OwenPrice

At iREIT on Alpha, we’re focused on the property sectors that provide optimal risk-adjusted returns.

Our analysis is focused on sectors with strong pricing power and solid supply-and-demand attributes. One sector that screens attractive is the self-storage sector.

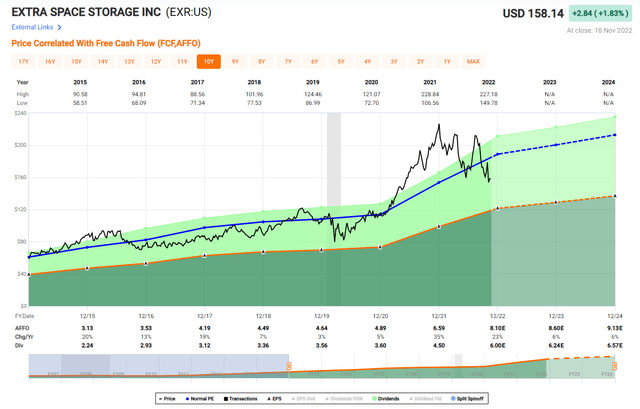

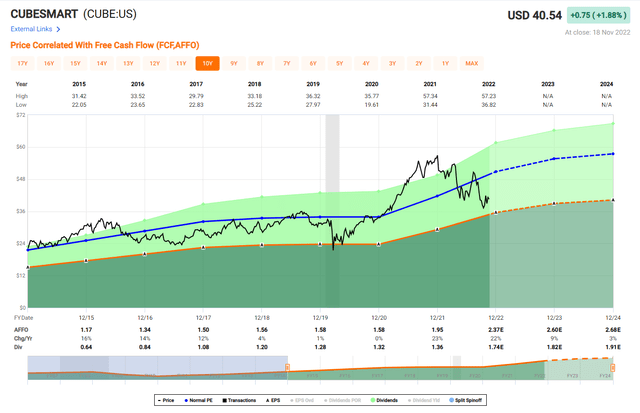

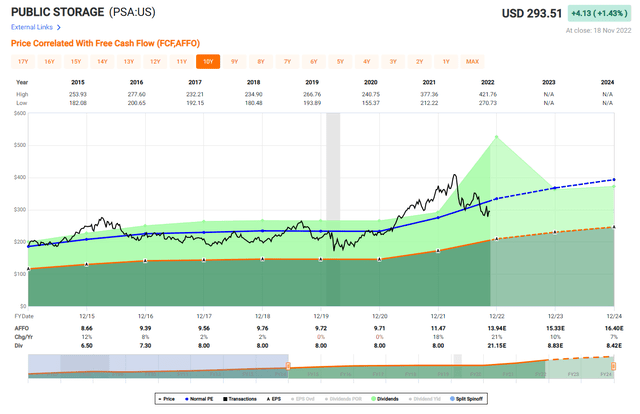

A few days ago, we wrote on three larger storage real estate investment trusts (“REITs”) that we consider attractive:

Extra Space Storage Inc. (EXR)

CubeSmart (CUBE)

Public Storage (PSA)

Also, a few days ago we wrote on AMERCO (UHAL), aka U-Haul, a C-Corp that has a massive fleet of 186,000 trucks, 128,000 rental trailers, and 46,000 towing devices seen all over the U.S. and Canada. It has a network of more than 21,000 locations in all 50 United States and 10 Canadian provinces.

UHAL has expanded into the complementary segment of self-storage, as it owns 2,188 company owned and operated locations, and 1,859 of these locations contain self-storage (1,374 owned, 485 operated).

Total self-storage square footage is over 75 million, and the portfolio also includes 11 manufacturing and assembly facilities, 149 fixed-site repair facilities, a distribution center, and corporate offices. Read more to see why we think UHAL is an attractive BUY.

(I spoke to management last week and I plan to meet them in person in a few weeks at the UHAL HQ.)

