Oselote/iStock via Getty Images

While silver has performed well since my previous update on February 3 (see ‘SLV: Silver’s Fundamentals Continue To Improve‘), the metal has yet to make a significant upside break, which I believe is likely over the coming months. Silver is now incredibly cheap relative to its historical drivers, and history shows it has the potential to spike higher should stagflation concerns mount. The iShares Silver Trust ETF (NYSEARCA:SLV) offers a reasonably priced vehicle to benefit from this strong risk-reward outlook.

As the largest silver ETF with a net asset value of USD14.1bn and 552 thousand ounces of silver under management, it has tracked the price of silver with a median 12-month tracking error of just 0.48%. The fund charges an expense fee of 0.50%, which is comparable to other precious metal funds, and is much lower than the spreads available on the physical metal. After recording persistent outflows following the Reddit-inspired peak of February 2021 to the low of January 2022, during which assets under management fell by over 22%, we have since seen a slight recovery in demand for the ETF.

Price action in the ETF has improved significantly over the past few months following the hold of key support at the USD20 area. My view over the past year has been that the lengthy period of sideways trading since mid-2020 would ultimately mark a consolidation ahead of a continuation of the long-term bull market and this remains my base case.

SLV ETF Price (Bloomberg)

Silver’s Fundamentals Continue To Improve

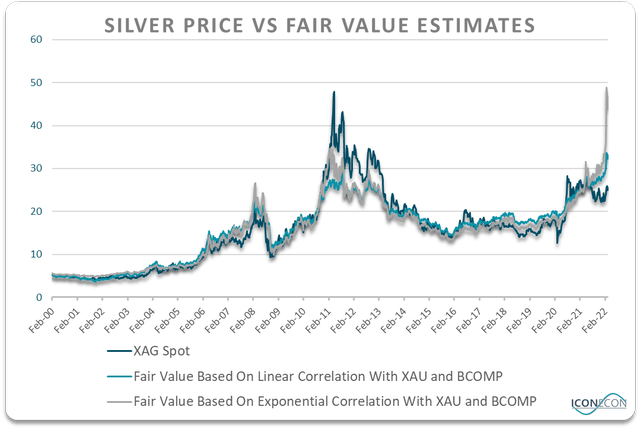

From a fundamental perspective, while silver prices have risen from their lows, the outperformance of gold and the broader commodity complex has left the metal at a near-record level of undervaluation. Silver prices tend to track the performance of gold and the broader commodity complex due to the metal’s dual role as a monetary and industrial metal, and while the commodity complex has exploded higher since the Russian invasion of Ukraine, and gold prices have closed in on their 2020 highs, silver has lagged significantly. As a result, depending on whether we use linear or exponential correlations, silver’s fair value appears to be somewhere in the USD30-50/oz range.

Bloomberg, Author’s calculations

As I argued back in September 2021, such periods of undervaluation have turned out to be great buying opportunities in the past (see ‘Silver Selloff: A Bargain Or Coming Commodity Crash? Maybe Both’). Indeed, the average 12-month return for silver following periods where the metal has been 20% undervalued or more has been 18.3%, compared to a 6.0% 12-month return in all periods and a 3.5% return during all other periods. The most recent example was the height of the March 2020 Covid crash, which led to a doubling of silver prices over the next 6 months.

A History Of Major Rallies Once Fundamentals And Technicals Align

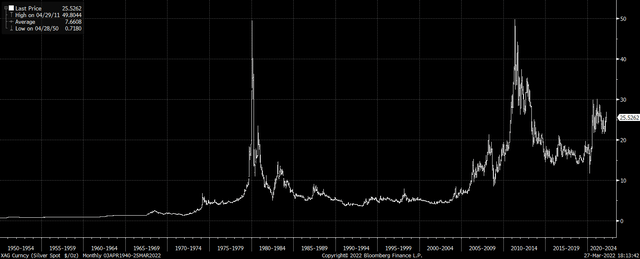

While another doubling of the silver price to USD50 over the coming months may seem on the aggressive side, the metal has a history of huge rallies once fundamental strength is matched by a bullish breakout. For instance, the late-1970s super spike driven in part by stagflation fears; the 2007-2008 spike driven by the broad commodity price bubble; the 2010-2011 spike fueled in part by the expansion of quantitative easing; and the 2020 spike, driven by the inflationary policy response to the Covid pandemic.

Long-Term Silver Price (Bloomberg)

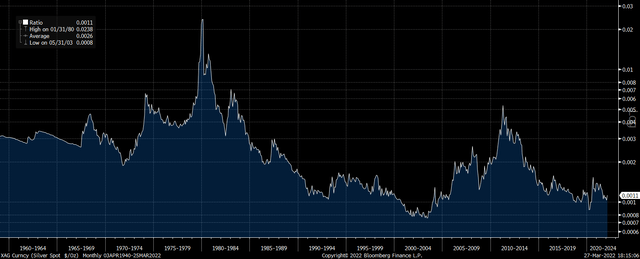

With the rise in U.S. inflation showing no sign of ending amid continued rapid growth in government debt and money supply, the case for a stagflation-driven silver price rally is easy to make. Should we see silver break out above the USD30 level, a self-reinforcing rally would become increasingly likely. Even a doubling of the silver price would still leave the metal significantly below its long-term average when measured against U.S. money supply.

Silver Price Deflated By U.S. M2 Money Supply (Bloomberg, Federal Reserve)

Summary

Silver has gained 16% since my previous bullish article on February 3, but the rally in gold prices and the broad commodity complex has left the metal even more undervalued than it was then. Given silver’s tendency to embark on significant price spikes once strong fundamentals align with technical breakouts, a significant rally is becoming increasingly likely amid heightened U.S. stagflation concerns. While many silver investors have voiced legitimate concerns over the SLV ETF, particularly since the prospectus was changed in February last year (see ‘SLV About To Skyrocket, And That’s Why You Should Buy Physical Silver Instead‘), the ETF has a proven track record of tracking the silver price with minimal tracking error and expense ratio.

Be the first to comment