BartekSzewczyk/iStock via Getty Images

It’s been a mixed Q2 Earnings Season for the restaurant industry group (EATZ), with companies reporting to date having difficulty beating earnings with negative industry-wide traffic trends and inflationary pressures. While First Watch (NASDAQ:FWRG) hasn’t been immune from inflationary pressures, it’s swimming with Phelps-like form against the current, posting impressive traffic growth in an industry that was down more than 250 basis points in Q2.

This helped FWRG easily beat top-line estimates and prompted a raise in guidance. Given this impressive performance, I see First Watch as one of the industry’s best buy-the-dip candidates. That said, FWRG is up 35% in 36 trading days and doesn’t offer nearly as much margin of safety near $17.00 per share. So, while I think sharp pullbacks are buying opportunities, I believe patience for lower prices is the best course of action.

First Watch Restaurant (Company Presentation)

Just over two months ago, I wrote on First Watch, noting that while the stock put together another impressive quarter in Q1, I didn’t see the stock trading in a low-risk buy zone at $15.80, but pullbacks below $12.40 would provide buying opportunities. Since trading within 1% of this level in June, the stock has risen more than 30% and just reported another exceptional quarter, trouncing industry-wide traffic trends (June traffic down 4%), which should solidify its premium multiple. Let’s take a closer look below:

First Watch Menu (Company Website)

Sales Performance

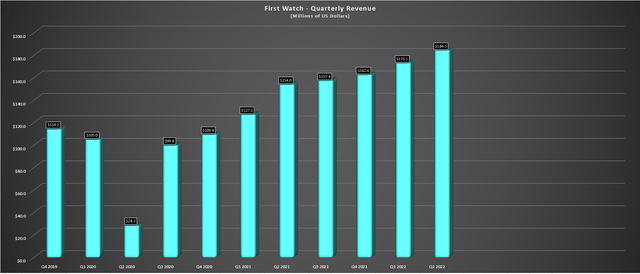

First Watch released its Q2 results this week and blew estimates out of the water. The company reported quarterly revenue of $184.5 million, up 20% year-over-year, driven by steady unit growth and strong same-restaurant sales growth of 13.4% (30.2% vs. Q2 2019). Notably, this comp sales growth was not driven by outpacing the industry from a pricing standpoint to ensure it could hold the line on margins like some brands. Instead, we saw the company report 8.1% traffic growth, an incredible figure compared to the industry, which saw a 4.8% decline in comp traffic, according to Black Box Intelligence.

First Watch – Quarterly Revenue (Company Filings, Author’s Chart)

First Watch noted that its premium items were received very well by guests (calling out its Crab Cake Benedict) despite this being one of the most expensive items it’s put on the menu. Meanwhile, it’s seen no negative impact from its price increases taken this year (3.9% at the start of the year plus 3.9% in July), and NPS scores and value scores remain solid according to management. The lack of resistance could be due to First Watch’s conservatism in raising prices last year (it declined to raise in 2021), so even with the last two increases, it’s still behind the industry average. Finally, juice incidences and alcohol as a percentage of the mix are up (6.5% vs. 4.0% for alcohol), suggesting no real check management by guests (which would be a negative development).

First Watch Menu (Company Presentation)

Overall, these are extremely encouraging results, and First Watch didn’t stumble in June, during a period when comparable traffic for the industry decelerated from May levels. In fact, it outperformed by 800 basis points (Placer AI and Black Box data) at (+) 4.2% vs. a 4% decline in traffic industry-wide. Given this solid sales performance which helped with leverage, First Watch was able to report restaurant-level operating margins of 18.2% in a challenging inflationary environment. However, margins were down 440 basis points on a year-over-year basis (Q2 2021: 22.5%).

Unit Growth & Long-Term Potential

In addition to the impressive sales metrics and traffic performance, First Watch opened nine new restaurants in the quarter, with five being company-owned and four being franchises. This increased the company’s system to 449 restaurants (22% franchised), and the company has guided for 43 new system-wide restaurants in 2022, which would translate to 10% growth if it can meet the mid-point of its estimates. Meanwhile, given the stronger than expected sales performance, it raised its adjusted EBITDA guidance to $67 to $71 million ($37.2 million year-to-date), with a path towards $105+ million in FY2025 if it can maintain its strong unit growth rates.

