Christoph Burgstedt/iStock via Getty Images

Thesis

The Aberdeen Global Dynamic Dividend Fund (NYSE:AGD) is a closed-end fund that has been in the market since 2006. The vehicle falls in the global equities risk factor and has a modest AUM of only $0.126 billion. The fund is about to get bigger by incorporating two funds from the Delaware Management Company, namely the Delaware Enhanced Global Dividend and Income Fund (DEX) and the Delaware Investments Dividend and Income Fund (DDF). The merger is still subject to shareholders’ approvals, but we believe it will go through.

Historically, AGD has posted decent (~7% annualized total returns) but has lagged its peers and the Vanguard Total World Stock Index Fund ETF (VT). There is nothing spectacular or very poor about this fund. It is just mediocre and in the middle or towards the bottom of the cohort. That is the reason behind the fund’s large discount to NAV of -10.65% and the fact that it has not traded at a premium to net asset value for over ten years. We expect for the merger to be generally positive for AGD, resulting in a larger AUM and a more focused and competitive management team. The three funds that are put together have different holdings and leverage ratios. It will be interesting to see how the new entity shapes up and the end strategy.

We expect the next period of time to be consummated by internal political machinations rather than performance optimization. New money looking to enter the space would do well to steer away from AGD until the merger is consummated, and a new strategy ironed out. There are much better peers in the space such as (LGI) and (ETO) which can be bought on dips rather than underwrite a changing fund. For investors already having bought units in the vehicle, the CEF is a Hold since it does manage to generate consistent positive returns, albeit mediocre when compared to the competition.

Analytics

AUM: $0.126 billion

Sharpe Ratio (5Y): 0.41

St Deviation (5Y): 16.8

Yield: 7.75%

Expense Ratio: 1.17%

Premium/Discount to NAV: -10.65%

Z-Stat: -0.45

Leverage Ratio: 4.7%

Annualized Total Return (5Y lookback): 7.73%

Risk Factor: Global Equities

The Merger

On August 11, the (DEX) and (DDF) funds announced that their Board of Trustees approved the reorganization of the vehicles into Aberdeen Global Dynamic Dividend Fund (the “Acquiring Fund”). As per the announcement:

It is currently expected that the Reorganization will be completed in the first quarter of 2023 subject to (I) approval of the Reorganization by the Acquired Fund shareholders, (II) approval by Acquiring Fund shareholders of the issuance of shares of the Acquiring Fund, and (III) the satisfaction of customary closing conditions.

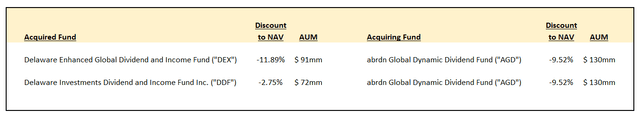

The two funds being merged into AGD are smaller in size:

The Delaware Management Company is liquidating its CEF business, so we believe the merger will go through. Ultimately, it is beneficial to AGD since it represents an elegant way to increase AUM, despite its mediocre long-term performance.

The three funds have different leverage ratios, portfolio management teams and holdings, so it will be interesting to see who ends up setting the strategy for the new combined fund and what metrics are going to be pursued. A merger is never easy, and it will force portfolio managers to be more focused on internal machinations rather than performance, so we would like to re-visit the combined fund mid next year to see where it shakes out.

Holdings

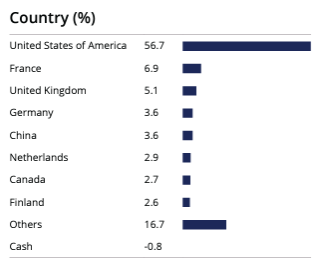

The fund is U.S.-centric:

Holdings (Fact Sheet)

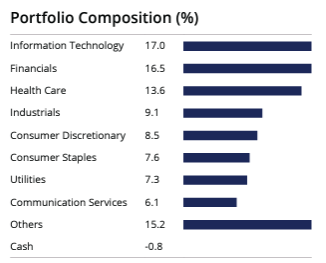

We can see that over 56% of the holdings are from corporations based in the U.S. From a sectoral standpoint, the vehicle is overweight Information Technology:

Sectors (Fact Sheet)

The top sectors in the fund are Information Technology, Financials and Health Care, which account for over 46% of the exposure.

The top holdings in the fund are large multinational companies:

Top Holdings (Fact Sheet)

There are 87 names in the portfolio, and the individual name exposure is fairly granular, with no security accounting for more than 5% of the fund.

