Olena_T

A Broken Record

My past two articles on Smartsheet (NYSE:SMAR) make me sound like a broken record. Each time, I’ve offered investors a general refrain along the lines of:

The company posted another strong quarter, but…[INSERT BEAR ARGUMENTS HERE].

Well, despite the firm…wait for it…posting another strong quarter, I will continue my bearish tirade a bit longer in this analysis.

A Striking Contrast

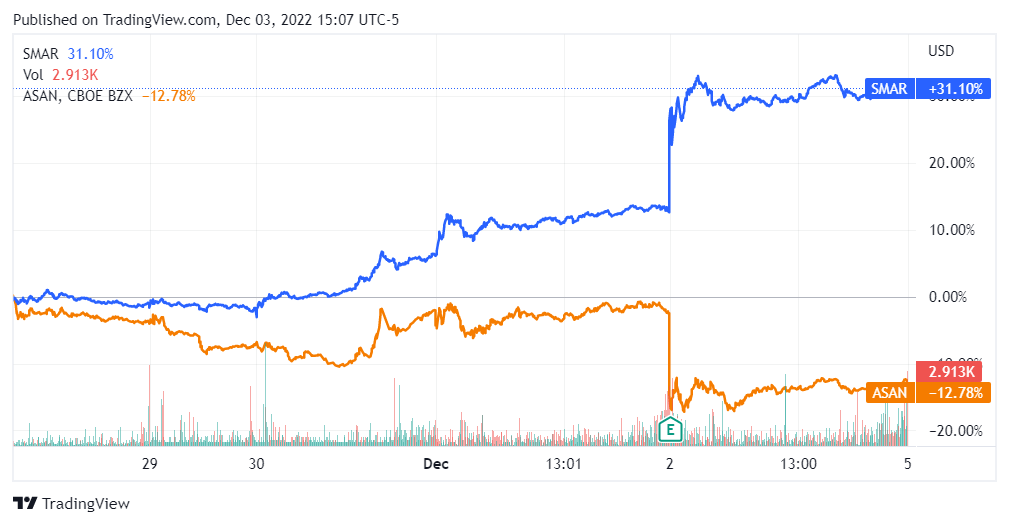

The work management leader just announced their Q3 FY ‘23 results on Thursday, December 1 and the stock took off like a rocket on the following trading day, gaining nearly ~17% to close at $37.90. By contrast, SMAR competitor Asana, Inc. (ASAN), who released their own Q3 FY ‘23 earnings results also on December 1, saw their stock nosedive more than 10% on the day.

Exhibit 1: SMAR and ASAN 5-Day Stock Price Performance (Seeking Alpha)

