naphtalina/iStock via Getty Images

Tonight after the bell, Snap Inc. (NYSE:SNAP) reported a much anticipated earnings. This is a stock we have traded a few times over the years, and like many growth tech type earnings names, the stock has been crushed. In the mid-$20s, we like a speculative buy in the stock for a run into the $30s on a trade. Long-term, as the platform continues to expand, new users are added and engaged, and the company refines its revenue generation approaches, we think there is a lot of promise here. SNAP has really become a strong force in the social media space. While there is a lot of competition as we know, and other competitors are struggling, SNAP has continued to gain market share. We think the stock is still somewhat expensive, but this and many other type disruptive tech stocks have been crushed. We suspect that the stock will enjoy a bit of rally off of these earnings, because the report had many positives and some negatives. There was a realization in the quarter that there is and will be a “challenging” environment. The immense growth that the company had seen during the pandemic is now normalizing, setting up tough comps. With the very difficult environment, the company has put out a decent quarter and strong commitments to investing in itself. It is nothing to cheer about, but also should be met with respect. A ‘golf clap‘ is appropriate here. The outlook for earnings is the same. As the stock has reset back to the $20s, we think you can be a speculative buyer. Let us discuss.

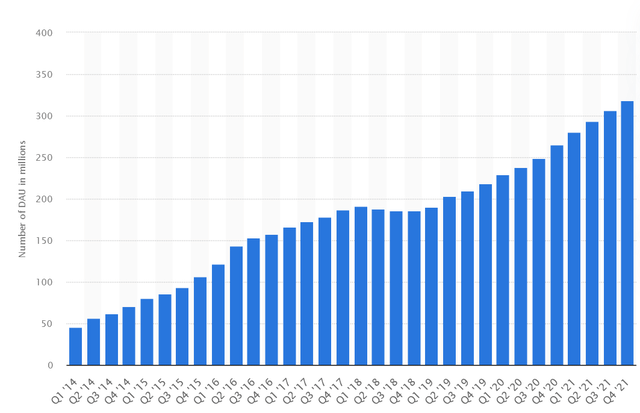

Active users continue to grow

One critical metric that we believe drives so many of the results are daily active users, or the DAU figure. The DAU figure had grown reliably as we entered Q1 2022:

The company had enjoyed 20% plus user growth over the last 5 quarters. In Q1, we are pleased that user growth remained very strong, though came in sub 20%. Daily active users grew 18% year-over-year to 332 million. That is still a very positive result, no matter how it is spun otherwise. The DAU on the platform rose both sequentially and year-over-year broadly across operating regions.

The company has aggressively invested in its content, and it is paying off in engagement. A key statistic that is linked to the DAU growth as well as the content being invested in was time spent on the platform. Specifically, in the release management highlighted that total daily time spent by users aged 25 and older engaging with shows and publisher content increased by more than 25% year-over-year. Do not forget SNAP is getting into some original content too. As a reminder there were over 10 million viewers for “Breakwater,” a SNAP Original about a dystopian future caused by climate change that featured episodic AR Lenses.

We like the direction the company is moving. With the new content, Bitmojis, clothing options, sharing, and original content, dynamic advertising revenue tripled. The company also has a bevy of digital retail sales, partnerships, and legacy ads. Overall, revenues grew by 38% to $1.063 billion, just short of expectations for $1.07 billion. The company however is spending a lot of money in itself, and so all told, net loss was $360 million. One big positive was that adjusted EBITDA became positive, registering $64 million, a nice increase from the loss of $2 million last year.

What really surprised us was the cash flow figure dipping, but seeing it positive was a strong result. Operating cash flow fell year-over-year, to $127 million, about $10 million less from the $137 million a year ago. Further, free cash flow also fell. It dropped about $20 million to $106 million vs. a year ago.

Why did cash flow fall?

You may be wondering why cash flow fell despite the strong revenue growth. The first thing that we want to point out is that this company had long lost money on a cash flow basis. This was the third quarter of positive cash flow, so that is something that needs to be said.

The operating leverage the company is seeing is a result from scaling infrastructure costs efficiently, which is a key input towards its ability to invest in the long-term growth of the business. But adjusted operating expenses were $586 million in Q1, up 60% year-over-year, reflecting a combination of the ongoing rate of investment in the business. The rate of hiring stepped up in Q1. Total personnel costs were up 52% year-over-year, driven by a 52% increase in full-time head count. There have also been costs associated with the integration of acquisitions. We should also point out that marketing was also a massive driver of year-over-year adjusted operating expense growth as total marketing spend more than doubled year-over-year in Q1. Finally, there was approximately $5 million in costs to support SNAP team members impacted by the war in Ukraine during Q1, which further contributed to the elevated year-over-year growth in adjusted operating expenses.

There is a large addressable market and SNAP is gaining share

The fact is that the social media addressable market is large and growing. Anywhere humanity can connect to the internet, there is a chance to get them onto the platform. It will take time to fully penetrate the globe, but the company is well on its way, specifically drawing in users with augmented reality. CEO Evan Spiegel stated in the release:

“We remain focused on providing value for our growing community, delivering ROI for our advertising partners, and investing against our enormous opportunity in augmented reality.”

But where things got interesting was on the conference call, specifically addressing the market the SNAP is addressing. Jeremi Gorman, chief business officer, stated:

“Today, we comprise less than 2% of the $210 billion U.S. digital ad market and less than 1% of the $520 billion global digital ad market, while reaching nearly half of U.S. smartphone users and more than 75% of 13 to 34 year olds in over 20 countries. In addition, mobile advertising is growing faster than desktop advertising, video advertising is growing faster than non-video advertising and self-serve advertising is expected to make up 90% of all digital display ad spend in 2022. These trends are favorable for our strategy and we believe our video advertising business has the potential to deliver robust top line growth.”

It is clear that the market of potential users is huge, and the company is gaining share.

Looking ahead

While cash flow was positive, the company has a nice war chest. The company ended the quarter with $5 billion in cash and marketable securities, up from $2.6 billion in the prior year. Recall the company had significant proceeds of convertible notes and had some cash generated from operations. As we look ahead to Q2, management is forecasting a return to 20%-plus revenue growth, and it’s forecasting adjusted EBITDA between break-even and $50 million. While the company sees possible 25% growth, we are viewing things conservatively, and view 20% as a reasonable goal which is still immense growth. We see some global headwinds. These risks still include supply chain disruptions which can hurt the timeline on developing new technologies or offerings. There also concerns over labor shortages although SNAP claims to have a “low attrition rate”. And there remain strong inflationary pressures, and the impact of rising interest rates on the overall economic environment could impact partner spend and advertising budgets going forward. Those are some risks to be aware of.

At $29 a share, even with impressive growth in many metrics, shares are expensive. There are few measures on which the stock is inexpensive. We do like that valuation has improved as the stock has been decimated. Growth metrics remain strong, and the future is bright for the company. However, the stock is speculative at this point.

All things considered, the results, our outlook and view of headwinds, and how SNAP has handled them, earn a respectable ‘golf clap’ from our team. We would much prefer entry into the stock sub $25.

Be the first to comment