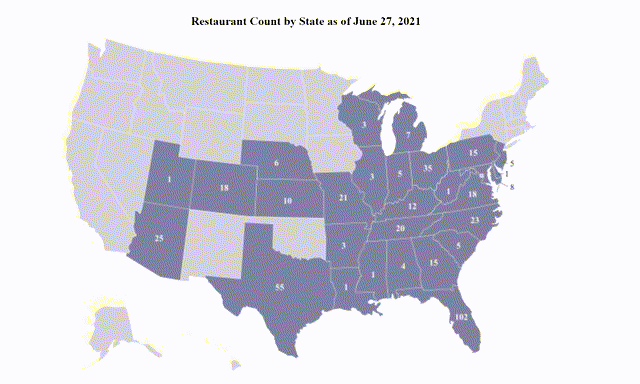

Restaurant Footprint – June 2021 (First Watch S1)

If we look at the map above, First Watch has barely scratched the surface thus far domestically, with significant white space in the western and northwest US and lots of infill opportunities in states where it’s already present. In fact, while it’s currently in 28 states, it has less than 20 restaurants in 15 of these states, suggesting that it doesn’t even need to expand geographically in a big way for its next growth phase. This makes a doubling of the store count quite achievable. If the company can continue with its industry-leading metrics, the long-term goal of 2,200 restaurants doesn’t seem as much of a stretch as it did when it was initially discussed by management.

While the company noted that it had no international plans even though it had received some interest, a logical long-term step would be an expansion north of the border in Canada, given the cultural similarities. Currently, the more popular breakfast brands in Canada (Sunset Grill, Cora’s) have over 100 locations, and other brands also have footprints closer to 50 (Symposium). Hence, I would not rule out the potential for another 150 restaurants north of the border (Ontario & British Columbia) if the company were to look at international expansion (~33% growth vs. current footprint). To summarize, I don’t see any reason the company can’t maintain a high single-digit to low double-digit unit growth rate given its whitespace.

Industry Headwinds

While it was hard to find anything wrong with First Watch’s execution in Q2, headwinds are abound. From a cost standpoint, food & beverage costs rose to 24.9%, with 17% commodity inflation. Simultaneously, labor costs were up, and wage inflation is currently hanging out near the 10% mark. That said, the company is cautiously optimistic that it has seen the peak of this year’s inflation in Q2. Meanwhile, the company could see less wage inflation than peers with lower training costs due to strong retention rates. The reason is that First Watch has a competitive advantage in its operating hours, allowing its team members to have a more normal schedule (7 AM – 2:30 PM).

On the demand side, we’re seeing near unprecedented headwinds with rising grocery costs, mortgage rates, and fuel prices severely impacting discretionary budgets. Meanwhile, restaurant brands that are raising prices above the industry average could be in trouble, with decreased traffic and a lower intent to return being correlated with high check growth, according to analysts at Black Box. Fortunately, First Watch seems to be immune on the demand side, ensuring it maintained a strong value proposition by not raising prices last year, allowing it some leeway with this year’s increases. Plus, margins could see a long-term uplift as the alcohol mix grows and it’s rolled out to 100% of the system. Therefore, I don’t see any reason to worry too much about the year-over-year decline in operating margins due to persistent inflation.

Valuation

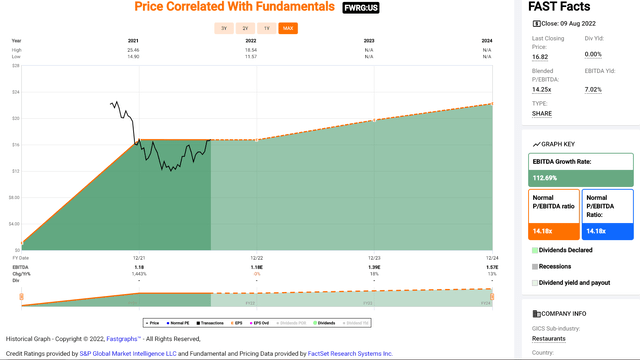

Based on ~59.1 million shares, net debt of ~$50 million, and a share price of $16.80, First Watch trades at an enterprise value of ~$1.05 billion. If we compare this figure with current estimates for FY2023 EBITDA of ~$83 million, First Watch trades at ~12.7x EV to EBITDA. This is a large premium to more established full-service brands like Dine Brands (DIN) and Texas Roadhouse (TXRH) and a massive premium to the full-service restaurant average forward EV/EBITDA multiple, with this figure currently sitting closer to 8.0x at the beginning of August.

That said, First Watch is a high-growth concept that is not just wading through the tricky traffic backdrop but swimming against the current with remarkable ease. This suggests that a premium multiple is warranted, especially if its biggest headwind (inflationary pressures) is in the rear-view mirror and might have finally peaked. Given the company’s considerable white space, industry-leading traffic metrics, and strong unit growth, I believe the stock can justify a multiple of 14x forward EV/EBITDA. So, assuming FWRG can meet its current estimates of ~$83 million, this would translate to a fair value of $1,162 million or $19.65 per share.

