Editor’s note: Seeking Alpha is proud to welcome Real Diligence Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Scott Heins/Getty Images News

Investment Thesis

In my view, investors are likely to become impatient with the turnaround efforts undertaken by Peloton Interactive (NASDAQ:PTON), and that the company will ultimately lose its “growth stock” valuation premium. I assign a “Sell” rating to the stock with a target valuation of $1.7 billion in market capitalization or ~$5/share. Declining key metrics, an important disclosure change, saturation of the premium connected fitness market, and a potentially costly strategic shift “down-market” are all contributors to my bearish stance and expectation of a continued decline in the share price.

According to Seeking Alpha, Peloton maintains a $3.5 billion market capitalization and enterprise value of $5.0 billion. This valuation is steep based on the company’s current unprofitability, flagging key performance indicators, a potentially margin-eroding strategic shift down-market, and an increasingly difficult macroeconomic environment. Investors appear to be underestimating the potential costs associated with Peloton’s new initiatives as the company seeks to expand under new CEO Barry McCarthy.

In a letter to shareholders following the company’s most recent earnings release on November 3, 2022, McCarthy stated that the “ship is turning” despite the company incurring a net loss in the quarter of $408.5 million (up from a loss of $376.0 million in the same period last year) and displaying another quarter of weak key performance indicators (see charts and commentary below). While the most severe losses appear to be over after recently implemented cost cuts, investors are failing to appropriately price in the state of the business and the possibility that the company may never achieve the sustained free cash flow needed to support its current market capitalization of $3.5 billion. I believe the narrative surrounding Peloton remains overly positive based on investors anchoring to previous economic conditions when the company faced less competition and benefited from crucial industry-specific tailwinds from the COVID-19 lockdowns.

Business Overview

Peloton earns revenue through the sale of connected fitness products and digital subscription offerings featuring various live and recorded instructor-led fitness programs. Fitness equipment offerings include Bike, Bike+, Tread, Tread+, Guide (weight training), and the upcoming Row machine (first delivery expected in December 2022). The associated fitness software offerings include the App Membership for $12.99/month which is sold individually and can be used with non-Peloton equipment, the Guide Membership for $24.99/month, and the All-Access Membership for $44/month which provides access to Peloton’s premium software features like social competitions, and advanced metrics. For the fiscal year ended June 30, 2022, the company earned 61% of its $3.6 billion in revenue from equipment and the remaining 39% from software subscriptions. Low subscription churn (defined below) has been essential to the company’s growth and will be important to monitor as the company matures.

Declining Key Metrics

The following key metric definitions from the company’s 2022 10-K annual filing will be a helpful reference as the following metrics are discussed below:

- Connected Fitness Subscriptions: “We define a ‘Connected Fitness Subscription” as a person, household, or commercial property, such as a hotel or residential building, who has either paid for a subscription to a Connected Fitness Product (a Connected Fitness Subscription with a successful credit card billing or with prepaid subscription credits or waivers) or requested a “pause” to their subscription for up to three months. We do not include canceled or unpaid Connected Fitness Subscriptions in the Connected Fitness Subscription count.”

- Average Net Monthly Connected Fitness Churn: “We use Average Net Monthly Connected Fitness Churn to measure the retention of our Connected Fitness Subscriptions. We define ‘Average Net Monthly Connected Fitness Churn’ as Connected Fitness Subscription cancellations, net of reactivations, in the quarter, divided by the average number of beginning Connected Fitness Subscriptions in each month, divided by three months. This metric does not include data related to our Peloton Digital subscriptions for Members who pay a monthly fee for access to our content library on their own devices.”

- Total Workouts: “We define ‘Total Workouts’ as all workouts completed during a given period. We define a ‘Workout’ as the completion of at least 50% of an instructor-led class or scenic ride or run, or ten or more minutes of ‘Just Ride’ or ‘Just Run’ mode by a Member associated with a Connected Fitness Subscription.”

