Creative-Family

A Quick Take On Smart Share Global

Smart Share Global (NASDAQ:EM) went public in April 2021, raising approximately $150 million in gross proceeds from an IPO that was priced at $8.50 per ADS.

The firm provides members with access to mobile device charging locations in China.

Given the firm’s cash flow dynamics, contracting revenue, worsening operating losses and uncertain pandemic restriction effects, I’m on Hold for EM in the near term.

Smart Share Overview

Shanghai, China-based Smart Share was founded to develop a network of mobile charging spots for users in Mainland China.

Management is headed by Co-founder, Chairman and CEO, Mars Guangyuan Cai, who was previously General Manager at Uber Shanghai.

The company’s power banks are generally placed in:

-

Entertainment centers

-

Restaurants

-

Shopping centers

-

Hotels

-

Transportation hubs

-

Public spaces

The firm operates a self-run network in larger cities via an in-house business development team as well as works through network partners in smaller cities.

According to an iResearch report commissioned by management, the firm was the largest mobile device charging service provider in China, in terms of gross 2020 revenue.

Smart Share’s Market & Competition

According to a recent market research report by iResearch, the market for mobile device charging services was approximately $1.3 billion in 2020 and is expected to reach $15.4 billion by 2028.

This represents a forecast CAGR of 36.2% from 2020 to 2028.

The main drivers for this expected growth are continued growth in smartphone usage and dependence on mobile applications by consumers.

Also, the adoption of next-generation, 5G technologies will expand the use cases for mobile phones and is expected to increase usage further.

Major competitive or other industry participants by category include:

-

Internet companies

-

Payment service providers

-

Other financial tech companies

-

Smaller, local players

EM’s Recent Financial Performance

-

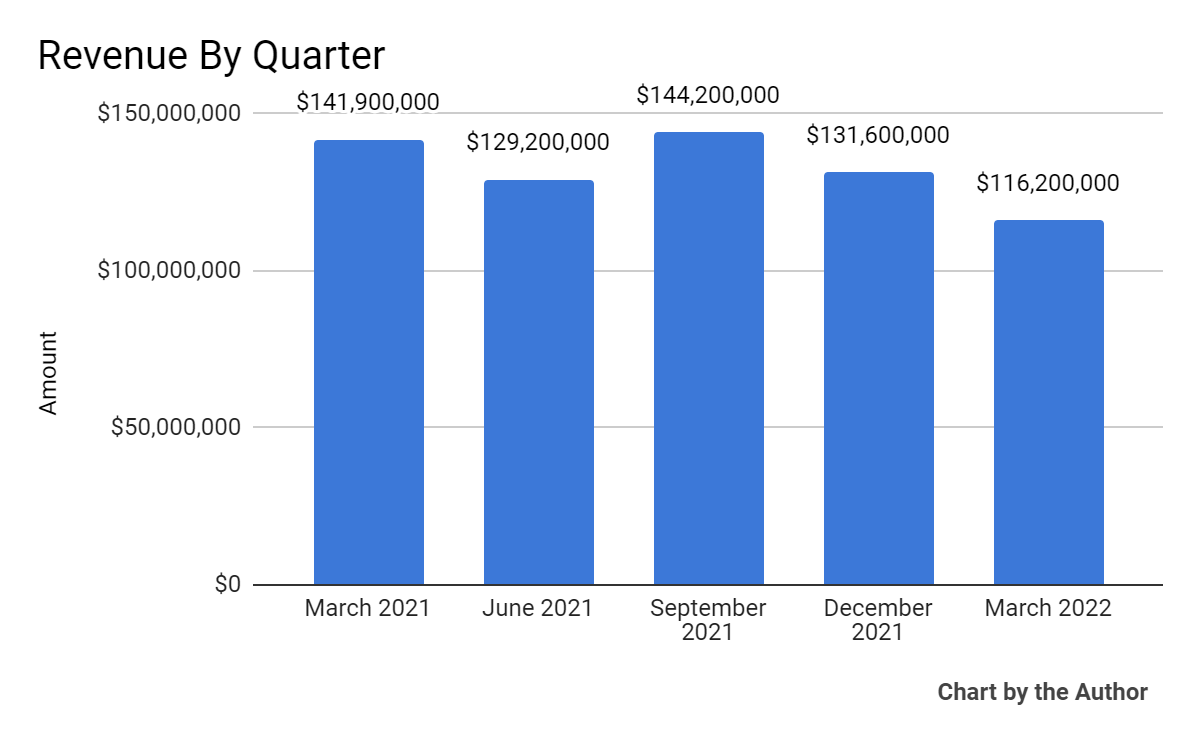

Total revenue by quarter has been uneven but has trended lower in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

