-slav-

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 30th.

Real Estate Weekly Outlook

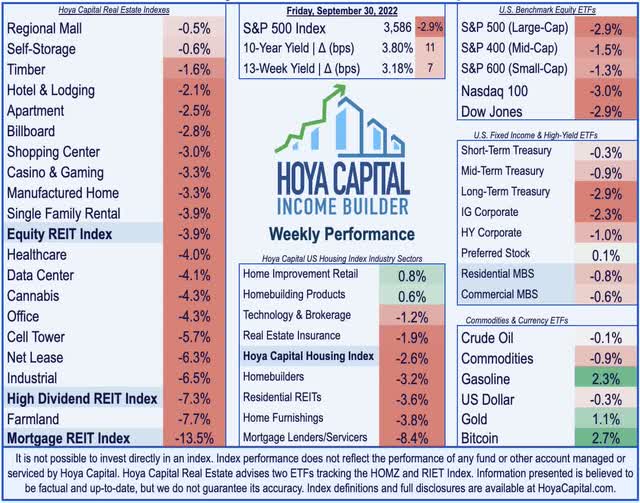

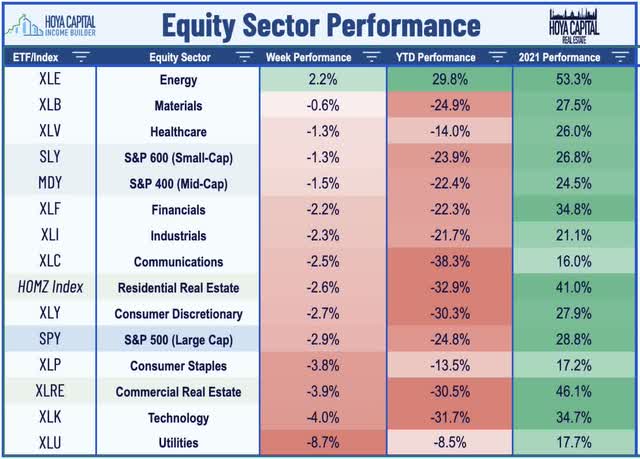

U.S. equity markets and bond markets continued to slide this past week – deepening a historic rout in which both stocks and bonds posted three-straight quarters of declines for the first time ever – as Federal Reserve officials doubled down on hawkish rhetoric despite increasingly-apparent tremors of market instability. Citing the need to protect their “credibility” following several years of woefully off-the-mark economic forecasts, FOMC members were unified in their endorsement of a “higher-for-longer” policy while expressing little acknowledgment of real-time market conditions that show a swift cooldown in price pressures and emerging market instability, underscored by an emergency intervention this week by the Bank of England.

Hoya Capital

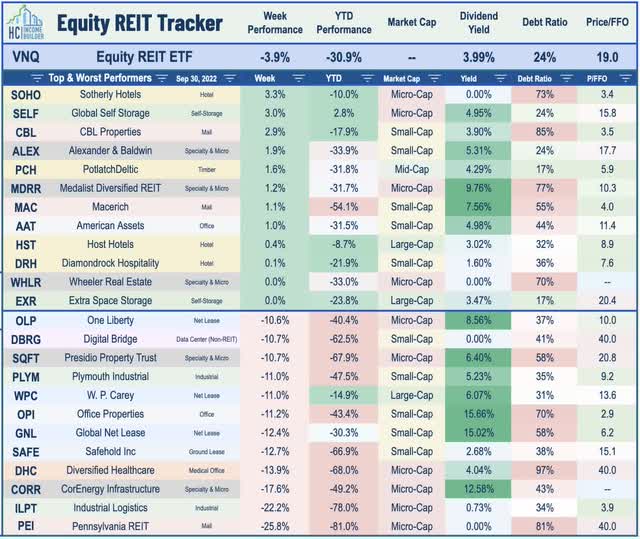

Closing the month and quarter at the lowest levels in over two years, the S&P 500 dipped another 2.9% on the week – its fifth decline in the past six weeks – while the tech-heavy Nasdaq 100 dipped another 3% to drag its year-to-date drawdown to over 30%. The Mid-Cap 400 and Small-Cap 600 posted more muted declines of roughly 1.5% each. Real estate equities were sharply lower again this week as long-term interest rates continued to surge. The Equity REIT Index dipped 3.9% on the week with all 18 property sectors in negative territory while the Mortgage REIT Index plunged 13.5%. Homebuilders dipped another 3% as the 30-Year Mortgage Rate briefly topped 7% while national home prices posted their first monthly declines in a decade.

