MarsBars

Stock investing isn’t just about looking at the upside, but also evaluating the downside as well. This may be hard to do when everything is looking up, but as the recent market rout has proven, downside protection is as important as ever. That’s why it pays to focus on companies whose business models are mission-critical and recession-resistant, with a growth kicker to boot. Such I find the case to be with Corporate Office Properties Trust (NYSE:OFC), and in this article, highlight why it’s a buy on the drop, so let’s get started.

Why OFC?

Corporate Office Properties is a self-managed REIT that’s focused on office and data center properties that serve high priority defense and cybersecurity missions of the U.S. Government. This is reflected by the fact that 90% of OFC’s properties are leased to either the government or its contractors, which are largely immune from the conditions in the overall economy, and the remaining 10% are Class A office buildings leased to commercial tenants.

The company has a long track record of operating in this space, as it’s been around for nearly 30 years. Along with Easterly Government Properties (DEA), OFC is just one of a handful of landlords that are entrusted to handle U.S. Government and defense contractor tenant requirements.

This specialized segment can be an attractive space to be in, as the defense-oriented tenant portfolio enjoys high occupancy. This results in portfolio stability and the specialized nature of its buildings come with lower recurring capex requirements compared to traditional office properties. That’s because government-related tenants are more stable and are therefore less likely to move, requiring less tenant improvement costs that are associated with re-leasing properties to new move-ins.

OFC isn’t known for outsized growth, but rather delivers steady results, with FFO per share growing by 2.6% YoY during the second quarter. It also enjoys healthy occupancy of 92% and the portfolio is 94% leased. Moreover, OFC has 1.9 million square feet of projects under development with target completion dates in the 2022 to 2024 timeframe, and these are 91% pre-leased.

Looking forward, OFC is well-positioned in the current operating environment, as the U.S. government continues to allocate higher spending towards defense. This is reflected by the increase in defense budget this year, as noted by management during the recent conference call:

The fiscal year 2022 National Defense Authorization Act passed through the base budget increase of 5.8%, representing the largest increase since 2018. We expect demand from this budget to manifest in our leasing pipeline in mid-to-late 2023. Recall that following the 14% increase in the defense budget, that occurred in 2018, we achieved record leasing levels in new development and vacancy leasing in 2019. Moreover, current actions in the defense committees of the House and Senate suggest another healthy increase in the 2023 NDAA. These events give us confidence leasing demand will remain strong through at least 2024.

Potential headwinds to OFC include inflation and higher rates, which could raise OFC’s cost of development. However, management has noted that it’s been able to negotiate rents that maintain its historical development yields. In recent history, this has helped OFC to maintain a healthy compound FFO per share growth rate of 4.4% from the 2018 to 2021 timeframe, and 8% growth last year.

While this year’s guided 2.6% growth is below those levels, it’s due to absorbing the dilutive sale effect of OFC’s DC-6 property. As such, I view this slow-down as only being temporary, as OFC’s development projects become stabilized and start generating revenue over the next couple of years.

Meanwhile, OFC maintains a prudent capital structure with 86% of its debt being fixed rate. The bond market also appears to have confidence in the safety of the enterprise, as it was willing to accept just a 2.6% interest rate on $1.4 billion of fixed rate bonds issued last year. This helped to minimize interest rate risk for OFC, as it only has $100 million of debt maturing prior to 2026. OFC also maintains a safe net debt to adjusted EBITDA of 5.8x, and has a strong fixed charge coverage ratio of 5.3x.

The recent drop in OFC’s share price has pushed its dividend yield up to 4.7%. The dividend is also well protected by a 47% payout ratio. While dividend growth has been lacking, I would expect for it to eventually pick up as the pipeline nears completion, and OFC has made strong progress towards deleveraging in recent years.

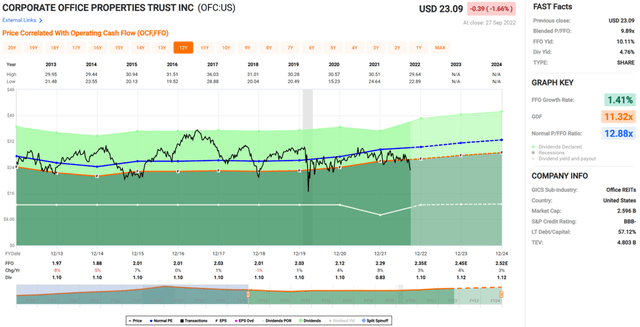

OFC has become attractive at the current price of $23.59 with a forward P/FFO of just 10.0x. As shown below, its sits well below its normal P/FFO of 12.9x over the past decade. As such, OFC could potentially return double-digit shareholder returns over the next year simply by returning to its mean valuation, and investors get to collect a very safe yield in the meantime.

Investor Presentation

In summary, OFC is a great option for those seeking a very safe yield from mission-critical properties and long-term growth. Furthermore, OFC continues to generate steady results and maintains a strong balance sheet. The recent drop in price presents a good entry point for value and income investors to layer into this quality name.

Be the first to comment