FWRG – Historical EBITDA Multiple (FASTGraphs.com)

Although this translates to a 17% upside from current levels, I prefer to buy at a minimum 30% discount to fair value when purchasing small-cap growth stocks, especially in a more turbulent market environment. So, while there is considerable upside for FWRG from current levels, if it can continue to execute successfully, the stock would need to dip below $13.75 to move into a low-risk buy zone. Obviously, there’s no guarantee that this will occur, and FWRG could keep marching higher, with it being one of the few restaurant names beating by a wide margin. Still, with the S&P 500 (SPY) in a cyclical bear market, I don’t believe there’s any value in paying up for stocks, even if they are bucking the trend.

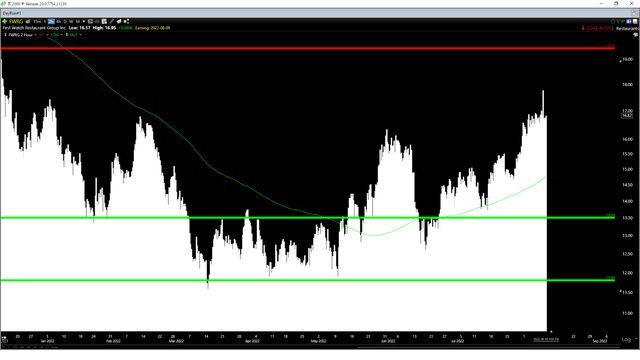

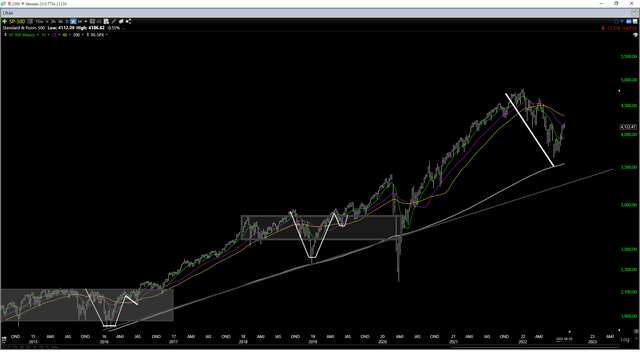

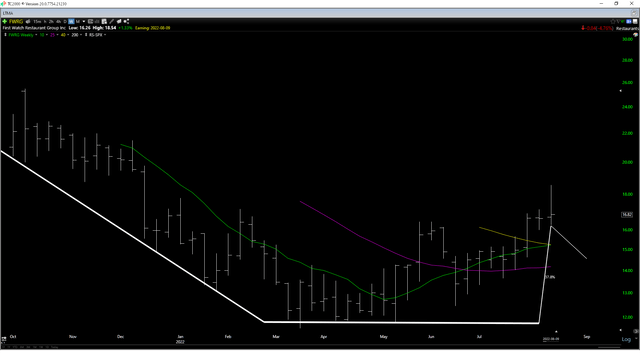

Technical Picture

Moving to the technical picture, this confirms that FWRG is not in a low-risk buy zone, with a potential resistance level at $19.45 and its upper support level at $13.50. From a current share price of $16.80, this translates to $2.65 in potential upside to support and $3.30 in potential downside to support, translating to a reward/risk ratio of 0.80 to 1.0. This is well below the 6 to 1 reward/risk ratio that I require to justify entering new positions in small-cap stocks, and FWRG would need to decline below $14.35 to enter a low-risk buy zone. Plus, we may have seen a short-term peak for the stock with an outside day on well above average volume (August 9th).

FWRG 4-Hour Chart (TC2000.com)

So, what’s the best course of action?

If I were holding the stock, I would view any rallies above $18.00 as profit-taking opportunities, given that the stock would have less than 10% upside to fair value and its first major potential technical resistance. Meanwhile, if I were looking to start a position in the stock, I would be waiting for dips below $14.00 per share to secure a lower-risk entry point. This might seem like a deep correction that is unlikely to transpire. However, patience typically pays off when the market is below all of its weekly moving averages with downside surprises, which is the setup we’re working with currently.

S&P-500 Weekly Chart (TC2000.com)

FWRG Weekly Chart (TC2000.com)

Summary

First Watch had another phenomenal quarter in Q2, trouncing estimates for sales and traffic, delivering one of the highest-quality beats industry-wide with sales not buoyed by aggressive menu price increases. This suggests that sharp pullbacks are likely to provide buying opportunities even if we are in a turbulent market environment. That said, I’ve never found any value in paying up for stocks in a cyclical bear market. So, while I think FWRG is a name to keep at the top of one’s watchlist, given its outperformance, I wouldn’t become interested in the stock unless it dipped below $14.30 per share, building a handle to its weekly cup base.

Be the first to comment