Hoya Capital

The carnage across bond markets deepened as well with the 10-Year Treasury Yield briefly breaching 4.0% before posting its largest-single-day decline in a decade after a historic plunge in the British pound forced the Bank of England to launch emergency quantitative easing measures – the first major central bank to pump the breaks on the aggressive tightening measures. The Cboe Volatility Index – a measure of stock market volatility – surged past 30 for the first time since June while the BofAML MOVE Index – a measure of interest rate volatility – soared to levels last seen in March 2020. Crude Oil prices ended the week flat as global demand concerns negated the upward pressure from disruptions caused by Hurricane Ian and a worsening energy supply crisis in Europe amid an increasingly volatile geopolitical dynamic. The U.S. Dollar retreated slightly from two-decade highs following a mixed slate of economic reports ahead of a critical week of employment data.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

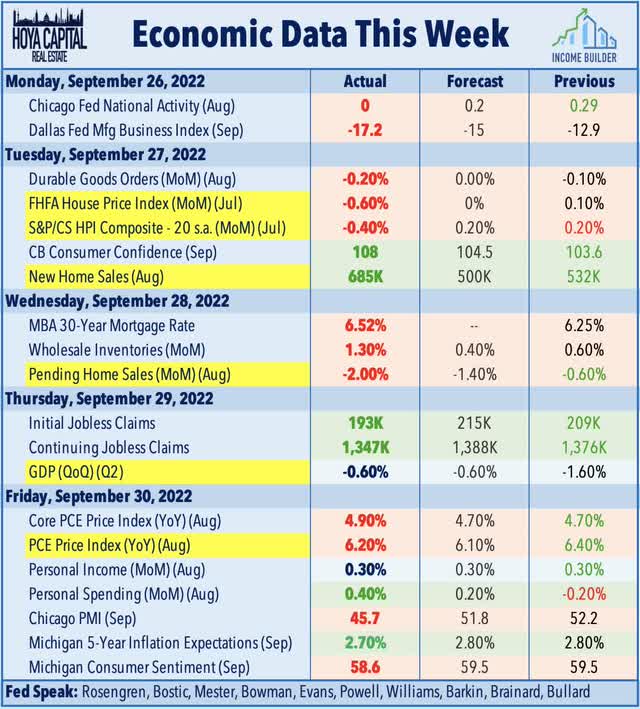

The U.S. housing sector continues to bear the brunt of the impact of extreme monetary tightening as the average rate on a 30-Year fixed-rate mortgage surged to 6.70% this week in the Freddie Mac Index and eclipsed 7% in the Mortgage News Daily Index – the highest rates in over two decades. Spotlighting a paradox in modern central bank theory which holds that raising the cost of borrowing results in lower inflation, the monthly mortgage payment required to buy the average-priced home in the United States has nearly doubled over the past twelve months. Naturally, home sales have slowed dramatically over the past two quarters and while New Home Sales data this week showed strength in August resulting from the pull-back in rates earlier in the summer, the extreme magnitude of Fed tightening over the subsequent two months suggests continued downward pressure on home sales.