National Storage: An Outlier Worth Considering

Last week while attending REITworld, I met with National Storage Affiliates Trust (NYSE:NSA) CEO, Tamara D. Fischer, who has served as an officer of NSA since its inception in 2013.

Prior to joining NSA, she was an executive at Vintage Wine Trust (a REIT focused on the wine industry) and Chateau Communities (one of the largest REITs in the manufactured home community sector).

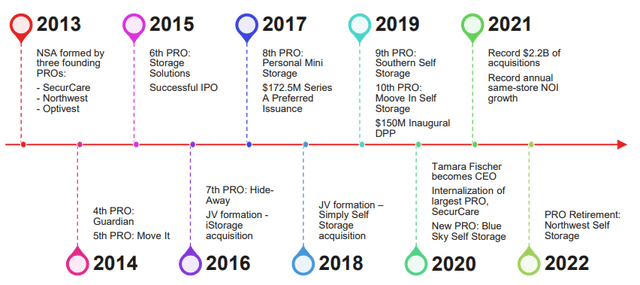

I was excited to meet Tamara, as I wanted to hear firsthand the key differentiators for the NSA platform, an internally-managed REIT that was organized on May 16, 2013 and was elected to be taxed as a REIT commencing in the taxable year ended December 31, 2015.

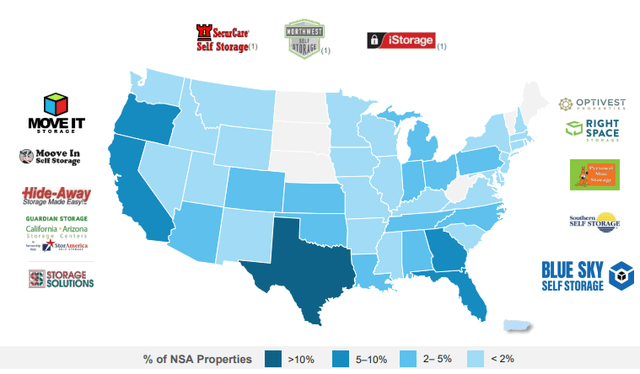

NSA’s chairman and CEO, Arlen D. Nordhagen, co-founded SecurCare Self Storage, Inc. in 1988 to invest in and manage self-storage properties.

While growing SecurCare to over 150 self-storage properties, he recognized a market opportunity for a differentiated public self-storage REIT that would leverage the benefits of national scale by integrating multiple experienced regional self-storage operators with local operational focus and expertise.

His vision became the foundation for NSA – aligning the interests of participating regional operators (or “PROs”) with shareholders, allowing the PROs to participate in the financial performance of the contributed portfolios.

A key component of this strategy is to capitalize on the local market expertise and knowledge of regional self-storage operators by maintaining the continuity of their roles as property managers.

The PRO structure creates financial incentives to accomplish these objectives: It requires PROs to exchange the self-storage properties they contribute to NSA for a combination of common equity interests (“OP units”) and subordinated performance units (“subordinated performance units”) in NSA’s operating partnership or subsidiaries of the operating partnership that issue units intended to be economically equivalent to the OP units and subordinated performance units issued by NSA’s operating partnership (“DownREIT partnerships”).

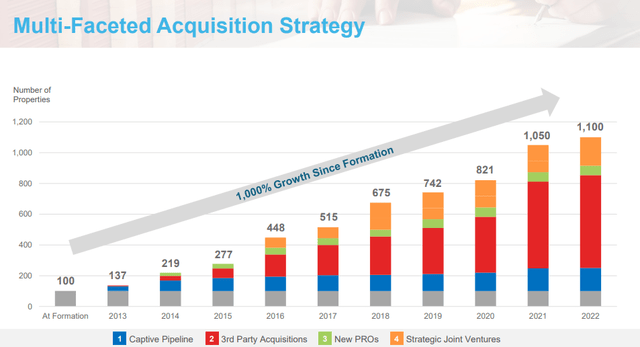

As you can see (above), NSA has grown its platform substantially since it was formed and currently boasts a portfolio of over 1,100 properties (915 wholly-owned and 185 JVs) and over 71.5 million square feet (around the same size portfolio as UHAL).

