iprogressman/iStock via Getty Images

It has been a tough year for social media and online advertisers, especially if they have any connection with iOS users. Meta Platforms (META) and Snap (NYSE:SNAP) are the two most popular social media platforms being thrown to and fro in this two-fronted battle of managing weak advertising dollars. If iOS privacy changes weren’t enough, the macroeconomic environment has stolen the show and provided a hefty slowdown in advertiser spending. This is why Snap’s announcement of having 1M Snapchat+ subscribers catches my attention. Snap would be the first to break from the cyclical ad industry to supplement its revenue with quantifiable success. Combined with the stock’s valuation, this provides a potential for huge returns if management can continue the Snapchat+ success.

It’s important to start by noting Snap hasn’t had success in doing anything outside of its core competency. Remember those cool glasses? Yeah, those are a thing of the past. How about that neat hand-sized selfie drone? Dumpster.

It’s clear the company has no business being in the hardware industry. For one, even if there was a demand for any of their past products, the margins on hardware are awful compared to its software-based model.

But, when the company creates a Twitter (TWTR) Blue look-a-like (really in idea only) and actually produces decent numbers, I say with quiet confidence, “That’s the ticket…”

When I wrote Snap is the first to make a break from sourcing revenue outside of ads, I considered Twitter’s Blue subscription. But because Twitter is a dumpster fire in and of itself, it can’t even turn in decent numbers on its subscription, with Sensor Tower estimating only $4M in revenue from the service since its launch in June 2021.

In contrast, Snapchat+ already has 1M subscribers at nearly all $3.99 monthly payments, according to Sensor Tower, totaling $5M in revenue in just the six weeks it was released.

At the very least, those kinds of numbers and timeframe require a second look, regardless of you’re a bull or a bear on the industry or Snap specifically.

The Mechanics Of Snapchat+

Snapchat+’s initial success means two things are true for Snap:

- It can produce a subscription product with features worth paying for

- Its users are directly monetizable

This is a first in terms of directly petitioning users for money successfully (read: at scale) rather than using the user’s information as marketing data points for advertisers to pay Snap. In addition, this is a divergence in the source of revenue by using a different product aimed at a different customer altogether, but all based on the same platform/application.

Features Worth Paying For

Twitter obviously tried this, but the feature set it came up with was not enticing enough, as illustrated by the poor uptake. Remember, Twitter and Snap have relatively similar daily active user metrics with 238M and 347M, respectively, compared to much larger competitors with ~1B or more DAUs. Snap’s attempt, however, with a product released in June, has already enhanced it with additional features earlier this month, with substantially better financial results demonstrably noted by the 1M paying users who subscribed.

As of August 8th, less than six weeks after launch, one million subscribers are producing $4M monthly. That’s $12M per quarter if growth completely stops at 1M subscribers. This is obviously a very short dataset period, but the velocity of this uptake is astonishing. Twitter couldn’t do that much in a year. Snap did it in five weeks and five days.

Clearly, Snap can create a subscription product with features worth paying for.

Direct Monetization

This proves Snapchat’s demographic is directly monetizable, which has been a tenant of the bear thesis since the beginning. I know; I was one of them. The thesis always mentioned how teenagers and the young demographic have to use mommy and daddy’s credit card to buy anything, so, one, why advertise to them, and two, they’ll never cough up money directly – mainly because they can’t.

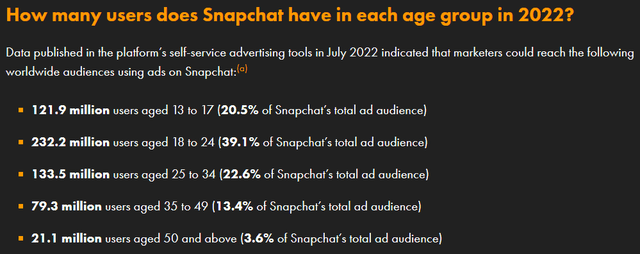

Now, I can’t say for sure these 1M subscribers are anything but 30-plus-year-old users who want to spruce up their Bitmoji, but the speed at which users signed up seems like even the basic features have lured them in without the new August 15th release having any impact, yet. So it can mean either user of the more “mature” demographic are sticky enough to pay for a subscription, and they are prevalent in large enough numbers, or the majority of users, who are under the age of 24 (59.9%), are capable and willing to subscribe.

The answer is likely somewhere in the middle. If those users are in college and able to pay for Netflix, then they are capable of paying $3.99 for Snapchat+. And so, the target audience for Snapchat+ likely ranges from the 18-49-year-old group (the older than 49 group has less likelihood of wanting any paid features). This is 75% of the Snapchat user base. That’s currently a 260M user TAM (total addressable market).

So there’s a set of features worth paying for and a set of users willing to pay for it.

The Financials Of Snapchat+

As I said earlier, it’s early innings, but the financials look enticing on the face of it. For example, the $12M I mentioned before is just over 1.1% of Q3’s expected revenue ($1.07B). But let’s say the company reaches 1.5M subscribers in another six weeks. That’s $18M on a quarterly run rate or 1.7% of the quarter’s expected revenue – from just 12 weeks of growth.

That’s not an inconsequential amount of revenue for starting from $0 and being live for 12 weeks. It will be low-hanging fruit to start, but just like any product with demand, it has a massive growth rate at the beginning. And the company appears to be on top of adding new features. Six weeks with another feature set means the company has a roadmap and has been working on new releases of the product before it was launched. This simply means there’s an investment happening here.

With the proof the company can attract 1M subscribers off the bat, it means the investment will grow. Contrast it with Twitter’s subscription service aimlessly testing beta-level features with no direction and only increasing the cost to $4.99. It makes Snap look like they’re geniuses but, more importantly, smart investors. This means investments will beget investments in the plus service as momentum grows.

The bottom line is success will produce success as more investments mean better features and more exclusive functionality. Then, the subscription service begins to market itself.

Going back to the 260M user TAM, the financials begin to add up if the company can attract just 10% of this user base. 26M subscribers at $3.99 a month mean $104M per month, or $312M each quarter. This is a long-term view of the subscription landscape, but 5M users in a year don’t seem too farfetched considering the 1M it acquired in a month and a half. A long-term view of 26M users in three or four years means the Snapchat+ business could generate upwards of 20% of the company’s revenues by the end of 2025. That doesn’t include any price hikes or added tiers of subscriptions along the way.

It’s Early, But The Potential Looks Promising

It’s early days to make extrapolations like the one I just made, but the rapid success of Snapchat+ means there is real potential. Supplementing 1%-2% of its revenues per quarter in just over a month means there’s reason to continue investing in the subscription service. The company needs to throw away any hardware ambitions it has and throw its financial weight behind the teams working on Snapchat+.

Diversifying away from the cyclical ad industry has been the ticking time bomb all social media and online advertisers have faced. Seeking Alpha and other financial crowdsourcing sites have shown it’s the future with their revenue model shifts. Social media, ironically, has been the laggard in the ad space, holding on to and depending on many other companies to support its ability to target users for ads and generate all its revenue. Snap may have just broken the social media barrier by showing it can create a subscription at scale and generate meaningful revenue.

For this alone, the future for Snap may have just gotten brighter. With it trading at historically low valuations due to the ad cycle at the worst it has ever been (iOS privacy changes plus macroeconomic headwinds), this product may be the one to reinvigorate the valuation and market’s perception of Snap’s growth.

Be the first to comment