Hoya Capital

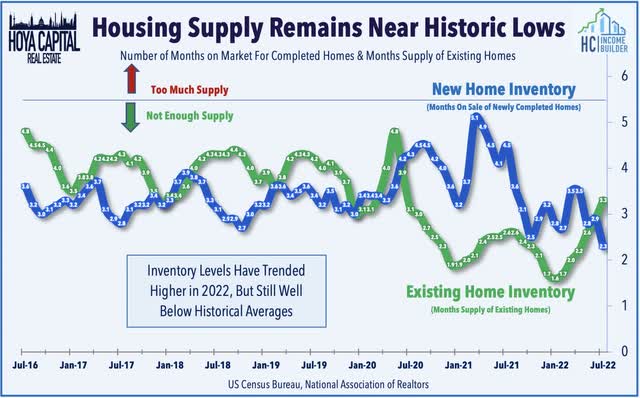

Exposing another paradox in the central bank approach, the attempt to tame housing cost inflation over the near-term by targeting the demand-side is likely to contribute to a higher long-term level of housing inflation through its effects on the supply side. Home price and rent inflation has been driven primarily by lack of housing supply resulting from a decade of historic underinvestment in new home development, and the higher rate environment has rapidly cooled the pace of new development – particularly in the single-family segment. Symptomatic of this dynamic, housing inventory levels have remained near historic lows despite the sharp drop-off in demand over the past several months. The New Home Sales report this week showed that in August, the Median Number of Months on the Sales Market for Newly Completed Homes stood at just 1.7 months – the lowest-level on record.

Hoya Capital

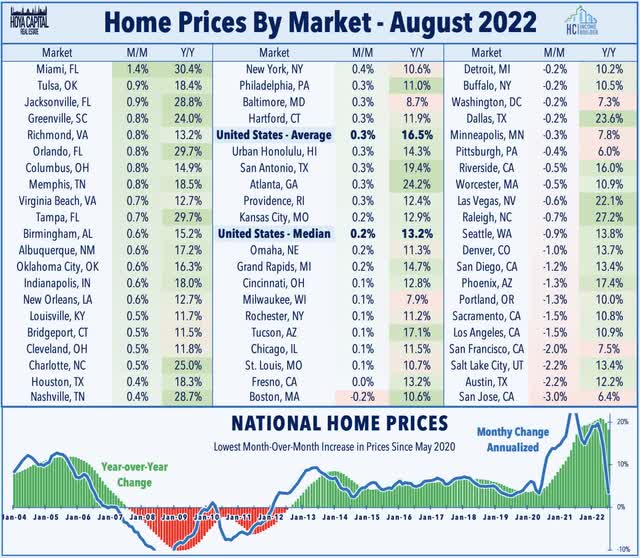

Low inventory levels should help to contain the potential downside in home values – particularly if mortgage rates moderate into year-end or if employment markets remain hearty – but an increasing number of housing markets in the U.S. are now seeing home price declines for the first time in a decade. The Case-Shiller US National Home Price Index – which lags current market conditions by about 3 months – declined 0.2% in July from the prior month, which was the first month-over-month decline since February 2012. On a year-over-year basis, home values were still 15.8% higher than July 2021, but notably, the slowdown from 18.1% in June was the steepest deceleration in the history of the S&P CoreLogic Case-Shiller Index. Data from Zillow (Z), meanwhile, showed that roughly a third of the Top 60 markets recorded negative month-over-month growth in August with particularly sharp slowdowns in California and other West Coast markets.

