Deagreez

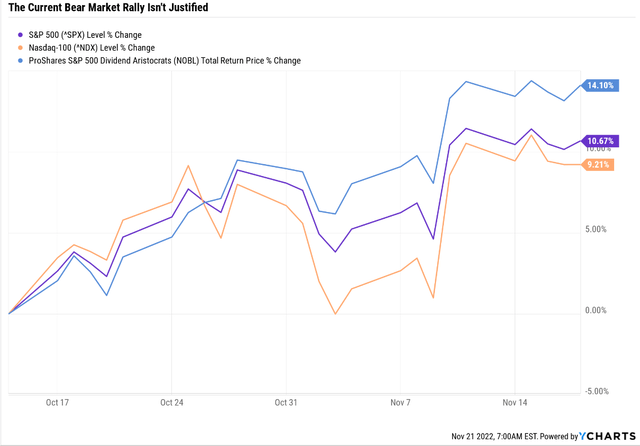

It’s been a great five weeks for stocks. Coming off the October 14th market low (the bottom so far in this bear market), stocks have rallied an impressive 9% to 11%, with dividend aristocrats up 14%.

This is a glorious reminder of the kind of face-ripping rally that’s coming once the bear market finally bottoms, but it’s also frustrating.

That’s because it’s the 5th or 6th bear market rally this year, depending on how you count them, and also means the market is moving further away from pricing in the 2023 recession that’s all but certain.

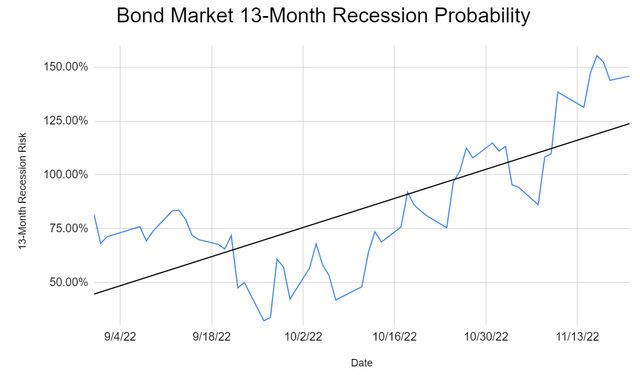

(Source: NY Fed, CNBC, DK S&P 500 Valuation Tool)

The bond market is 100% confident that we’re getting a recession next year.

How can 13-month recession risk be over 100%?

- the bond market is pricing in a 100% risk of recession earlier than 13 months

- four to five months away according to 18 economic indicators

- March to April potentially recession start

This means that the broader S&P 500 likely has a lot further to drop in the first half of 2023 before the true bear market bottom is in.

- 15% to 27% decline from here according to the blue-chip consensus

- 3,000 to 3,400 S&P bottom between Q1 and Q2

But remember it’s always a market of stocks, not a stock market.

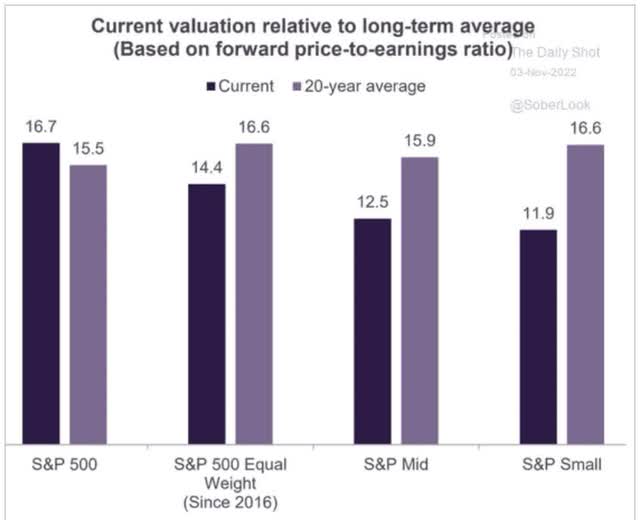

While the S&P 500 is historically slightly overvalued at the moment, hidden-gem small-cap blue-chip stocks are already pricing in a recession.

- 11.9X forward earnings

- a 28% historical discount

Now it’s important to remember that undervalued blue-chips can still fall further.

- in the Pandemic some Ultra SWAN (sleep well at night blue-chips) achieved as much as a 65% historical discount.

