputation for quality and the persistence of its growth has long made it a pricey stock (one that’s also often seen as a bellwether for valuations in the sector), but right now, the stock is sitting down ~25% year to date and down nearly 40% from highs above $300 notched last November.

Owing to the collapse in Salesforce’s valuation plus the persistence of its good results, I’m now finally going bullish on Salesforce and recommend buying it on the rebound.

Note that Salesforce next reports earnings on August 24; recent trends and quarterly results from the business have been positive, so I’d recommend investing before the results are released.

The bull case for one of the world’s largest software companies

First, we’ll preface this: in case you didn’t know, Salesforce operates one of the largest portfolios of enterprise software products in the world – really only rivaled by the likes of SAP (SAP), Oracle (ORCL), and Microsoft (MSFT). Its products have become the gold standard, especially for sales and marketing teams.

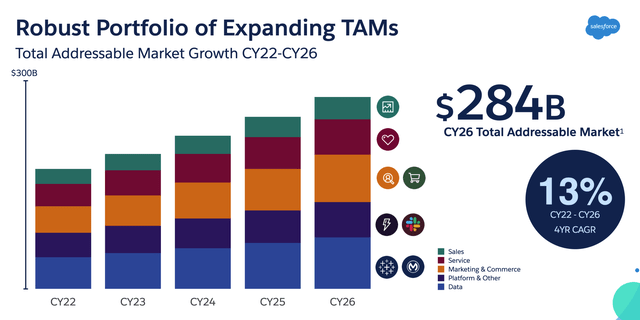

Owing both to its early-mover status in CRM software plus Salesforce’s penchant for growth-via-M&A throughout the years, Salesforce’s product portfolio now sits on top of one of the biggest global markets in the sector. Salesforce estimates its current TAM at $284 billion. You can see as well that its TAM has grown every year:

Salesforce TAM (Salesforce Q1 earnings deck)

At its current ~$31 billion annual revenue run rate, Salesforce is only approximately 11% penetrated into its overall market. We note that alongside natural TAM expansion (13% CAGR over the past four years), Salesforce has grown revenue at faster than that pace, indicating that Salesforce can continue to grow through both natural expansion of its market plus market share growth.

Beyond its TAM, here are the other key bullish drivers that investors should know on Salesforce:

- Best-in-breed reputation- In the software industry, few brands are as recognizable as Salesforce, particularly in the CRM space where Salesforce has dominant market share.

- Pure recurring revenue- Outside of one-time professional services and implementations which make up a very tiny portion of Salesforce’s revenue, Salesforce is unsurprisingly built on an entirely recurring subscription revenue base. Given as well that most of Salesforce’s products are seat-based (meaning it’s priced per user), Salesforce has plenty of opportunity to expand within its current install base as well.

- RPOs continue building- Remaining performance obligations, which is a measure of Salesforce’s contracted subscription revenue, continues to build at a nearly equivalent pace as revenue, which is a strong leading indicator that revenue deceleration isn’t in the near-term cards.

- Rule of 40- Salesforce has a high-teens pro forma operating margin and mid-20s revenue growth, and classifies as a “Rule of 40” software stock – which makes Salesforce even more appealing in the current market which has shifted away from a growth-first mindset to one that considers bottom-line expansion as well. Salesforce also generates healthy free cash flow that adds an additional buffer on top of a balance sheet loaded with more than $13 billion in cash, which is useful fodder for its regular acquisitions.

There are downside risks and red flags that bears often like to point out, of course. Chief among these is A) Salesforce has historically had low GAAP earnings despite strong pro forma metrics, due to its reliance on generous stock compensation like many other companies in Silicon Valley; and B) its penchant to pursue M&A aggressively may be a signal that organic growth is faltering, and a future mega-acquisition may lead to a major blunder.

All that being said, I believe Salesforce’s tailwinds outweigh these usual critiques, especially at its new lower valuation.

Strong execution

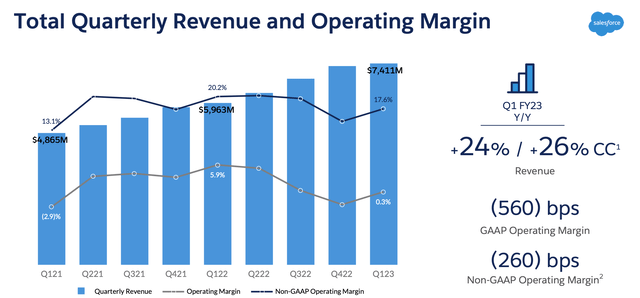

Salesforce is riding into 2022 on the back of very strong fundamental momentum. In Q1, which the company released in early April, the company grew revenue at a 24% y/y pace to $7.41 billion, handily beating Wall Street’s expectations of $7.11 billion (+19% y/y) by a five-point margin – which is a huge beat margin for a company of Salesforce’s massive scale (where revenue is also far more predictable).

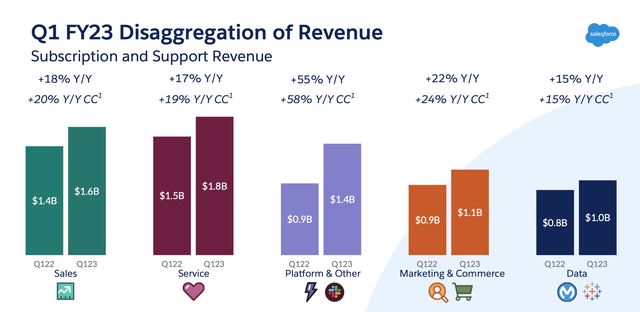

The chart below shows the breakout of how each of Salesforce’s cloud categories are growing:

Salesforce growth trends (Salesforce Q1 earnings deck)

The big standout here, of course, is the platform segment which grew 55% y/y – driven by Salesforce’s July 2021 acquisition of Slack. But it’s also nice to see Salesforce’s original Sales Cloud growing at an 18% y/y pace, and even 20% y/y on a constant currency basis.

So far, the company has noted no macro impact on its results, and that circumstances during the 2001 dot-com boom are completely different to what it’s seeing today. Per CEO Marc Benioff’s prepared remarks on the Q1 earnings call:

We’re carefully watching the economic data. I know all of you are doing that as well. And so far, we’re just not seeing any material impact from the broader economic world that all of you are in. Our demand environment where demand is very strong, and if you look over the last 23 years, Salesforce has proven to be incredibly resilient based on this incredible business model. We have an incredible technology model that we have, where we’ve been through all kinds of dot-com crashes and recessions and financial crises and global pandemics and all of you have watched us go through every possible storm, but we continue to weather these storms through the power and strength of our model.

In 2001, I think it really impacted us. We almost lost our business because we were — on monthly contracts, we didn’t have the right cash flow structure, investors just wouldn’t give us any money, and so we made a lot of changes then, and it’s really strengthened our business and made us more durable over time. There’s now no better measure of our durability of the business model, the momentum of the business, the strength of the technology model, than our remaining performance obligation, the future revenue that we have in our contract.”

Salesforce’s bottom-line execution has been strong as well in spite of inflationary/wage pressures. Pro forma operating margins in Q1 hit 17.6% – down 260bps y/y, but still putting Salesforce in the “Rule of 40” club on top of its 24% y/y revenue growth.

Salesforce growth vs margin (Salesforce Q1 earnings deck)

Opportunistic valuation and key takeaways

At the current share price of $188, Salesforce trades at a market cap of $188.45 billion. After we net off the $13.50 billion of cash and $10.60 billion of debt on Salesforce’s most recent balance sheet, the company’s resulting enterprise value is $184.5 million.

Meanwhile, Wall Street’s consensus is pegging Salesforce’s revenue at $31.77 billion (+20% y/y) for the current fiscal year (FY23), and $37.30 billion for FY24 (+17% y/y). Against these estimates, Salesforce trades at

- 5.8x EV/FY23 revenue

- 4.9x EV/FY24 revenue

Recall that historically, Salesforce has traded in a range of 6-8x revenues. I’m pegging my year-end price target for Salesforce at $226, representing 20% upside and 6x EV/FY24 revenue.

I think there’s a tremendous opportunity here to catch upside on Salesforce as the market’s risk-on attitude is returning – use this as a buying moment.

Be the first to comment