Svetlana123/iStock via Getty Images

Thesis

ACRES Commercial Realty Corp. (NYSE:ACR) has been left behind due to historical defaults by previous management and it’s microcap status. New management has grown book value 33% in just 1.5 years by making significant changes to the balance sheet and utilizing a share buyback. The common shares trade at a 65% discount to their equity book value and $27.6m worth of shares been bought back in the last two years decreasing overall share count by 10.5%. An additional $12.4m is currently authorized and likely to be used before the end of the year.

Our interest is in the preferred series C shares (NYSE:ACR.PC) which currently trade at an 19.8% discount to par value and near 52-week lows. They offer a cumulative fixed-to-floating dividend with a floor of 8.625% which represents a 10.77% yield at current prices and are callable July 30th, 2024. At current prices, I’d argue the dividend is safe and the discount offers an opportunity to capture a 23% capital gains return if the stock trades at par or $25.00. I believe it’s likely the preferred will be called near July 2024 which would represent a ~46% total return in two years. As the middle piece of the capital stack, I’d argue that these shares have a margin of safety built in for the following reasons:

-

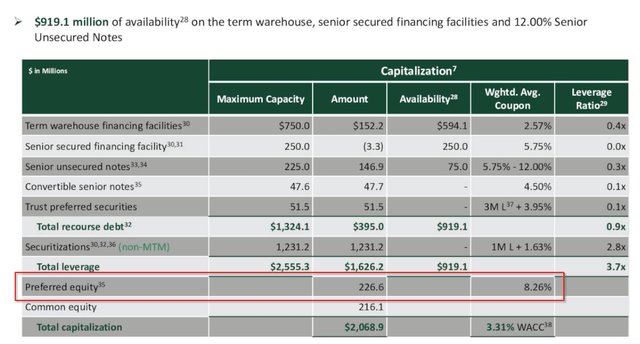

Total stockholders equity of $442.702m covers preferred equity value of $226.6m by 1.95x.

-

ACR.PC preferred is trading at a current 20% discount to par value of $25.00.

-

99.7% of their CRE loans are first lien loans secured by the properties themselves. Latest loan-to-value ratio of 72% means that 28% of equity value must be lost before principal is at risk.

-

A recession resistant 72.7% of the loan book is invested in multi-family properties which saw record property sales this past year.

-

Originated $443.6m net CRE loans in the last 12 months. This represents 23% of their current loan book and shows they are growing.

-

Active $12.6m available for share repurchase program on the common shares after $27.6m spent on shares in the last two years with a buyback yield of 10.5%.

-

Inflation protection given 99.8% of loans are based on floating rates and the preferred dividend rate is fixed-to-floating.

-

Book value has grown 33% in just 1.5 years under new management.

Dividends on the preferred have been paid consistently with new management even as they have accelerated debt refinancing, share repurchases, and grown book value overall. I believe that given changing dynamics of the business the ACR.PC preferreds offer a margin of safety for a position which is uniquely inflation hedged and recession resistant.

The Story

ACRES Commercial Realty Corp. is a managed real estate investment trust (REIT) primarily focused on originating, holding, and managing commercial real estate loans. Their stated focus is on originating transitional floating-rate CRE loans between $10m and $100m. They also use collateralized loan obligations (CLOs) to leverage returns on their loans. Management aims to generate income on the difference between their lending and borrowing rates while maintaining an appropriate level of risk. Part of why this company trades so low is that previous management did not do this so well.

ACRES Capital, the current management company took over in August 2020. Prior to this the company was known as Exantas and experienced a notice of default with regard to its corporate mortgage backed securities portfolio in March 2020. They made a decision to fully exit their CMBS position at a significant loss causing a related decrease in equity value but allowed them to reposition their focus on their CRE portfolio. Total stockholders’ equity in the company went from $556.39m at the end of 2019 to $334.38m at the end of 2020, a near ~40% reduction.