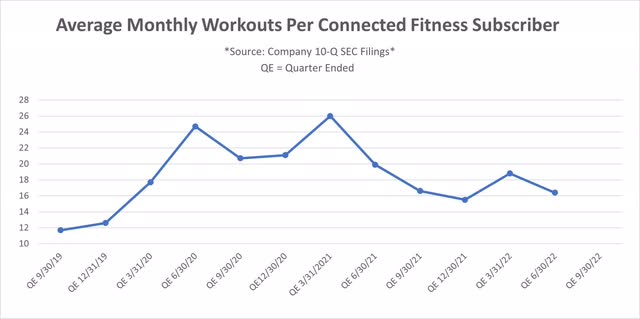

- Average Monthly Workouts per Connected Fitness Subscription: “We define ‘Average Monthly Workouts per Connected Fitness Subscription’ as the Total Workouts completed in the quarter divided by the average number of Connected Fitness Subscriptions in each month, divided by three months.”

Since Peloton went public in September 2019, the company has publicly disclosed four non-financial “Key Operational and Business Metrics” to investors in its regular form 10-Q quarterly filings. According to the filings, the metrics are intended “to give investors an idea of the figures the company uses to evaluate the business, measure performance, develop financial forecasts, and make strategic decisions.” These metrics suggest that business peaked in the quarter ended March 31, 2021 when the company achieved an impressive 26 average monthly workouts per connected fitness subscription, 149.5 million total workouts (for the quarter), 2.08 million ending connected fitness subscribers, and Total Average Net Monthly Current Fitness Churn of 0.31%. While these key indicators have ebbed and flowed since the company’s peak quarter in early 2021, each indicator now shows stagnation or decline in recent quarters.

Author Generated Graphic (PTON 10-Q SEC Filings)

Ending Connected Fitness Subscriptions flatlined in the last quarter after showing slowing growth in the prior four quarters. Total average monthly workouts have fallen almost to pre-pandemic levels (see above), and Total Average Net Monthly Churn exceeded 1% for the first time in PTON’s public history starting with quarter ended June 30, 2022 after it increased the price of its connected fitness subscription to $44/month from $39/month. Notably, Peloton appears to have stopped disclosing average monthly workouts per connected fitness subscription and total workouts as of the most recent quarter ended September 30, 2022. No mention of this reporting change is referenced in any SEC Filing, earnings transcript, or publicly available management communication to which I am aware. In Peloton’s 10-Q filing from May 2022, the company claimed that average monthly workouts per connected fitness subscriber “is the leading indicator of retention for our Connected Fitness Subscriptions.” In my view, the change in disclosure coinciding with declining metrics raises questions regarding continued deterioration in engagement in the most recent quarter ended September 30, 2022.

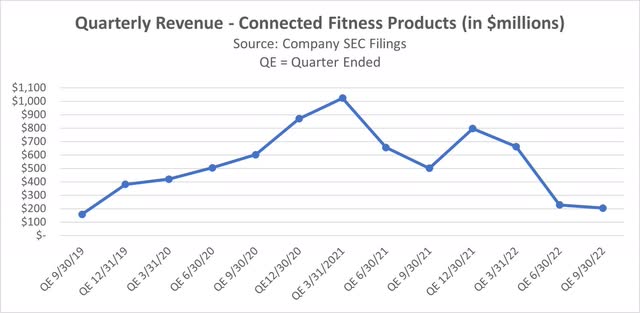

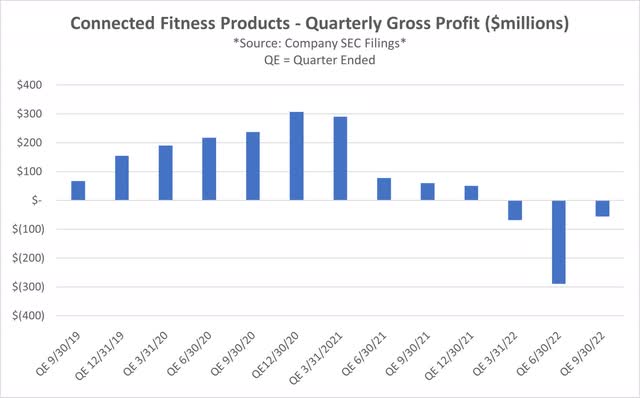

Strategic Shift

As the sharp decline in connected fitness product revenue and gross profit indicates in the charts below, my view is that the company can no longer rely on high-margin equipment sales as a significant contributor to the company’s bottom line as the premium connected fitness market matures. As discussed below, I believe Peloton will be forced to discount its historically profitable hardware as it faces new competition, reduced demand for premium fitness offerings, and the need to share gross margin with third-party distributors as the company moves downmarket.

