EXTREME-PHOTOGRAPHER/E+ via Getty Images

There is an old saying that the market generally got “eleven of the last seven recessions correct” because Mr. Market worries far too much about things that may not happen. Even when they do happen as the market expects, they are rarely as bad as the market expects. SL Green’s (NYSE:SLG) common stock is already at pandemic levels. Yet much of the country has moved on from the pandemic. Life is returning to normal. The pandemic issues are unlikely to recur. But you would not know that from the stock price which is at panic levels and heading lower.

Today this REIT did announce a 12.9% dividend cut to $.2708 from $.3108 on the monthly payout effective of course with the next payment. The purpose of the cut is to retain cash to repay debt is a rising interest rate market. But the market was prepared for far worse.

Rising interest rates have brought on a fear of another economic crash, even though most forecasts are for a recession, not a depression. But most measures, economic activity is sky high even if the economy meets or will meet the textbook definition of a recession. So, depending upon the definition you use, this economy may have one of the highest levels of activity during the book definition of a recession ever. The reason is that the market is going from overheated to hopefully down to full blast.

If that is the case, then the stock price of SL Green is a wonderful bargain. Many look at REITs as a variable distribution entity because they worry what rising interest rates will do to cash flow in the future. Management just stated that they have hedged the variable interest debt where possible during the conference call. So. I was prepared for a far larger cut in the distribution, and if it happens, I will not be upset. By the time it does happen, the market will likely be looking at a recovery, which would send the yield way down.

I happen to love a crisis that sends a variable distribution entity’s stock into a tailspin because the time to consider an investment in a variable distribution entity is when the distribution is low, or Mr. Market perceives that distribution will be low in the future. Since the market worries enough to get “eleven of the last seven” recessions correct, there will likely be plenty of stock price declines for fears that never materialize.

That meant that the conference call subject changed to chasing down “loose ends,” which usually means unconsolidated debt that the company is not managing. Again, Mr. Market was seeing ghosts of past inflation and imagining that this time it would be very damaging.

Just as a stock price often worries about a depression that does not happen. So, does Mr. Market often get excited about a recovery when it gets underway. The key is to determine if future earnings got damaged in the downturn. That is a very unlikely scenario. Add to the fact that 2020 is unlikely to repeat and the upside potential far exceeds the downside potential in all but the most unlikely scenarios.

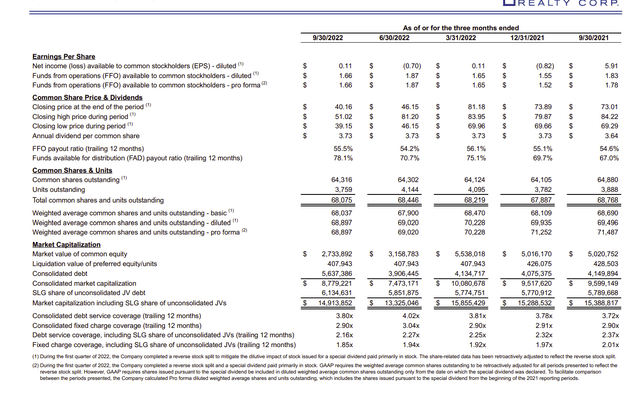

Earnings And Key Ratios Holding Up

So far there is no evidence of a problem.

SL Green Operational Summary Third Quarter 2022 (SL Greeen Third Quarter 2022, Earnings Report)

As shown above, the Funds From Operations reported in the latest quarter appears to be holding up rather well. Admittedly, there are only five quarters there. But then again, what is there has to be better than what happened during the pandemic. This time around, there is no threat to shut things down.

The rising interest rate environment is causing management to re-evaluate the optimum amount of debt. That may mean a projection of lower cash flow. But the stock price is already at 2020 levels. Things may go downhill in any downturn. But 2020 was far worse than anything we face now.

It is clear that there was an asset bubble underway in the real estate market. This company really operates in the commercial market in a part of the market that probably has a very different purchasing and selling crowd. Therefore, values in the portfolio may not have been affected quite the way that the retail housing market was affected.

If anything, the market became very soft during the pandemic. That softness was in the process of reversing when the Federal Reserve began to raise interest rates. There is every chance that the trend to work in the office is continuing even as the economy cools down.

Right now, the latest figures show good demand in some areas and maybe some softness in other areas. But this company is large enough and financially strong enough to bid for some of the best office locations in New York City. Unfavorable trends may not hit home as hard as they do for some other landlords not in prime locations.

Bank Line

The REIT just closed on a bank line. Management stated throughout the conference call question and answer session that the REIT has access to credit markets. What management has been doing is focusing upon taking out the risk of rising interest rates to protect the cash flow.

Another market perceived risk is that management will not be able to protect the debt from rising interest rates long enough (or hedge enough debt). This is something that management addressed several times during the conference call in several different ways.

There are always going to be loose ends. The question is how badly those loose ends will hurt. This time around, it appears that the interest rate increases will probably end within 6 months or so. Those of us who lived through the 1970’s know that Paul Volker (past Federal Reserve Chairman) has many times noted the lessons learned in taming that inflation. The current round of inflation is nothing like that. Therefore, it should not take as long to resolve the inflation issue. Even if the Federal Reserve brings about a recession in the process of taming inflation, a recession is generally a very tame version of a depression that is also usually short term.

The Future

SL Green is in fine financial shape with decent debt ratio coverage shown above and Funds Flow that appears to be holding up reasonably well. The market fears a deep recession or possible depression. The stock price has already reached levels last seen in fiscal year 2020 even though pandemic challenges are noticeably absent this time around.

Should inflation persist, this company has a lot of fixed rate debt that is locked in. Long term, inflation would likely on balance prove to be a blessing.

This company has found a way to retain some cash by taking advantage that allows for a special dividend to be issued in stock. Management then declares a reverse split to put things back the way they were before the stock dividend.

Having that extra cash allows for considerably more floating rate debt to be paid off. That gives this REIT some flexibility that some competitors do not have. Therefore, refinancing some floating rate or even new debt at a higher rate can be offset with the repayment of debt or even selling some assets for a gain and using those profits to repay some debt.

This management increased the base dividend during the pandemic. That should calm some market fears about the future. This time around, the base dividend will decline. The difference is rising interest rates combined with an accompanying decision to repay more debt rather than refinance that debt. Note that the decision on debt can reverse when interest rates come back down.

Admittedly, a multi-year roaring inflation problem combined with a recession or worse could pose a longer-term problem to the base dividend. But there are really no forecasts out there from reliable sources for such an event at the current time. Instead, it is far more likely that the stock is at bargain levels and will recover as the inflation issue is dealt with. That would provide decent recovery potential for an investor as this stock would double from current levels to get anywhere close to previous highs.

Remember the old saying “Buy straw hats in January”.

Be the first to comment