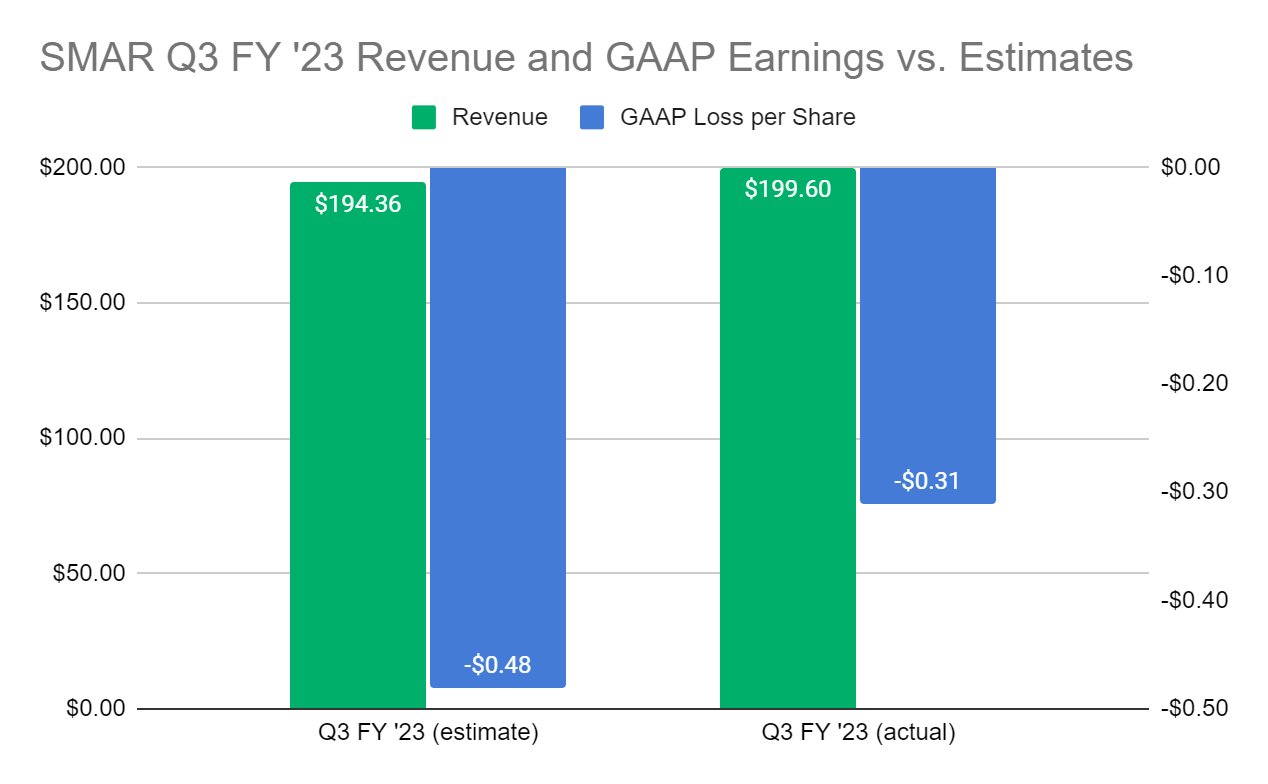

SMAR beat on both lines, with that performance coming despite challenging macroeconomic conditions.

Exhibit 2: SMAR Q3 FY ‘23 Sales and Earnings Results vs. Estimates (Yves Sukhu/Seeking Alpha)

Notes:

-

Revenue and GAAP earnings estimates from Seeking Alpha.

-

Revenue in $millions.

Interestingly, ASAN also beat estimates; but investors were particularly impressed with SMAR’s bullish Q4 FY ‘23 and full-year guidance, which was raised against management’s more cautious outlook provided at the end of Q2. As per SMAR’s Earnings Release Q3 FY ‘23:

For the fourth quarter of fiscal year 2023, [management] currently expects:

-

Total revenue of $205 million to $207 million, representing year-over-year growth of 30% to 32%

-

Non-GAAP operating loss of $2 million to $0.

-

Non-GAAP net loss per share of $0.02 to $0.00, assuming basic and diluted weighted average shares outstanding of approximately 131.5 million.

For the full fiscal year 2023, [management] currently expects:

-

Total revenue of $760 million to $762 million, representing year-over-year growth of 38%.

-

Calculated billings of $878 million to $885 million, representing year-over-year growth of 33% to 34%.

-

Non-GAAP operating loss of $45 million to $43 million.

-

Non-GAAP net loss per share of $0.31 to $0.30, assuming basic and diluted weighted average shares outstanding of approximately 130 million.

-

Free cash flow of $5 million.

Notably, SMAR’s expectation of positive free cash flow (“FCF”) for the full-year exceeds their previous break-even guidance.

Credit Where Credit Is Due

Irrespective of how I feel about SMAR as an investment, I think it is important to heap appropriate praise on SMAR as a company. It could be fairly argued, I think, that the nearly 20-year-old company was at the vanguard of those software providers who recognized limitations in spreadsheet technologies and sought to revolutionize project management and collaboration in the modern digital age. Today, they find themselves recognized as a work management software leader.

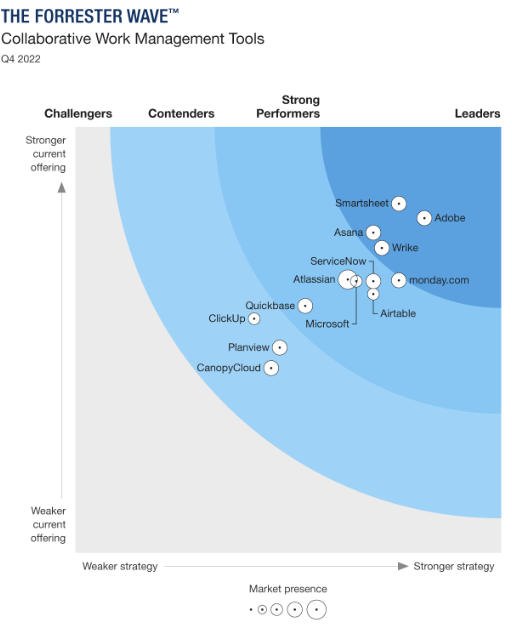

Exhibit 3: Forrester Wave Collaborative Work Management Tools Q4 2022 (Forrester)