Hoya Capital

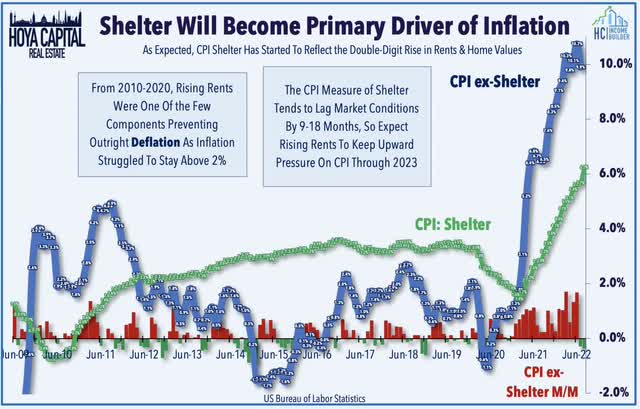

For a central bank that has increasingly benchmarked its policy success by the headline readings on backward-looking inflation indicators, whether or not the Fed will pivot in time to avoid “breaking something” with more permanent economic damage may hinge on a handful of economic reports over the next month. One critical report – the August PCE Index this past Friday – surely did not change the Fed’s course as its preferred measure of inflation accelerated in August, rising 0.3% following a decline of 0.1% in July. Like the CPI Index, however, the PCE suffers from critical issues related to the substantial 9-18 month lag in its measure of housing inflation – the largest category by weight – and the index is just now reflecting the double-digit increase in rents and home values seen last year. As a result, the category will keep upward pressure on the overall index and potentially “hide” the real-time cooldown in price pressures, exacerbating the risk of a continued monetary policy error.

Hoya Capital

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

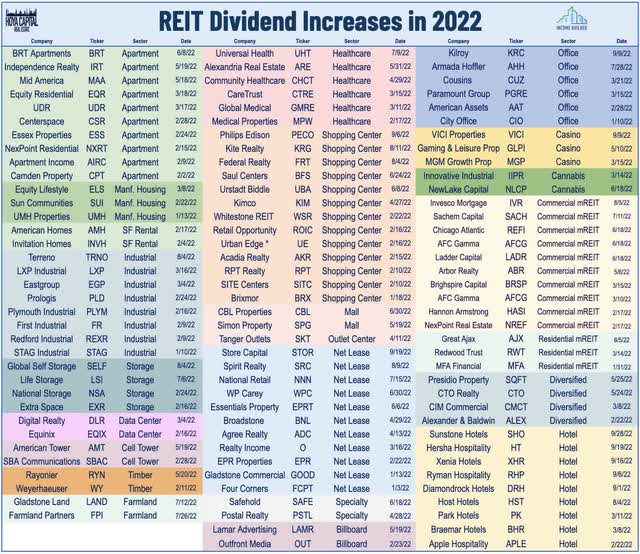

Hotels: Beginning with the relative “bright spots” amid an otherwise dismal week, Sunstone Hotel (SHO) reinstated its quarterly dividend at $0.05/share – a rate consistent with the company’s pre-pandemic dividend amount which was last paid in April 2020 and equates to a roughly 2% dividend yield. Sunstone joins Apple Hospitality (APLE) and Host Hotels (HST) as the three hotel REITs that have meaningfully restored their dividend. We’ve now seen 109 REIT dividend hikes this year – the second most on record behind 2021. Importantly, REITs have been exceedingly conservative in their dividend distribution policy since the pandemic with dividend payout ratios declining to just 65.3% in Q2 – well below the 20-year average of 80% – leaving a cushion to maintain dividends in the event of a deepening recession.

Hoya Capital

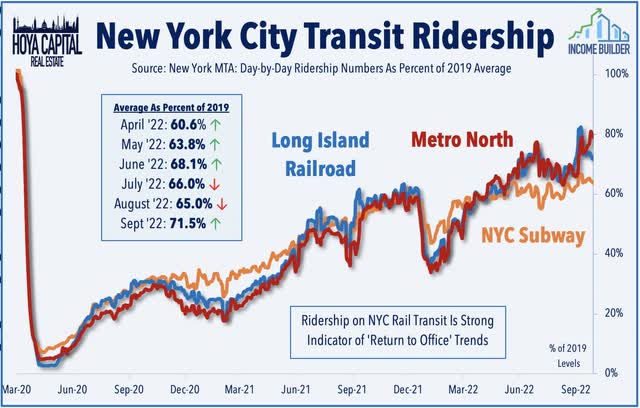

Office: SL Green Realty (SLG) was among the better performers on the week after it signed a 15-year lease for 11 floors – 350k square feet – at its flagship One Madison Avenue property to Franklin Templeton Investments. The lease follows another large 330k square foot lease to IBM in the same property which together was the second and third largest new leases signed in Manhattan in 2022. Also this week, Brookfield Asset Management (BAM) announced a large 280k square foot lease to hedge fund D.E. Shaw at Two Manhattan West. Recent data from the New York MTA shows that we have indeed seen a “return to the office” trend in the Big Apple since the Labor Day holiday. Ridership levels across Metro North and Long Island Railroad improved to roughly 75% of pre-pandemic levels in the back half of September. Recent data from Kastle Systems showed that office utilization levels increased roughly 5-percentage-points after Labor Day, while noting that it’s seeing “increased occupancy mid-week and significant drops on Friday.”

