Parradee Kietsirikul Myovant

You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets. – Peter Lynch

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 27, 2022.

As you can see, there is a flurry of biotech acquisitions in recent months. They include AVEO Oncology (AVEO), Myovant Sciences (MYOV), and Akouos (AKUS). You can appreciate taht mergers & acquisitions (M&A) analysis is both interesting and potentially highly profitably. Asides from the intellectual curiosity, a company is typically getting acquired at a substantial acquisition premium. In other words, you can see your stock usually gaps up by over 40% if there is news of an upcoming deal.

Due to recent macroeconomic factors like hyperinflation, the M&A environment becomes highly conducive to more transactions. Of many companies that I assess, I believe that Axsome Therapeutics (NASDAQ:AXSM) is likely to get acquired. In this research, I’ll feature a fundamental analysis of the M&A landscape while focusing on Axsome.

Figure 1: Axsome Chart

Larger M&A Environment Favoring Deals

To appreciate previous deals and forecast upcoming acquisitions, you should first analyze the current M&A environment. Notably, Fiscal 2022 is a prime year for more acquisition activities because of the current Corona Bear market. That is to say, the macroeconomic factors are causing great uncertainty, thus increasing market fear. Consequently, investors are fleeing the stock market en masse which created excellent bargain-hunting opportunities for sophisticated investors and larger companies having cash with a long-term investment horizon.

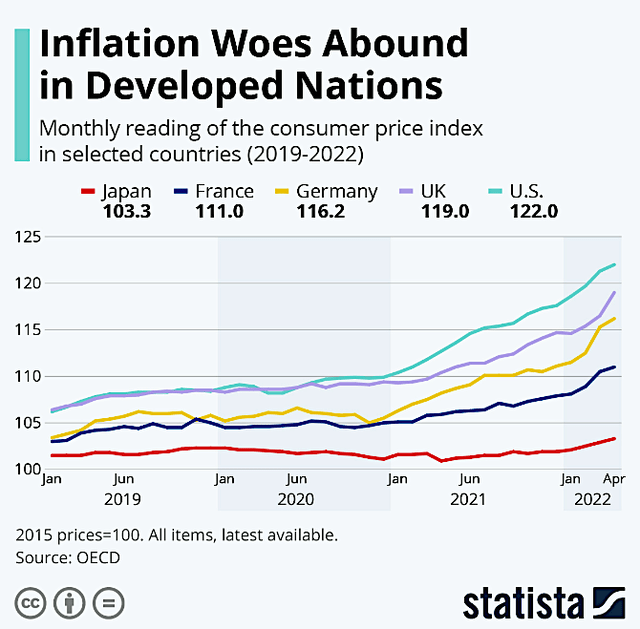

As you can imagine, the aforesaid macroeconomic factors include supply chain constraints relating to the pandemic, rising interest rates, falling home prices, looming recession, and hyperinflation. As the common denominator (COVID-19) hits all countries worldwide. Therefore, it’s logical that you’re seeing rising inflation worldwide as depicted below.

Figure 2: Hyperinflation

Sumitomo Acquisition Of Myovant

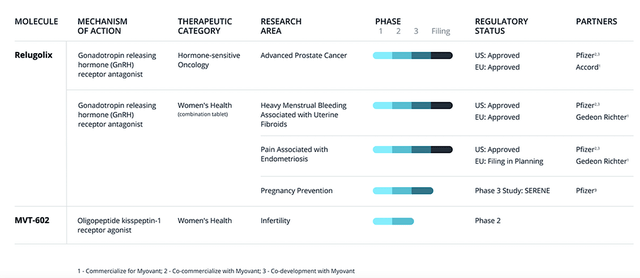

Shifting gears, let us walk through the recent acquisitions. Notably, Myovant Sciences is a rising powerhouse innovator of novel therapeutics for women’s and men’s health with high unmet needs. The lead medicine (relugolix) is already approved and launched for various conditions: advanced prostate cancer in men as well as uterine fibroids/endometriosis in women. As a novel oral gonadotropin-releasing hormone (GnRH) receptor blocker, relugolix delivers excellent safety/efficacy while being convenient for patients. Simply put, the drug doesn’t need to be injected like competing molecules.

Beyond the macroeconomic factors, there are several variables that enticed Sumitomo (i.e., the majority shareholders) to acquire Myovant. One reason is that the convenient oral pill gives relugolix a marketing advantage. Second, relugolix sales have been increasing aggressively year-over-year since its launch. Third, Myovant has world-class partners like Pfizer (PFE) that can fully unlock the value of relugolix.