Performance

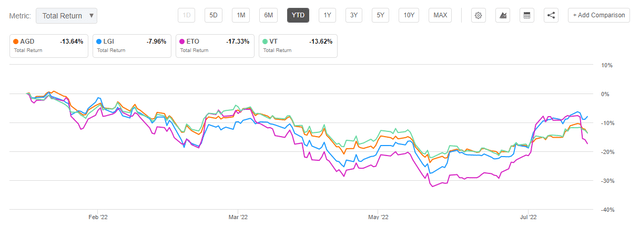

The fund is down more than -13% year to date, matching the index:

On a 3-year lookback period, the CEF has a middle of the cohort performance:

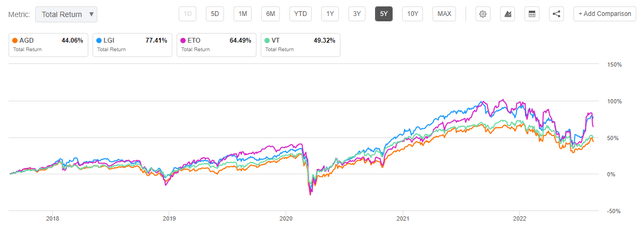

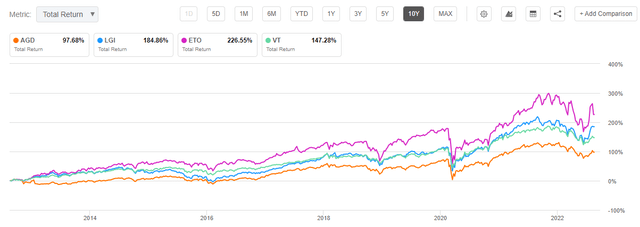

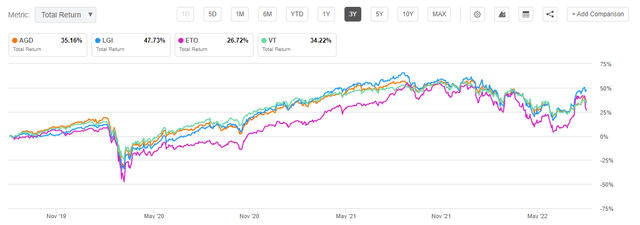

We can see that AGD matches the index’s performance on the 3-year lookback but fails to outperform. Longer term, the fund lags:

5-Y TR (Seeking Alpha) 10-Y TR (Seeking Alpha)

Both 5- and 10-year lookbacks show the fund underperforming. It seems that while the managers can speculate certain short-term trends, they are unable to generate consistent long-term alpha for the fund here.

Premium / Discount To NAV

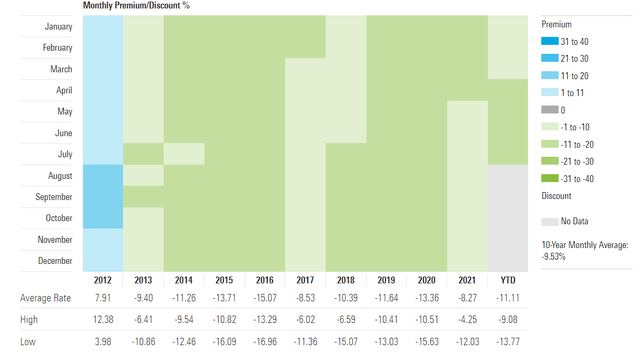

The fund has consistently traded at discounts to NAV in the past:

Premium/Discount to NAV (Morningstar)

We can see from the above chart, courtesy of Morningstar, that since 2012 the fund has effectively traded only at discounts to NAV, discounts that average -10%. We believe this is due to the CEF’s mediocre performance, the vehicle being unable to match or beat a world stock proxy like the Vanguard Total World Stock Index Fund ETF (VT).

What is interesting from the above table is to note that since 2012, the CEF has not traded at a premium to net asset value. The best it could muster was a discount to NAV of “only” -4.25% achieved in 2021 on the back of a zero rates environment. The fund does not really fluctuate from a discount to NAV performance like other CEFs – you do not see massive +/- 10% swings here. Do not expect a negative performance from a widening of the discount during market selloffs here.

Conclusion

AGD is a global equities CEF with fairly mediocre long-term results. While the fund is in the middle of the return cohort on a 1- and 3-year lookback periods, longer term it fails to keep up with the competition or a cheap world stock proxy ETF like the Vanguard Total World Stock Index Fund (VT). This is the reason for which AGD has been trading at a sizable discount to net asset value for the past decade, and we expect a discount as long the performance lags. The fund is set to absorb two smaller vehicles from the Delaware Management Company (namely DEX and DDF), a merger which is going to double the fund’s AUM. Overall, this is a positive for AGD since a higher AUM is more beneficial, but long-term performance is what matters. We are hard-pressed to see any alpha generation here, and we would only consider this fund on the back of very large discounts to NAV. Given the upcoming merger and re-shuffling of staff, strategies and allocations, we are in the “hold-and-see” camp here until mid next year. For investors already having bought units in the vehicle, the CEF is a Hold since it does manage to generate consistent positive returns, albeit mediocre when compared to the competition.

Be the first to comment