But the point is that small caps offer a much better margin of safety than large caps, and that’s why they are likely a lot closer to bottom than the market in general.

The 2023 recession likely to be mild and relatively short, according to the Conference Board’s CEO survey.

- 85% of CEOs think a short and mild recession is coming in 2023

- 44% are still planning on hiring

- just 14% are planning on cutting back on growth spending

What does this mean for investors looking for incredible bear market blue-chip bargains? That some of the best opportunities lie in cyclical small caps, such as industrials and financials.

- the industries that recover fastest once a recession is over.

And when it comes to sleeping well at night, there are few better options than dividend aristocrats and champions.

- aristocrats = S&P companies with 25+ year dividend growth streaks

- champions = any company with a 25+ year dividend growth streak.

And do you know what else helps you stay calm, safe, and sane during turbulent market times? Such as the final stage of a bear market, which tends to be the most volatile and terrifying? Safe high-yields!

When you’re locking in a relatively safe nearly 5% yield, you are getting paid to wait for the market recovery that is a guarantee as long as the world doesn’t end.

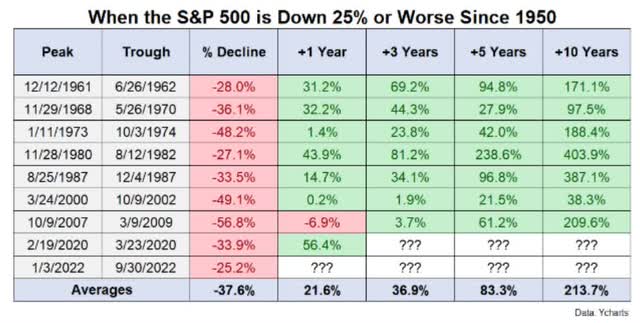

Historically speaking, if you buy stocks as soon as the S&P hits -25%, even if the market keeps falling (on average it falls 17% more), then within one year you make 22%.

More importantly, over the next decade you average a more than 3X return.

- 12.0% annual returns

- 20% more than the market’s historical rate.

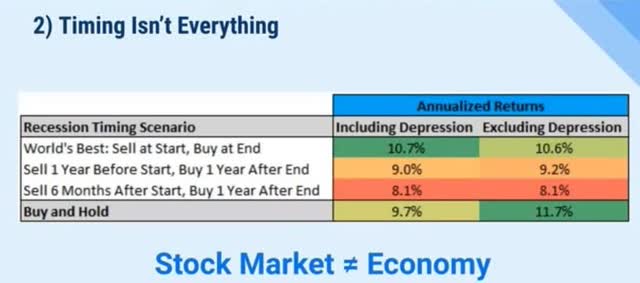

In other words, rather than trying to be “cute” and time recessions and market bottoms, long-term blue-chip investors can just take the easy/lazy/smart road to riches.

If perfect economic timing can’t beat long-term blue-chip buy and hold investing, then buying the world’s best blue-chips today is the best chance you have to achieving good to great returns.

So let me show you why The First of Long Island Corporation (FLIC) and Leggett & Platt, Incorporated (LEG) are two hidden-gem high-yield dividend aristocrat bargains that might be just what you need to feel like a stock market genius in 2023 and beyond.

- small caps

- deeply undervalued

- safe yields of nearly 5%

- Buffett-like medium-term return potential.

First Of Long Island Corp: One Of The Best Regional Banks You’ve Never Heard Of

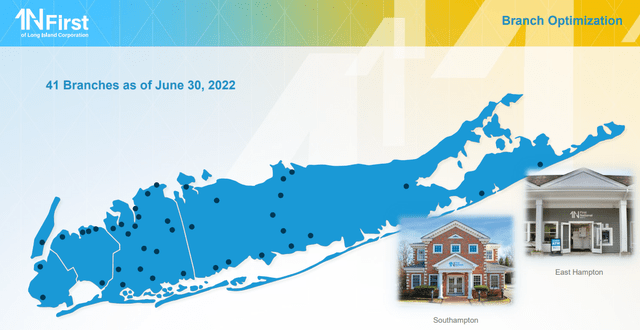

FLIC was founded in 1927, and is the oldest independent bank in Long Island, New York.

Today, FLIC has 41 branches, $4.1 billion in assets, and generates $129 million per year in revenue.

