FilippoBacci/E+ via Getty Images

Author’s note: This was released as part of the Weekly CEF Roundup released to CEF/ETF Income Laboratory members on July 11, 2022, with certain numbers updated.

Saba moves against SMM

On June 28, 2022, Salient Midstream & MLP Fund (NYSE:SMM) announced that its board has proposed a reorganization of SMM into the open-ended Salient MLP & Energy Infrastructure Fund (SMLPX). From the press release:

SALIENT MIDSTREAM & MLP FUND ANNOUNCES PLANNED REORGANIZATION

Salient Midstream & MLP Fund (the “Fund”) (SMM) announced today that its Board of Trustees determined to reorganize SMM into Salient MLP & Energy Infrastructure Fund (“SMLPX”) (the reorganization of SMM into SMLPX is the “Reorganization”). SMLPX is an open-end fund that is a series of Salient MF Trust with approximately $849 million in net assets and is also managed by Salient Capital Advisors, LLC, the investment adviser of SMM, using a similar investment strategy.

After careful consideration of a variety of factors and alternatives, the Board of Trustees determined that it would be in the best interest of shareholders to merge SMM into SMLPX.

The proposal to merge SMM into SMLPX will require the approval of SMM shareholders. This press release is not intended to, and does not constitute an offer to purchase or sell shares of SMM or SMLPX (together, the “Funds”) nor is this press release intended to solicit a proxy from any shareholder of the Funds. The solicitation of the purchase or sale of securities or of proxy to effect the Reorganization will only be made by a definitive Proxy Statement/Prospectus. The Proxy Statement/Prospectus has yet to be filed with the U.S. Securities and Exchange Commission (the “SEC”). After the Proxy Statement/Prospectus is filed with the SEC, it may be amended or withdrawn. The Proxy Statement/Prospectus will not be distributed to shareholders of SMM unless and until a Registration Statement comprising of the Proxy Statement/Prospectus becomes effective with the SEC.

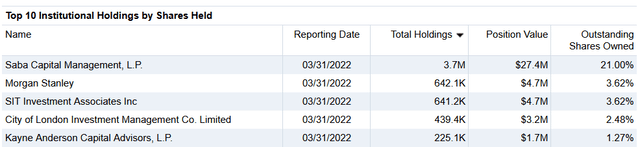

Our Tactical Income-100 portfolio purchased SMM on February 1, 2022. The thesis of the trade was that the activists Saba Capital was accumulating shares in this highly discounted MLP CEF with a 13D filing, indicating active intent.

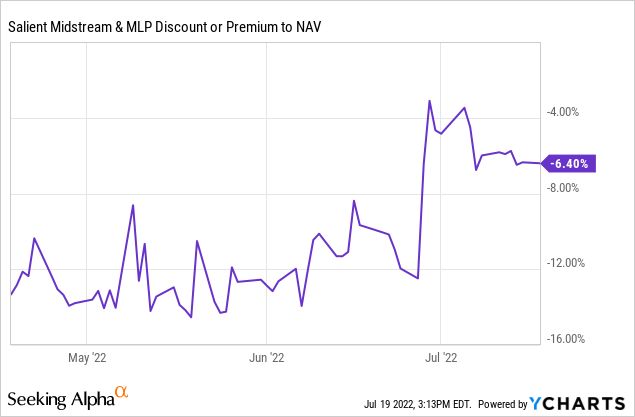

Indeed, this has played out exactly as we had hoped. The board of SMM has just announced approval of a merger of SMM into the open-ended fund, SMLPX. Remember, open-ended funds always trade at NAV. Therefore, this announcement is beneficial for investors who purchased SMM at a discount because they would potentially soon be able to cash out their shares at NAV. As expected, SMM’s discount narrowed instantly upon announcement of the proposed merger, from -12.48% to -3.11% in two days. The discount has since widened back out a bit and sits at -6.40% (as of July 18, 2022).

Fidelity

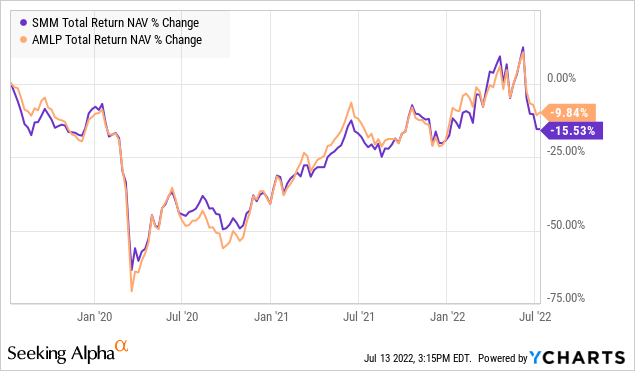

Arbitrageurs wishing to play the merger arbitrage game to extract the remaining 6% of alpha could consider hedging with the benchmark Alerian MLP ETF (AMLP) to hedge their MLP exposure. However, note that a major risk of this strategy is that should the shareholders of SMM not approve the merger, the discount of the CEF would likely widen back out again causing losses to the long SMM/short AMLP trade.

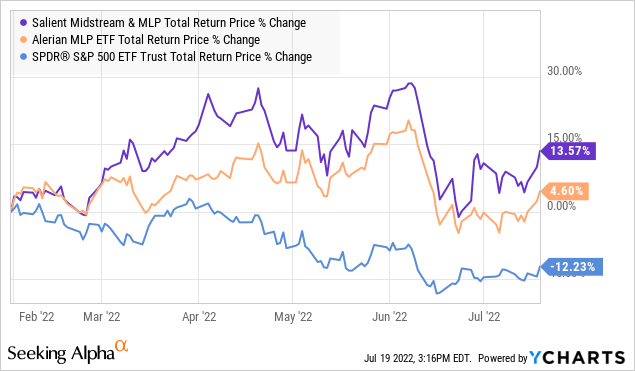

YCharts

As for our Tactical Income-100 portfolio, we’re content to hold onto the position for now, happy that Saba’s success has led to a massive outperformance of our SMM position (+13.57%) against both the MLP benchmark (+4.60%) and the S&P 500 (SPY) (-12.34%) since we purchased SMM in our portfolio at the start of February.

If SMM’s discount contracts to under -3%, that would be a good reason to sell the position as the activist thesis would be nearly fully played out at that point.

Be the first to comment