NSA’s structure offers PROs a unique opportunity to serve as regional property managers for their contributed properties and directly participate in the potential upside of those properties, while simultaneously diversifying their investment to include a broader portfolio of self-storage properties.

This structure provides NSA with a competitive growth advantage over self-storage companies that do not offer property owners the ability to participate in the performance and potential future growth of their contributed portfolios.

The Benefits of Consolidation

One of the biggest growth drivers for NSA is the expansion of the platform to recruit additional established self-storage operators, while integrating operations through the implementation of centralized initiatives, including management information systems, revenue enhancement, and cost optimization programs.

These additional operators will enhance NSA’s existing geographic footprint and allow the company to enter regional markets in which it currently has limited or no market share.

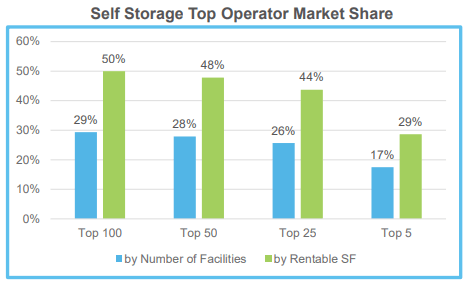

The self-storage sector is highly fragmented, with ~51,000 properties with over 30,000 operators. NSA’s PRO growth primarily targets top private operators with 20 or more institutional quality properties in the top 100 MSAs. As you can see below, the top 100 operators, excluding public REITs and U-Haul, own and/or manage over 4,900 self-storage properties.

NSA Investor Deck

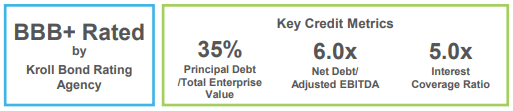

As viewed below, NSA is BBB+ rated by Kroll with solid credit metrics:

NSA Investor Deck

During Q3-22 NSA closed on a $200 million 10-year unsecured debt private placement with a fixed rate of 5.06%. At quarter end, the leverage was 6.0x net debt to EBITDA, right in the middle of the targeted range of 5.0x and 6.5x.

NSA has no debt maturities through 2022 and $375 million scheduled to mature in 2023, $300 million of which consists of 2 term loans. Approximately 24% of debt is subject to variable rate exposure, half of which is the revolver. NSA has over $210 million available on the revolver at quarter end.

NSA Investor Deck

The Latest Earnings Results

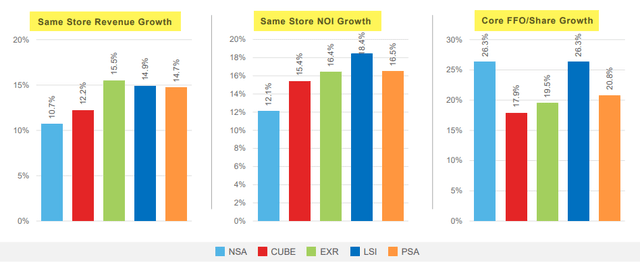

In Q3-22, NSA delivered a solid quarter, with growth in core funds from operations (“FFO”) per share of 26.3% and same-store NOI growth of 12.1%. Like other peers, results continue to moderate as operators face tougher year-over-year comps and a return to more normal seasonality.

The moderation is also fueled by inflationary pressures and more challenging macroeconomic environment in 2023. However, NSA’s CEO said:

“…keep in mind that the self-storage asset class has historically proven to be quite recession resilient through various economic cycles. The sector benefits from unique countercyclical demand factors, including demand driven by household contraction and necessity-based relocations.”

So, in Q3-22, NSA reported core FFO per share of $0.72, which represents an increase of 26% over the prior year period. As the CFO explains:

“This continued robust year-over-year growth was driven by a combination of double-digit same-store growth and our healthy acquisition volume over the past 4 quarters.”

