LordRunar

Aluminum packaging and aerospace are not two areas that investors might think to go together. Typically, they wouldn’t. But these are the two lines of business that make up Ball Corporation (NYSE:BALL). In recent months, the company’s performance has not been all that great. This comes even at a time when financial performance for the company remains robust. Fundamentally speaking, the company seems quite attractive at this point in time, though it is true that shares are trading at the higher end of the scale relative to similar firms. At the end of the day, the business likely does offer some upside potential for investors moving forward. But given that the company is priced where it is relative to its peers, there are better prospects that can be had.

Assessing recent performance

Back in February of this year, I wrote an article discussing the investment worthiness of Ball Corporation. In that article, I acknowledged that the company had experienced nice growth in recent years. I said that the long-term prospects for it were probably favorable, indicating my belief that the business was a quality prospect. On the other side of the equation, however, I also said that shares of the business were not exactly cheap. The company was pricey relative to similar firms and, at best, it looked to be fairly valued. These two opposing sides led me to rate the business a ‘hold’, reflecting my belief that it would likely generate returns for investors that would match the broader market for the foreseeable future. Since then, however, things have not gone exactly as planned. While the S&P 500 is down 13.7%, investors in Ball Corporation would have generated a loss of 26.9%.

Given this significant decline relative to the market, you would be forgiven for thinking that the fundamental performance of the company had suffered. But in truth, that has not been the case. In fact, for the first quarter of its 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the firm, the company continued to boast strong performance. Consider, for starters, revenue. In the latest quarter, revenue came in at $3.72 billion. That represents an increase of 18.9% over the $3.13 billion reported just one year earlier. According to management, a good portion of this increase was attributable to the company’s ability to pass through higher aluminum prices to its customers and because of a favorable price and product mix.

Looking into the data more deeply, we can see what has been the main driver of the company’s top and bottom line performance. In the Beverage Packaging, North and Central America segment, sales skyrocketed year-over-year, jumping 24.2% from just under $1.30 billion to $1.61 billion. In addition to the passing through of higher aluminum prices and a favorable price and product mix, this segment also benefited from a 3% rise in volume. The Beverage Packaging, EMEA segment also came in strong, with revenue rising 18.3% from $796 million to $942 million. Volume growth here was an impressive 10% according to management. Meanwhile, the Beverage Packaging, South America segment experienced a modest 1.4% rise in revenue, with sales inching up from $487 million to $494 million. Higher prices here were largely offset by a 21% decrease in volume due in large part to unfavorable weather conditions that impacted the summer selling season and because of economic volatility in Brazil.

Under the Aerospace segment, revenue rose by 18.9% from $424 million to $504 million. This rise was driven by new contracts the company brought on. To illustrate just how important these contracts are, consider that backlog for the company ended the latest quarter at $3.2 billion. That compares to the $2.5 billion in backlog reported just one quarter earlier. This does pose some questions about future profitability, however. According to management, 44% of backlog at the end of the quarter was associated with cost-type contracts. Under these, the company bills for the costs incurred plus an agreed-upon earned profit component. This is great for investors. But what isn’t great is at 53% of its backlog is associated with fixed price contracts. Depending on the nature of the costs involved, that could prove painful for the enterprise.

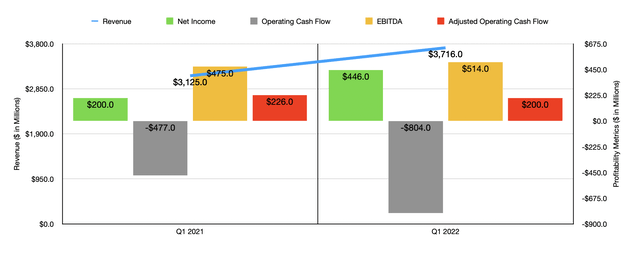

When I hear that a company is having to push higher costs onto its customers, I instantly start to worry about profitability. But so far, this has not been an issue. In the first quarter of 2022, net income came in at $446 million. That’s almost double the $200 million reported one year earlier. Operating cash flow went from negative $477 million to negative $804 million. But if we adjust for changes in working capital, it would have decreased only modestly from $226 million to $200 million. At the same time, EBITDA rose from $475 million to $514 million.