Hoya Capital

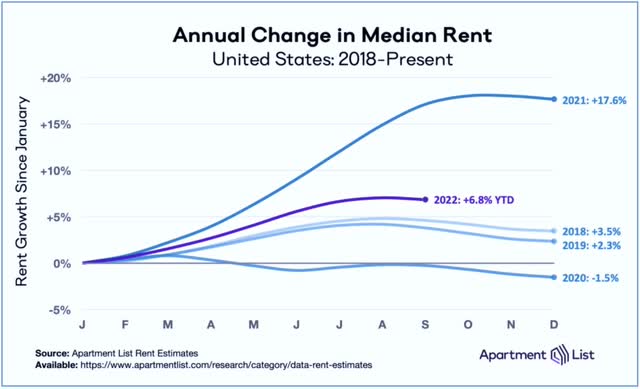

Apartments: Residential REITs also held their ground this week as investors evaluated the effects of Hurricane Ian and parsed a mixed slate of housing market data. Apartment List released their National Rent Report this week which showed that multifamily rental rates continued a trend of moderation from their historically strong levels seen earlier this year – but are still on pace for one of the strongest years of rent growth on record. On a month-over-month basis, national rents declined 0.2% in September, consistent with the seasonal trend that was typical in pre-pandemic years. Apartment List noted that even if rents continue their seasonal dip for the remainder of the year, 2022 will still likely end up being the second fastest year of rent growth in its data. Elsewhere, Washington REIT (WRE) provided a business update this week in which it noted that leasing spreads remained in double digits in August with 10.6% blended rent growth. WRE also reiterated its 2022 guidance while providing upbeat guidance for 2023 in which it expects Core FFO to increase 14% driven by NOI growth of 10%.

Hoya Capital

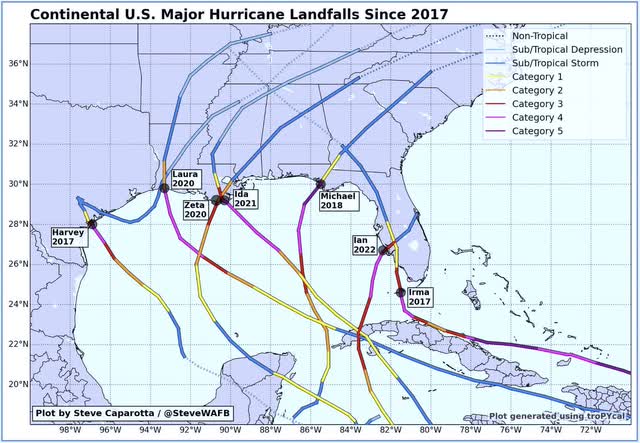

Manufactured Housing: With Hurricane Ian making landfall this week as a destructive Category 4 storm on the Southwest Florida coast, we published Impacts of Ian which analyzed the expected impacts on Equity LifeStyle (ELS) and Sun Communities (SUI) – which each own several dozen communities that received direct impacts from the storm. The storm took a similar path as Hurricane Irma in 2017, but Ian’s storm surge and wind impacts appear more significant. Florida is the largest market for MH REITs with ELS deriving over 40% of its revenues from the state while SUI derives roughly a quarter of its revenues. ELS and SUI incurred a roughly 1% FFO hit from Irma, but damages will be higher given these REITs’ recent marina investments and recent acquisitions of additional MH and RV communities in Florida. Irrespective of the impacts, we continue to expect MH REITs to deliver impressive rent growth in the back half of the year and throughout 2023 despite the broader moderation in rental rates we’re seeing in the multifamily and single-family markets as home price appreciation cools.