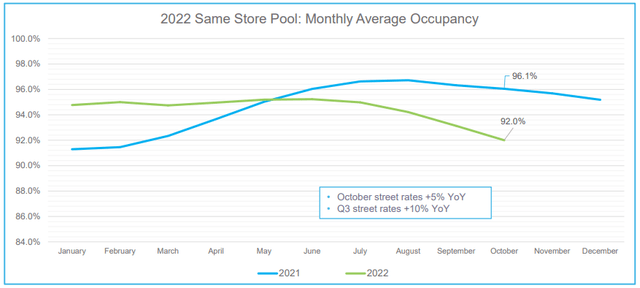

NSA’s Q3-22 same-store NOI increased 12.1% over last year, driven by a 10.7% increase in revenue combined with a 6.9% increase in property operating expenses. The contract rates were up 15% in Q3-22 from the prior year, while street rates were up 10% year-over-year. As the CFO explains (emphasis added):

“Consistent with return to normal seasonality, we continue to see moderation in our street rates, which we expect to continue through the end of the year. Our rent roll-up was flat for the quarter and now following normal seasonal trends. Discounting and concessions remain below historical averages during the quarter, and we’ve increased our marketing spend as customer acquisition activity returns to normal.”

Same-store occupancy averaged 94.1% for Q3, down 240 basis points compared to 2021. NSA ended Q3 with a same-store occupancy of 92.6%, down 350 basis points compared to the prior year.

NSA’s average length of stay for tenants that have moved out has increased from 15.5 months to 16.2 months. The percent of customers that have stayed for longer than 2 years has increased from 45% to 50%. All of these data points support healthy fundamentals.

The company said that expense growth is trending a bit higher than previously expected, as it relates to property taxes and inflationary pressures. So, for the full year 2022 NSA estimates same-store revenue growth of 11.5% to 12.5%, a tighter range than previous guidance while keeping the midpoint at 12%.

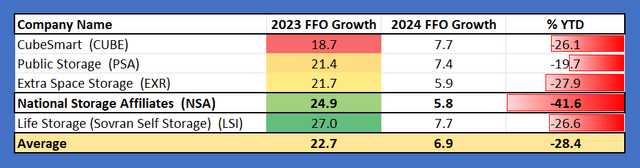

These factors result in adjusting the midpoint of core FFO per share guidance down by $0.05 to $2.81. The updated range is $2.80 to $2.82. The midpoint still represents an impressive 24% growth above the strong 2021 results and a two-year combined increase of 64% over FFO per share in 2020.

Third Quarter 2022 Key Metrics

Valuation

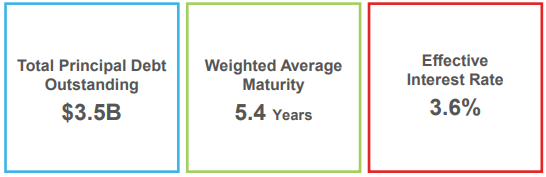

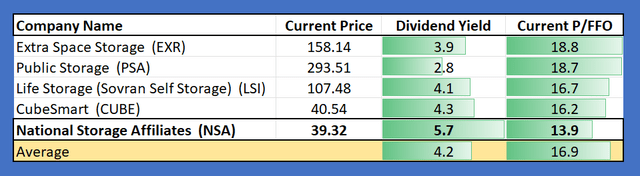

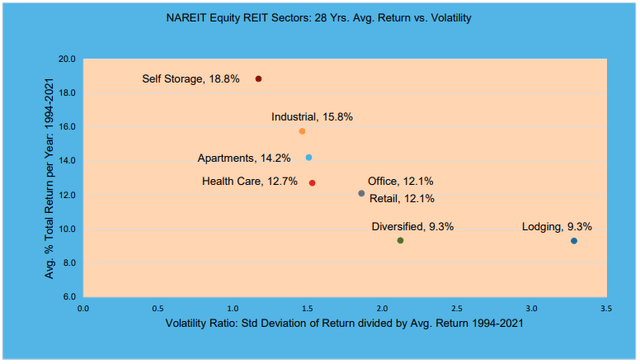

As viewed below, NSA is trading at the lowest P/FFO multiple (13.9x) and the highest dividend yield (5.7%) in the peer group:

As seen below, NSA is forecasted to have the second-best FFO per share growth in 2022, while all of the self-storage REITs are forecasted to see 6% to 7% growth in 2023. As you can see (below), NSA is the worst-performer YTD – shares are down over 41%.

NSA maintains attractive dividend growth – NSA’s Q3 2022 dividend represents a 34% increase YoY and a 189% increase since the IPO.

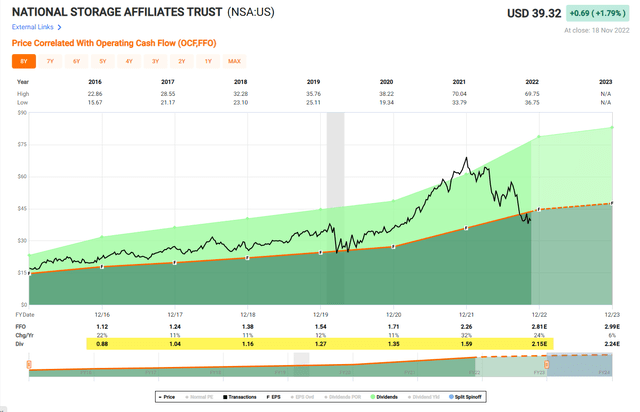

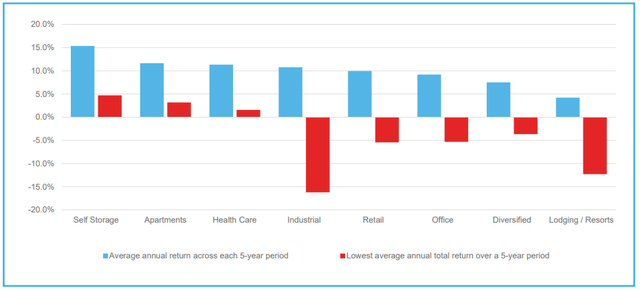

One of the things that I like about the self-storage sector is the fact that the category delivers superior returns, with lower volatility. As viewed below, Self-Storage total returns have outperformed all other equity REIT sectors for 28 years while experiencing the least volatility:

This chart below provides another snapshot illustrating the fact that the self-storage sector has optimal risk-adjusted returns:

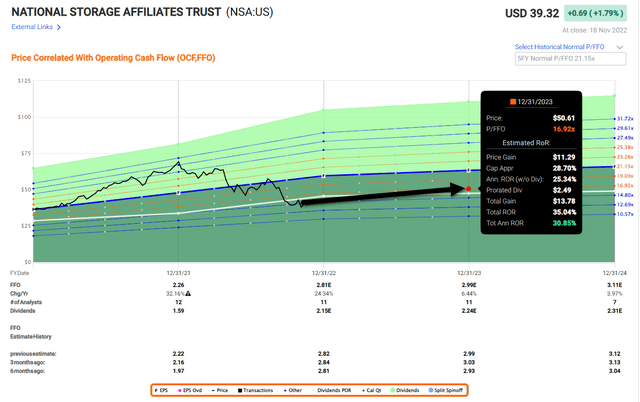

Pound for pound, NSA is one of the best REITs around… I do own shares in EXR, CUBE, and PSA, but I’m ready to add NSA to my collection. Our conservative model has NSA returning 30% over 12-months, and I’m perfectly happy to collect 5.6% while I wait.

As I told Tamara last week, it would be great to get that divy paid every month, just like I pay when I rent my storage unit. I’m sure the growing base of retail investors would appreciate it!

Be the first to comment