Aslan Alphan

While a lot of payment stocks that went public via a SPAC over the last year or so have generated generally positive results, Paysafe (NYSE:PSFE) has mostly struggled. The specialized payments platform focused on iGaming and digital commerce constantly fails to reach minimal growth targets. My investment thesis remains Neutral on the payments stock until the new management team generates positive results from the turnaround plan.

Outside Pressure

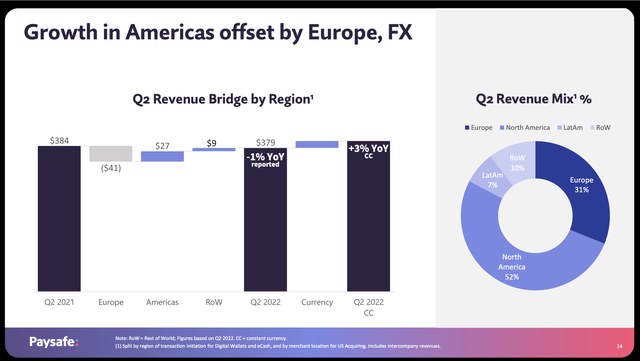

While Paysafe was doing well in the Americas, the company faced a tough situation in Europe due to the war in Ukraine and currency exchange headwinds. In total, the company reported Q2’22 revenues down 1% to $379 million with Europe revenues were down $41 million.

Source: Tilray Q2’22 presentation

Paysafe was supposed to have growth drivers in the iGaming and digital commerce spaces offsetting any macro issues, but the company has failed since going public to grow. In addition, the payments firm has $2.6 billion in outstanding debt causing the stock to struggle with Paysafe trading at 5.7x LTM adjusted EBITDA.

The company provided Q3’22 guidance that didn’t offer much hope. Paysafe targeted revenues of $350 to $365 million for the just closed quarter. The company reported $354 million last Q2 just after coming public following an initial Q1’22 revenue total of $384 million highlighting how bad results have been since completing the SPAC deal.

Some of the above excuses are valid as no company can overcome a currency issue or a war, but some companies have survived with much better results. A few companies actually operating in Ukraine haven’t felt the same impact on the business.

Paysafe had to slash EBITDA targets for the year from $450 million to only just above $400 million now. The company started public life with adjusted EBITDA targets closer to $500 million suggesting the possibility for a 20% dip in EBITDA profits in just a year after going public.

New Management

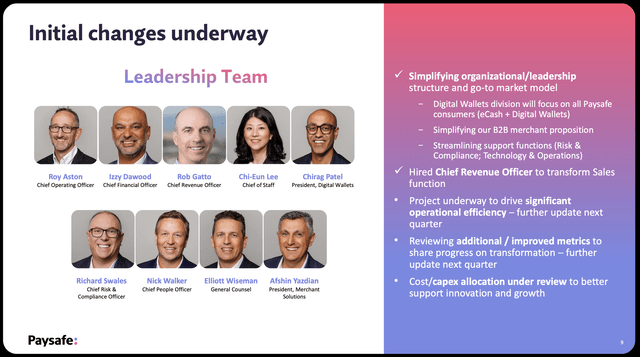

A lot of changes in the management team can definitely reinvigorate growth over the long term, but massive changes can be very disruptive to the business. The problem here is that the company has completely reshuffled the management team that took the company public.

Source: Paysafe Q2’22 presentation

CFO Izzy Dawood is leaving the company later this year with Alex Gersh starting at the company as the new CFO on October 3. CEO Bruce Lowthers was only hired on May 1 with a new CRO hired back in August in signs of the massive shuffle in executive leadership in just a few months.

The new CEO wasn’t around for the whole Q2, but the company has only missed revenue estimates for the quarter and slashed targets for the forward period. The new CRO would suggest revenues are still under pressure in Q3 and the new CFO just doesn’t point to a very promising next 6 to 12 months until these executive leaders can reconfigure the company for actual growth at likely lower starting levels.

The stock has a market cap of only $1.0 billion, but the enterprise value is up at $3.4 billion due to the large debt load in a space not typically encumbered with debt. If the new management team got the business turned around and Paysafe started generating 10% annualized growth normal for a digital payments firm, the stock would be very appealing with this EV.

The company is still targeting $1.5 billion in annual revenues and over $400 million in adjusted EBITA, or less than 10x the current EV. The problem here is the large debt load with weakening results heading into a global recession. Paysafe has an extra level of risk not common in most payments and fintech stocks, typically not holding any debt at all.

Paysafe paid nearly $30 million in quarterly cash interest expenses in the quarter leading to $120 million in annual costs. The company now pays an interest rate below 5% here, but Paysafe faces the risks of higher interest rates cutting into limited and declining profits.

Takeaway

The key investor takeaway is that Paysafe is still in the penalty box until the new management shuffle can confirm a business turnaround. Investors should watch the turnaround from the sidelines.

Be the first to comment