welcomia/iStock via Getty Images

Solar Thermal Energy Generation Returns

Heliogen (NYSE:HLGN) is attempting to profit from an area of renewables that has had a few issues over the years: solar thermal. Essentially, mirrors direct light onto a central tower that is full of a high melting point substance, usually molten salt, which then drives steam electricity generation. Benefits over solar panels include the ability for the molten substance to be hot well past sunset to extend the available generation time frame. When combined with energy storage systems, the ability to run constantly is likely, and beneficial for users. This will be the main drawing point for Heliogen clients.

However, some issues regarding the generation capabilities of solar thermal plants have risen from NRG Energy (NRG) and Google’s (GOOG) Ivanpah site. According to MIT Tech Review, the main issue is cost and production inefficiency, which almost led to the location being decommissioned. Utilities PG&E (PCG) and SoCal Edison (EIX) were quite upset when the plant was not up to contracted energy levels by late 2015, a year after initial operation started:

One of the most ambitious solar energy projects on the planet is in trouble. The $2.2 billion Ivanpah concentrated solar power facility in California has fallen well short of its expected power output and now has a year to get itself back on track, or it risks being forced to shut down.

Built with great fanfare by BrightSource Energy, NRG Energy, and Google, Ivanpah has been dogged by criticism from environmentalists since construction began. The plant uses thousands of mirrors to concentrate the sun’s energy and heat water to produce steam and generate electricity. But since it came online in 2014, the power it produces has been much more expensive than electricity from solar plants that get their energy from photovoltaic cells, to say nothing of power from natural gas.

Since then, new solar thermal projects have been few and far between, especially due to falling prices of photovoltaics. While it is noble for Heliogen to step up to the plate and bat for this potentially useful application, especially in smaller-than-utility applications, I am unsure whether the financial outcome will be satisfactory. However, let’s take a look at the Heliogen platform so far.

