tolgart

During a vacation last week to Lake Chelan, I planned a rough outline of what I would be writing about when I got back. Over the next couple weeks, I will be covering the big tech companies, but I will also be writing updates on the companies that I own and plan to own for the foreseeable future. While I was gone, one of my largest holdings, Magellan Midstream Partners (NYSE:MMP), reported Q2 earnings. I listened to the earnings call, and I figured a quick update was in order.

Investment Thesis

Magellan Midstream Partners is an MLP with a market cap of $10.9B. Magellan operates a large network of pipelines in the center of the US and is trading at a very cheap valuation today. Even after a nice little 10% run from $46 in early July, units trade at 10x cash flows, which is below the average multiple of 11.3x. The company has been pretty aggressive with their unit repurchase program over the last couple years and spent another $190M in Q2 on buybacks.

While the valuation is cheap, one of the biggest draws for investors is the large distribution yield. The yield is just over 8% today, and if the pattern of the last couple years holds, we will likely see another distribution hike in Q4 this year. That would put the streak of annual raises at 21 years. While the distribution growth has slowed in recent years, a growing 8% yield is attractive in my mind, especially in today’s market.

A Brief Summary & An Update on Q2

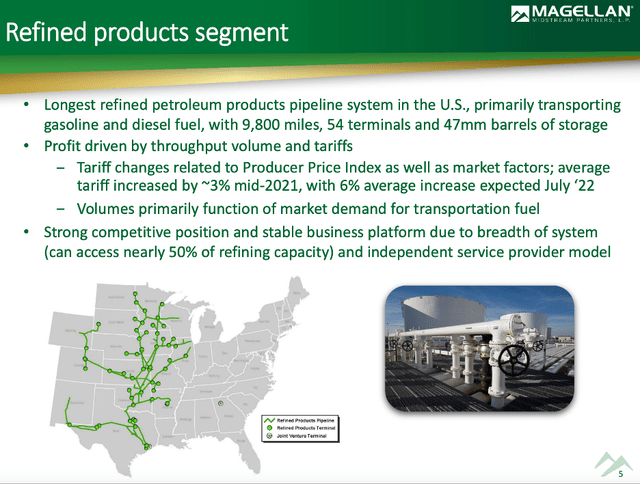

For the investors who aren’t familiar with Magellan, the company is a midstream business focused on the transportation and storage of fossil fuels. I would assume most readers are familiar, but if not, a brief summary of the company and its assets is below (I have also covered the business in more detail in previous articles if readers are curious and have some extra time to burn).

Magellan Footprint (magellanlp.com)

One of the biggest updates on Magellan is the finalization of the sale of independent terminals. The sale closed in June for $447M, which the company plans to use for more buybacks. While they haven’t been growing the business much as of late, the main driver of the bullish thesis is the cheap valuation.

Valuation

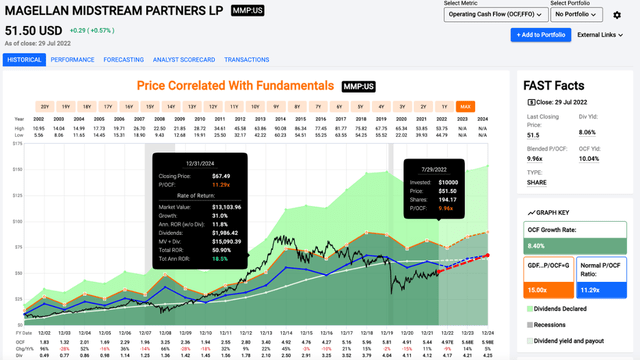

Magellan has spent the last couple of years at a large discount. While units have had a nice little run since early July, they are still cheap today. You can pick up shares at 10x cash flows, which is a turn below the average 11.3x multiple. I think units are worth $60 today, and I think it is only a matter of time before the market agrees.

Price/Cash Flow (fastgraphs.com)

When you throw in an 8% distribution yield, I think it is very likely that we will see double digit returns over the next couple years. Even if we don’t get the slight multiple expansion that I’m expecting, I think the returns will still be attractive relative to the rest of the equity market. The buybacks are another reason to be bullish at current prices.

Distributions And Buybacks

As I have mentioned in previous articles on MLPs, Magellan’s distributions are treated differently from regular C-Corp dividends. Owning units of Magellan also forces investors to file a K-1 tax form, so you should be aware of the tax implications before buying units. If you understand the nuances of owning an MLP, I think Magellan is one of the better options out there.

The distribution yield of 8% is juicy, and the company is riding a 20-year streak of annual raises. If you purchase units this week, you can receive the distribution that will be paid out in a couple of weeks. Units tend to sell off a little bit after each distribution, though, so you might be able to pick up units below $50 in the next month. The company is also rewarding unitholders with continued repurchases.

In Q2, the company spent $190M on buybacks. They bought 3.9M units at an average price of $48.79. That leaves $460M on the buyback program, which runs until the end of 2024. My guess is that Magellan will continue to buyback units, especially with the proceeds from the independent terminal sale.

Conclusion

Magellan is approximately half of my midstream portfolio. The other position, which is slightly larger, is Enterprise Products Partners (EPD). Both companies are cheap and throw off a ton of cash in the form of generous distributions. I will be writing an update on EPD once they release Q2 earnings, but Magellan is still a buy today even after a strong month of July. The buybacks are set to continue, and the independent terminal sale closing might allow the company to buyback even more units. At 10x cash flows, Magellan is a good value, and I think units are headed to $60 or more in the coming years. For income investors willing to play in the MLP space, Magellan is a solid option and I think double-digit returns lie ahead for patient long-term investors.

Be the first to comment