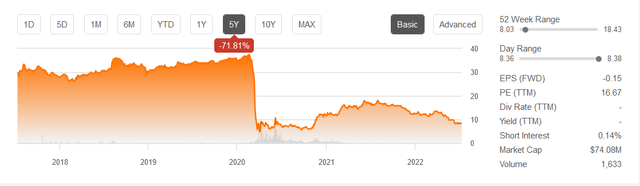

ACR five year stock chart (Seeking Alpha)

The default episode of 2020 caused a significant and lasting change in the stock price which affected the ACR.PC shares as well. The dividend on the preferred was suspended in the midst of the crisis but was reinstated and caught up within new management’s first quarter and paid out on October 30th, 2020. For those who are interested in a deeper dive on the story of the default and management change, I’d point you to this article from fellow SA contributor Brad Thomas. It was written in December 2020 and Brad suggested that the ACR.PC preferreds at $22.12 were a strong buy given their 10% implied yield and positive changes with new management and financing. Previously suspended dividends have been caught up and paid since then while also growing book value yet ACR.PC trades currently at $20.05.

The main rationale for a purchase of the preferreds then was the management shift to ACRES and improved capitalization status supporting the value of the preferreds. I’d say this thesis is strengthened today due to deleveraging overall, decreasing risk on their loan book, share repurchases, and steady origination of new CRE loans.

The Reign Of ACRES

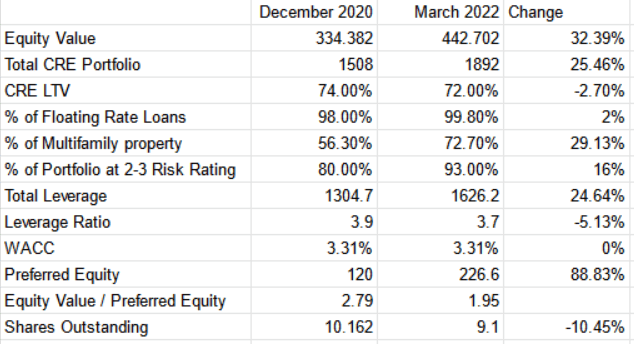

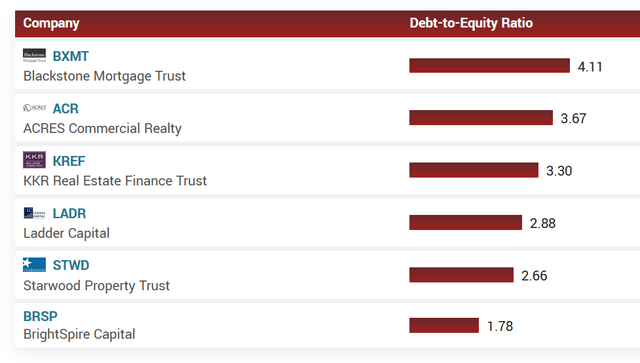

Management has been hyper focused on cleaning up their CRE loan book, managing their debt risk, and returning value to shareholders. Through this management has grown total stockholders’ equity from $334.382m to $442.702m since December 2020 which represents a 32.39% increase. This has been done predominantly by reworking their debt agreements to lower rates, growing new business, and share repurchases. Their debt-to-equity ratio has decreased from 3.9 to 3.7 in the same period which is high compared to peer group average of 3.06. The CRE loan portfolio has grown 25% showing origination and sourcing strength which is likely to continue. Additionally, the share count was reduced by 10.5% over this period.

|

Peers |

Debt-to-Equity Ratio |

|

ACR |

3.67 |

|

BRSP |

1.78 |

|

BXMT |

4.11 |

|

KREF |

3.30 |

|

LADR |

2.88 |

|

STWD |

2.66 |

|

Average |

3.06 |

Author’s Calculations

The resultant growth in book value has also come with a reduction of risk. Loan-to-value ratios are down to 72% helping to provide more protection for the company as a lender. The % of loans at 2-3 risk rating have increased to 93% with all but two of their 89 loans (97.8%) current. They’ve done all of this while maintaining the same weighted average cost of capital (WACC) which to me demonstrates they have reduced risk while maintaining their cost.

From a macro perspective, there’s been a 29% increase in multifamily properties in the portfolio which is forecast to be at 95% occupancy rates in the coming year according to research from Fannie Mae. In that same report they stated, “The multifamily sector is set for a record-breaking 2022 amid solid fundamentals and heightened investor interest. With tremendous liquidity and a growing range of debt options available, multifamily pricing will be as strong as ever.”