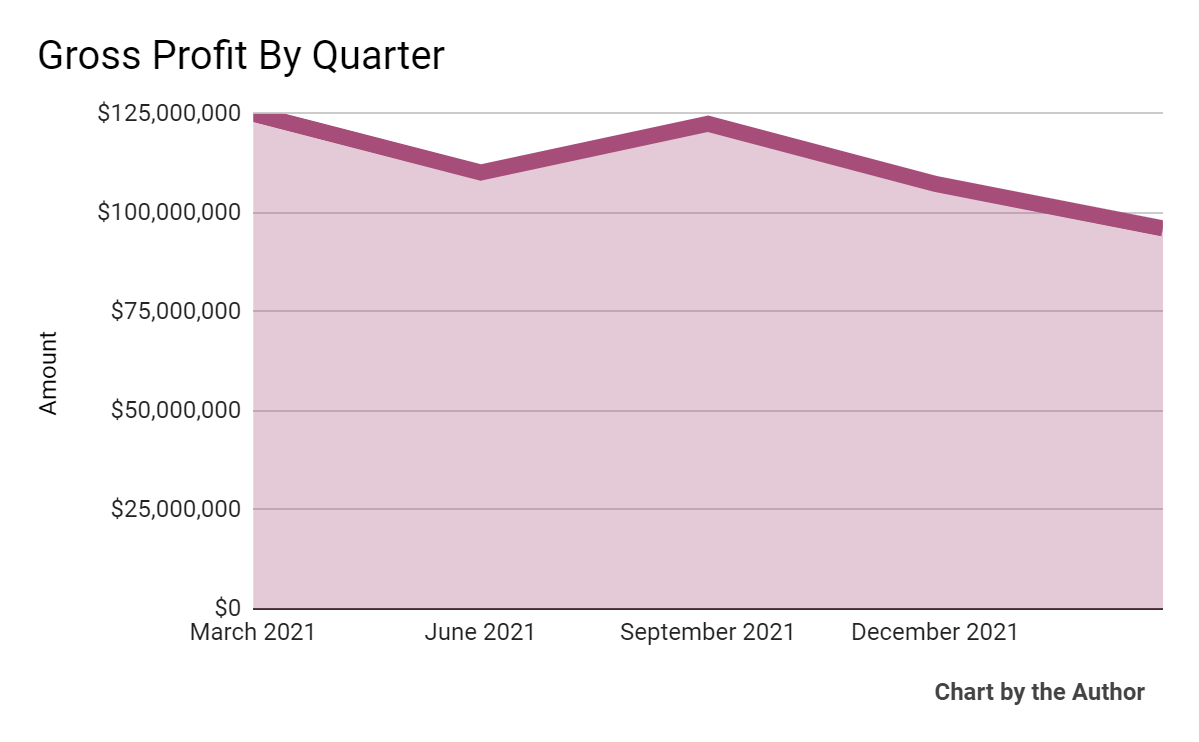

Gross profit by quarter has also trended lower as the chart shows below:

5 Quarter Gross Profit (Seeking Alpha)

-

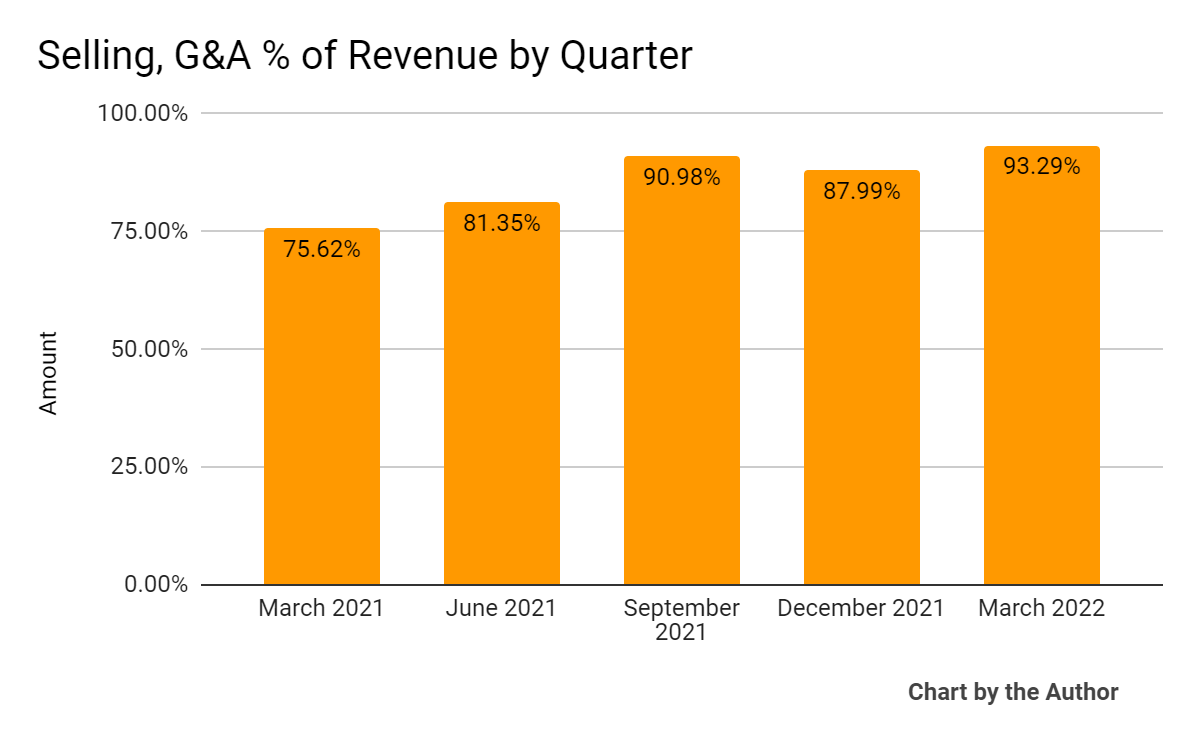

Selling, G&A expenses as a percentage of total revenue by quarter have increased over the past 5 quarters, indicating the company has become less efficient at generating revenue:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

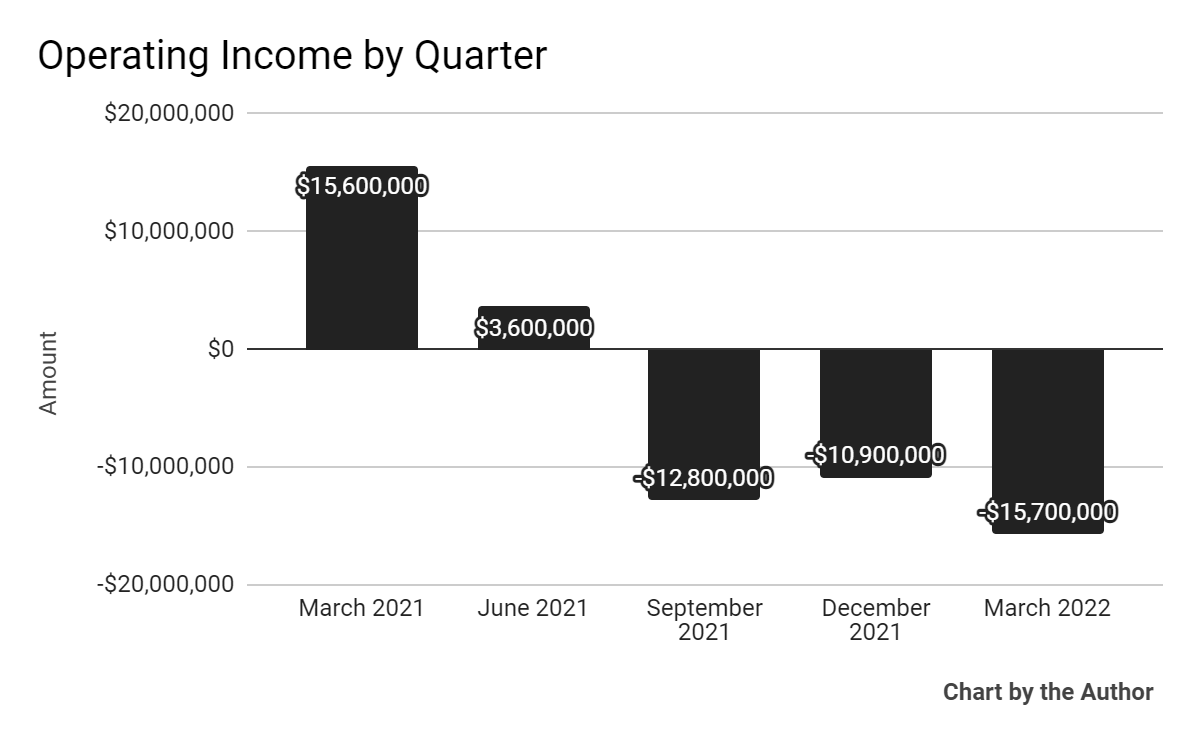

Operating income by quarter has swung well into loss territory over the past 3 quarters:

5 Quarter Operating Income (Seeking Alpha)

-

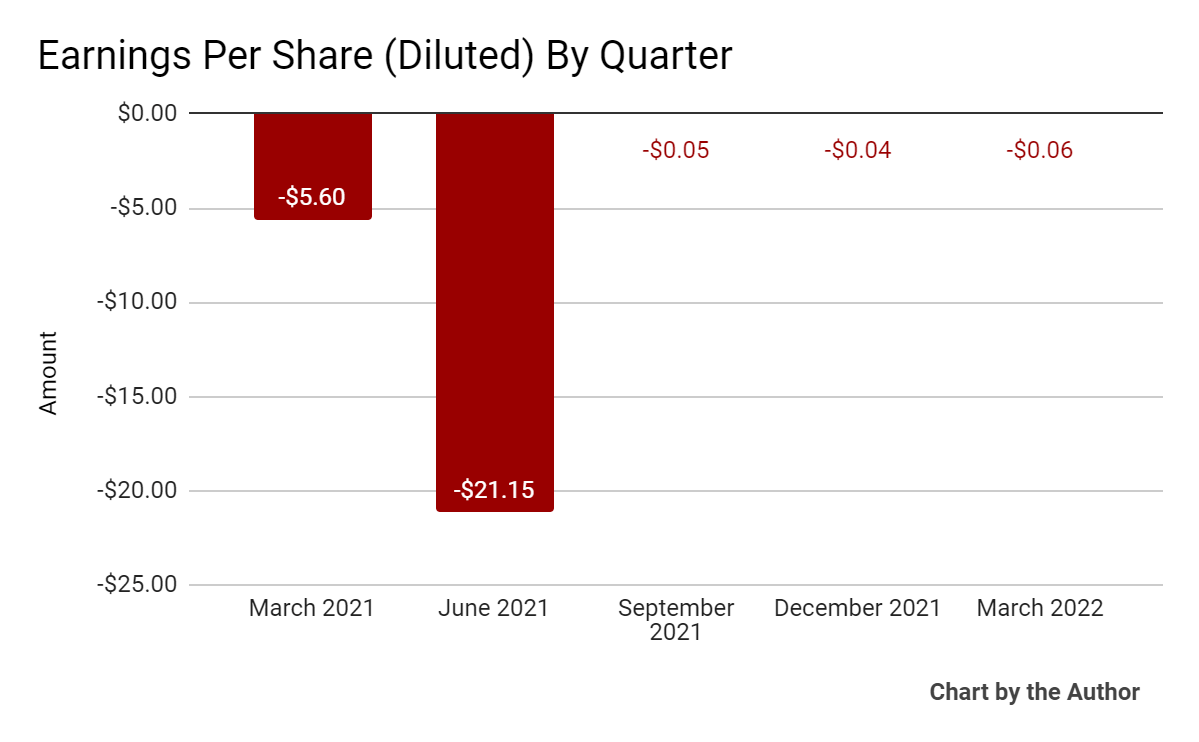

Earnings per share (Diluted) have also remained negative in the 5 quarters ended March 31, 2022:

5 Quarter Earnings Per Share (Seeking Alpha)

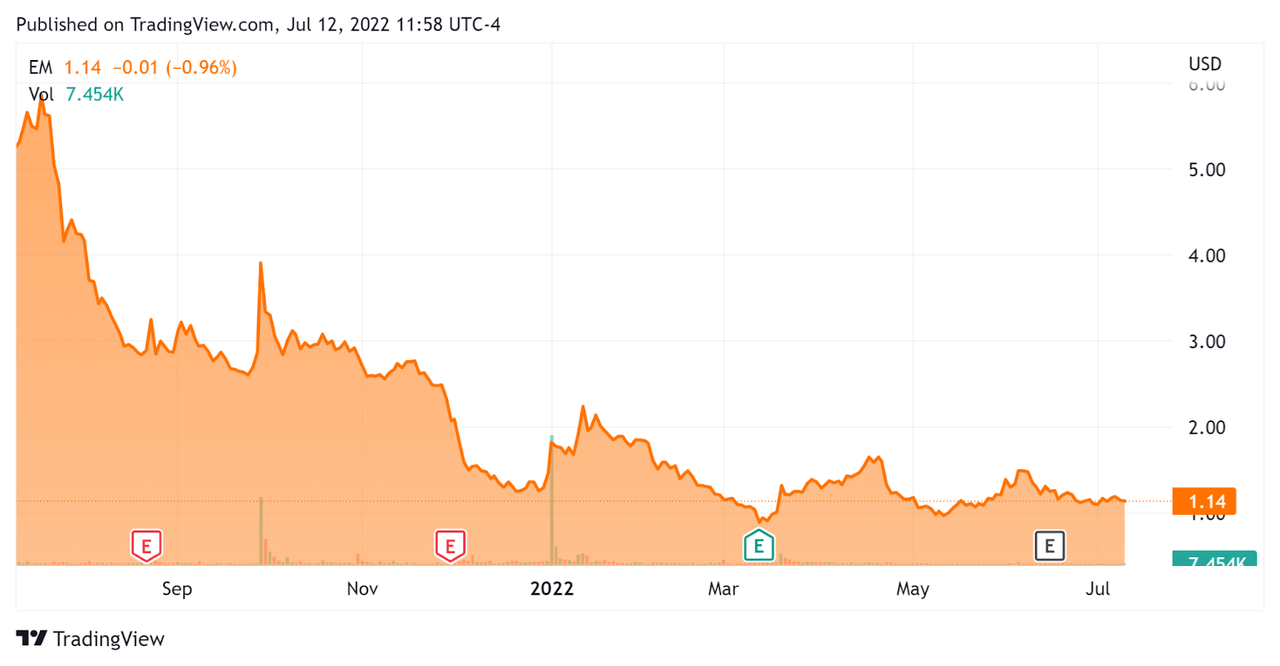

In the past 12 months, EM’s stock price has dropped 78.2 percent vs. the U.S. S&P 500 Index’s fall of around 12 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Smart Share

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

-$106,620,000 |

|

Market Capitalization |

$297,570,000 |

|

Price/Sales (TTM) |

0.54 |

|

Revenue Growth Rate (TTM) |

4.26% |

|

Operating Cash Flow (TTM) |

$35,680,000 |

|

CapEx Ratio |

0.48 |

|

Earnings Per Share (Fully Diluted) |

-$21.30 |

(Source – Seeking Alpha)

Commentary On Smart Share

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the firm’s challenges due to a continuous outbreak of COVID-19 in regions that affected its network use.

This resulted in a reduction of same-store revenue of 35% year-over-year.

However, registered user numbers continued to grow, reaching 299 million by the end of the quarter, representing impressive growth of 25% year-over-year.

Notably, management continues to focus on coverage expansion, especially in higher-tier cities while reducing its incentive fee rates for new signups.

The firm is increasing its network partner acquisition approach, with now over 1,300 network partners across China, having grown by 180% year-over-year.

As to its financial results, total revenue dropped by 13% year-over-year while the cost of revenue increased by 2.4%.

Sales & Marketing expenses dropped only 0.3% due to lower user acquisition incentive fees paid to location partners.

Operating losses increased to their worst performance in the past 5 quarters as the company has significant fixed costs against a revenue decline.

For the balance sheet, the firm finished the quarter with cash and equivalents of $151 million, but free cash use during the quarter was $38.6 million.

At that run rate, the firm will need to cut back on its CapEx quickly unless it has access to large lines of credit.

Regarding valuation, the market has severely punished EM for its uneven and now contracting results while the firm continues to invest in expanding its network and pursuing growth despite generating increasing operating losses.

The primary risk to the company’s outlook is its dwindling cash position as against its capital expenditures.

It seems something will need to give, although the firm may face improved conditions as major lockdowns ease in some regions.

However, these conditions are highly fluid, with fears of new lockdowns in Shanghai and other regions rising.

Given the firm’s cash flow dynamics, contracting revenue, worsening operating losses and uncertain pandemic restriction effects, I’m Hold for EM in the near term.

Be the first to comment