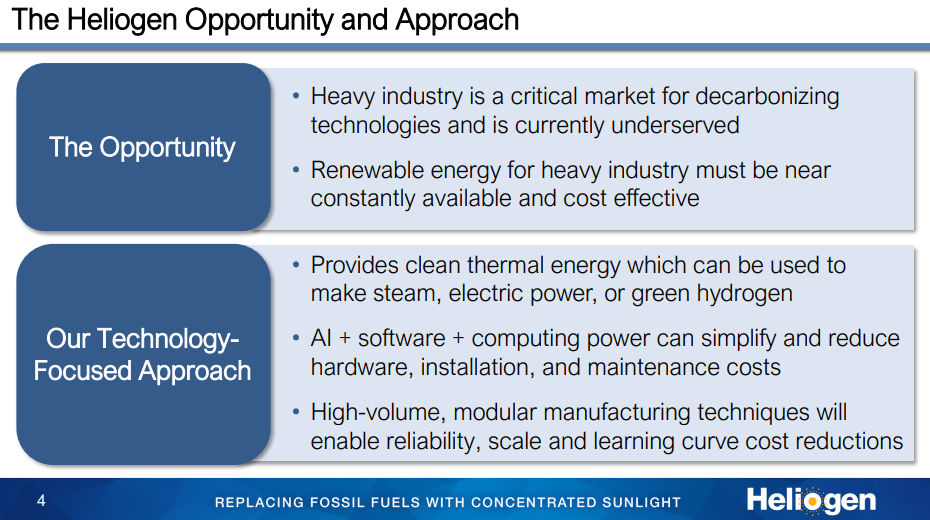

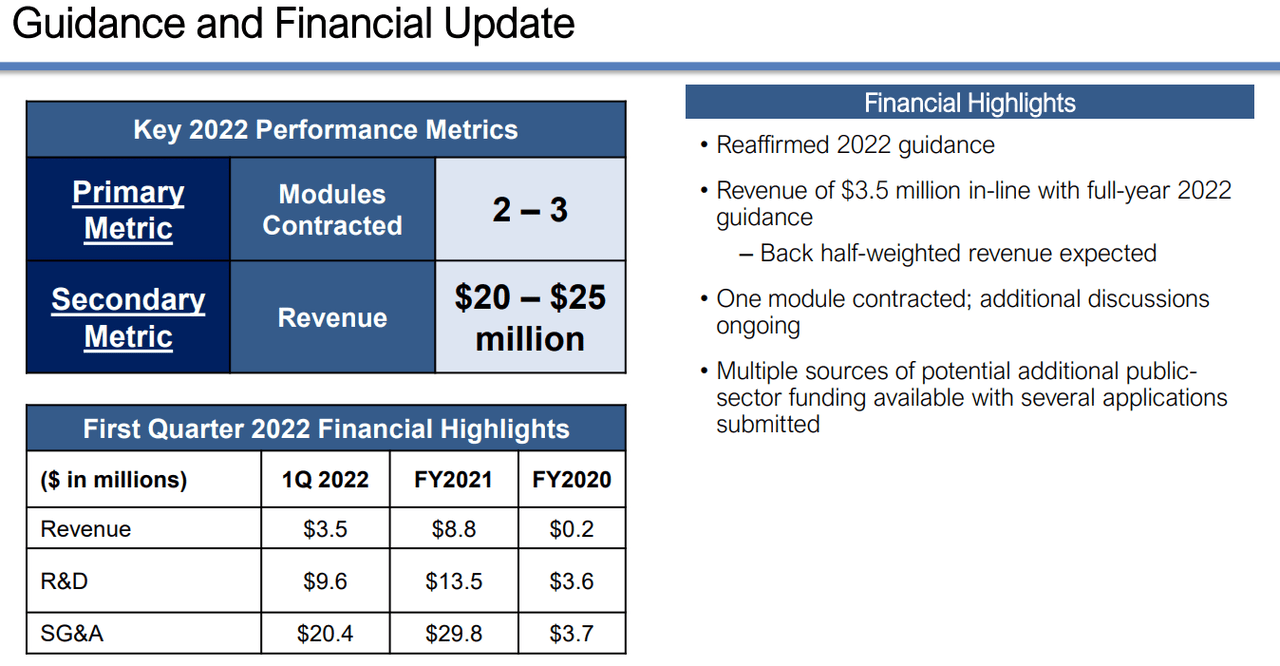

Heliogen Investor Presentation

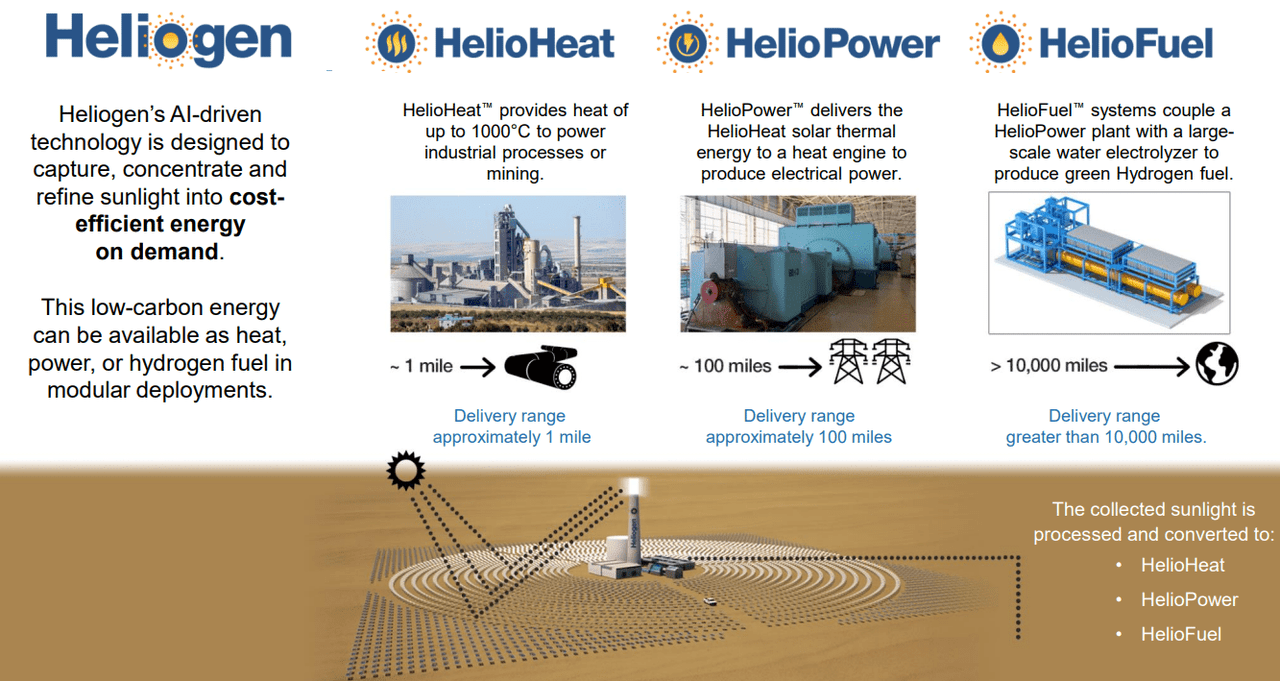

Importantly, Heliogen is looking to reduce the cost of concentrated solar technology by using smaller, more efficient applications. In particular, the company looks to drive growth in three ways. First, by allowing modular deployment in various industrial regions, the company has the ability to transmit superheated liquid to neighboring industrial companies for their own usage. At the same time, Heliogen can produce their own electricity and supply it to the grid. Lastly, the company will attempt to leverage the growing hydrogen fuel push by using an electrolyzer to create green hydrogen. Then, the company can deliver renewable fuels around the world.

Heliogen

It is good that the company is trying to be nimble and not bogged down by heavy infrastructure developments. However, as the company is in an early stage the relative cost of Heliogen’s products is not available. Thankfully, development is moving along so far, and multiple contracts have initially been announced. I will let the management summarize recent news, including the announcement of Rio Tinto (RIO) as a customer:

‘During the first quarter, we finalized and signed the full project agreement with Woodside for our first commercial-scale, single-module 5 MWe facility,’ continued Gross. ‘We continue to make great progress with several other potential customers including global metals and mining company Rio Tinto. I’m also pleased with the discussions taking place with Woodside as we kick off our collaboration effort to jointly market Heliogen’s technology in Australia.

‘On the manufacturing and development side, we have made rapid progress on the build-out of our facility in Long Beach, California. Multiple fully-automated pilot production lines are now operational along with the vast majority of our reliability and testing lab. We remain on track for the main production lines to be operational in the second half of this year. The impressive progress our production team has made on this facility is a testament to their ingenuity and efficiency, which we expect to apply across all manufacturing, installation and operational efforts,’ concluded Gross.