What this means is that ACRES is poised to take advantage of the growing market here. Of note is that Oaktree Capital Management (of Howard Marks fame) who own 8.81% of common shares and warrants released a paper outlining a case for private debt in real estate investing in November 2020. This paper was released just two months after Oaktree participated in a $375m financing agreement where they became owners in ACRES.

Two pieces make up the backbone of their thesis and I think provide a strong backdrop for ACRES moving forward.

-

Annual maturities of $400-450b of CRE loans per year for the coming years. This will drive new origination.

-

Lending standards have increased among banks meaning they are not able to compete in the space as much. Less competition is likely to drive more attractive rates.

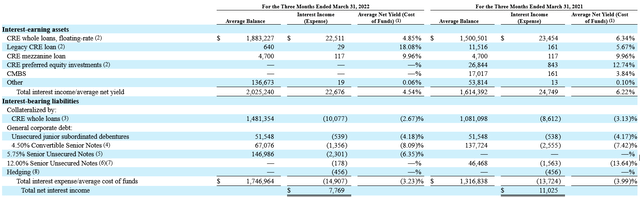

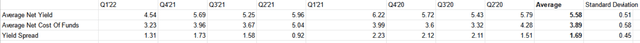

ACRES has grown their CRE portfolio significantly in just a year and a half demonstrating their ability to originate loans in the current environment at terms they see as favorable. Looking at their most recently quarterly filing we can see that average net yield of 4.54% and average cost of funds at 3.23% creates a spread of 1.31% and an interest income of $7.769m for the quarter.

The spread has declined from 2.23% achieved in the same quarter last though it is within one standard deviation of the two year quarterly average of 1.69%. This spread is an important metric to monitor moving forward to understand gauge management’s capability of this balancing act.

With net liquidity at $172.9m as of April 30th, a stated $250m of eligible loans in the overall ACRES platform coming up this year, and a target of total CRE loan value of $2.3b by the year end we can expect to see continued origination which will drive income and help to continue in unwinding the balance sheet. This organic growth of earnings will be compounded by the $260m in net operating losses (NOL) mostly incurred during the 2020 default. For a company with a market cap of $76.9m this NOL is not just sizable, it is also nearly all usable and accretive to shareholders if used in the coming years.

Under the tenure of ACRES the company has stabilized its capital position while generating growth in its origination portfolio. They are poised to leverage the value of their NOLs in coming years to generate greater earnings even amidst a recession or inflationary environment. Three different insiders have made purchases in common and preferred shares in the past couple months. ACRES Capital Corp. is the management company for ACR and they own 599,998 shares or 6% of shares. As per their performance agreement they are eligible for up to 333,333 shares each time stock book value targets are met of: $21.00, $24.00, $27.00, $30.00, $33.00, and $36.00. This incentive structure I think aligns management strongly with growing shareholder value over the long term.