Author Generated Graphic (PTON 10-Q SEC Filings)

Author Generated Image (PTON 10-Q SEC Filings)

Based on the company’s recently announced strategic initiatives – distribution through Amazon and Dick’s Sporting Goods, outsourcing of manufacturing and logistics functions, and proposed launches of certified pre-owned and bike rental programs – it has become evident that the new strategy revolves around on improving the functionality and monetization of the company’s software offerings. McCarthy confirmed this emphasis on software during the Goldman Sachs Communacopia + Technology conference this fall by simply stating, “I don’t think of us as being a hardware company. We’re a software company.” In particular, management appears very enthusiastic regarding the prospects of a relaunch of the Peloton app in 2023. During the Q&A portion of the most recent earnings call, McCarthy said, “Our strategy is to relaunch the digital app in the new year. It will be a different price value opportunity than it is currently. There’ll be a tiered pricing associated with a content strategy – a new content strategy. We’re chasing the 100 million digital app users. The current product has never really grown bigger than a million.” In my view, the 100 million digital user goal appears to be very ambitious as the company currently has less than 7 million total users between its connected fitness subscription and paid Peloton App offerings. For additional context, according to its most recent 10-Q SEC filing, Planet Fitness (PLNT) had 16.5 million members among its 2,353 gyms as of September 30, 2022.

In addition to the increased focus on software offerings, Peloton has acknowledged the need to move down-market as the market for premium connected fitness becomes saturated. At the same Goldman Sachs Communacopia + Technology Conference in September, McCarthy said the following in response to a question about the remaining market opportunity in the premium connected fitness category:

The question is, how big a business can that (premium connected fitness) become? Today, Peloton is 70-plus percent of the premium Connected Fitness category, so not much bigger than that category can support. Today, the category is shrinking. Will it shrink over the long term? I don’t think so.

– Peloton CEO Barry McCarthy

In response to premium market saturation, I believe the company will now have to contend with lower gross margin sales via third-party distributors like Amazon and Dick’s Sporting Goods. McCarthy acknowledged the costs and uncertainty of the push down-market during the Q1 2023 earnings call with investors:

It comes at the cost of some margin. How is it going so far? Well, Amazon has outperformed our expectations for sure. We just launched Dick’s Sporting Goods. We have high expectations for it, but it remains to be seen how it will perform over time.

– Peloton CEO Barry McCarthy

An underemphasized aspect to Peloton’s turnaround are the capital allocation and macroeconomic challenges McCarthy and the rest of the management team face while attempting to implement new strategic initiatives. According to the company’s most recent quarterly report, the company’s balance sheet has substantial leverage with total liabilities of $3.3 billion against total equity of $258.5 million of as of September 30, 2022 with rising interest expense from recent borrowings. I believe that near-term liquidity is manageable with $938.5 million in cash and an unused revolver of $500 million as of September 30, 2022. Further, the bulk of the company’s long-term liabilities do not come due until 2025 or later. McCarthy’s previously communicated goal is to achieve breakeven operating cash flow by Q4 of this fiscal year (quarter ended June 30, 2023); however, in my view, the company has been noticeably careful in setting low expectations for this milestone in the company’s Q1 2023 earnings call and associated Form 8k current report.

So while we haven’t specifically guided to a free cash flow number at all, we talked about our goal of reaching free cash breakeven or near breakeven by the second — for the second half of the year. And we remain on track to being able to achieve that goal. It’s not certain. There’s always some risk. It’s not a guaranteed outcome.

–Peloton CFO Liz Coddington

Breakeven FCF is an objective but it is not a guaranteed outcome. There are risks we will underachieve our forecast, particularly in this economic climate and given the outsized importance and uncertainty of the holiday selling season on overall performance.

– Peloton CEO Barry McCarthy

As the U.S. economy faces ~8% inflation, rising interest rates, and a possible recession, I am skeptical of Peloton’s ability to handle a potential non-lockdown related economic downturn, particularly as it will increasingly rely on middle and lower income consumers to maintain growth. With current economic conditions in the background, my view is that management’s emphasis on growing the app offering via lower pricing tiers vs. the premium $44/month offering is the right move – at least for now.