Figure 3: Myovant’s pipeline

Putting all the aforesaid factors together, you can see it made sense for Sumitomo to acquire Myovant: a growing company with a drug that is on its way to becoming a blockbuster. Initially, Sumitomo made what I believed to be a “low-ball” offer at $22.75 which Myovant’s Board of Directors rightfully rejected. Contrary to conventional wisdom, I forecasted that Sumitomo would “up the offer” to appease the Board. I noted in the prior article,

As Sumi expressed a strong interest in Myovant, you can bet that they won’t give up. That explained why Sumi continued to build more shares over time to become the majority shareholder. Looking ahead, the most reasonable next step is that Sumi would come back with a higher offer.

As it turned out, it didn’t take long for Sumitomo to come back to raise the offer to $27.00 per share. As you know, the Board voted to move forward with the deal. As you saw, it pays to “read the tea leaves” in an M&A situation where the deal temporarily stalls, like this one with Myovant.

LG Chem Purchasing Of AVEO

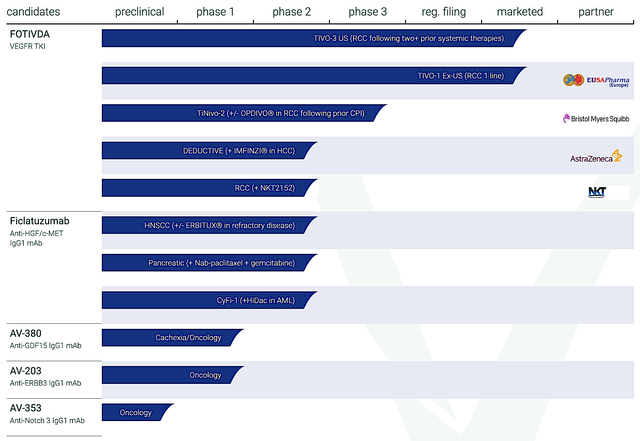

Aside from Myovant, AVEO Oncology is another interesting company that recently got acquired. As an oncology specialist, Aveo’s lead medicine is known as tivozanib which is marketed under the brand Fotivda for renal cell carcinoma (i.e., RCC) both in the USA and worldwide. I shared in the prior research,

In expanding its commercial footprint in North America, LG Chem is poised to acquire Aveo for $566M. At that price, LG chem would buy out Aveo for $15.00 per share, or my estimate of 5X forward revenues. As Aveo disclosed, the deal would be executed in an all-cash transaction.

At such a price, you can see that the deal is at a 43% premium to Aveo’s market valuation on October 17. On a 30-day moving average basis, that would be 71% higher. Even at that premium, you can see from the figure below that Aveo shares are still much lower than their former highs.

Figure 4: Aveo’s pipeline

In addition to getting a deep bargain, you can see that LG Chem wants to expand its global market outreach. And, owning a company like Aveo would give it a strong presence in the American market. Asides from Fotivda, you can appreciate that Aveo’s pipeline is also quite deep with ficlatuzumab AV-380, -203, and -353. As the year progresses, you can expect that LG Chem will benefit greatly from those molecules as well as Fotivda’s various label expansions.

Lilly Buying Out Akouos

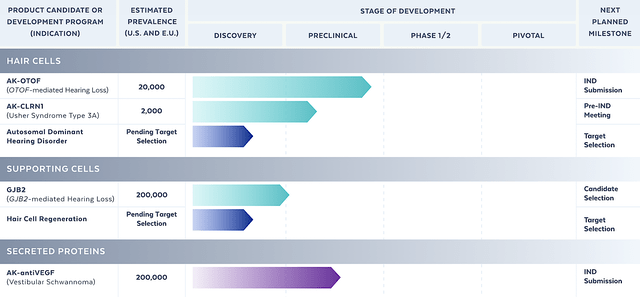

October has been a red-hot month for M&A because Eli Lilly (LLY) also seeks to acquire Akouos at $12.50 per share, plus one contingent value right (i.e., CVR) of up to $3.00 per share. As you know, the bear market suppressed Akouos’ share price significantly below its former high back in 2021 (i.e., $26.34).

Akouos is a promising gene therapy company that is focused on ophthalmology (i.e., eye diseases) that are considered rare (i.e., orphans). By definition, an orphan disease has an annual occurrence of fewer than 200K cases. As you can appreciate, orphan drugs are reimbursed at roughly $150K annually to offset the costly and lengthy innovation process (in a space that is lacking innovation).

In my view, Lilly acquired Akouos because its pipeline is highly geared toward orphan conditions. Moreover, I believe Lilly likes the fact that Akouos is highly specialized in rare eye diseases. And specialization usually brings strong data results. Another point is that Akouos utilizes the adeno-associated viral (AAV) vector which I believe to be excellent for gene therapy. After all, the whole backbone of another gene therapy company, Regenxbio (RGNX) rests on AAV.