Despite This Valuation Remains Low

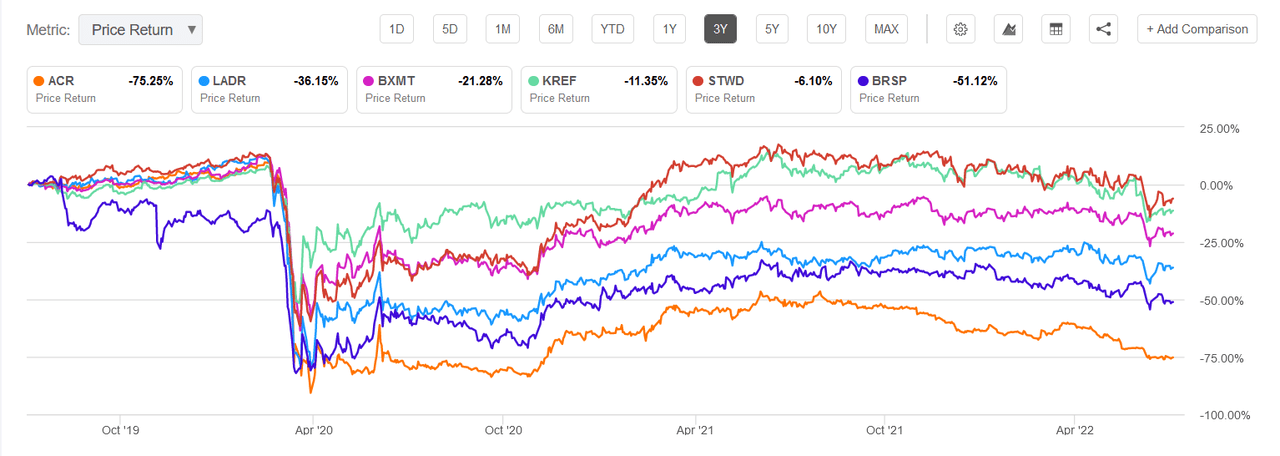

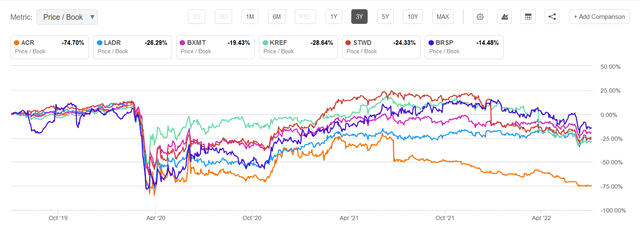

The market continues to discount ACRES. Total stockholder equity of $442.702m less the preferred equity amount of $226.6m leaves $216.1m or $23.81 book value per share. ACR is currently trading at a P/B of 0.34. If we look at a chart comparing a basket of similar companies we can see just how much of a disconnect between ACRES and peers has developed in terms of P/B.

We can see that in the case of ACR almost all of the 74% decrease in P/B can be traced to the performance of the common shares over the same period.

Seeking Alpha

So while the stock price has been declining and is near 52-week lows, book value per share has actually been increasing. And it’s likely it will continue for the reasons I outlined above. Despite this the company is trading as if it’s poised to go bankrupt and management is opportunistically buying up shares with their average purchase price of $12.90 as of March 31st, 2022. With $12.4m still authorized we expect the full amount to be used and be immediately accretive. At current prices this represents a sizable 16% of the current market cap.

This will force a re-rating on the value of the commons eventually. If not, the company can continue to utilize share repurchases to grow book value while also filling out their CRE debt portfolio to grow net interest income. Preferred shareholders are offered an increasingly secure position as a result.

The reason I believe ACRES trades for such a discount to peers is because of the 2020 default episode as well as historical leverage. With some data points from new management clear to evaluate I believe it’s safe to acknowledge this isn’t the same company it was in 2020. And if we look at the debt-to-equity ratio in relation to peers, while a bit high, I do not believe it warrants the type of discount implied.

The Balance Sheet

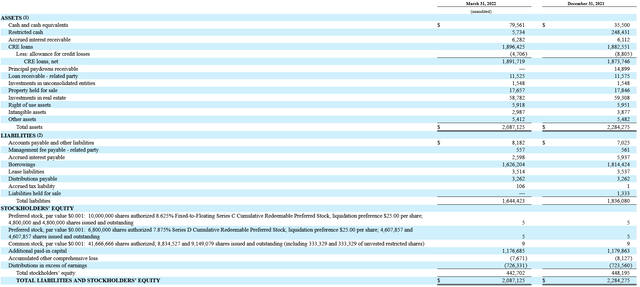

Let’s turn our focus more directly to the balance sheet.

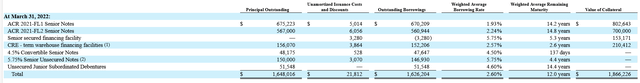

Of note here is the $79.561m in cash and the $58.782m of real estate held for investment. In their quarterly call they noted that “our team completed $51.6 million of initial equity investments on two properties immediately following quarter-end” meaning the real estate position has increased to ~$110m and the cash position reduced. Total debt is at $1,626m with a weighted average maturity of 12 years and weighted average borrowing rate of 2.60%.

None of these things seem to suggest a company likely to go bankrupt. The 4.75% convertible notes mature this summer and management has already bought $39.8m back this past year. As of April 30th, the company had $172.9m in liquidity. Both of the CLOs, ACR 2021-FL1 and ACR 2021-FL2, helped to pay off previous management’s CLOs and refinance to lower rates. With low borrowing rates locked in for years to come management has flexibility in their capital stack to drive shareholder value.