Further, they have a strong, comprehensive offering as supported by Forrester’s grading of SMAR’s general capabilities versus key competitors, including ASAN. Their more recent move into the digital asset management (“DAM”) space with their acquisitions of Brandfolder and Outfit is also bullish in my opinion, albeit not without risks. As with the work management space, there is no clear-cut definition of the DAM market and therefore its size. But analysts who attempt to model the market seem to agree that it is growing at a healthy double-digit CAGR, with one particularly bullish assessment offering a nearly 25% growth rate. SMAR’s DAM push is quite logical as organizations of all sizes have to manage the development process of all kinds of content – digital, print, social media, etc. SMAR, and larger competitors like Adobe (ADBE), have a growing market opportunity to help customers store and organize their brand/digital assets, and to manage the creative processes themselves that deliver finished content.

So, I get why SMAR bulls are excited. You have a company that is a leader in their space, they have fertile ground with their (newer) push into digital asset management, and they continue to improve with respect to several key performance indicators:

-

Total revenue of $199.6M jumped 38% in Q3 FY ‘23 versus $144.6M in the prior period. Subscription revenue of $186.1M grew more than 40% against subscription revenue of $132.6M in Q3 FY ‘22.

-

Net retention rate (“NRR”) during Q3 held strong at 131%, bolstering the top line. Management noted that “…strong [expansion] within our customer base continued with 235 customers expanding by $50,000 or more and 79 customers expanding by $100,000 or more.”

-

Continued average annualized contract value (“ACV”) growth in Q3. Average ACV jumped 25% versus the prior period to $7,951.

-

Continued growth in key ACV buckets during Q3. Management noted that customers with an ACV of $100,000 or more grew to 1,346, an increase of 55% year over year; customers with an ACV of $50,000 or more grew to 2,962, an increase of 43% year over year; and customers with an ACV of $5,000 or more grew to 17,446, an increase of 23% year over year.

-

Continued high-value customer growth. SMAR ended Q3 with 40 customers with annual recurring revenue (“ARR”) over $1M, as contrasted with 36 $1M ARR customers at the end of Q2. Total ARR was $792M at the end of Q3, compared with $736M at the end of Q2.

-

Continued user growth. SMAR finished Q3 with ~11.7M users versus ~11.1M users at the end of Q2.

But, repeating my general thrust from my earlier articles, I think SMAR presents certain risks from an investment standpoint such that I continue to recommend that long investors avoid the stock.

Still Not Convinced

In my prior Seeking Alpha articles on SMAR, I (broadly) argued:

1. SMAR may be more of a tactical rather than strategic solution for many companies.

2. The company’s competitive moat might not be all that wide.

3. The overall economics of the business are weak.

4. Current macroeconomic conditions are not favorable heading into FY ‘24.

5. Sales execution challenges may hint at deeper problems.

I’d like to elaborate on a few of these points using some additional context from SMAR’s latest Earnings Call Q3 FY ‘23.

-

SMAR may yet be struggling to be viewed as an enterprise-class solution. I realize SMAR has done a great job growing their top-line and key customer buckets, as for example their 40 customers with ARR over $1M. CEO Mark Mader noted during the recent earnings call that “in Q3, a Fortune 50 healthcare company expanded its Smartsheet investment by over $0.5 million, bringing their total Smartsheet ARR to nearly $2 million.” This too is nothing to sneeze at and SMAR deserves a lot of credit. But, $2M in ARR for this Fortune 50 company is almost certainly a miniscule, albeit not insignificant, part of their enterprise software budget. As I’ve argued previously, we might also look at SMAR’s services uptake as a proxy for strategic use of the platform. Services revenue increased 12.5% in Q3 to $13.5M versus $12M in the prior period. While services sales increased, investors might keep in mind that services revenue growth was 50% in Q3 FY ‘22 versus Q3 FY ‘21. Management also noted that services margin dropped (600 bps) from Q2 FY ‘23 to Q3 FY ‘23 due to lower utilization rates. From my perspective, professional services revenue seems a bit too low for the age of the company, and the slowing rate of growth could hint at a broader struggle to convince customers to use SMAR across the enterprise.