Hoya Capital

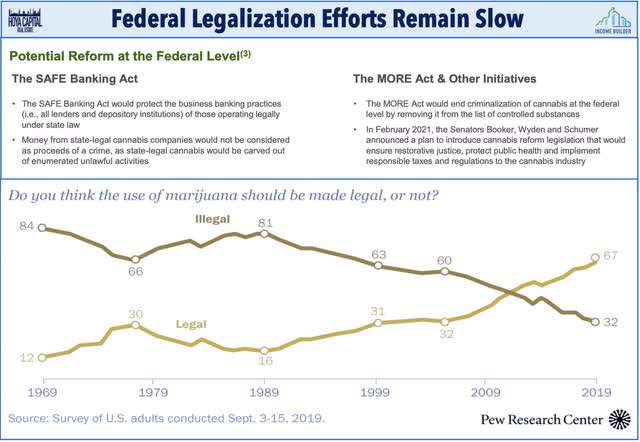

Cannabis: Just when it appeared that potential federal action on cannabis legalization was off the docket before the midterms, Senate Democrats made a renewed last-minute push this week after two years of stalled progress This week we published Cannabis REITs: Too Cheap To Get High which noted that the previously-high-flying cannabis REITs have been slammed this year on concerns over rent payment from their cannabis cultivator tenants, which have been struggling amid a plunge in wholesale cannabis prices. The 30-50% plunge in pot prices comes amid a flood of new entrants to the cannabis retail and cultivation industry and as institutional capital to multi-state operators has driven production efficiencies. Tighter monetary policy and lack of progress in federal legalization have further stifled capital raising activity and led to a handful of defaults from smaller single-state operators, including several REIT tenants, but we’ve been encouraged by recent updates which suggest that nonpayment issues remain contained and isolated to a handful of smaller single-state operators. While Federal legalization efforts remain stalled, five more states will decide on marijuana legalization ballot measures: Arkansas, Missouri, Maryland, North Dakota, and South Dakota.

Hoya Capital

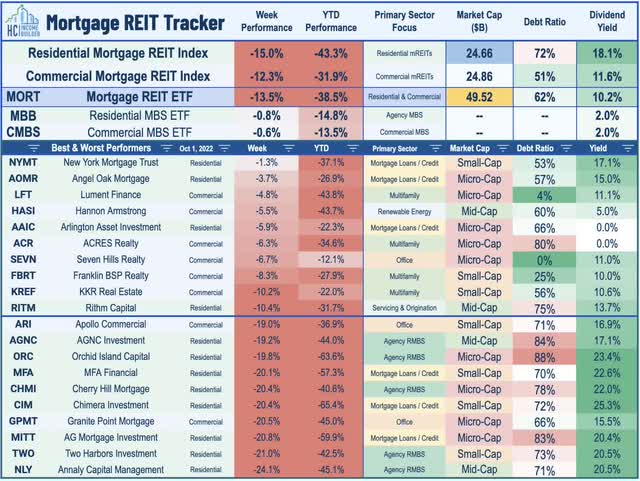

Mortgage REIT Week In Review

Mortgage REITs were slammed once again this week as a measure of interest rate volatility – the ICE BofAML MOVE Index – soared to levels that matched that of the historically violent two-week period in early March 2020 during the initial wave of pandemic-related lockdowns, sparking fears of similar “forced selling” events. More than a half-dozen mREITs dipped more than 20% on the week including Annaly Capital (NLY) – the largest mortgage REIT – as hawkish Fed commentary added to the historic pressure on mortgage-backed bond (MBB) valuations, which extended their drawdown to levels that are twice as deep as the next previous drawdown. New York Mortgage (NYMT) was a significant outperformer after announcing a “strategic repositioning” by opportunistically disposing of its joint venture equity interests in multi-family properties and reinvesting in higher-yielding assets. Invesco Mortgage (IVR) – one of the more highly-levered mREITs – dipped by more than 15% and cut its quarterly dividend to $0.65/share, becoming the sixth mREIT to lower its dividend this year compared to 13 mREIT dividend hikes.

