pwmotion/iStock Editorial via Getty Images

Investment thesis

Apart from its lows in March 2020, BMW (OTCPK:BMWYY) has never traded below the low 20s in the past decade. As we are once again near this range, investors who are looking for an opportunity may be paying closer attention to the stock. I do think the stock offers an upside, however, in the current market, caution should be followed by those investors who can’t withstand a high volatility. In particular, BMW has relied more and more on financing and leasing services to boost up sales, revenues and margins. In this article I will mainly focus on these activities to clarify why, even though I globally see BMW as an interesting investment, I think that at the moment the stock is a hold.

An overview of BMW

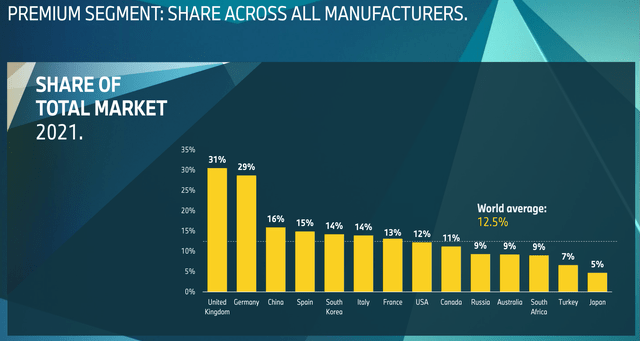

BMW has three main branches: the automotive division which is the largest one and owns three brands (BMW, Mini, Rolls Royce), the motorcycle one and the financial branch. It currently holds a 12.5% market share in the premium car segment, with above average results in the UK and Germany.

BMW 2022 Investor Presentation

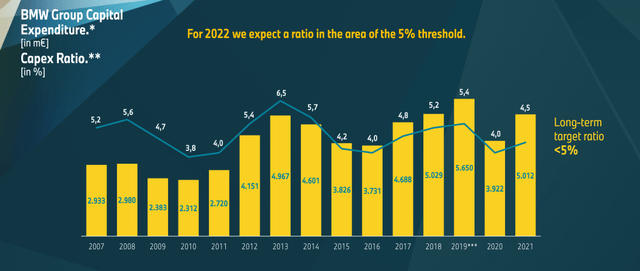

If we look at BMW’s last ten years we see that the company increased its delivered cars from 1,845,186 in 2012 to 2,521,514 in 2021. This went along with a clear increase in its top line at a CAGR of 3.66%, which brought total revenues up from €76.85 billion in 2012 to €111.24 billion in 2021. However, gross profit margins declined a bit as they were 20.2% back in 2012 and last year they came in at 19.8%. Since 2021 was a great year for automakers, it is important to know that in 2019 BMW saw its gross profit margin at 17.3%, which shows a downward trend. However, BMW has been good at managing costs and we see that while its capex/revenue ratio has come down from 5.4% in 2012 to 4.5% in 2021. This is particularly important as BMW, like many other automakers, is facing huge costs to implement the EV turnaround of the industry. As we see from the graph below, even though BMW is undertaking a massive turnaround in technology, its capex ratio is always withing the range between 4 and 5% which shows that the company has its costs under control

BMW 2022 Investor Presentation

EBT also spiked up more than 2x over the past decade: from €7.8 billion in 2012 to €16.06 billion last year. Also thanks to a decreasing effective tax rate, BMW was able to pass down to the bottom line of the income statement all these increasing numbers. This is why we see the company move its net profit from €5.11 billion in 2012 to €12.46 billion in 2021. However, 2021 saw a huge spike in net profits that is likely unsustainable and that saw both the tailwinds of pent-up demand meeting tight supply, the perfect environment to boost BMW’s pricing power. In fact, even before the pandemic BWS had seen its net profit at first increase up until 2018, but then, starting already in 2019, the results were somewhat choppy.

BMW did increase its debt at a CAGR of 2.62% over the past decade. However, the very interesting fact is that the company has been able to grow its free cash flow from €8.37 billion in 2012 to €16.01 billion in 2021. Currently BMW has a debt/free cash flow ratio around 20, which shows a financially stable company.

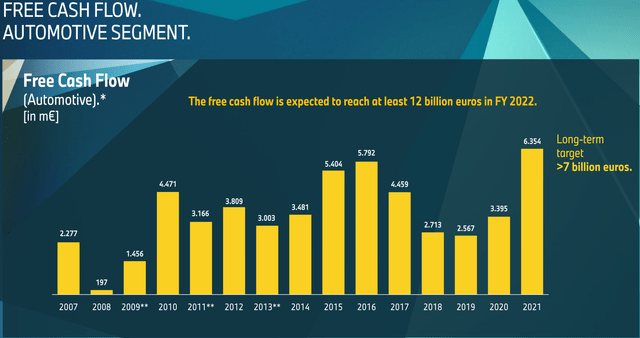

Speaking of free cash flow, the automotive segment was able to almost triple it from 2007 to 2021, a time-span during which two recessions occurred. We can see this from the slide below, which proves that BMW has been resilient to major economic downturns.

BMW 2022 Investor Presentation

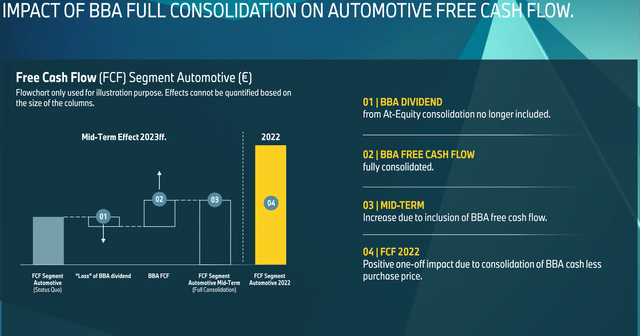

Now, in 2022 we will see a big spike in free cash flow due to the fact that BMW recently increased its stake in its BBA Chinese joint venture from 50% to 75%. As shown from the slide below, the net amount from consolidation of BBA’s liquid funds amounted to €5 billion and will increase the 2022 free cash flow. Investors should know this will be a one-time event with an impact on 2022 results, but, more than a big spike in numbers, it will be important to assess the benefit of this operation which aims at strengthening BMW’s position in China.

BMW 2022 Investor presentation

BMW financial services

In order to understand the importance of BMW’s financial services, it is important to be aware of how leasing works.

First of all, the produced vehicle is sold by the automotive division to the financial services one. At this stage, there is still no purchase from a customer. The sale however is registered at a normal retail price. The financing service division becomes the lessor and leases the vehicle to a customer who pays a monthly fee to use the car, enjoying the good while avoiding the total cost of ownership. The lessor earns an interest on the payment. In a low rate environment credit was easy and this led many customers to pick a leased car instead of buying one.

Once the lease is over, the customer either has the possibility to buy the car for its residual value or return it to the lessor and start a new lease.

Now, this is where things become interesting. When the auto division sold the vehicle to the financial services, it wrote on its income statement both the earned revenue and the cost of it. At the end of the lease, the financial services division writes on its balance sheet the depreciation expense that comes from the difference between the cost of revenue and the residual value of the vehicle. Since this happens internally at BMW, reconciliation is needed to offset the revenue and its cost between the two divisions, in order to prevent a double account.

Thus, BMW sees immediately the profit from the vehicle sold to the financial services, and then reconciles it as the leasing expires.

Let’s get to the important part, where the risk lies. BMW clearly controls the pricing between its automotive and its financial services divisions. If BMW is in an environment where car prices are high, then the sale between the two divisions is in line with the true retail price for the car. However, if the price of the sale is a price that won’t be accepted by customers because they will ask for a discount, then the sale between the two divisions takes place but it is overpriced and there will be a difference between the price of the internal sale and the real price that comes from the lease payments and the residual value at the end of the leasing period.

Why does this matter? When residual values of leased vehicles go up and is higher than the expected sale price of the vehicle, then the company has to correct the excess revenue with a negative reconciliation. On the other side, when residual values of leased vehicles go down, the price of the internal sale is too high and we will end up with a positive reconciliation that corrects the difference.

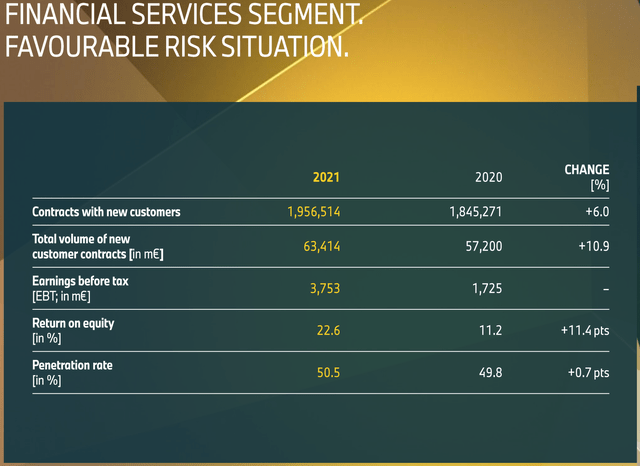

Now, let’s understand the current situation. BMW’s financial services highlighted a positive environment for its operations. Contracts increased by 6% from 2020 to 2021 and the total volume of new customers contracts rose, too.