-

SMAR has a great offering as evidenced by Forrester’s bullish assessment. But, the moat around core functionality could shrink quickly. SMAR differentiates itself from traditional spreadsheet software via its integration of spreadsheet-like functionality with project management and collaboration features. This “killer” combination, along with the ability to integrate with disparate data sources, allows SMAR to model and automate different customer workflows. One question SMAR investors should ask themselves is: What would happen if Microsoft (MSFT) or Google (GOOG, GOOGL) decided to roll out the next major versions of their respective spreadsheet technologies with features clearly meant to encroach on SMAR, ASAN, and others? My point is that it would make sense in the future for these heavyweights to introduce more sophisticated project management, workflow management, and collaboration features into Microsoft Excel and Google Sheets respectively to promote and protect the Microsoft 365 and Google Workspace franchises. In that case, SMAR (and others) would find that their market opportunity has shrunk virtually overnight. Now, such a scenario helps explain why SMAR has moved into the digital asset management space. It adds an additional dimension of differentiation beyond their legacy functionality. However, the DAM space is very crowded and is not a “one-size-fits-all” type of market. For example, a Chief Marketing Officer (CMO) responsible for a large number of web assets (e.g. websites), each with several hundred or several thousand pages, is almost certainly juggling a huge volume of digital assets and complex team workflows. That being said, this particular domain of DAM is characterized by its own set of players and technologies, and is not necessarily a great fit for what SMAR brings to the table. But even for those DAM domains where SMAR is a good fit, is a large organization (e.g. Fortune 100) more likely to trust their enterprise digital asset management needs to SMAR or with, say ADBE? I tend to think SMAR may find its DAM opportunities at a departmental level and with smaller organizations – which is not bad by the way. But, it would imply smaller deal sizes and less strategic use. So, again, I applaud SMAR’s decision to enter the DAM space; but, investors should not immediately jump to the conclusion that they can grow so quickly with their DAM offerings so as to offset a serious competitive threat to their core software.

-

The business economics are what they are. I’ve offered that SMAR’s ACV is simply too low relative to what it spends on sales and marketing to generate that ACV. I don’t see how this changes in any material way moving forward. For the 9-months ended October 31, SMAR’s sales-and-marketing expense to sales ratio was ~70%, although the ratio improved to ~65% in Q3 due to “…moderated and controlled costs…[including] moderated…hiring and people-related costs.” Following Q3 results, investors are clearly happier with SMAR’s profitability picture versus that of ASAN; and they were impressed with management’s ability to avoid layoffs during an otherwise tough period for tech companies. However, I maintain that the spend on sales and marketing is just too high – and will almost certainly remain too high – even with continued increases in the average ACV. If some SMAR bulls are betting on a dramatic change in the firm’s profitability outlook, I just don’t see it.

-

FY ‘24 might be shaping up to be a tough year. SMAR management lowered their guidance following Q2 FY ‘23 results citing macroeconomic headwinds. They obviously deserve credit for navigating such a challenging environment and churning out a strong Q3 performance. But, the macro picture heading into 2023 has not changed and many analysts expect a rough road for the tech sector in the coming calendar year. Indeed, SMAR CFO Pete Godbole noted during the earnings call that “…[they] haven’t come up with guidance for next year.” So, while investors have every right to feel bullish following Q3 results, they may not want to get too far ahead of themselves.