For investors worried about the future, it’s worth noting that analysts aren’t. At least they aren’t worried about the near future. At present, the company is expected to report financial results covering the second quarter of its 2022 fiscal year on August 4th. The current expectation is for the company to generate revenue of $3.84 billion. That would represent an 11% increase over the $3.46 billion reported just one year earlier. Earnings per share, meanwhile, should be $0.82. That compares favorably to the $0.61 per share generated in the second quarter of 2021. Using the company’s profitability, on May 9th, it entered into a $300 million accelerated stock repurchase agreement, buying back an estimated 4.3 million shares. Factoring this in, achieving analysts’ expectations would imply a net income for the company of $258.7 million. That would be 28.1% higher than the $202 million generated just one year earlier. This all should come even in spite of the company winding down its operations in Russia toward the end of the first quarter. Their current plan is to sell off that business, which is currently responsible for 4% of the company’s revenue and 8% of its operating income.

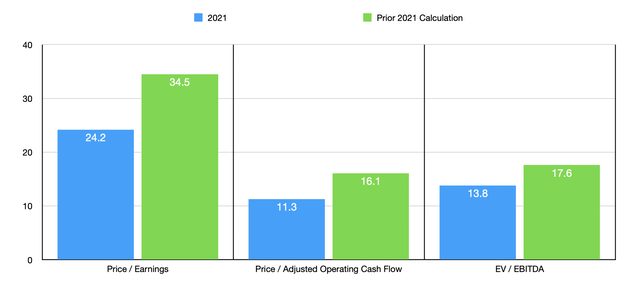

We don’t actually know what the rest of the 2022 fiscal year will look like. But it’s still early so a more conservative way to value the company would be to base its valuation off of 2021 results. At present, the firm is trading at a price-to-earnings multiple of 24.2. That’s down from the 34.5 when I last wrote about the firm. Although this is lofty no matter what angle you look at it from, the other multiples for the company look quite attractive. The price to operating cash flow multiple is 11.3, while the EV to EBITDA multiple should be 13.8. These numbers compared to the 16.1 and 17.6, respectively, that the company traded at when I last wrote about it. While shares do look attractive from that angle, they are still rather pricey compared to similar firms. Comparing the company to the same five companies that I compared it to in my last article, I found that those firms were trading at price-to-earnings multiples of between 6.2 and 24.7. Their price to operating cash flow multiples were between 3.1 and 11.6. And their EV to EBITDA multiples were between 5 and 56.7. In all three cases, four of the five prospects were cheaper than Ball Corporation.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ball Corporation | 24.2 | 11.3 | 13.8 |

| Silgan Holdings (SLGN) | 11.9 | 9.5 | 9.5 |

| Berry Global Group (BERY) | 10.0 | 8.1 | 7.8 |

| Crown Holdings (CCK) | 24.7 | 11.6 | 56.7 |

| Greif (GEF) | 10.9 | 9.8 | 7.5 |

| O-I Glass (OI) | 6.2 | 3.1 | 5.0 |

Takeaway

Based on the data provided, I do believe that Ball Corporation has gotten more attractive. Overall, the company seems to be a quality operator, and I suspect that attractive performance will continue for the foreseeable future. I am a bit concerned about the nature of some of its Aerospace contracts given the current inflationary environment. And I also don’t like that shares are still pricey relative to similar firms even though, from a cash flow perspective, they look cheap on an absolute basis. Because of these mixed figures, I have decided to keep my ‘hold’ rating on the business despite shares declining nicely since I last wrote about it.

Be the first to comment