It survived and thrived through:

- the Great Depression (when 9,000 U.S. banks failed)

- WWII

- inflation as high as 22%

- Fed funds rates as high as 20%

- 10-year yield as high as 16%

- 15 recessions

- 23 bear markets

- dozens of corrections

- the Great Recession

- the Pandemic

- the stagflation of 2022.

In other words, FLIC is built to last and will likely outlive us all, and possibly our children and grandchildren as well (unless it’s acquired).

FLIC has a 28-year dividend growth streak, as long as it’s been paying one.

- every year since 1994

- through four recessions

- three market crashes

- seven bear markets

- dozens of corrections and pullbacks.

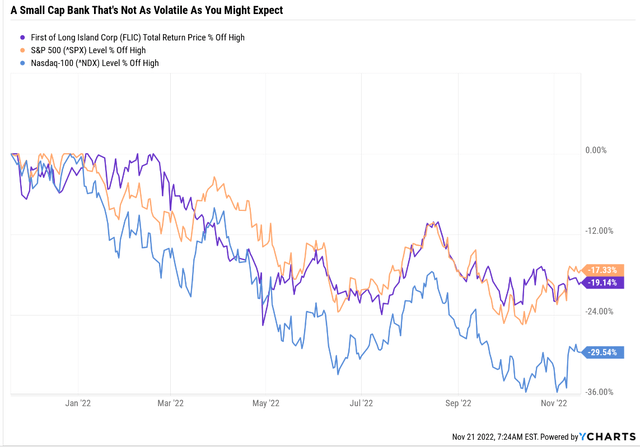

You might think that a small-cap bank would be ferociously volatile. You’d be wrong.

In this recession, FLIC is down less than the S&P 500 (SP500) and much less than the Nasdaq (QQQ). Why? Because it’s so conservatively run.

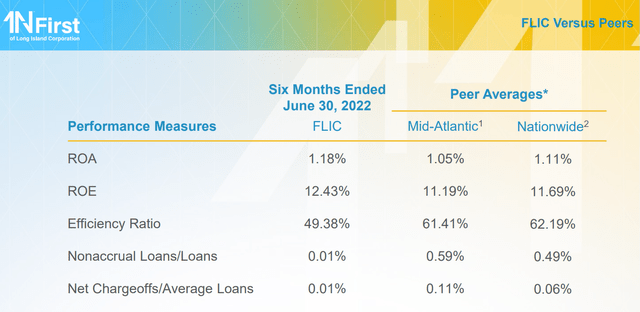

Despite being a $403 million market cap bank, FLIC’s profitability is remarkable.

- efficiency ratio = non-interest expenses/revenue

- 60% is considered a good efficiency ratio

- FLIC’s is 49% (on par with the most efficient banks on earth, including Canada’s big six).

It’s such a conservative bank in terms of underwriting that its loan losses in the first half of 2022 were just 0.01%, 6X lower than the national average of 0.06%.

- 11X lower than its regional banking peers.

It’s no-performing loans are also 0.01% of its loan book, a staggering 59X better than its regional peers and 49X better than the national banking average.

Yet, thanks to running such a lean operation, FLIC is able to achieve 12% higher returns on assets than its peers, and 11% higher returns on equity.

- more profitable and much safer banking practices.

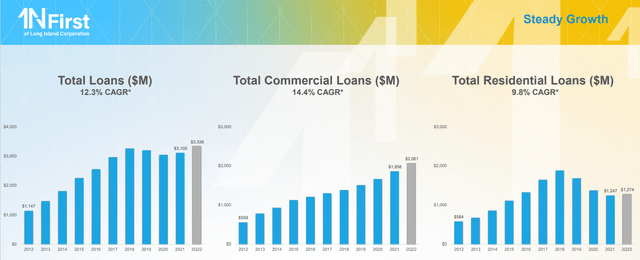

Despite the pandemic hammering NYC, FLIC has managed to deliver impressively steadily growth in total loans, 12% annually over the last decade.

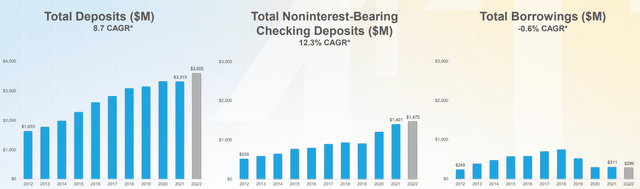

Thanks to $5 trillion in government stimulus checks, borrowing has shrunk a bit since the Pandemic, but deposits have continued to grow at almost 9% annually.

