bjdlzx

(Note: This article appeared in the newsletter on August 20, 2022, and has been updated as needed.)

Diamondback Energy (NASDAQ:FANG) has long had a rock-solid balance sheet. This company has long mitigated typical company (financial leverage) risks by using stock to make acquisitions. That lowered the risk of failure that happens when debt must be serviced during cyclical periods of weak commodity prices. At the same time, the company has some rock-bottom operating costs that limit the risk of shut-ins during times of low commodity prices.

Above-average profitability that results from the two strategies is a good way to minimize the risk of a company crisis during a cyclical downturn. So many investors believe that tremendous financial leverage is needed for above-average returns. Yet this company has been reporting some good operating results for years without needing a lot of debt.

This results in a company that can meet the market demands for payments to shareholders while still choosing to grow production. Right now, it appears that a choice has been made to repay debt, pay shareholders, and maintain production. But the conservative debt levels allow for a strategy change at any time even though some high margins already demonstrate generous cash flow for the amount of production.

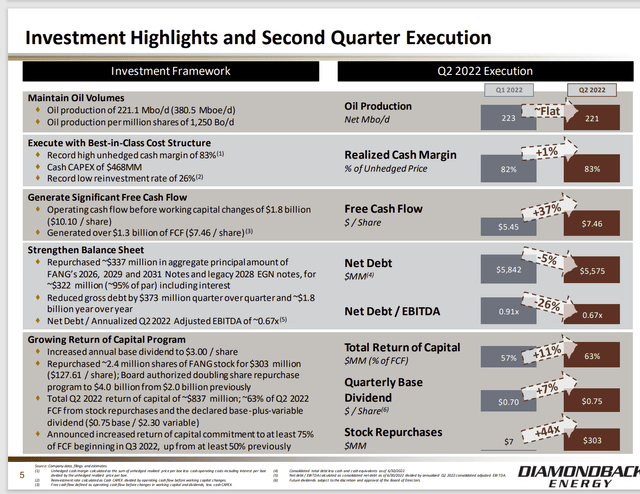

Diamondback Energy Second Quarter 2022, Operating And Financial Highlights (Diamondback Energy Second Quarter 2022, Earnings Conference Call Slides)

The capital required to maintain production is essentially a very small portion of the cash flow reported. That allows proportionately more cash flow to be allocated to other priorities.

So many times, investors wonder where the overall profitability of leases is demonstrated. Usually, that profitability is demonstrated by the average profitability and cash flow reported throughout the industry cycle. Write-offs and impairments have traditionally been not as material here as has been the case with some competitors.

That average profitability should also factor into the multiple given to the company stock throughout the business cycle. This is one of the few independents that has an investment grade rating for the debt issued. It does take a certain size of operations to obtain that rating. But it also implies an above-average profitability throughout the business cycle.

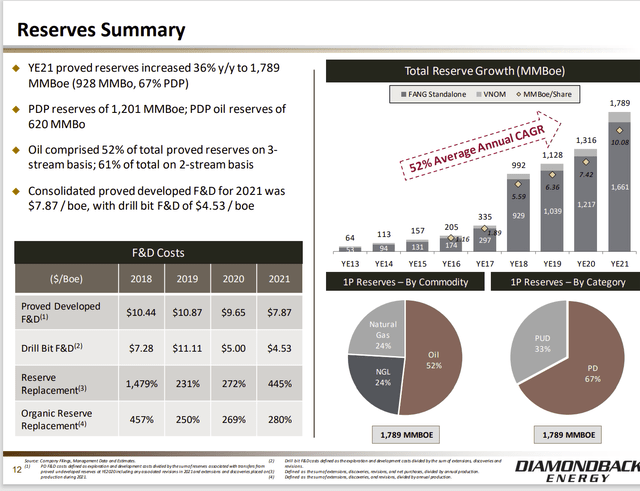

Diamondback Energy Reserve Costs And Growth History (Diamondback Energy Second Quarter 2022, Earnings Conference Call Slides)

The reserve growth mirrors production growth and shows an emphasis on a countercyclical growth strategy. For example, reserves grew dramatically in fiscal years 2017 and 2021. That growth was primarily from acquisitions that were planned and executed well before the industry recovery was obvious to the market.