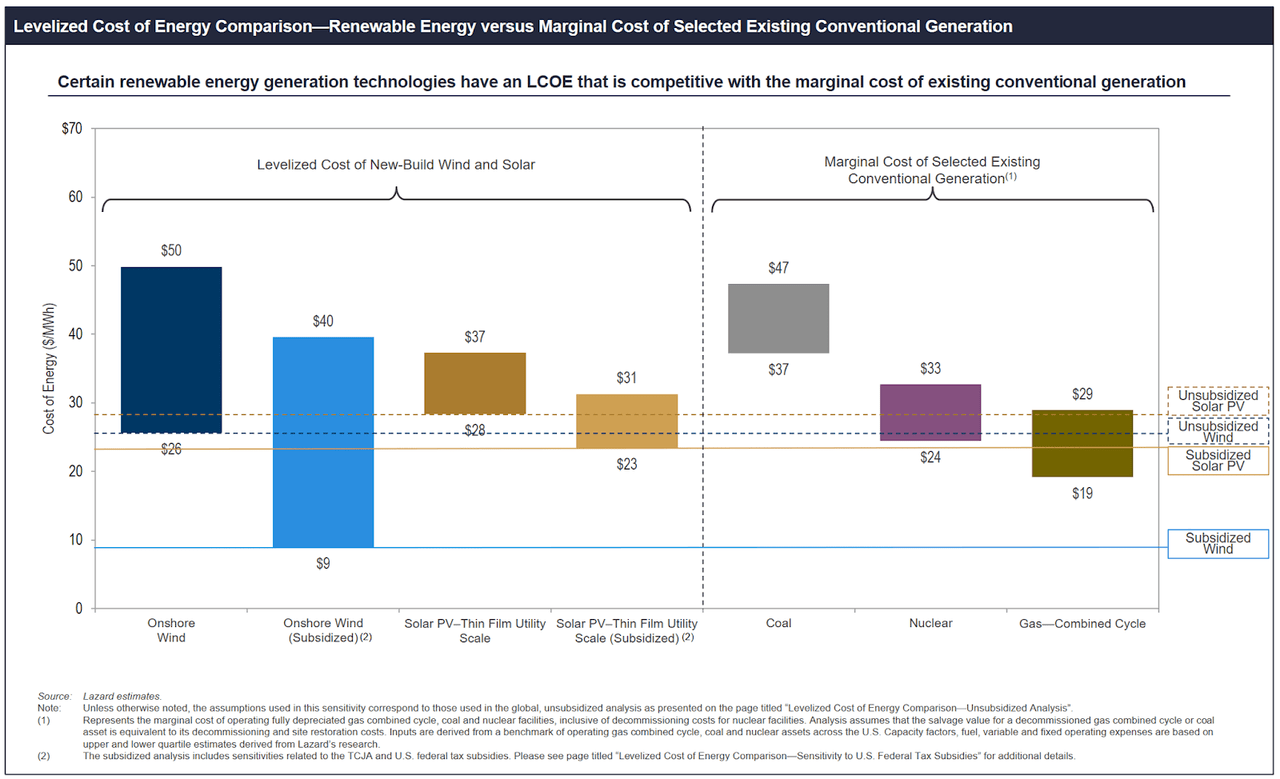

As you can see, the company is already focusing on the creation of low-cost systems, perhaps at the cost of early funding. However, advanced production technology should play out down the road. This will help reduce the risk associated with the current low cost of competitive forms of energy generation, primarily solar at the moment. To this point, I would like to compare Ivanpah’s decline to Heliogen’s potential headwinds. As KQED reported in regards to Ivanpah, utilities had to pay almost four times as much for thermal solar than regular photovoltaics, in 2014/15!

According to data from the Federal Energy Regulatory Commission, PG&E paid an average of $197.33 per megawatt-hour for electricity from Ivanpah Unit 1 in the June-September period this year, and $201.99 for Unit 3 electricity. In contrast, the Lawrence Berkeley National Laboratory reported this year that falling project costs had driven down prices in new photovoltaic power purchase agreements to around $50 per MWh. (Photovoltaic plants have had no problem meeting their performance targets quickly. In 2014, its first full year of operation, a new 250-MW solar plant in San Luis Obispo County — a 1,500-acre array of solar panels on the Carrizo Plain — generated 688,000 MWh of electricity. That’s above the expected 662,000 MWh.)

Now pricing is even more competitive as solar has reached between $23 and $37 per MWh, and it is unknown what Heliogen’s pricing will be. Therefore, it will be up to the small advantages of modularity, specificity, and the ability to run 24/7 that will be the catalysts for growth. While revenues have been less than $10 million per year so far, I will now cover some information on the current backlog.

