SKapl/iStock via Getty Images

Since I put out my bullish piece on AMMO, Inc. (POWW) a few months back, the shares have absolutely collapsed, down ~21% against a gain of just under 4% for the S&P 500 in that time. The company has since published financial results, so I thought I’d look at the name again. I initially bought a small position in this name (the word “speculative” was in the title), and most of bullishness was expressed in my short options, which are about to expire. I want to look at the most recent financial history and I want to look at the stock as a thing distinct from the underlying business. I also want to express my ideas about my short puts, while offering another trade to you, dear readers.

I’ll come right to the point. I think this is an excellent business with a great growth profile, and I’ll be happy to have shares “put” to me at $5. This will bring my net purchase price to $4.75, which I consider a great long term entry price. I am of this view after looking at the financial history here, and by looking at the stock itself. For those who are interested, I think AMMO, Inc. offers yet another excellent short put, this time with the opportunity to buy in at a net price of $3.95.

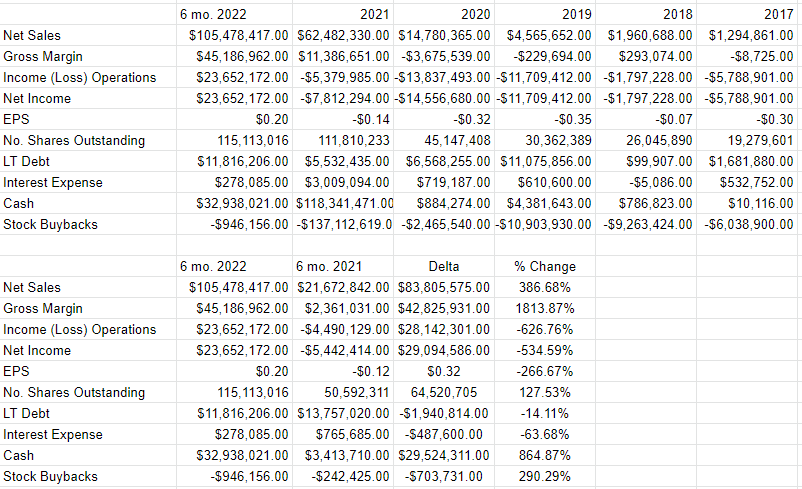

Financial Snapshot

The first six months of the latest fiscal year were mostly good relative to the same period a year ago in my view. For example, revenue, gross margin, and net income have all (forgive the pun) exploded higher. Sales are up just under 387%, and gross margin is up over 1800%. On the back of this, net income has swung from a loss of just under $5.5 million to a $23.6 million profit. This is a fast growing company.

Like many similar companies, AMMO, Inc. is suffering from growing pains. Specifically, the number of shares outstanding is up ~127% relative to the same period a year ago. If you buy this company, dear readers, you will likely face further dilution, which, perversely, is made worse by the drop in share price. That said, the level of indebtedness has dropped slightly, which reduces the risk here. Interest expense has plummeted from the year ago period.

Given all of this, I’ll be happy to own the shares at the right price. In the “stock” section, below, I’ll try to determine whether the $5 strike price is worth acquiring the shares at, or whether I should simply buy the puts back at a small loss.

AMMO, Inc. Financials

The Stock

In my opinion, an investor’s return on a given investment is almost entirely a function of the price paid for it. For instance, the investor who bought shares the day my article was published is down ~21%. The investor who bought identical shares exactly a year previously is up ~117%. Price paid matters a very, very great deal. It’s for this reason that I try (but don’t always succeed) to buy shares cheaply.

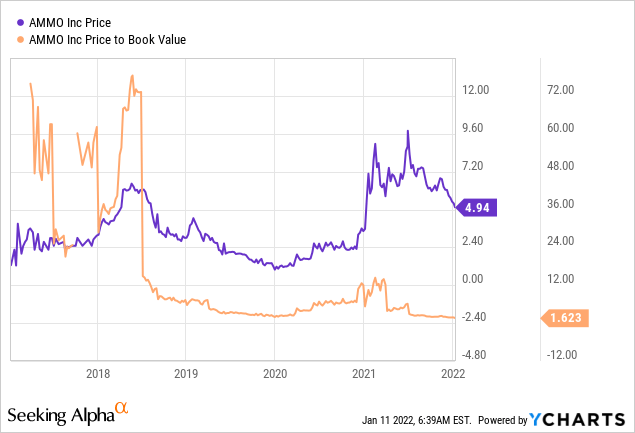

It may seem counterintuitive to apply “value” measures like “price to” ratios to a “growth” company. In my view, a tool is a tool, and these distinctions are largely artificial. If a company that’s growing at this rate trades as a value stock, so much the better in my view. As my regular reader-victims know, I like to buy stocks that are trading at a discount relative to the overall market, and to their own history. On that basis, AMMO, Inc. is very inexpensive, per the following:

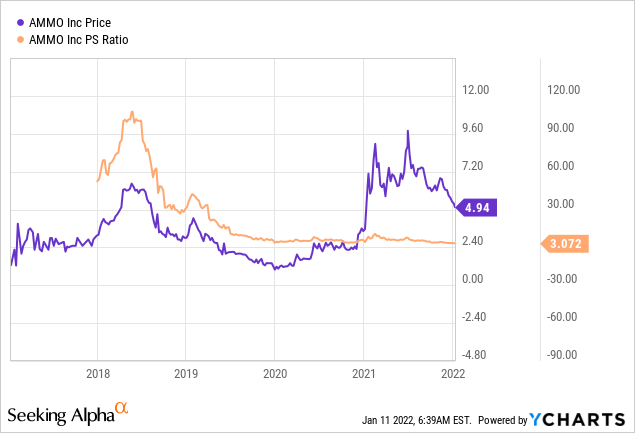

We see a similar picture when we look at price to sales. The shares seem to be trading near record low valuations on this basis, too.

