Scott Olson/Getty Images News

The premise

The company was founded by Lyndon Hanson, Scott Seamans, and George Boedecker in 2002 primarily to create boat shoes. Crocs (NASDAQ:CROX) had a significant breakthrough when people began to see these shoes on the feet of celebrities such as Al Pacino and Matt Damon. From then on, counterfeits began to circulate at much more affordable prices. With the 2008 crisis, the company lost $185 million and began to incur debts: employee layoffs and warehouses full of unsold goods were the norms. As a result, a period of economic crisis began for the company, closing in 2014 with a 44% profit drop, leading to an actual collapse. Since 2018 the company has carried out a business turnaround: it invests in online advertising and initiated numerous collaborations with famous people and brands. In 2021 Crocs acquires the Italian company HeyDude.

The new marketing policy

A relatively clear picture can be drawn by reconstructing the marketing choices of the last few years carried out by Crocs. In 2018 Crocs collaborated for the first time with one of the most influential brands in the world, Balenciaga. This first collaboration was followed by others, including famous faces from the music world, such as the collaboration with singer Post Malone in 2019, the collaboration with South American singer Bad Bunny in 2020, and the second collaboration in 2021 with Justin Bieber.

But the most effective marketing choice in recent years was the one carried out during the pandemic. In 2020, Crocs donated more than 860,000 pairs of shoes globally – worth $40 million – to health workers. This gave the company unprecedented national visibility. In addition, the values attributed to the product have also changed in consumers’ perceptions: the value of cleanliness and safety has been added to the comfort.

To summarize the company’s brand policy, it is helpful to read the words of the CEO of Crocs, Andrew Rees: “Our goal is not to make the haters love the brand; it’s to exploit that extrinsic tension because it creates opportunity, it creates PR, it creates media, it creates interest. It creates a lot that would cost you a fortune to buy in other ways.”

Jibbitz™ customization

Jibbitz charms can be added to shoes to personalize the product. These charms range in price from $5 to $20 for more complex sets and drive high levels of engagement and frequency of purchase because they allow the shoe to be transformed depending on the contexts and moods of the buyer. Crocs enjoy licensed partnerships with Disney (Marvel and Lucasfilm) Warner Bros, Nintendo, and Nickelodeon.

Acquisition of HeyDude

The most important event that marked Crocs’ 2021 was the announcement of the decision to acquire the Italian company HeyDude (the acquisition was later completed on February 22, 2022). HeyDude produces shoes that look like contemporary, modern shoes while offering the comfort of slippers. Thus, the comfort of footwear is also a hallmark of Crocs’ famous clogs.

The acquisition was financed through a $2.0 billion Term Loan B maturing in 2029 and bearing interest at SOFR (with a 0.50% SOFR floor) plus 3.50%. In addition, Crocs increased commitments under its Senior Revolving Credit Facility by $100.0 million for a total of $600.0 million. They drew down $50.0 million under the Senior Revolving Credit Facility to finance the balance of the acquisition cash consideration. HeyDude is expected to achieve revenues of approximately $700-750 million, including the period before the closing of the acquisition, and $620-670 million on a consolidated basis as of February 17, 2022.

The acquisition of HeyDude has been perceived very negatively by the market, and, since the announcement, Crocs shares have lost more than 65%. Investors are concerned about the enormous debt the company has taken on to finance the acquisition. A period of rising interest rates is a severe risk to balance sheet strength. However, this acquisition solves a significant problem for Crocs: poor diversification.

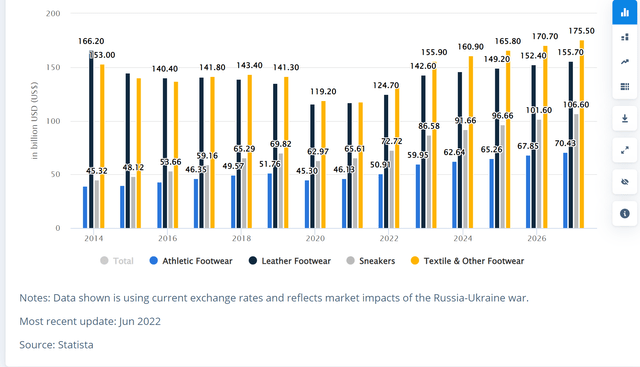

The footwear market

The global footwear market is challenging to frame: first, it must be divided into Athletic Footwear, Leather Footwear, Sneakers and Textile & Other Footwear. Often companies operating in this sector focus on only one or two of these markets. Crocs, in particular, wants to become the leader in the sandals market, which to date sees no one company excel clearly over the others.