Earnings & Cash Flow

Last year the company saw a net increase in their cash position of $216.19m. Earnings results in Q1 came in at a net loss of $2.8m or $0.30 and were convoluted by some nonrecurring charges which management highlighted in their most recent call:

“Net interest income was $7.8 million or $0.85 per share in the first quarter as compared to $11.9 million or $1.25 per share in the fourth quarter. As a reminder, the fourth quarter results included $3.3 million or $0.35 per share of income related to loan payoffs. In addition, we saw loans with higher coupons and base rate floors paying off as compared to newly originated loans. Other income includes a loan recovery of $630,000 on a middle market loan in a business line that was disposed of several years ago.

First quarter also included nonrecurring charges of approximately $500,000 related to the retirement of convertible note debt and approximately $1 million for charges related to the termination of 2 static CLOs included in interest expense. We also had a nonrecurring noncash charge of approximately $700,000 for real estate depreciation.”

If we back out the total $2.2m of non-recurring charges quarterly earnings would have been a loss of $0.6m or $0.07 per share. Management is guiding for 2022 EPS losses between $0.00-0.15 which would suggest that we should see profitability moving forward. With management intending to grow the $1.9b CRE loan book to $2.3b by the end of the year we can estimate they are looking to do an additional $400m of financing. We can use the current spread of 1.31% to estimate an additional $5.24m of net interest income as a result.

So Why The Preferred Shares

With all that said about the business and in reference to the common shares, let’s talk about why I’m recommending the ACR.PC preferred shares. Entering positions with a margin of safety is part of my investment approach and despite all of the ways highlighted above which suggest the common shares themselves are undervalued my interest in ACR.PC was piqued by the increased security in the capital stack, their discount to par value, and the qualified dividends represented. In this case, I like to think of the common shares themselves as part of my margin of safety here.

There are two preferred shares, the series C and the series D (ACR.PD), with 4.8m and 4.608m outstanding respectively. Both have liquidation preferences of $25.00 per share which equates to preferred equity of $235.2m. With total equity of $442.702m that leaves shareholders with $207.502m in equity. Technically this means that as an owner of the preferred shares total stockholder equity value would need to decrease by $207.502m or 47% before it eats into the value of the preferred shares. That’s part of the margin of safety.

Additional margin of safety is represented in the 18% discount to par value and the cumulative dividends themselves with a currency yield of ~10%. Let’s look at some comparative data points for the two preferreds:

|

Series C |

Series D |

|

|

Type |

Fixed-to-Floating Cumulative |

Cumulative |

|

1st Call Date |

07/30/2024 |

05/21/2026 |

|

Price |

$20.05 |

$20.15 |

|

Coupon |

8.625% |

7.875% |

|

Current Yield |

10.71% |

9.77% |

The Series C preferreds are more attractive to me for a few reasons. The fixed-to-floating rate allows for upside optionality if interest rates continue to rise and would also increase pressure on management to redeem them. The previous management did the series C preferred offering and we’ve seen ACRES management rework everything that previous management had its hands on. This gives me more reason to believe they will likely look to rework ACR.PC as soon as they can.

Given the overall balance sheet restructuring we can see that the preferred shares are amongst the company’s highest cost represented by the weighted average coupon of 8.26%. Buying back shares of the preferred on the markets may be something we see as a result even before they are callable.

From a capital allocation perspective, management is focusing on repurchasing common shares for now but we can see that the preferred shares themselves are a high cost of capital and could be targeted as management seeks to grow book value further.

If we see rising interest rates going forward and the preferreds are not called they will move to 3 month LIBOR plus 5.927%. With 3 month LIBOR at 2.35% right now this would indicate a dividend of 8.28%. Original coupon is 8.625% and it also serves as a floor after call date for the coupon. What this means is that there is upside optionality for a rising interest rate environment and a downside floor if not.

Some Bear Thoughts

In any investment case there is always the other side to consider so let’s reflect on the bear thesis.

Management hasn’t really been tested at this point, including their underwriting ability. While we have seen them taking a number of steps to rework the balance sheet it still remains to be seen if CEO Mark Fogel and team can generate meaningful returns for investors. Though we should note that Mark Fogel founded the management company ACRES Capital in 2012 and they have always been focused on this space, so he’s not new to this.