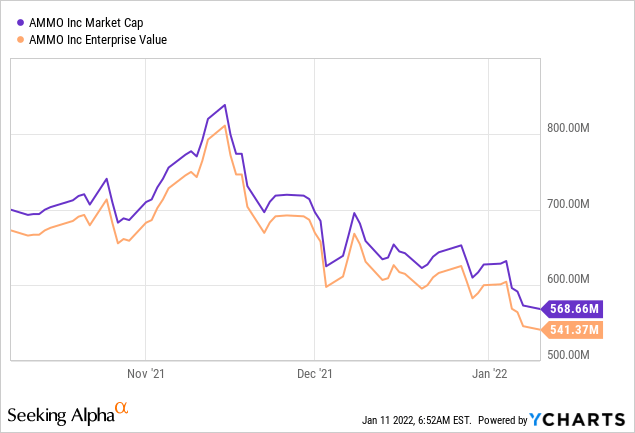

Although I don’t often write about it on this forum, dear readers, I do sometimes like to look at both market cap and enterprise value, and compare those numbers to the amount of cash the company spins off. Per the financial figures above, the company earned $23.6 million in the first six months of the current fiscal year. If we assume growth stalls, the company will generate ~$47 million this year. The company is “worth” between $541-$568 million. I consider this earnings yield of ~8.3% to be reasonably good.

Before leaving this exploration of the stock, I should note that I used this exact logic in my previous missive on this name, deciding to buy when the shares were trading hands at a price to sales ratio of 4.58 times. They’re now trading ~33% cheaper on that basis. The problem is that what is cheap can always get cheaper. There’s no guarantee that the shares won’t continue to fall in price. Given that, I would urge investors to remember the title of my previous missive: this is an interesting speculative stock.

Options Update

In my previous missive, I bought a few shares, but most of my bullishness was expressed in my short put trade. The premia was 5% for three months, and this premia seemed too great to pass up. I sold them for $.25, they’re about to expire, and they last traded hands at $.36. Way back in October, I decided I was comfortable being obliged to buy these shares at $5, and I’m still comfortable. I expect that, barring any sudden price surge, the shares will be put to me.

If/when they are, I’ll sell the July calls with a strike of $7.50, currently bid at $.45. If by some miracle these aren’t “put” to me, I’ll turn around and sell the July puts with a strike of $5. These are currently bid at $1.05. This is what I’m doing.

In case you’re one of the people who didn’t follow my lead in October, and you’re just coming to this trade now, I would strongly recommend selling the aforementioned puts. Receiving a premium of $1.05 for tying up $5 of capital for a little over six months is an enormously good return in my view. If the shares climb above $5, you’ll pocket the large premium. If the shares fall, you may be obliged to buy this growth business at a net price of ~$3.95, which is extraordinarily good in my view. This “win either way” is one of the reasons I consider this to be a win-win trade.

Now that you’re hopefully excited about the prospects of a win-win trade, it’s time for me to indulge in my somewhat sadistic tendency to completely foul the mood by talking about risk. The reality is that every investment comes with risk, and short puts are no exception. We do our best to navigate the world by exchanging one pair of risk-reward trade-offs for another. For example, holding cash presents the risk of erosion of purchasing power via inflation and the reward of preserving capital at times of extreme volatility. The risks of share ownership should be obvious to readers on this forum.

I think the risks of put options are very similar to those associated with a long stock position. If the shares drop in price, the stockholder loses money, and the short put writer may be obliged to buy the stock. Thus, both long stock and short put investors typically want to see higher stock prices.

Puts are distinct from stocks in that some put writers don’t want to actually buy the stock – they simply want to collect premia. Such investors care more about maximizing their income and will be less discriminating about which stock they sell puts on. These people don’t want to own the underlying security. I like my sleep far too much to play short puts in this way. I’m only willing to sell puts on companies I’m willing to buy at prices I’m willing to pay. For that reason, being exercised isn’t the hardship for me that it might be for many other put writers. My advice is that if you are considering this strategy yourself, you would be wise to only ever write puts on companies you’d be happy to own.

In my view, put writers take on risk, but they take on less risk (sometimes significantly less risk) than stock buyers in a critical way. Short put writers generate income simply for taking on the obligation to buy a business that they like at a price that they find attractive. This circumstance is objectively better than simply taking the prevailing market price. This is why I consider the risks of selling puts on a given day to be far lower than the risks associated with simply buying the stock on that day.

I’ll conclude this long winding discussion of risks by looking again at the specifics of the trade I’m recommending. If AMMO, Inc. shares remain above $5.00 over the next six months, the put seller will simply pocket a very generous premium. If the shares fall in price, they’ll be obliged to buy at a price ~21% lower than the current level. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” I’m aware. That’s a strange way to end a discussion of risk, but this is neither the first, nor the last time my views could be described as “strange.”

Conclusion

I think this is an excellent business, with a great growth story. In spite of the high levels of growth, the shares are trading hands at very reasonable multiples. While there’s a very real chance that shares may drift even lower from here, over the long term, a company that grows sales and earnings at this rate won’t stay cheap forever. I think patience will be rewarded here. For my part, I’ll sell covered calls on some or all of my position, as the yield on my (presumed net acquisition price) is ~9.4%. For people who are just exploring this business for the first time, I recommend selling the puts described above. The premia is very generous, and the trade is the definition of a “win-win” in my view.

Be the first to comment