hapabapa/iStock Editorial via Getty Images

Thesis

Adobe (NASDAQ:ADBE) is one of the world’s premier software companies.

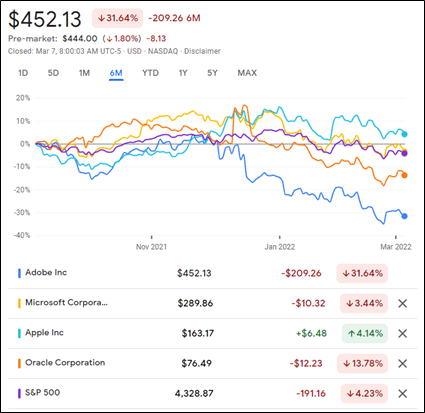

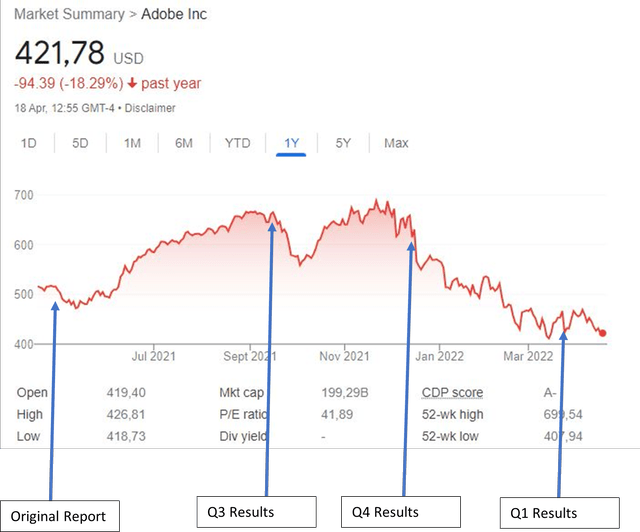

The share price has declined by more than 30% over the past six months and 18% over one year, primarily on slowing growth fears.

A correction was warranted, and the stock is still not cheap – but the market might be overdoing the correction, sending the stock back into buy-territory.

Overview

In May 2021 Adobe shares traded at $480. At that stage, the stock presented clear upside, and I calculated a fair value of $588 (upside of 22% at the time). All seemed to be going according to plan for the creative giant, with the share price rising roughly 35% through September 2021, when things started going a bit pear-shaped after the Q3 results. There was a brief comeback, but Q4 and full-year results published mid-December, sent the price crashing down to current levels.

Although the last few months have generally been quite volatile and tough on growth-oriented, software equities globally, it is clear that Adobe has been punished to a much greater extent than some of its blue-chip SaaS peers, trailing the S&P and Microsoft (MSFT) by about 25%, as seen in the comparison below over the past six months.

Google Finance

Fundamentally, nothing has changed. There is no regulatory risk or new competitor taking the market by storm, and the performance boils down to weaker than expected guidance, expanded on below.

Q2 21 Results (Mar – May): 17 June 2021

- EPS of $3.03 beats by $0.21

- Revenue of $3.84B (22.60% YoY) beats by $106.49M

Q3 21 Results (Jun-Aug): 21 September 2021

- EPS of $3.11 beats by $0.09

- Revenue of $3.94B (22.02% YoY) beats by $38.64M

- Guided above expectations for Q4.

Q4 21 & Full Year Results: 16 December 2021

- EPS of $3.20 in-line by $0.00

- Revenue of $4.11B (20.04% YoY) beats by $21.20M

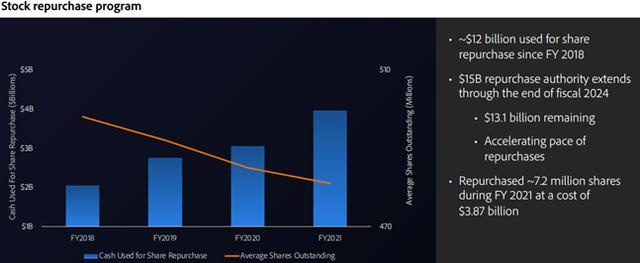

- Repurchased a further 1.6 M shares during the quarter, continuing trend of returning cash to shareholders.

Q1 22 Results: 22 March 2022

- EPS of $3.37 beats by $0.03

- Revenue of $4.26 billion (9.14% YoY) beats by $23.8 million

Thus, in summary, no misses, and a >30% drawdown. Mr Market seems to have

- overestimated the growth

- upon realising this, overdone the correction.