-

Management suggests sales execution is improving, but I would urge caution. During SMAR’s Earnings Call Q2 FY ‘23 Mr. Mader cited challenges ramping up newer reps leading to sales execution issues (e.g. pipeline development, pipeline conversion, etc.). Based on my own experiences selling enterprise software, I proposed the firm’s sales execution challenges might mask deeper problems. Tabling that suggestion for the moment, Mr. Mader offered a more optimistic assessment of SMAR’s sales organization in his Q3 remarks, noting “…this quarter, we saw improvements in quota attainment and pipeline generation from our newest reps…[and we] exited the quarter with a record pipeline.” This is a clear positive, particularly that quota attainment is improving – i.e. reps are closing deals. However, before investors rush to assume SMAR’s sales organization challenges are firmly in the rearview mirror, I would offer a point of caution. On SMAR’s “record pipeline”, investors should understand that when sales reps (again, I was one for a long time) are pressured to build their pipeline, they will often find a way to do so one way or another. What happens in some cases – not necessarily in the case of SMAR – is that the pipeline gets filled with “junk”: deals that have a low probability of closing or deals that aren’t even “real”. So, investors might want to view SMAR’s “record pipeline” with a skeptical eye because pipeline size obviously does not translate to revenue. If SMAR’s reps felt significant pressure to build the pipeline, the quality of those deals should be called into question. Coming back to my proposal that management’s claim of sales execution challenges may mask deeper issues, I concede, as I have before, that this is merely a guess based on my own experiences. Although, I do find it a bit curious that this problem came up following Q2 FY ‘23 earnings when management lowered guidance and seems to be on a path to resolution 90 days later following Q3 FY ‘23 results. Again, I have no insight into what’s going on inside SMAR; but, perhaps the “sales conversation” over the last couple quarters should at least elicit some questions in the minds of SMAR investors. That being said, Mr. Godbole offers that “…[SMAR] will go into [FY ‘24] with a sales team that’s very ramped, and that’s going to be positive to [pipeline] conversion.”

Expectedly, I am still in the bear camp when it comes to SMAR as an investment even though, as I laid out in the prior section, I think SMAR as a company deserves a lot of credit for what they’ve accomplished.