Checking deposits that provide low cost of capital have been growing at 12%.

- average funding cost 0.54%.

Bottom Line: First Of Long Island Is One Of The Best Regional Bank You’ve never Heard Of

What kind of returns can you expect from FLIC in the future?

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| First Of Long Island | 4.7% | 7.0% | 11.7% | 8.2% | 5.9% | 12.3 | 1.77 |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% | 4.7% | 15.4 | 1.58 |

| Schwab US Dividend Equity ETF | 3.6% | 8.5% | 12.1% | 8.4% | 6.1% | 11.8 | 1.81 |

| Dividend Aristocrats | 2.6% | 8.5% | 11.1% | 7.8% | 5.4% | 13.2 | 1.70 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.8 | 1.61 |

(Source: DK Research Terminal, Morningstar, FactSet, Ycharts)

Analysts expect FLIC to keep growing at 7%, the growth rate of the last 15 years, long into the future.

That means potentially better returns than the aristocrats, S&P, and you’re getting paid a very safe yield of nearly 5% up front.

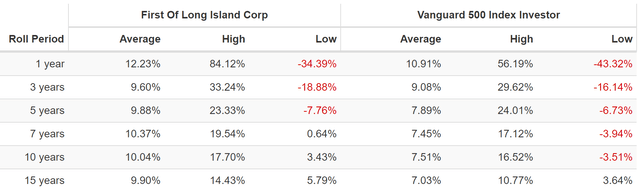

Rolling Returns Since 1995

FLIC’s average historical 12-month return for 27 years has been 12%, similar to what analysts expect in the future.

It’s a consistent market-beater that from bear market lows is capable of long periods of Buffett-like returns.

- up to 84% returns within 12 months

- up to 33% annual returns for three years = 2.4X return in three years

- up to 23% annual returns for five years = 2.9X return in five years

- up to 20% annual return for seven years = 3.6X return in seven years

- up to 18% annual return for 10 years = 5.1X return in 10 years

- up to 14.4% annual return for 15 years = 7.5X return in 15 years.

But you don’t have to wait years or decades for FLIC to generate good to great returns. Why?

- fair value: $28.65

- current price: $17.80 = 9.1X earnings

- historical discount to fair value: 38%

- DK rating: potential very strong buy.

What does a 38% undervalued almost 5% yielding aristocrat offer in terms of short-term return potential?

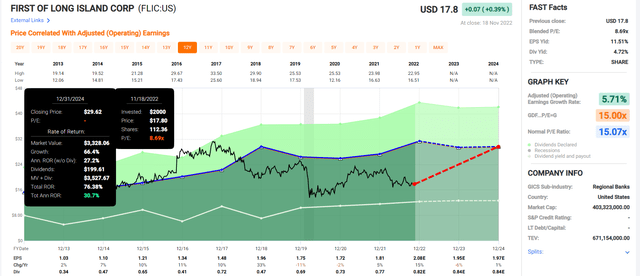

First Of Long Island 2024 Consensus Total Return Potential

Regular Dividend Growth Streak Is 28 Years ((Source: FAST Graphs, FactSet))

If FLIC grows as expected and returns to historical fair value by 2024 investors could see almost 80% total returns, or 31% annually.

- 2.5X better than the S&P 500

- Buffett-like return potential from an aristocrat bargain hiding in plain sight.

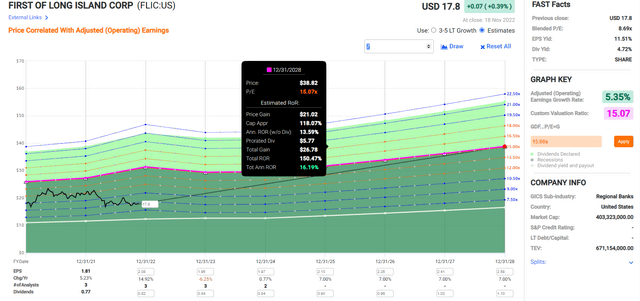

First Of Long Island 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If FLIC grows as expected through 2028 and returns to historical market-determined fair value, it could deliver 150% total returns, or 16% annually.

- about 2.5X more than the S&P 500 consensus.

