aluxum

Thesis

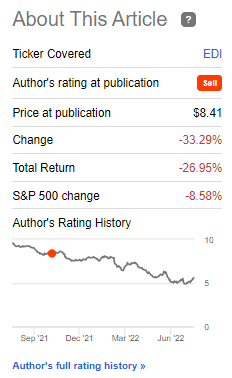

Stone Harbor Emerging Markets Total Income (NYSE:EDI) is an EM fund from the boutique asset manager Stone Harbor (now part of Virtus after the acquisition), albeit a small fund at approximately $60 million assets under management. We wrote an article about this closed end fund late last year when we slapped a Sell rating on it. Our call proved to be extremely accurate with the fund down significantly since:

Author Rating (Author)

The main drivers behind the move have been:

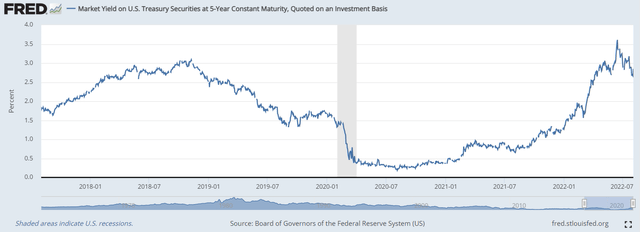

1) Significantly higher USD risk free rates

- On the back of higher inflation readings, USD risk free rates are up

- The market has violently re-priced higher as inflation readings have come in much higher than expected

- There is a positive correlation here with EM spreads – > inflation has been partially been caused by the war in Ukraine (higher oil prices, higher food prices), war which caused EM spreads to widen as well

- The market did not anticipate the velocity of the rates move this year with fixed income being lower across the board

2) Significantly wider EM credit spreads

- The Fed induced zero rates environment distorted most credit instruments with historic low credit spreads

- USD EM assets did not escape this macro move, with 2021 having seen tightening across the board

- Following the invasion of Ukraine and higher risk free rates, investor capital fled EM fixed income which has caused EM spreads to widen significantly

We feel we are careening towards the end of the move for both those factors. While we are not done in the widening of rates in USD, we feel most of the move is now behind us. The market as shown in the forward SOFR curve is pricing a 3.5% terminal Fed rate. We are fairly close across the curve tenors to that yield point. On the credit spreads side we can see from the above graph that we have widened to historical highs (outside of the 2020 Covid crisis).

Fixed income has been absolutely pummeled in 2022 by the violent move up in risk free rates. Coupled with a widening of EM spreads as well, the market has not been kind on EDI. We anticipated this move and we highlighted our thesis to investors. We believe that although structurally many EM governments and corporates will have to deal with a higher level of inflation for longer, 2023 will be kinder to the asset class. After every storm the sun comes out again, and while 2022 will weed out weaker names by outright defaults, 2023 will bring a rally in the asset class in our opinion. We believe that EDI is starting to form a bottom and having a short position here on the name is not a good risk/reward trade at this point. We are therefore moving from Sell to Hold on this CEF.

Performance

The fund is down more than -34% on a total return basis in the past year:

1-Year Total Return (Seeking Alpha)

The vehicle compares very negatively to some of its peers in the space that have only half the negative performance. Think about the capital destruction here for a second – a third of your hard gained cash has been erased by this fund in the past year. Long duration funds can experience significant loses in instances such as this one where rates rise violently.

Holdings

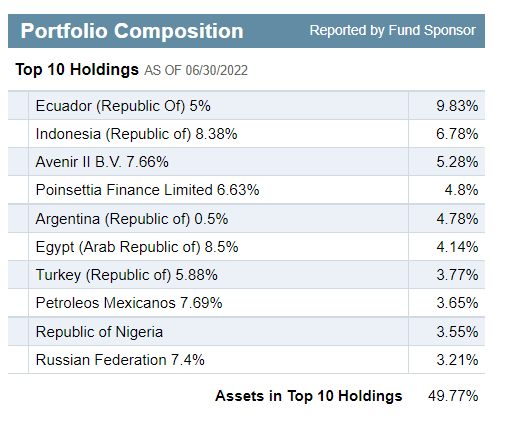

EDI invests in both sovereign bonds denominated in local currency and corporate EM bonds. The top ten holdings represent almost 50% of the portfolio:

Portfolio Composition (Morningstar)

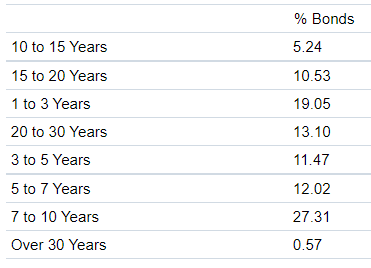

The fund does not report its duration profile, but its collateral maturity breakout is as follows:

Maturity Ladder (Fidelity)

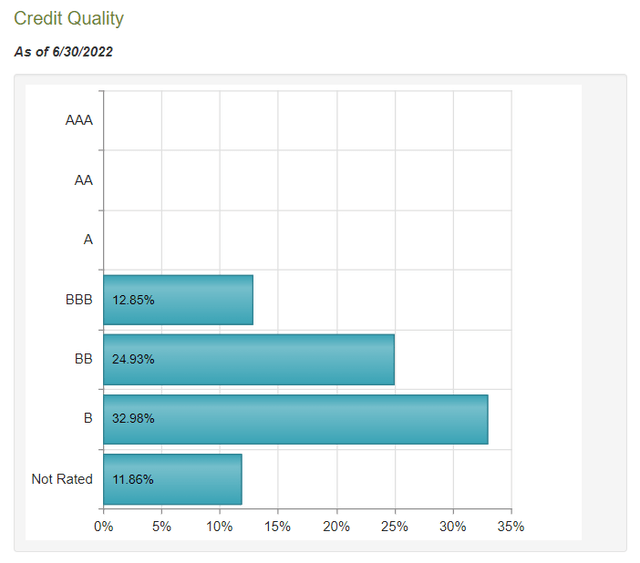

From a credit rating perspective, the fund is overweight below investment grade bonds, thus taking significant credit risk to achieve its returns:

Collateral Credit Quality (CefConnect)

We can see that only 12.85% of the rated bonds fall in the investment grade category, with the rest being high yield or not rated.

Conclusion

EDI is an EM CEF with a very negative performance since our Sell rating. The vehicle has been pummeled by rising risk-free rates and widening EM spreads. The fund is down more than -33% since our article on the name. We believe we are approaching the end of the move-up in rates and the widening in EM spreads, hence we believe short selling the name here does not expose the best risk/reward analytics. We are therefore moving from Sell to Hold on this name.

Be the first to comment