While management may talk about honoring the market request for dividends and share repurchases at the expense of growth, the company is well positioned to continue to act as a consolidator. Even though growth is unlikely to continue at the blistering pace of the history shown above. It is likely that acquisitions made at market bottoms will be accretive enough for the company to average double-digit production growth per share in the future.

Sometimes the acquisition activity can substantially raise the finding and development costs for a fiscal year. But the ongoing operating activity shown above demonstrates costs that are far more typical of a natural gas producer than for a company with a substantial percentage of oil production. The result is directly traceable to the huge operating percentage that the company regularly reports.

Another reason for not growing production during a cyclical upswing is the rising costs that accompany an upswing. This company has some excellent permanent cost advantages not only in geology but also by investing in acquisitions during market downturns (or before the recovery becomes apparent to the market).

The Permian is known for takeaway capacity constraints that often result in significant discounts to posted oil prices. This company avoids that by contracting for capacity and then waiting for that capacity before increasing production.

Second Quarter

The second quarter report emphasized the company profitability at lower prices. This is going to be important when the next inevitable cyclical decline occurs.

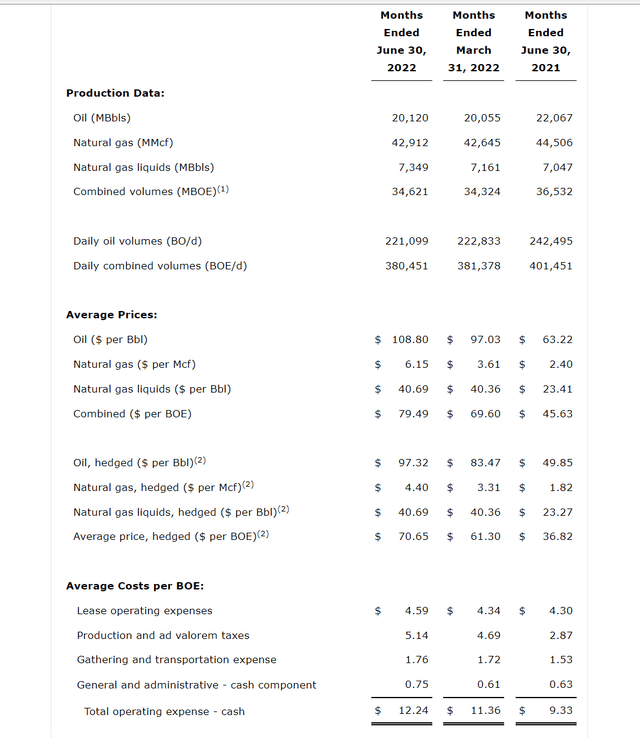

Diamondback Energy Second Quarter 2022, Results Summary (Diamondback Energy Second Quarter 2022, Earnings Press Release)

The operating expense combined with the finding and development costs shown before implying a well breakeven point when oil prices received are in the $20 range. That range favorably compares with some of the more profitable large projects in the industry.

Many of the leases have multiple intervals that are not yet part of the reserve report. The current acreage could keep this company very busy for a very long time because there are more intervals to derisk.

It should also be noted that the Permian is fairly close to many export facilities. This is important because the country largely exports the unconventional light oil produced while importing heavier oils to make money on the spread between the two products. This is one of the few things the country does to help its balance of payments deficit.

The Future

A company as well run as this one makes an attractive acquisition candidate (at the right price of course). Many of the unconventional producers that exist today will eventually consolidate. That has been a long-term trend for a very long time.

Investors need to remember that any company making an acquisition wants the best deal for their shareholders with as few problems as possible. That often eliminates high debt companies because the debt was often obtained during times of higher acquisition costs. Therefore, the more debt a company has, then oftentimes, the less that can be offered to shareholders.

The profitability established by management allows for a generous dividend while shareholders wait for the future to unfold. In fact, the dividend and share repurchase program are likely to provide double-digit returns as long as oil prices remain robust.

The recent selloff provides an opportunity for investors to consider a well-run company. This company tends to have a far above-average financial performance and historical growth rate.

Whenever the next cyclical downturn for the industry occurs, this management will likely be a consolidator that is shopping for accretive acquisitions. That strategy should provide for above-average growth rates during cyclical downturns combined with generous dividends during times of high commodity prices. Even given the cyclical nature of the industry, the long-term return from current common share prices is likely to prove appealing.

Be the first to comment