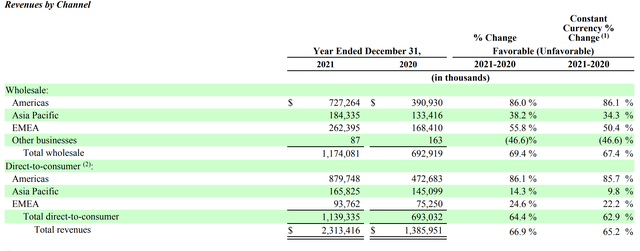

Footwear market revenue is $381.90 billion in 2022, and analysts expect annual growth of 5.88% (CAGR 2022-2027). Most of the revenues are generated in the United States ($85.84 billion in 2022), which is also the primary market for Crocs. Crocs had revenues of $727 million in the Americas, compared to $184 million achieved in Asia (where the main markets are Japan, South Korea, and China) and $262 million in EMEA. Market penetration by Crocs is therefore very shallow, and there is plenty of room to grow, particularly in North America and Asia, where the brand is highly valued.

An uncertain economic environment

The past six months have been very problematic for the economy. Rising energy costs have negatively impacted transportation, and the price of plastic, one of the main components of Croslite, the technology behind the clogs, has also increased in price.

Supply chain issues

One of the significant problems facing Crocs in recent months has been the closures of its factories in Vietnam and China due to coronavirus. In China, where the population is less vaccinated and more susceptible to coronavirus infections, the fall and winter could cause further supply chain disruption. The company has responded to this problem by opening new factories in Indonesia and Bosnia. Another significant difficulty is rising fuel prices. Early in the year, the company had told shareholders that to avoid slowdowns in the delivery of goods, it would increase air shipments at the expense of ship shipments and lessen the impact of the increase in the price of shipping containers. This choice, however, should be reanalyzed now that fuel prices are skyrocketing.

Rising inflation

Tuesday’s inflation data do not make investors sleep easy dreams, especially for those companies that sell discretionary goods like Crocs. Rising interest rates by the FED will also help to contract demand, partly explaining investors’ pessimism about this stock and the entire fashion sector. However, unlike other companies in the fashion industry, Crocs’ products, with their very competitive pricing (a pair of clogs sells for around $55), may be less affected by price increases and the elimination of special offers.

Crocs stock valuation

Crocs, at this time, appear particularly undervalued. The price of its stocks has fallen by 70% since November 2021, bringing a considerable decline in multiples. Right now, the company has a PS of 1.3 and a PE of 4.8, shallow values even when compared to the rest of the industry. However, the valuation again looks attractive if one looks at the company’s free cash flow yield. Investors’ concern is that the company may be in a value trap, and its earnings may decline in the coming years due to high inflation and reduced demand, as already happened during 2008. In addition, the 2 billion in debt the company has on its balance sheet for the acquisition of HeyDude makes it less attractive during high inflation rates. However, unlike then, brand perception in shoppers has dramatically improved (as evidenced by the past three years of fantastic growth), and the HeyDude acquisition has allowed Crocs to diversify its products. This is why analysts expect significant revenue growth in the coming years, with a CAGR of 14% through 2026.

Conclusions

Crocs is not without risk: Inflation, supply chain, and interest rates are the worst enemies of this investment. On the other side, however, there is a company that has delivered extraordinary results in recent years, increasing the value of its assets almost 10-fold in just four years. In addition, management has already proven its ability several times over by revitalizing a brand that seemed dead and making a significant acquisition for the company’s future growth.

Be the first to comment