franckreporter

Skillsoft (NYSE:SKIL) recently reported lower-than-expected Q2FY23 results with both revenues and earnings coming in short of the consensus estimates. While revenue of ~$140.57 mn missed consensus estimates by ~$26.83 mn, GAAP loss per share of 74 cents was worse than consensus estimates by 54 cents. The company also lowered its adjusted revenue, bookings, and adjusted EBITDA guidance.

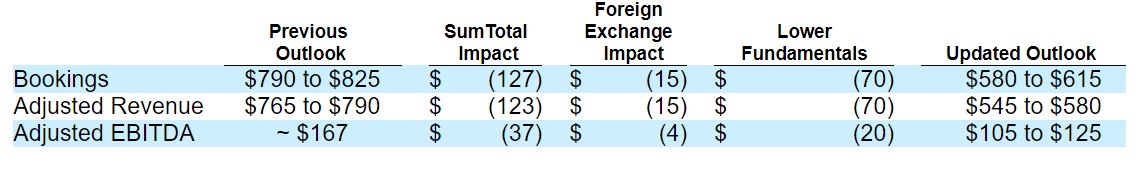

Skillsoft’s Revised Guidance (8-K Filing)

The sale of SumTotal, foreign exchange impact, and weak fundamentals especially in the company’s Global Knowledge business were the primary reasons behind this lowered guidance.

Skillsoft – Revenue Analysis and Outlook

The company’s total adjusted gross revenue from continuing operations declined 5% Y/Y for Q2 FY2023. Segment-wise, Skillsoft’s content business which consists mostly of recurring or subscription revenue grew ~3% Y/Y and the Global Knowledge business, which is transactional in nature, declined ~19% Y/Y. Bookings growth showed a somewhat similar trend with Skillsoft Content bookings growing ~3% while global Knowledge bookings were down 27% resulting in an overall booking decline of ~10%.

The majority of the booking decline which the company witnessed in its Global Knowledge business was due to changes in training programs at two large technology clients. The strengthening of the USD against other major currencies also led to ~6% of forex headwinds in Global Knowledge revenues as well as bookings. While I understand the forex impact, what bothers me is the company losing clients or getting reduced work from them. I don’t think what happened with the two large clients in the Global Knowledge business is a one-off thing. There appears to be an execution issue with the company. In the company’s Q1 2023 earnings call as well, the company reported a similar loss of a large customer for SumTotal’s payroll solution business (SumTotal wasn’t divested at that time.)

If one looks at management commentary from their recent conference calls, they have often emphasized an opportunity to cross-sell multiple offerings to their existing clients as a meaningful future growth driver. However, if they are having trouble retaining some of their biggest customers, it raises doubts if their offerings are compelling enough to cross-sell. Similarly, many analysts often refer to their scale and diverse offering as a competitive advantage. But if the cut-throat competition in the fragmented online training industry is causing them to lose clients, I am not sure how much of a competitive advantage Skillsoft’s size and diverse offerings are actually providing.

Looking forward, I expect revenue declines to worsen further over the coming quarters given the booking declines in the Global knowledge segment and overall business have outpaced revenue declines in Q2. Further, while the Skillsoft Content business has remained resilient so far, if the global economic headwinds persist and companies resort to cost-cutting measures, it might come under some pressure as well.

Profitability and Leverage

The company’s adjusted EBITDA from continuing operations also declined 5% Y/Y from $34.3 mn to $32.6 mn in line with revenues. Forex headwinds played a major role in this decline and on a constant currency basis adjusted EBITDA was up ~1% Y/Y. The company’s Skillsoft Content business has relatively higher incremental margins than the Global Knowledge business. So, growth in this business supported profitability. However, as discussed above, if the global economic headwinds continue and the Skillsoft Content business also gets impacted, we might see a steeper decline. While it has not happened yet, there is a great deal of uncertainty in the market and I am not too optimistic about adjusted EBITDA growth prospects.

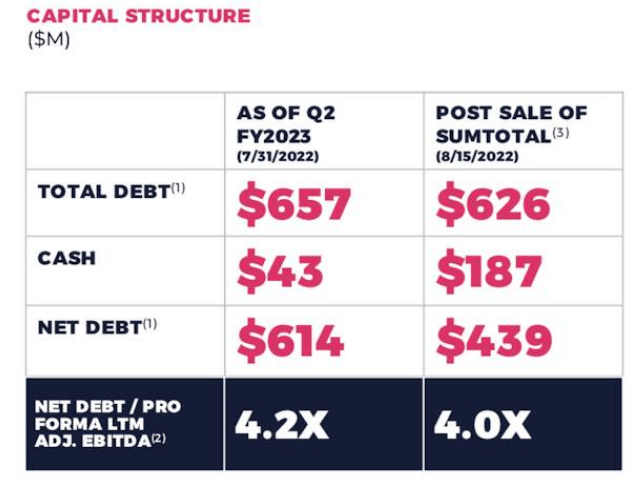

In terms of capital structure, the company had a net debt to proforma LTM adjusted EBITDA of ~4.2x at the end of the last quarter and if we include the proceeds from the SumTotal divestiture which was completed in August, the company’s leverage ratio was ~4.0x.

Skillsoft’s Net Leverage (Company Presentation)

I find the company’s balance sheet a bit stretched, especially given the possibility of its adjusted EBITDA declining. While the company has got some cash infusion post divestiture of SumTotal and management has announced a ~$30 million share buyback, I am not too excited about it. I would prefer this money be used for paying down debt or re-investing in improving the content. In the past, the company has suffered from a high debt load burden which prevented it from investing in content which further worsened its competitive position and financials, thus, resulting in a vicious cycle. The company had to file a prepackaged chapter 11 bankruptcy as a result. It was then recapitalized through a SPAC transaction and got listed. Given the highly competitive nature of the industry, high leverage and the likelihood of the company’s profitability being under pressure, I believe this buyback only adds to the risk.

SKIL Stock Valuation and Conclusion

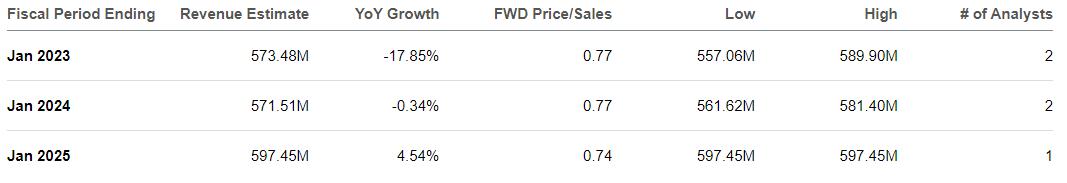

If we look at the company’s sales growth, analysts are expecting it to decline over 17% in the current fiscal year (FY23) due to SumTotal’s sale, forex headwinds, and worsening fundamentals. It is expected further decline in FY24 and grows in the mid-single digit in FY25.

Skillsoft’s Revenue Estimates (Seeking Alpha)

So, we are not talking about a high-growth company here and investors looking for growth are much better considering the companies like Coursera (COUR) or Udemy (UDMY) which are expected to grow their revenues at over 20% Y/Y for the next several years. While Coursera and Udemy are trading at higher EV/Sales (1.97x and 3.20x, respectively) compared to Skillsoft’s ~1.5x, they have much better growth prospects.

In terms of EV/EBITDA, SKIL is trading at ~7.22x if we take the midpoint of the current year’s management guidance. While it is not expensive, I believe it is best to be on the sidelines until the bottom is in place and the company returns to its growth trajectory again. Hence, I have a neutral rating on the stock.

Be the first to comment