Figure 5: Akouos pipeline

More Acquisitions To Come

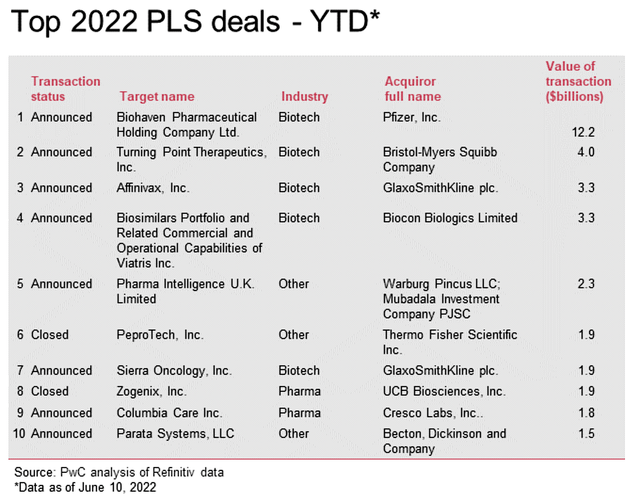

Based on a report by the Big Four Accounting firm (i.e., PwC), you’re likely to see more deals during the second half of this year. And, that’s true because, among many other acquisitions, you saw three deals that I featured. Perhaps, there are more coming. Pertaining to the PwC report,

All of the stars are aligned for there to be a flurry of deals activity across all areas of the sector despite the slow start to the year so far. Many large pharma players are flush with cash (particularly those that have COVID-19 treatments in their arsenal), biotech valuations have been normalizing after years of a boom market and the 2025 patent cliff is rapidly approaching, all making for a strong deal environment.

Figure 6: Notable Deals in 2022

Top Candidate: Axsome Therapeutics

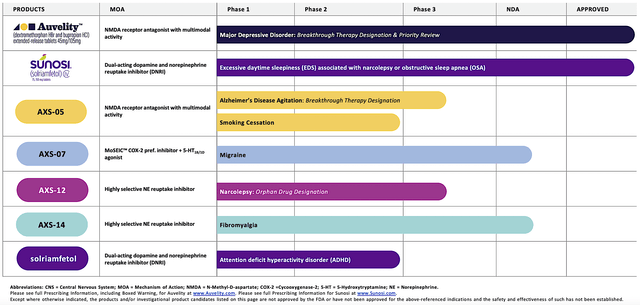

As my top acquisition pick, Axsome Therapeutics is a rising powerhouse psychiatric medicine innovator. Like the cream that always rises to the top, Axsome cleared market doubts to gain FDA approval for its lead franchise known as AXS05. As a novel/differentiated drug, AXS05 is being marketed under the brand Auvelity for major depressive disorder (i.e., MDD).

Not satisfied with its initial success, Axsome is expanding Auvelity’s label for Alzheimer’s and smoking cessation. There are also other highly promising drugs like AXS07, -12, and -14. Asides from its organic molecules, Axsome recently acquired Sunosi from Jazz Pharmaceuticals (JAZZ). As such, there are now two commercialized products with an expansive pipeline having aggressive advancements.

Figure 7: Axsome’s pipeline

At $41.96 per share (i.e., $1.69B market cap), Axsome is an ideal purchase for a large company that wants to deepen its psychiatric portfolio. Interestingly, I believe that Jazz would benefit big time in launching Auvelity. As a specialty drug for MDD, Auvelity has demonstrated efficacy even for treatment-resistant depression. That’s a feat that very few drugs can achieve.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this stage in their growth cycle, all of the aforesaid companies (Aveo, PDS, and Akero) have the risks that their future data report (either for their main indication or label expansion) won’t be positive. As such, their potential acquisition would be substantially devalued to the acquirer. The risk of creating pipeline synergy is also extremely high. Very few acquisitions actually deliver synergy. Nevertheless, value addition is the best a company is likely to get.

As to investors, your risk that none of these companies would be acquired is very high. After all, M&A forecast is a low-yielding endeavor. Sometimes the deal might fall through. In that case, a company that is already engaged in an M&A discussion would see its stock drop precipitously.

Conclusion

In all, I strongly believe that you’ll see more M&A activities heading toward yearend and into 2023. It seems all the stars are lining up for more deals to be consummated going forward. The strongest determinant that fosters more deals is the highly favorable M&A environment. Right now, it’s a buyer’s market that favors larger pharmaceuticals with a strong balance sheet.

Of all firms, I believe that Axsome has the best chance of being picked for the reasons I mentioned above. Even without getting bought out, the company is likely to grow organically to become a much larger operator in the future.

Be the first to comment