Alex Wong

The Powell moderation speech

The S&P 500 (NYSEARCA:SPY) increased sharply higher by over 3% after the Fed Chair Powell speech on November 30th at the Brookings Institute and broke the important technical resistance at the 200dma.

Powell essentially confirmed the Fed’s intention to moderate the pace of interest rate hikes starting December, but also to keep the interest rates longer at the restrictive level and warned against the premature interest rate easing policy.

The market is now convinced that the Fed is aiming for the “softish landing”. It appears that this is a departure from the “whatever it takes” approach from the Powell’s Jackson Hole speech with the reference to the “pain to households and businesses”.

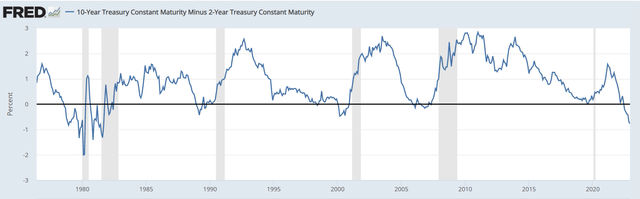

However, the Powell’s moderation speech could also be a warning that the Fed has already caused the severe inversion of the yield curve, and the damage to the economy has already been done.

The Fed’s dovish pivot?

Mike Feroli of JPMorgan asked the Fed Chair Powell, after his speech on November 30th, 2022 at the Brookings Institution: “So you spoke about going somewhat restrictive and then staying there for a long time. Why would you prefer that over a shock and awe approach that goes very restrictive but for a shorter period of time.” Here is the Powell’s response:

I think we’ve been pretty aggressive. I would say. No, I don’t, I don’t agree. I mean, we wouldn’t, you know, just raise rates and try to crash the economy and then, and then clean up afterwards… if we crashed the economy and raised, we might get rid of inflation. But at very high human cost.

The Powell’s response could be interpreted as a dovish pivot – the Fed is apparently unwilling to cause the deep recession to slay inflation. Specifically, a deep recession would require a sharp increase in an unemployment rate, which the Fed is unwilling to cause.

The Fed is apparently aiming for a softish landing, defined as only slightly uptick in an unemployment rate, possibly from current 3.7% to 4.4%. The hope is that such slowdown would be enough to bring inflation down to 2% over time.

The first question is whether such policy moderation is possible, given the current inflationary pressures? The second question is whether the Fed policy in 2022 was the “shock and awe approach” and the damage has already been done – and thus, the moderation is necessary?

Is the moderation possible?

The Fed has increased the Federal Funds rate from 0.08% in February 2022 to 3.82% by November 2022, with expectations of further increases to 4.91% by May 2023, based on the Federal Funds futures.

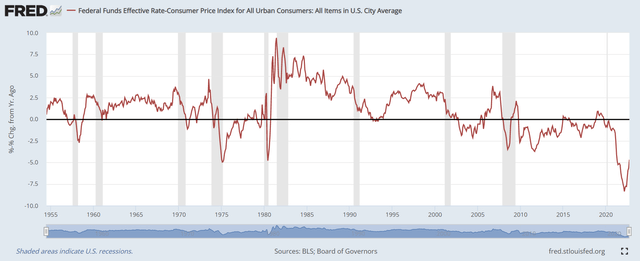

Yet, the CPI inflation is 7.7%, core CPI is 6.3%, the PCE inflation is 6% and core PCE is 5%, for October 2023. The data from 1954 to 2022 shows that the Federal Funds rate is on average 1% higher than the CPI inflation. More importantly, the Volker Fed held the Federal Funds rate 5-7% above the CPI inflation in early 1980’s to slay the 1970s inflation. Here is the chart showing the difference between the Federal Funds rate and CPI inflation. The Fed is still well behind the curve on the CPI inflation give the still deeply inverted FF-CPI curve at -4%.

The Fed Chair Powell acknowledges that the Federal Funds rate needs to be above the inflation, however, he is referencing the lowest inflation reading as a benchmark (core PCE), or even some forward based measure. The history is clear, it’s the CPI that counts, the highest reading. So, the Federal Funds rate should be above 8% now.

Thus, the moderation policy is not possible yet given that the CPI inflation is still 4% higher than the Federal Funds rate. However, if the damage has been done already with the aggressive Fed tightening in 2022, the CPI inflation will sharply fall in 2023 as the economy enters recession, in which case the moderation is necessary.

The CPI would have to fall below 5% by mid 2023 to justify the Fed’s moderation policy, which could be possible with the deep recession. However, Powell still views the softish landing as possible and describes a utopian inflationary macro environment where inflation would moderate without a recession.

The Fed’s utopian inflationary macro environment

The Fed Chair Powell acknowledges that all inflation forecasts have been wrong, and rather that predicting inflation, Powell describes the macro environment required to lower inflation to 2% and breaks down core inflation into three component categories: core goods inflation, housing services inflation, and inflation in core services other than housing.

Powell attributes the inflation in core goods to pandemic-related supply chain bottlenecks and acknowledges that core goods inflation is likely to continue to fall as the supply-chain issues continue to improve, and also acknowledges that the housing services inflation is likely to continue to fall as the rents on new leases continue to fall.

However, the main problem is the inflation in core services other than housing, which is highly dependent on rising wages. Specifically, Powell acknowledges that the main inflationary risk now is the potential wage-price spiral.

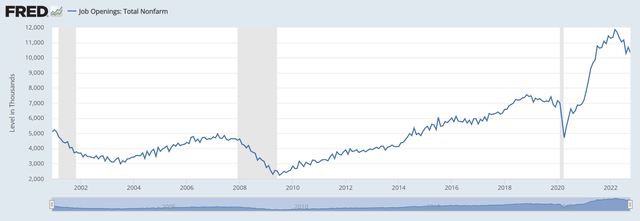

However, rather than aiming to prevent the wage-price spiral by causing the deep recession and the spike in unemployment, Powell hopes that wages inflation would moderate as the job openings drop.

Currently, there are about 1.7 job openings for every person looking for work, and thus, there is a large jobs-worker gap, which can cause the wage-price spiral. Job openings have started to fall, but are still well above the pre-pandemic levels, as shown in the chart below.

Powel hopes that the job openings would somehow drop (by 3-4 million) and the jobs-workers gap would narrow to prevent the wage-price spiral, without the sharp increase in the unemployment rate. This is the foundation of the “softish landing.”

The inflationary environment reality

David Wessel of Brookings pointed to Powell the inflationary reality and asked: “whether long term changes of the economy like labor supply, deglobalization, climate change, could reduce the elasticity of supply and that this may be a problem going forward”?

Here is Powell’s response:

The question is what is the new normal going to be…Are we going into a situation a little bit like the seventies where there will be ongoing repeat shocks and which would tend to have, to tend to put more upward pressure on inflation over time? We don’t really know. I mean, that’s a, it’s a great question. I guess the real question is, if that’s true, what are the implications? We still have a 2% inflation target, and we still have to use our tools to achieve it and to keep inflation expectations anchored. But it’s very hard to know the answers to these things. I mean, we tend to assume things will go back to the way they were just naturally. But that doesn’t seem to be happening so far.

However, we do know the inflationary reality – at least with respect to the unfolding trend of deglobalization:

- The trend of China-US decoupling is unfolding, which is causing re-shoring and home-shoring, and adds to the worker shortages and the inflationary pressures.

- The geopolitical situation related to de-globalization is also escalating with the Russian invasion of Ukraine, which increases the likelihood of supply-side shocks in commodities and further supply-chain disruptions.

- The US political environment is unlikely to promote a widespread immigration to the US, which will keep the labor supply tight.

Thus, the job openings are unlikely to drop, and the wage-price spiral will continue to keep the CPI inflation elevated, in an absence of a deep recession. In fact, the November 2023 jobs report was very strong with the unemployment rate at steady at 3.7%, and the sharp increase in wage growth to 5.1%. The inflationary component of the jobs report reflects, and will continue to reflect, the deglobalization reality.

Investment implications: the damage has been done

It could be argued that the Fed has already caused the damage and the deep recession is unavoidable. As a leading recessionary indicator, the yield curve spread between the 10Y Treasury and the 2Y Treasury has been deeply inverted for the most of 2022, and it is approaching the 1970s level (see chart below). Thus, the deep recession is already in the cards – the damage has been done.

The S&P 500 is currently trading at ttm PE ratio near 20, and the forward PE ratio near 19. Thus, US stocks are still overvalued – while facing a possibly deep recession.

Why would anybody pay for S&P500 earnings more than 15x in price, given the long-term consequences of de-globalization? The fair price is likely closer to 10x earnings given the longer-term growth expectations, similarly to the valuations in the 1970s.

JPMorgan just cut estimates for S&P 500 earnings for 2023 by 9% to $203/share, which is still higher than $193/share as of June 2022. Assuming this holds, the fair price for S&P500 Index is somewhere between 2000 and 3000, which is 25-50% below the current price.

However, in a recession corporate earnings drop. If you factor in a drop in S&P 500 earnings by 20% to 160, which is still above the pre-pandemic level, the fair value for S&P 500 could be anywhere from 1600 to 2400, which is 40-60% below the current price.

The Fed is well aware of this scenario, and Powell is likely spooked by what’s coming. Thus, the Fed feels that moderating the pace of interest rate hikes is a good risk management strategy while waiting for the storm to come. Thus, this is definitely not a dovish pivot – it’s a warning.

Thus, my recommendation for SPY is a Sell.

This is consistent with what most on Wall Street expect. For example, BlackRock states: “The Fed is set to raise rates into restrictive territory. Earnings downgrades are starting, but don’t yet reflect the coming recession.”

Mohamed El-Erian goes even further and says this is not just another recession, but a profound economic and financial shift, specifically referencing the deglobalization trends.

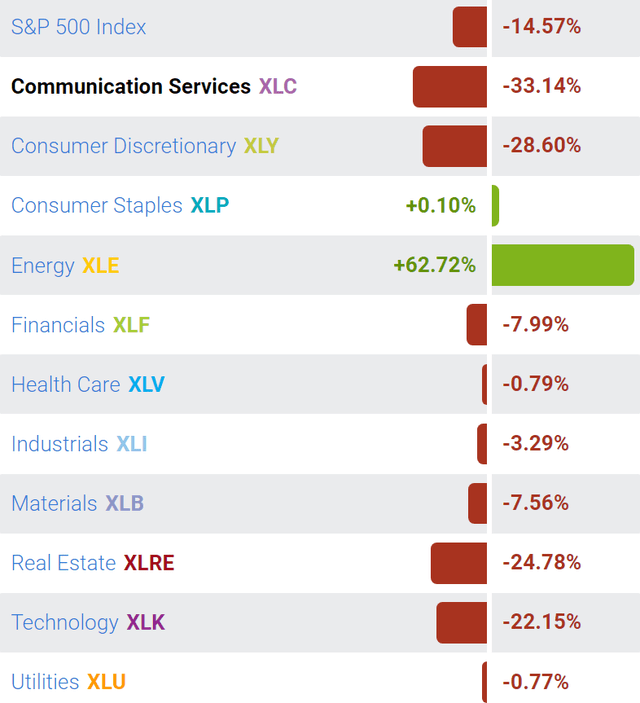

SPY Sector Analysis

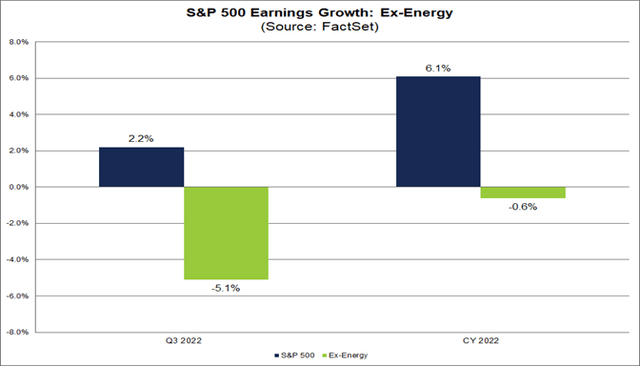

An ETF that tracks S&P 500 is currently down by 14.57% YTD, and all sectors are down except the defensive staples (XLP) and energy (XLE) which is up by almost 63%.

In fact, if you exclude the energy sector, SPY earnings are down by 5.1% in Q3, and down by 0.6% in 2022 (while the combined earnings are up 2.2% and 6.1% respectively). Considering this, the expected 20% drop in total SPY earnings once the recession hits seems reasonable, which puts the S&P 500 in that 1600-2400 range. Very bearish indeed.

Be the first to comment