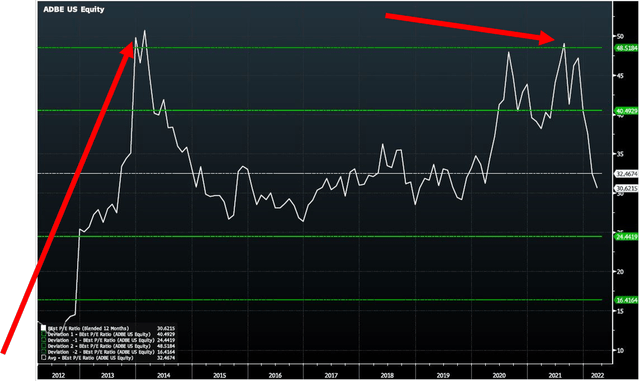

This market darling, that has outperformed the S&P by 15% per annum over the last 5 years, (recent downturn included), is now essentially flat over a 1-year period, while underperforming the S&P by 10%. The question is whether the initial rally and subsequent outperformance during the first 6 months was justified, and whether the subsequent correction presents an opportunity to buy a market leader at a cheap price. On a relative basis – even after such a large sell off, “cheap” is still not the case… Adobe is currently trading on a blended forward PE multiple of 30X, just south of its 10-year average of 32. At the height of the recent rally, the forward PE ratio had jumped to more than 2 standard deviations above the 10-year average, territory it had only entered once before at the end of 2013/start of 2014 when earnings were depressed and the benefits of moving to a SaaS system started becoming clear (marked in red). Thus it had clearly reached a level far in excess of its fair value.

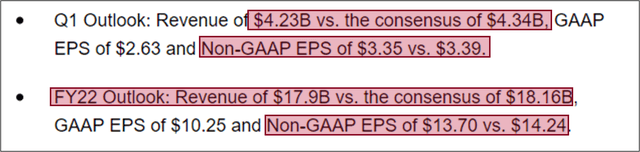

The problem with the Q4 (and full year) results and subsequent selloff is in the guidance. Consensus Estimates versus company guidance below:

This led to 11 million shares trading the day after FY earnings, as opposed to Adobe’s normal trading volume of 2.6 million shares per day. Comments from sell side Analyst Kirk Matern from Evercore indicated that Adobe has a history of guiding fairly conservatively and the beating those estimates, providing some comfort to the lower guidance.

However, some observations from the results presentation that I found to be very positive include:

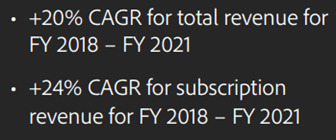

- Digital experience subscription revenue grew 27% YoY, versus 24% for the segments as whole – meaning the subscription portion is growing faster than the overall segment. This is also true for the business in general:

Company Documents

- Operating Income is growing much faster than revenue. GAAP Operating margin increased by 37% YoY and non-GAAP by 31%, versus revenue increase of 23% YoY, indicating management is executing excellently while still achieving great growth figures.

Company Filings

How big is the addressable market?

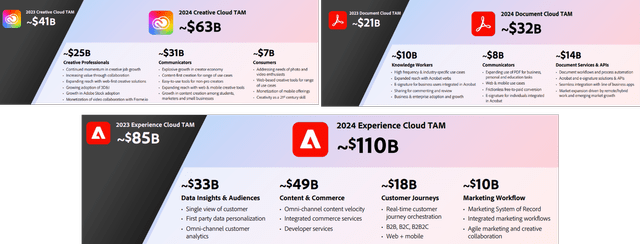

Adobe’s internal estimates pin their TAM at $205 billion by 2024 – adding > $50 billion to their previous estimates from 2020.

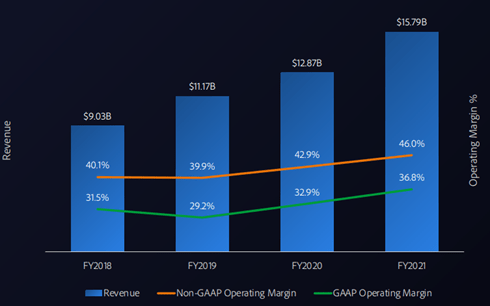

It is clear that although Adobe utterly dominates the Creative Cloud section of the market, a large portion of their value proposition and future growth is baked into their enormous TAM estimations for the experience cloud. If industry reports are anything to go by, it surely seems that Adobe is well positioned to capture a large part of this enormous market. The image below uses extracts from Gartner and indicates Adobe has positioned itself the correct quadrant for all metrics.