Takeover Speculation

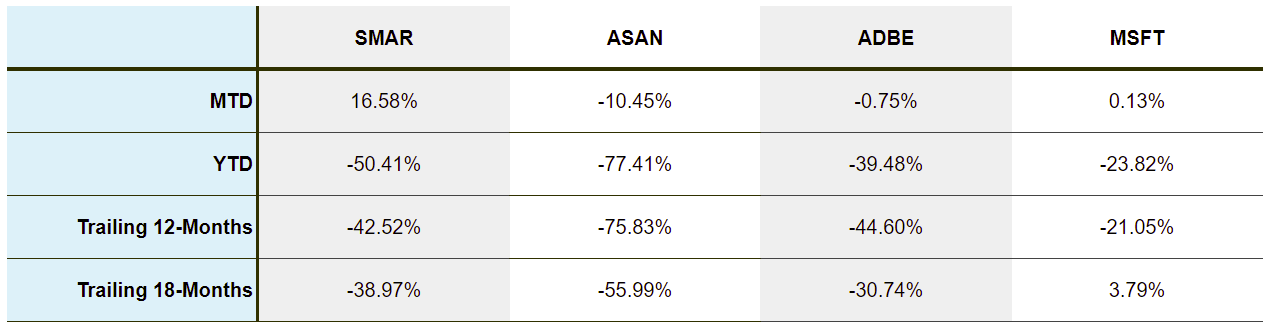

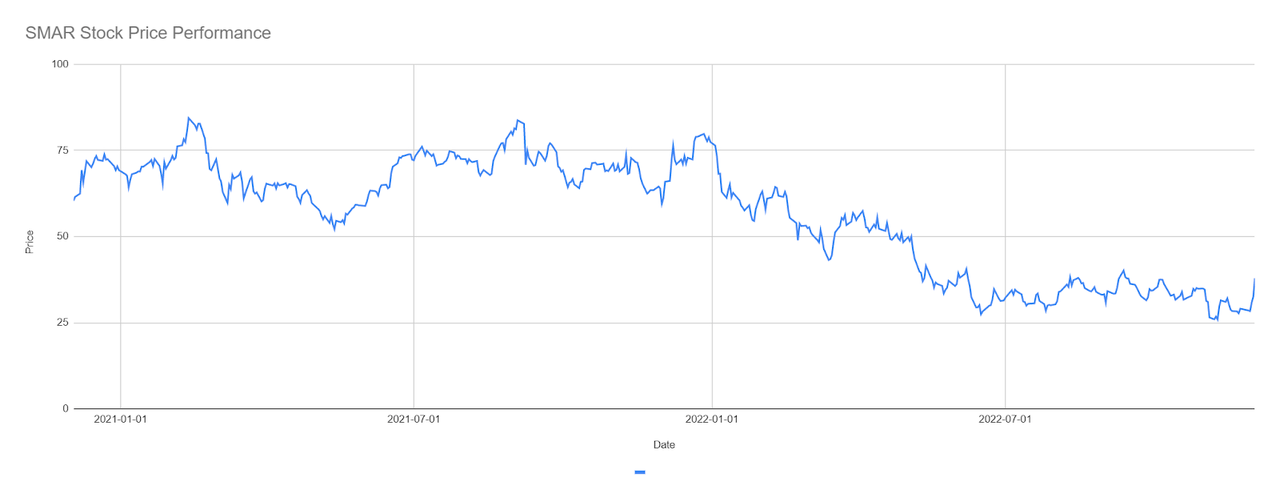

The rally in SMAR shares come as a respite for long SMAR investors who have taken a beating over the last few months.

Exhibit 4: Smartsheet and Selected Competitor Performance (Yves Sukhu)

Notes:

-

Data as of market close December 2, 2022.

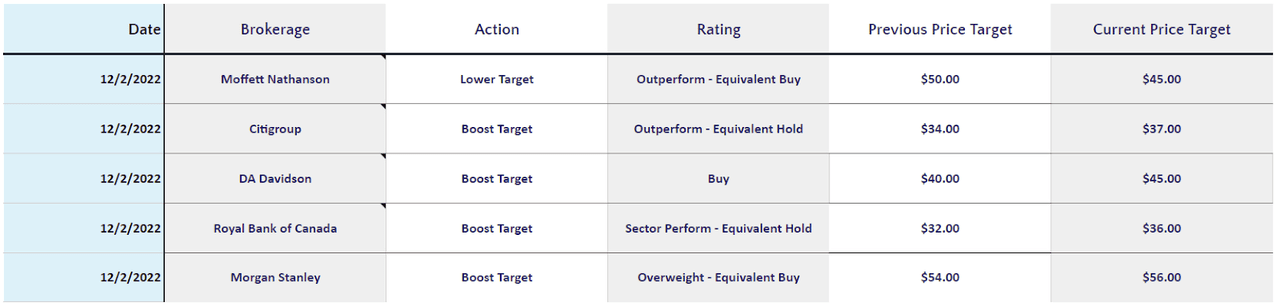

Notably, a number of analysts raised their price targets for SMAR following Q3 results with a moderate “buy” consensus among them.

Exhibit 5: Selected Smartsheet Analyst Ratings (MarketBeat)

The average price target of the analysts I selected for Exhibit 5 above is $43.80, implying shares have more room to run.

Unsurprisingly, I wouldn’t touch shares where they are trading now based on the areas of concern that I outlined. But, SMAR has value; and some analysts have identified the firm as a takeover target. I tend to be skeptical of a takeover at current levels, with SMAR sporting a market cap ~$5B. So, what valuation makes sense? Of course, I don’t exactly know what someone would be willing to pay. But, assume that a 4x sales multiple is reasonable in this market and SMAR will hit $760M in sales exiting FY ‘23. That would give the firm a “fair” valuation of ~$3B right now. If we divide that figure by 130M shares, we would get a price of about $23.40/share. So, personally, I’d be willing to make a speculative bet below $20/share. Granted, this is just a quick back-of-the-envelope calculation, and I won’t hold my breath that SMAR shares are going to be in that neighborhood anytime soon with the stock finding support at ~$25 over the last few months.

Exhibit 6: Smartsheet Stock Price Performance (Yves Sukhu)

Notes:

-

Data as of market close December 2, 2022.

Still, as discussed earlier, many forecasts for 2023 are less-than-rosy and, while SMAR looks poised to close out their FY ‘23 with a good performance, FY ‘24 is anybody’s guess even by management’s own admission. Speculators looking for an entry point might indeed find one with SMAR’s new fiscal year approaching.

I maintain a “sell” recommendation for SMAR; but, as explained, would be willing to speculate on shares at the “right” price on the bet of a future takeover. While SMAR, and just about every tech company, talk about building enduring enterprises, the grim reality is that many tech firms do not have business models that will lead to sustainable, profitable growth. I suspect management may be increasingly eager to find a suitor for the business given its inherent economics (see my earlier point) and as the business nears 20 years in age.

Be the first to comment