Valuation

Peloton maintains a market capitalization of $3.5B and an enterprise value of $5.0B despite the concerns highlighted above. Since the company is currently unprofitable, investors could value it on its trailing 12-month revenue of $3.4 billion. On this basis, the company is trading for just over 1x revenue or ~1.5x enterprise value. Although these ratios appear low and show a steep drop from those seen in 2020 and 2021, I believe investors should realize the company is in much worse position now. In my opinion, Peloton faces numerous headwinds and has little chance of achieving sustained profits.

In the absence of current and potential profits, I applied a simple relative valuation to the stock using an enterprise value to sales ratio. Using an average between Seeking Alpha’s industry median enterprise value to sales ratio of 1.12 and the median of five similar publicly traded companies selected below of 0.80, I arrived at a target EV/Sales multiple of 0.96.

PTON Relative Valuation

| Company (Ticker Symbol) | EV/sales Ratio (Last 12 Months) |

| Nautilus (NLS) | 0.34 |

| GoPro, Inc. (GPRO) | 0.59 |

| Under Armour (UA) | 0.80 |

| Spotify Technology S.A. (SPOT) | 1.19 |

| Garmin Ltd. (GRMN) | 3.00 |

Using the calculation below with financial data from Seeking Alpha, I arrived at a target market capitalization of $1.7 billion which equates to a value of $5/share.

Trailing 12 Months Sales = $3.394 Billion

(x) EV/Sales ratio of 0.95 calculated above = $3.26 Billion

(-) Total Debt = $2.46 Billion

(+) Cash = $0.938 Billion

(=) Target Market Capitalization = $1.73 Billion

(÷) Shares Outstanding = 340.1 million

(=) Target Valuation of ~$5.10/share

At the current price of $10.30/share, the stock has a potential downside of at least ~50%. To be clear, this valuation is intended to be an estimate rather than an assertion of definite value. Peloton does not have perfectly comparable public companies available for relative valuation and absolute valuation is difficult in the absence of a long-term history of profitability.

Ultimately, I predict the company will choose to maximize shareholder value by attempting a sale to a larger strategic bidder interested in using the company’s intangible assets and customer base to complement its own offerings. However, this process is far from certain as buyout rumors are speculative at this point and the company will have to convince a diffused group of former management to carry out a major corporate action as they maintain a majority of voting control, according to Peloton’s 2022 proxy statement. Overall, I believe investors are overly confident in the current management team’s ability to reinvigorate a stagnant business with serious fundamental headwinds.

Risks to My Thesis

The primary risk to my bearish thesis is that the company successfully finds ways to maintain its margins and reinvigorate growth while moving down-market. Initiatives like Peloton Row, the potential relaunch of the Peloton App in 2023, Fitness as a Service, Certified Preowned, and distribution through third-parties could prove successful as the company attempts to broaden its distribution. Relaunch of the Peloton App in 2023 along with more affordable hardware options could bring in price conscious customers who previously viewed the product and service as unaffordable.

Additional risks to the bear thesis include higher than expected cash flow from increased sales of the $993 million of inventory, new acquisition rumors, new partnerships, and additions to the management team. If the company shows a sustained reversal of hardware gross margin declines, significant improvements in subscriber count and gross profitability, signs of success with third-party partnerships, and an improved balance sheet, I will reconsider my stance on the stock.

Conclusion

To acknowledge the bull case, the company still has almost 7 million fanatical subscribers and a high gross profit subscription business. However, over time, the company’s margins and revenue growth are likely to decline as the broader market proves more challenging than the premium market, churn increases as customers grow tired of the product and have new alternatives, and increased spending becomes required to keep users engaged.

The ultimate sale of the company isn’t guaranteed given the company’s dual class share structure and worsening financial conditions both internally and externally. Within 1-2 years, I believe Peloton will no longer be valued as a high growth company, but rather as a stagnant provider of fitness software. Investors will likely lose patience with the turnaround strategy and subsequently value the company based on current economic reality rather than future potential.

Be the first to comment