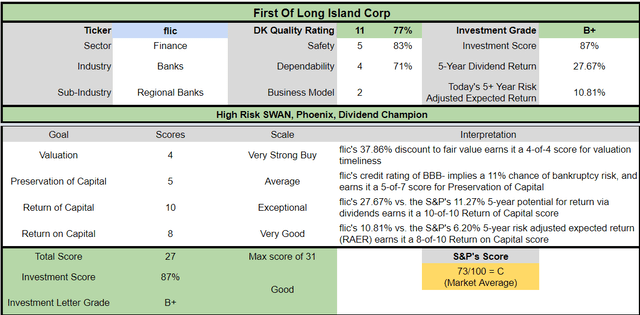

First Of Long Island Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

FLIC is a potentially good and reasonable high-yield small cap aristocrat opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 38% discount to fair value vs. 3% premium S&P = 41% better valuation

- 4.7% very safe yield vs. 1.8% (2.5X higher and much safer)

- approximately 15% higher long-term annual return potential

- about 2X higher risk-adjusted expected returns

- about 2.5X higher income potential over the next five years.

Leggett And Platt: One Of The Best High-Yield Dividend Kings You’ve Never Heard Of

LEG isn’t just a high-yield small-cap undervalued dividend aristocrat opportunity, it’s a high-yield, small-cap, dividend-king opportunity.

- 51 consecutive years of rising dividends (since 1971)

- 56 consecutive years without a dividend cut (since 1966).

LEG was founded in 1883 in Carthage, Missouri. In those 139 years LEG has survived and thrived through:

- the Great Depression

- six depressions

- 30 recessions

- The Spanish Flu Pandemic that killed 5% of humanity

- WWI

- WWII

- inflation as high as 22%

- interest rates as high as 20%

- 10-year Treasury yields as high as 16%

LEG has been raising its dividend every year through:

- eight recessions

- the Great Financial Crisis

- the Pandemic

- inflation as high as 15%

- interest rates as high as 20%

- 10-year Treasury yields as high as 16%

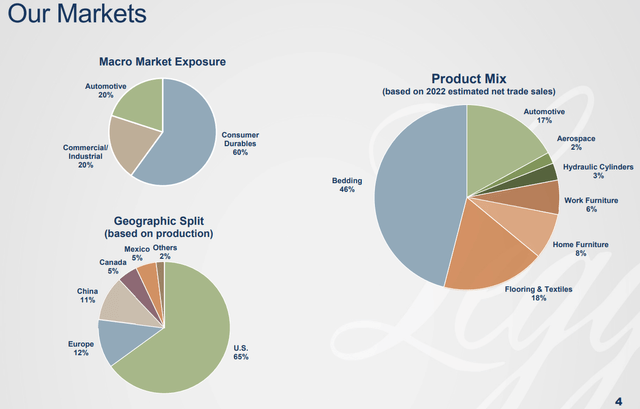

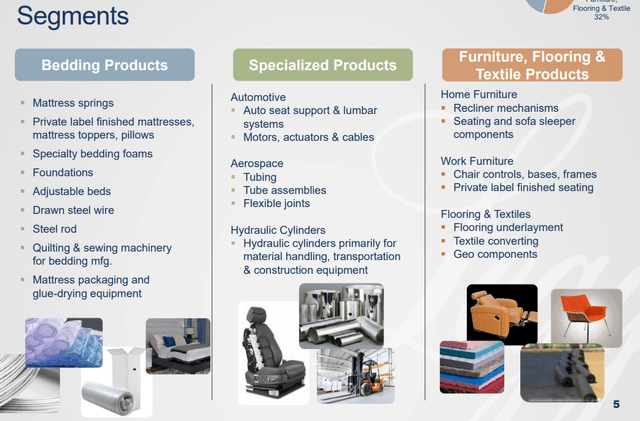

OK, so LEG is also a blue-chip that’s likely to outlive us all and possibly our grandkids. What do they do?

What Leggett And Platt Does

Leggett & Platt, Inc. engages in the manufacture and distribution of furniture and engineered components and products among homes, offices, automobiles, and commercial aircraft.” – FactSet

LEG makes bedding products and materials for commercial and residential uses.

It’s a global company with 35% of sales from outside the U.S.

From mattresses, to car seats, to tubing used in aerospace, LEG is a furniture maker par excellence.

- the industry leader

- but a $4.6 billion small-cap few people have heard of

- a hidden-gem high-yield dividend king.

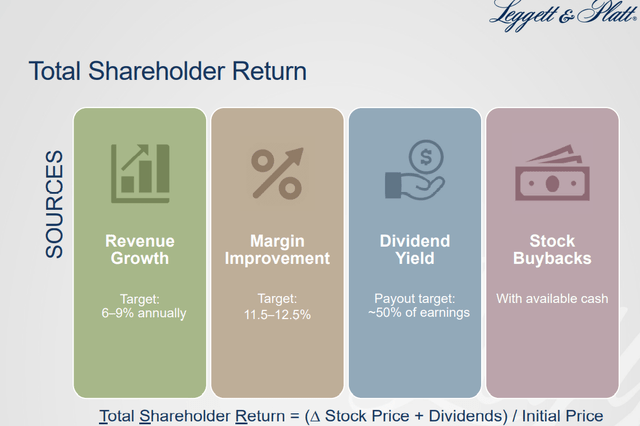

Management plans to grow earnings by about 7.5% CAGR over time generating 11.1% to 14.1% CAGR total returns.

- 5.1% safe yield + 6% to 9% long-term EPS and dividend growth.

How realistic is 11% to 14% long-term return potential guidance from LEG’s management?

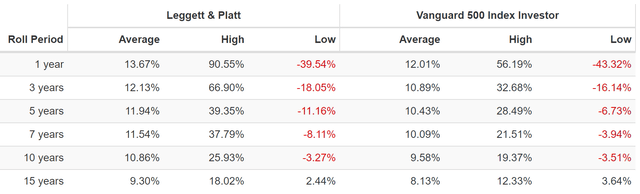

Rolling Returns Since 1987

LEG’s average annual return since 1987 has been nearly 14% and its average 10-year rolling return has been 11% CAGR.

- management is guiding for long-term historical growth to continue into the future.

How realistic is that guidance? Consider LEG’s total addressable markets:

- US bedding $11 billion

- Global automotive: $20 billion

- 2 largest parts of the business: $31 billion annual addressable market

- 2021 sales: $5.1 billion

- market share: less than 16% and the market leader in a highly fragmented industry.

Given the size of this market (which itself is growing at around 4% per year over time) I think management 6% to 9% CAGR sales growth guidance is pretty reasonable.

- LEG’s historical EPS growth rate range: 4% to 10% CAGR

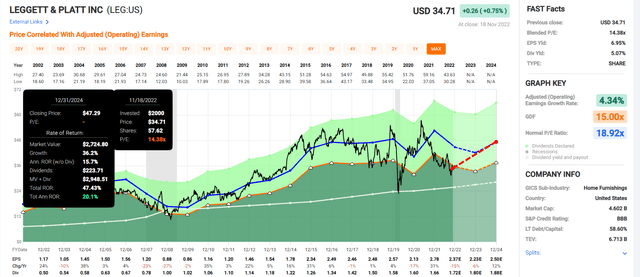

Valuation

- fair value: $48.65

- current price: $34.71

- discount to historical fair value: 29%

- DK rating: potential speculative good buy

- Max risk cap recommendation: 2.5% or less.

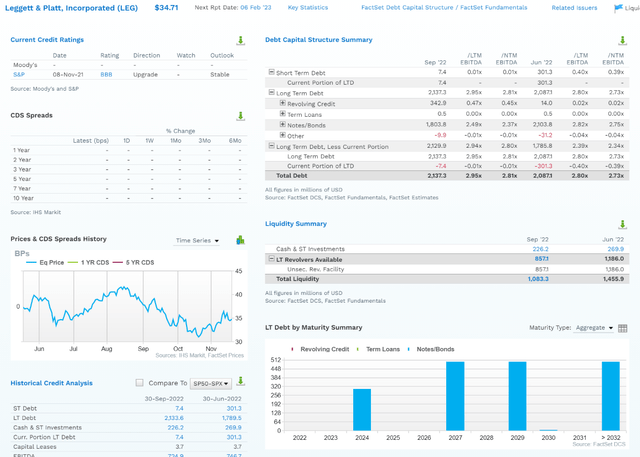

LEG is a speculative blue-chip. Why? In 2019, right before the Pandemic, they made a $1.25 billion acquisition of Elite Comfort Systems, doubling their debt.

They’ve been working to deleverage ever since, and the pandemic didn’t help matters, and neither will the 2023 recession.

LEG’s leverage ratio is expected to be 3.0X this year and fall to 2.8X next year.

- rating agencies consider 3.0X or less safe for this industry.

It has $1.1 billion in liquidity and no bonds maturing until 2024, after the 2023 recession is expected to end.

S&P rates them BBB stable, implying a 7.5% 30-year default risk.

- 1 in 13.3 chance of losing all your money investing in the company today.

Once the recession is over, assuming management delivers on the expected deleveraging, LEG will no longer be speculative and its max risk cap recommendation will rise to 7.5% or less.

- the same as all non-speculative blue-chips

What kind of return potential can a 29% undervalued high-yield small cap dividend king potentially deliver in the short-term?

Leggett & Platt 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If LEG grows as expected and returns to historical fair value by 2024, it could deliver about 50% total returns or 20% annually.

- about 2X more than the S&P 500

- Buffett-like return potential from a 5.1% yielding dividend aristocrat bargain.

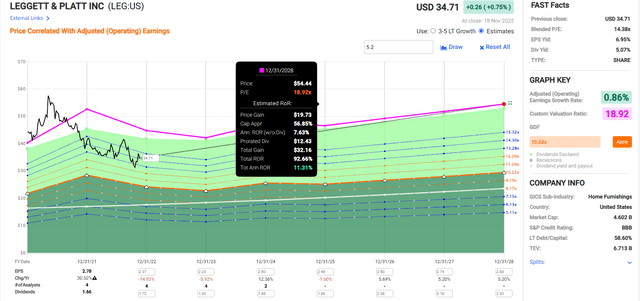

Leggett & Platt 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

Due to the global recession coming in 2023, analysts think LEG is going to face a slow growth period of just 1% EPS growth through 2028, and potentially “just” double with 93% total returns and 11% annual returns.

- 50% higher return potential than the S&P 500

- and a safe 5.1% yield that grows every year

- 10% to 14% CAGR five year consensus total return potential range.

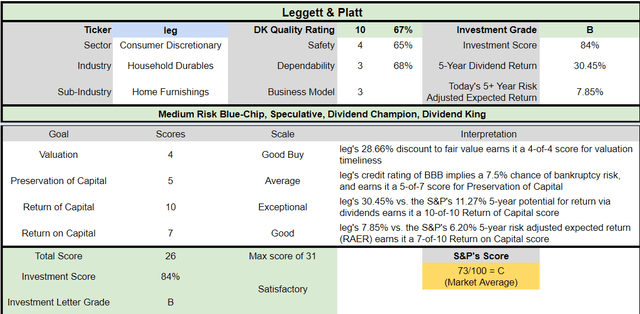

Leggett & Platt Investment Decision Tool

DK (Source: Dividend Kings Automated Investment Decision Tool)

LEG is a potentially satisfactory and reasonable high-yield small cap dividend king opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 29% discount to fair value vs. 3% premium S&P = 32% better valuation

- 5.1% very safe yield vs. 1.8% (2.5X higher and safer)

- approximately 20% long-term annual return potential

- about 15% higher risk-adjusted expected returns

- 3X higher income potential over the next five years.

Bottom Line: FLIC and LEG Are 2 Hidden-Gem High-Yield Aristocrat Bargains To Consider Today

Let me be clear: I’m NOT calling the bottom in FLIC or LEG (I’m not a market-timer).

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

In the short-term stock prices are a crap shoot, in the long-term they are fundamentals driven destiny.

And what I can tell you about FLIC and LEG’s fundamentals is that these are two of the best small cap high-yield aristocrat bargains not on your radar that deserve to be.

Both are:

- nearly 30% or more historically undervalued

- yielding around 5%

- with 28 to 51 year dividend growth streaks

- time tested management teams and adaptable corporate cultures (they’ve survived depressions, recessions, and Pandemics without cutting their dividends)

- double-digit long-term return potential just as they’ve delivered for decades.

Unless you think this coming recession will bring with it the apocalypse, then today is almost certainly a great time to buy these hidden-gem aristocrats.

If you are able to look beyond the 2023 recession and a few more painful months for stocks (most likely), then today is a great time to potentially add FLIC and LEG to your portfolio.

If you are looking for deep value aristocrats with high margins of safety that more than compensate your for their risk profiles, then FLIC and LEG are two reasonable and prudent ideas to consider today.

From everyone at Dividend Kings and iREIT, I want to wish you and yours a safe, healthy, and relaxing Thanksgiving holiday:)

Be the first to comment