Company Filings

Leading to glowing reviews and indications of value add from customers:

Company Filings

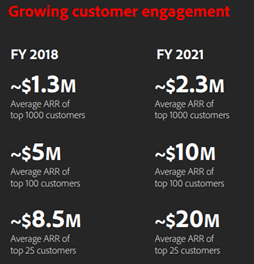

The growth might not be as explosive as the market had been expecting, but it does certainly seem that Adobe is making progress in expanding the number of customers making use of their Experience Cloud, as well as considerably increasing the average revenue for all of these customers

Company Filings

SWOT Analysis

Strengths

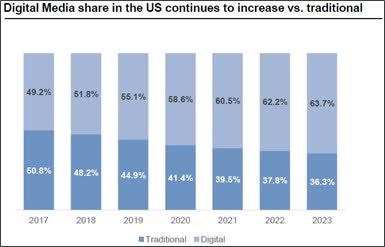

- Adobe has a deep moat around the core section of its business. It enjoys pricing power, high margins, market dominance and continued strong growth. Along with this it has strong financials, a FCF conversion rate of > 100%, and a massive opportunity ahead to grow the Digital Experience business – which has a TAM > Digital Media. Furthermore, Adobe is perfectly positioned in a world that is becoming more digital everyday – which will only add to the stickiness factor of their products.

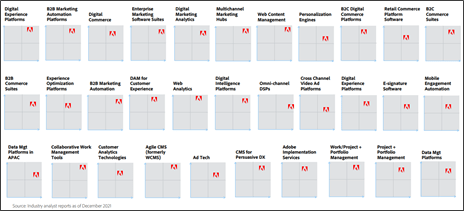

- Unmatched breadth of ecosystem offering. Adobe is uniquely situated in terms of the breadth and scale of their ecosystem. They offer a full stack of services that enable clients to create and manage all the digital aspects of their business. Creative Cloud enables customers to create all the digital media they require, which can then be managed and turned into a shoppable experience using the Digital Experience Cloud, and all of this can be effectively coordinated using newly acquired Workday. All of this while supporting the digitization of the business through the Document Cloud.

- Capable Management Team. Aside from growing revenues and increasing margins over the last couple of years, Adobe has achieved a ROIC of 21% over the last 5 years – indicating that management is successfully utilizing the large cash stash being generated by the business. Their capabilities are also showcased through their ever-improving margins.

- Strong Cash return to shareholders – $13. 1 billion approved and remaining for repurchases till end FY24.

Weaknesses

- Pricing. One weakness that Adobe might be perceived to have is the price of their products – especially for the lower-end user. Requirements in this market will naturally be much lower than in the institutional market. Consumers might thus rather opt for cheaper/free products.

Opportunities

- No real end in sight to the digitization of everyday life (work, shopping, socializing, the metaverse)

Industry Reports

Threats

- It is possible that growth was previously slowing, and the growth seen in 2021 was an effect of customers fast tracking their planned future spend as the lingering effects of the pandemic forced them to adapt to a changing environment. See below quote from UBS analyst:

UBS said it downgraded the stock after speaking with over a dozen large enterprise IT executives and Adobe service partners about their spending plans for the company’s products in 2022. Most of the executives said their organizations had pulled forward spending on Adobe products into 2021 due in part to more employees working at home during the pandemic.

I believe this points toward a possible short-term slowdown, not a long-term impairment.

- Failure to adequately grow the Digital Experience segment of the business, would mean they continue to rely on a single segment to provide 70% of revenue and 90% of EPS.

Valuations

Previously, I used a 10-year forecast period during valuation to try and get to a “mature” level of growth for Adobe, as the stock is, and has been, trading at elevated multiples for more than a decade. Growth over this period has been incredible, justifying the higher multiples.

Instead of again forecasting for a 10-year period, I have chosen to forecast only 5 years out to try and avoid unrealistic compounding effects, and rather used a slightly higher mature multiple – as a company with Adobe’s credentials clearly demand much higher from the market.

Note that I have not forecasted any further margin improvement, as Adobe already has great margins. However, this does provide further upside potential.

Normal “mature” multiple applied:

- Bear Case: 20 (-1.5 std deviations, the share has not traded near these levels since transitioning to a SaaS Model)

- Base Case: 22 (-1.25 std deviation – this would mean further derating of >25% from current levels)

- Bull Case: 30 (Still less than the average since transition to SaaS business)

Bloomberg

Using the above mature multiples, a revenue CAGR of roughly 17% over the next 5 years, compared to 22% over the previous 5), and current profit margins, I believe Adobe is currently slightly undervalued. Keep in mind that even if fairly valued – this implies that Adobe still delivers my required return of 8.1% per annum from a multiple that I believe is very conservative and provides further upside potential.

Moving more towards my bull case, upside increases considerably – almost 45% from current levels.

Conclusion

- While Adobe might still not be cheap in the traditional sense of the word, the stock is certainly moving into buy range again, especially considering that it is one of the top SaaS companies globally.

- It has outperformed the market by 15% per year for 5 years, and I believe it will continue to outperform for the foreseeable future.

- It is the clear leader in a market that is expected to continue growing in relevance and importance.

Be the first to comment