Hoya Capital

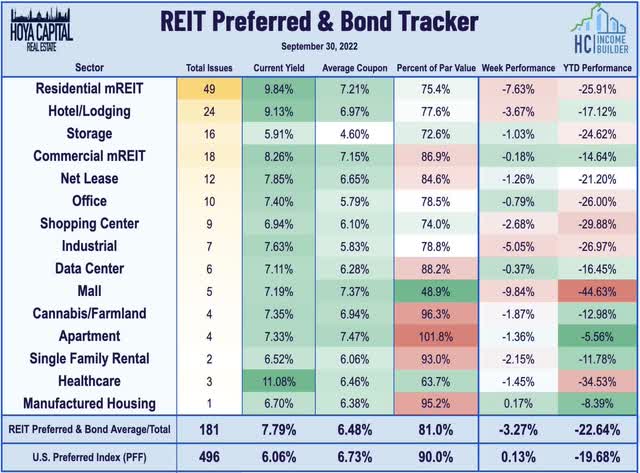

REIT Capital Raising & REIT Preferreds

The REIT Preferred Index (PFFR) dipped another 3.3% on the week – underperforming the broader iShares Preferred ETF (PFF) which ended the week flat – dragged down by sharp selling pressure across a handful of mortgage REIT preferreds. Performance patterns marked by large dispersion between otherwise similar securities were again characteristic of disruptions caused by the clashing of large passive and/or programmatic fund flows with relatively illiquid individual securities. For example, the Rithm Capital Series D (RITM.PD) gained more than 3% on the week while its RITM Series A (RITM.PA) dipped nearly 6%. The preferred series of New York Mortgage Trust saw similarly enormous performance dispersions with a 17% spread between the weekly return of its NYMT Series F (NYMTL) and its NYMT Series D (NYMTN) while a handful of other mREITs posted double-digit weekly declines.

Hoya Capital

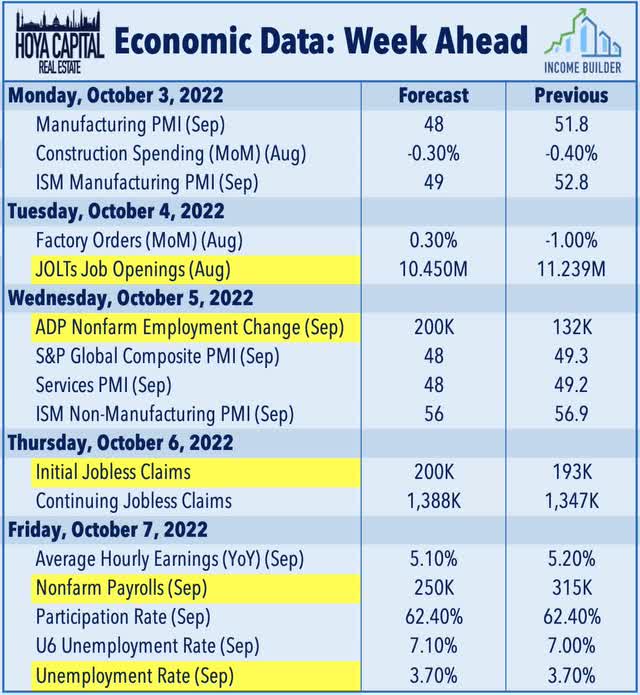

Economic Calendar In The Week Ahead

Employment data highlights another critical week of economic data in the week ahead headlined by JOLTS data on Tuesday, ADP Payrolls on Wednesday, Jobless Claims data on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 250k in September – which would be the smallest gain since December 2020 – and for the unemployment rate to stay steady at 3.70%. ‘Good news is bad news’ will likely be the theme of these reports as investors and the Fed look for signs of the long-awaited cooldown in job growth which has yet to materialize. Purchasing Managers’ Index (“PMI”) data will continue to be a major market focus – particularly in Europe and Asia – as recent reports have dipped below the breakeven 50-level.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment