designer491/iStock via Getty Images

CTO Realty Growth, Inc. (NYSE:CTO) is a small real estate investment trust with a market capitalization of less than $500 million. Nonetheless, the trust has a lot of room to expand in its defined niche of retail properties in high-growth markets.

CTO Realty Growth anticipates a 15% increase in adjusted funds from operations in 2022, and the dividend is fully paid. Finally, the multiple at which CTO trades is appealing and may undervalue the trust’s FFO prospects.

Small But Growing Real Estate Portfolio In Attractive Markets

CTO Realty Growth is a trust with a market capitalization of $390 million, making it significantly smaller than other retail real estate investment trusts in the sector. CTO Realty Growth, on the other hand, is an appealing REIT to consider because of its sole focus on high-growth markets, which promises above-average funds from operations growth in the future.

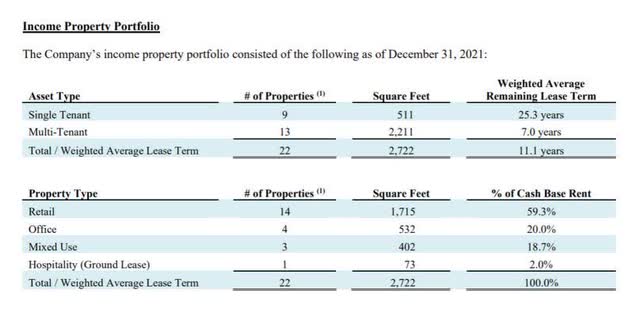

CTO Realty Growth is a small trust, both in terms of market value and property count. In 2021, the REIT owned only 22 properties (9 single tenant and 13 multi-tenant). Fourteen of these properties were retail, four were office, three were mixed-use, and one was a hospitality property.

In addition to its direct real estate investments, the trust has a 16% stake in Alpine Income Property Trust (PINE), a publicly traded, single tenant net lease REIT worth $41 million. After deducting accumulated depreciation, the net real estate value of CTO Realty Growth’s assets in 2021 was $494.7 million.

Income Property Portfolio (CTO Realty Growth)

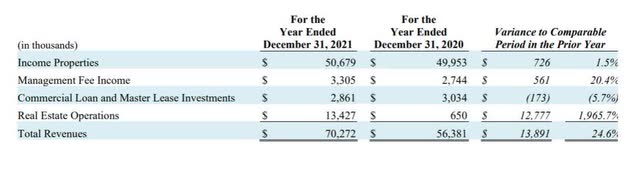

When compared to trusts like Realty Income (O) or STORE Capital (STOR), CTO Realty Growth is barely on the radar of investors, but this could mean that investors are missing out on gains as the trust grows rapidly. CTO Realty Growth generated $70.3 million in total revenue from its real estate operations in 2021, a 25% increase YoY.

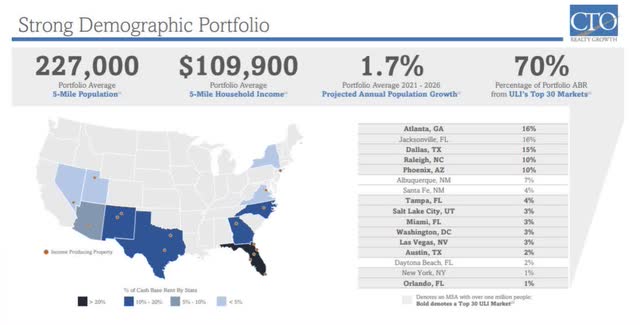

The trust’s focus on strong economic markets with above-average household incomes and prospects for robust population growth is critical to its growth. CTO Realty Growth’s real estate is only found in markets with high economic growth potential, such as Miami, Las Vegas, Dallas, and Jacksonville. The geographic focus of the REIT is Florida, where 9 of the 22 trust properties are located. The concentration of trust properties in high-growth markets translates into an appealing opportunity for above-average fund-from-operations growth.

Demographics (CTO Realty Growth)

92% Pay-Out Ratio And Increasing Dividend Pay-Out

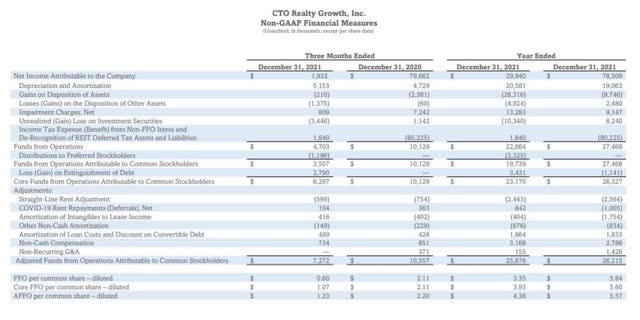

Based on the number of real estate assets currently in the trust’s portfolio, CTO Realty Growth generates approximately $26 million in adjusted funds from operations per year. The REIT outperforms its dividend with adjusted funds from operations and increased it by 8% in 1Q-22. The trust’s AFFO for 2021 was $4.36 per share, implying a 92% pay-out ratio.

Non-GAAP Measures (CTO Realty Growth)

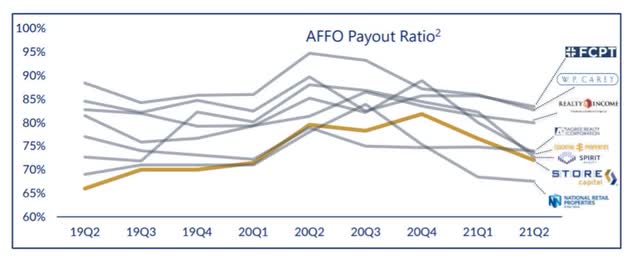

The pay-out ratio of CTO Realty Growth is also significantly higher than the pay-out ratios of the trust’s larger retail trust peers. In 2021, Realty Income had a pay-out ratio of 79%, while STORE Capital had a pay-out ratio of 73%. The majority of large retail REITs have pay-out ratios ranging from 70 to 85%.

AFFO Payout Ratio (Store Capital)

AFFO Outlook For 2022, Multiple

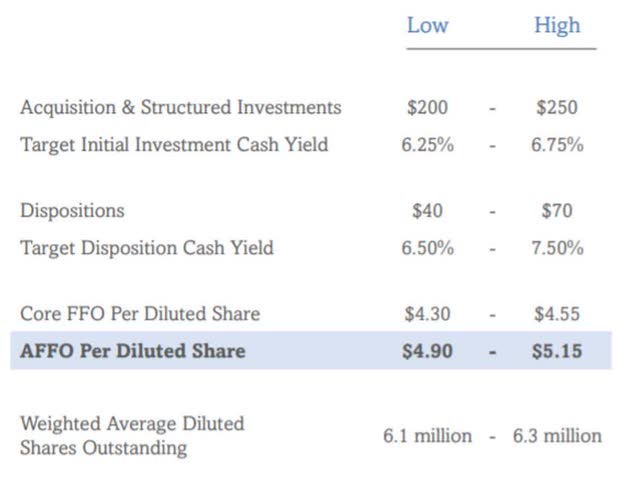

CTO Realty Growth expects adjusted funds from operations to be $4.90-$5.15 per share in 2022, representing a 15% YoY increase. The trust’s guidance implies a 13x AFFO multiple. The multiple is low in comparison to larger retail-focused REITs, which is likely due to the higher risk associated with CTO Realty Growth’s much smaller, less diversified real estate portfolio. Realty Income has an AFFO-multiple of 19.2x and STORE Capital has an AFFO-multiple of 14.0x. However, the trust’s lower valuation and smaller size provide an opportunity to ride a wave of growth at CTO Realty Growth.

AFFO Per Diluted Share (CTO Realty Growth)

Dividend Growth

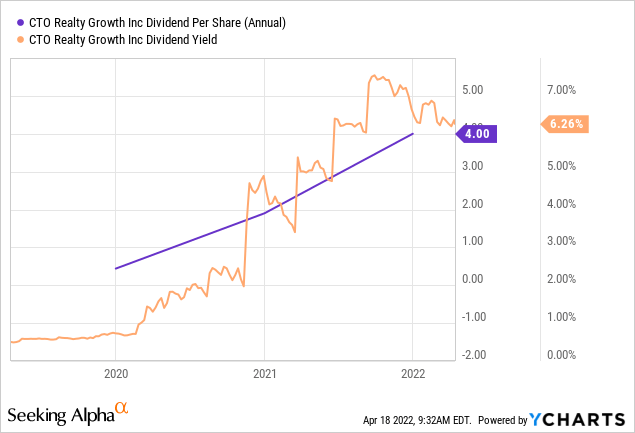

CTO Realty Growth’s forecast for 2022 assumes 15% AFFO growth, implying the potential for strong growth in the trust’s quarterly cash dividend. CTO Realty Growth’s stock currently yields 6.26%, but the dividend is likely to be increased again next year given the strong expected AFFO growth.

Why CTO Realty Growth’s Stock Could See A Lower Valuation

Because of their lack of diversification, small REITs are at a disadvantage when compared to larger trusts. A recession in Florida would hit CTO Realty Growth much harder than a large retail trust like Realty Income or STORE Capital.

On the other hand, limited diversification allows the trust to grow its funds from operations more quickly. Moving forward, CTO Realty Growth’s valuation multiple may prove to be more volatile than the multiples of its larger retail trust peers.

My Conclusion

The stock of CTO Realty Growth is a good buy because it has above-average potential for funds from operations and dividend growth. The trust’s focus on high-growth markets makes it particularly appealing to investors seeking not only a high, covered dividend yield but also capital gains.

Be the first to comment