A big risk overall would be an impairment in the value of their CRE loans. With an asset value of $1.896b and total equity value of $442.702m a writedown of 23% would bring total equity to $0. I think this is highly unlikely given the secular tailwinds of multifamily CREs but let’s talk about the ways in which there’s margin of safety built into the loan valuation process already.

The most recent loan-to-value ratio of 72% means that the $1.896b in loans is secured by $2.633b in collateral value, in other words the property. If loans go into default there is recourse to the property which the company becomes the owner of and can seek to try and recoup their investment. Most debtors are highly incentivized to pay these loans first given they lose their property if they don’t. As mentioned, the portfolio is predominantly invested (72.7%) in multi-family properties which is expected to have 95% occupancy rates in 2022. These are essentially renters that are typically on annual leases which let’s them adjust to rising costs. Additionally, there’s a housing shortage which is driving the value of these assets and rents up which isn’t expected to change in the near term. With mortgage rates climbing and home ownership becoming more expensive, rentals are the only option for a lot of people. All of this provides a strong backdrop for the value of these CRE loans and also shows that default on the loans does not necessarily not mean writedown of the assets.

These macro factors also put pressure on renters and if we see a significant recession it could be that there a number of people unable to pay rents which could domino up to these property owners and then up to ACRES. That kind of domino wouldn’t happen overnight though and I believe it’s a manageable risk.

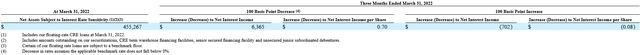

Interest rates rising as we enter an inflationary period is another area of risk that these days. ACRES indicates in their filings that “our business model is such that rising interest rates will typically increase our net income, while declining interest rates will typically decrease net income”. Yet we can also see from the most recent quarter that an increase in rates of 100 basis points would result in an estimated $0.08 decrease in net interest income. I believe this is a manageable risk and represents something else to monitor moving forward. And perhaps a benefit when interest rates start coming down.

Some may critique the share repurchase program given it has been consistently buying the stock back at higher prices. What I’ll note here is that these buybacks, while done at higher prices, were still done at a discount to book value. This means that it generates immediately higher book value per share. It’s hard to argue that increasing book value this way is bad unless you believe there are better ways to reinvest that capital — which I might suggest that buying back their preferreds may be at some point.

Another related critique here could be that the growth in book value is happening artificially through the $27.6m in repurchases while hiding bad underwriting which will cause the loan book too unravel in value eventually. I think this is highly unlikely though I’m not sure there’s any data point I’ll be able to point to in order to support that. At this point I think it comes down to your take on management and risk profile here. My take is that Mark Fogel is an asset valuation person first and he’s stated that “you never make a loan unless you know you’re prepared to own it.” They are underwriting against the valuation they see of the property and are willing to get a return by any means on that even by taking ownership. The only way we will really know is with time.

Conclusion

If things continue on the current track I believe it is highly likely that ACR.PC will be redeemed near its call date. With a current price of $20.05 a reversion to par would generate 24.69% which would be supplemented by the dividend for two years at a 10.71% yield. Total return in two years implied is 46.11%. This is within a sector with secular tailwinds and in an asset class (commercial real estate) which typically helps to hedge against inflation. Not only that, the company is invested in the most secure part of the asset class – first-lien debts which typically hold the property itself as collateral in case of default. With a long-term view and given current uncertainty in the market I think ACR.PC offers rare relative safety. Those with a greater risk appetite could consider a position in ACR common shares directly as they stand to appreciate significantly on potential P/B rerating in alignment with peers.

Risks

-

Commercial real estate values and activity are material to this thesis, particularly multi-family properties. If there are widespread issues in the sector it will impact ACRES.

-

The underwriting quality of the new management team has not really been tested. While they have originated volume it remains to be seen if they did so while minimizing risk.

-

Capital allocation decisions are paramount as we move forward. One poor decision on this front could make a material difference in this thesis. Given management’s performance so far I consider this to be a low risk but one to be monitored.

-

Dividend suspension on the preferred shares would likely decrease value significantly in the near term. When the dividend was suspended in 2020 shares ACR.PC dropped to below $5 before settling in the $10-12 range. Within a year they were trading back at par and dividends were fully caught up.

-

ACR.PC only trades around 12,000 shares a day. This represents potential illiquidity risk depending on your position size.

Be the first to comment