Lazard

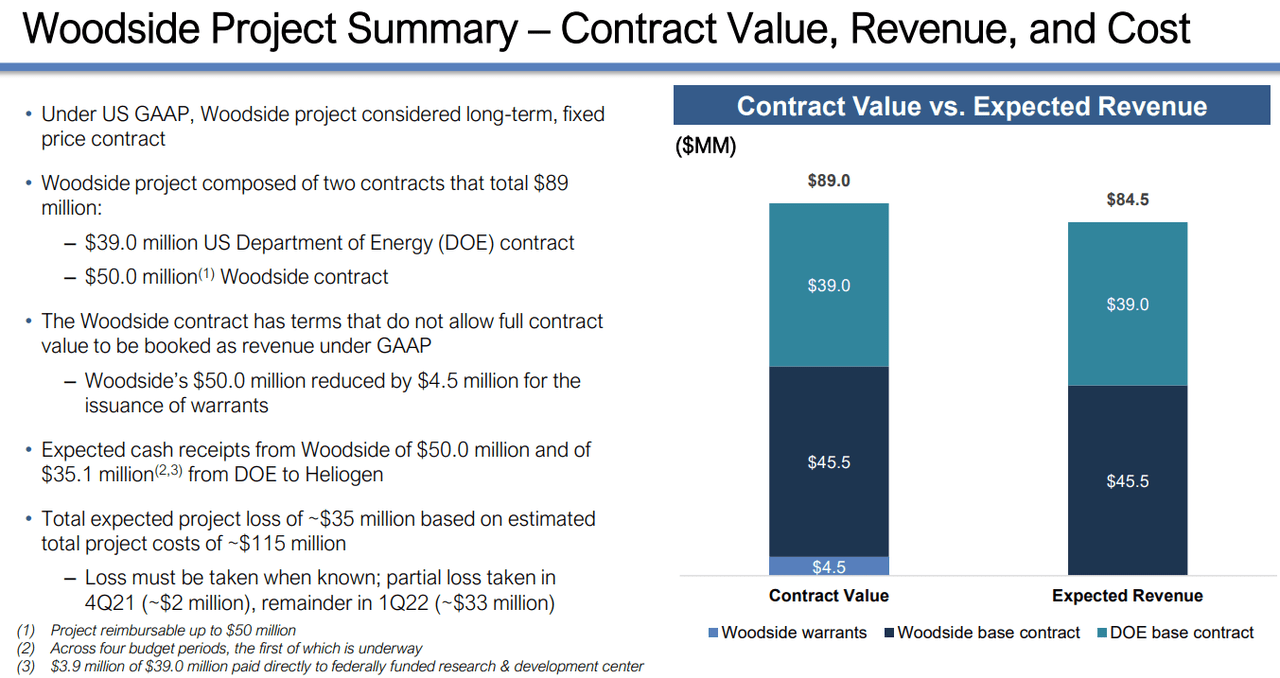

The major lifeline for HLGN is a large $89 million contract with the US department of energy and energy conglomerate Woodside (WDS). While this will be the major case study for use for other private firms, it comes at a price: a loss of $35 million. Whether this is a sign of no profitability for the future, or is just due to the early stage of development is unclear. However, recent guidance suggests that more public-private contracts may arise, and hopefully production line optimization can occur by that point. This is certainly not a high growth area of the market so investors must view it as such.

Heliogen Heliogen

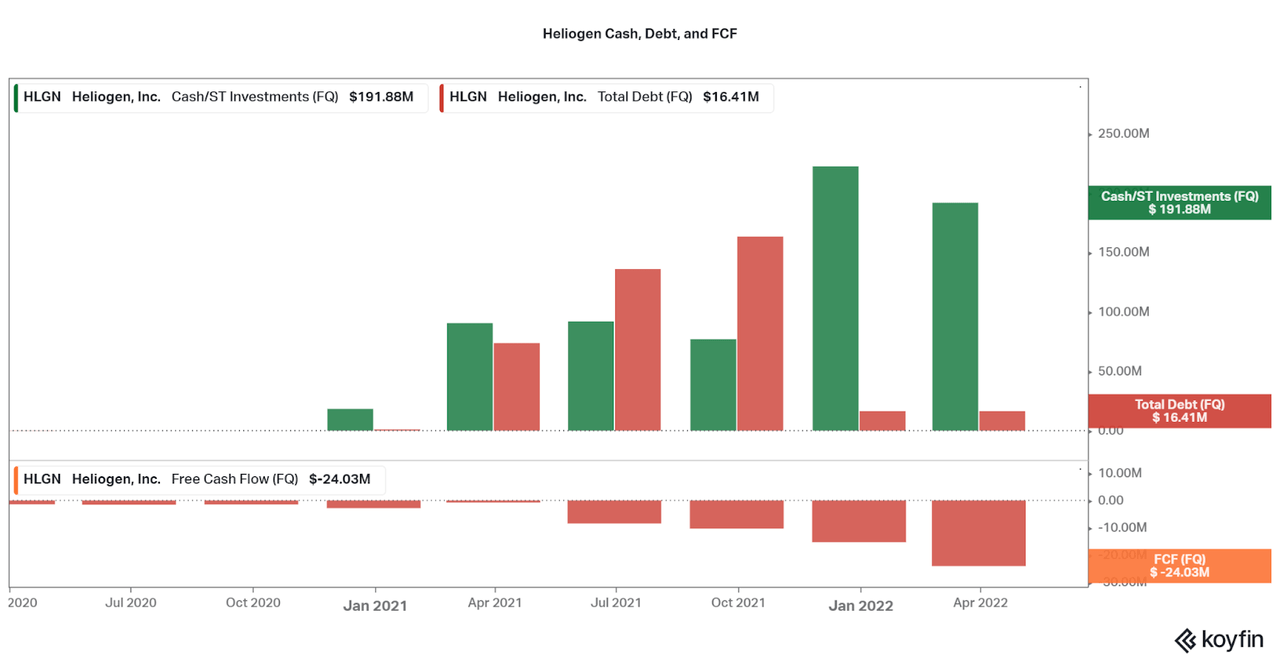

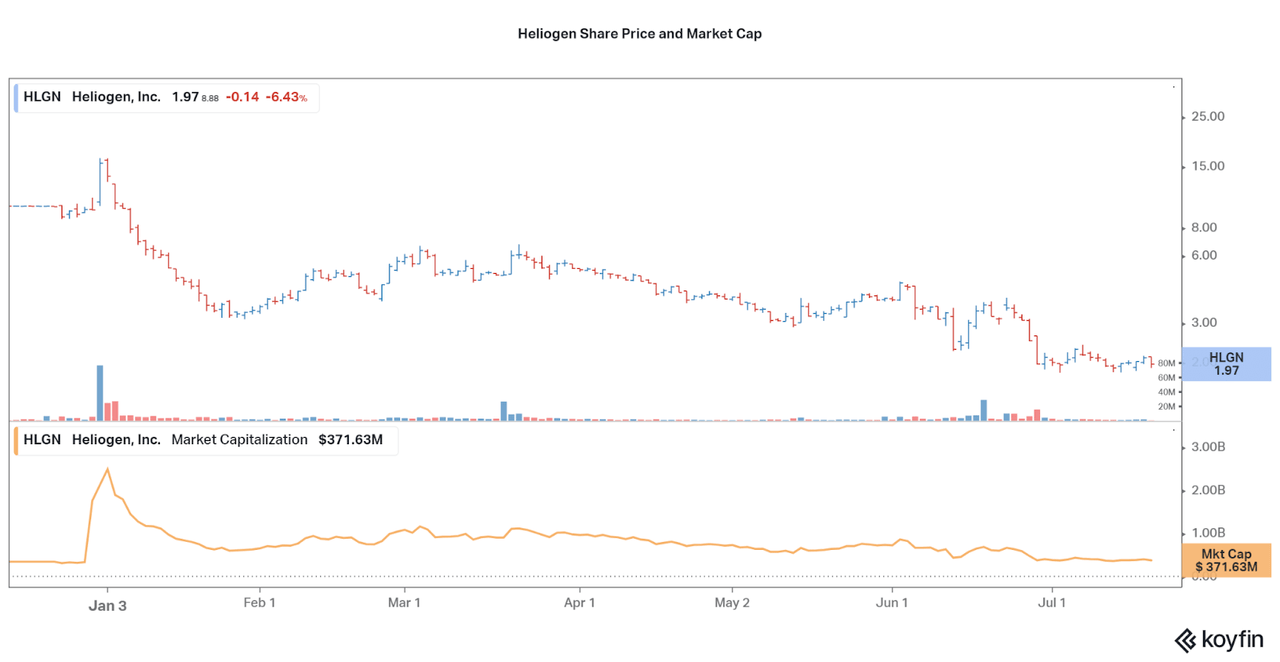

There are good and bad financial points to further consider. While cash is up to $200 million (and debt is negligible), FCF remains negative. However, as revenues fund parts of the coming contracts, I expect operations should be supported for at least a few years. As I discussed before, the issue will be gaining profitable clientele. With that, I find the current $371 million market cap is certainly quite optimistic and forward looking considering the circumstances. In fact, I would not be surprised if the price continued to fall even as revenues increase over the next few years. The problem comes with the fact that component makers such as Heliogen often struggle with profitability, and mature companies always earn a low valuation.

Koyfin Koyfin

While Heliogen certainly offers an interesting narrative in terms of the potential for profitable thermal solar applications, I find little evidence to support financial success. The first listed contract with Woodside and the DoE do not paint a positive picture as the expected loss reaches over $30 million. Also, prior attempts at successful thermal or concentrated solar projects have had issues. However, one positive is the fact that Ivanpah has managed to stay operational even after warnings were issued. For now, I recommend letting the company mature into a stable earner, and this may take a few years. There is little upside potential in my eyes, except in the case of M&A, but no news is circulating about an acquisition.

Thanks for reading.

Be the first to comment