BMW 2022 Investor Presentation

However, as BMW pointed out in its 2021 Annual Report,

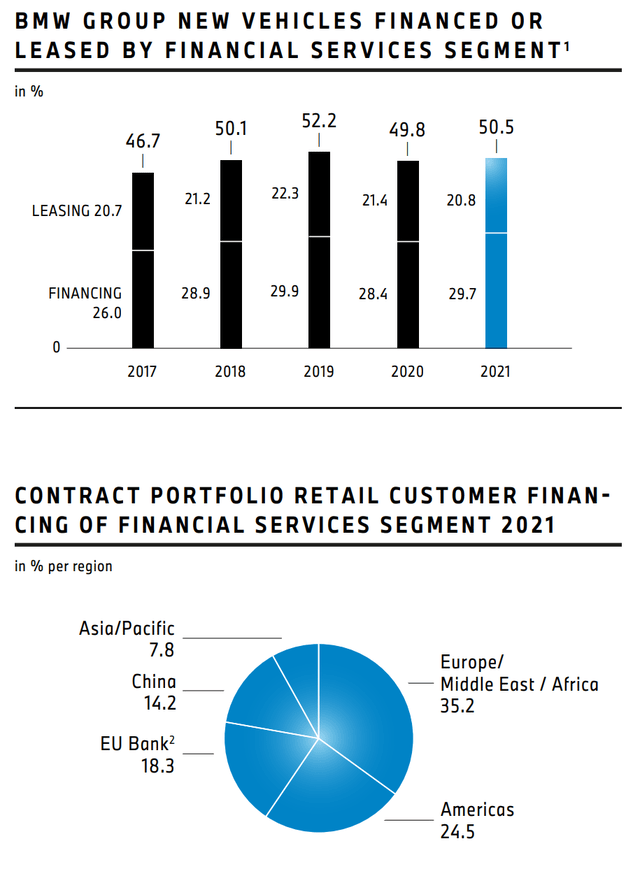

the past year was influenced by the exceptionally positive trend on pre-owned vehicle markets, particularly in the USA and the UK. Pre-owned vehicles saw their prices spike upwards by 30-40%. Leasing accounted for 31.8% and credit financing for 68.2% of new business. Business with pre-owned vehicles also developed positively, with the number of new contracts signed up by 1.4%. In total, 411,520 new credit financing and leasing contracts for pre-owned BMW and MINI brand vehicles were signed during the year under report (2020: 405,713 contracts). The total volume of new credit financing and leasing contracts concluded with retail customers during the 12-month period amounted to € 63,414 million, significantly up on the previous year (2020: € 57,200 million; + 10.9%). The share of new BMW Group vehicles either leased or financed by the Financial Services segment stood at 50.5%1 (2020: 49.8%; + 0.7 percentage points).

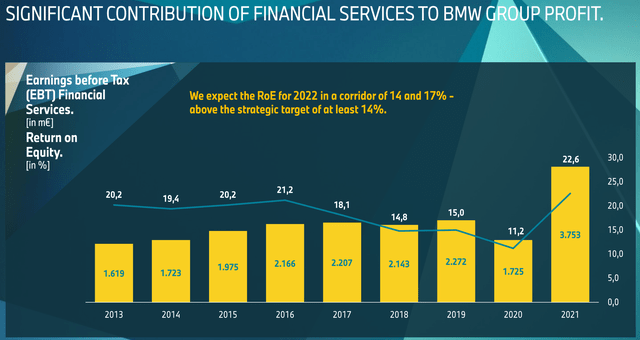

Meanwhile, all throughout last year, interest rates were still at their minimum and this made many people choose a leasing service. The natural consequence was that the financial services provided BMW with outstanding results. Financial Services segment revenues increased to € 32,867 million and an EBT of €3.75 billion, that is well above the usual results that were around €2 billion.

BMW 2022 Investor Presentation

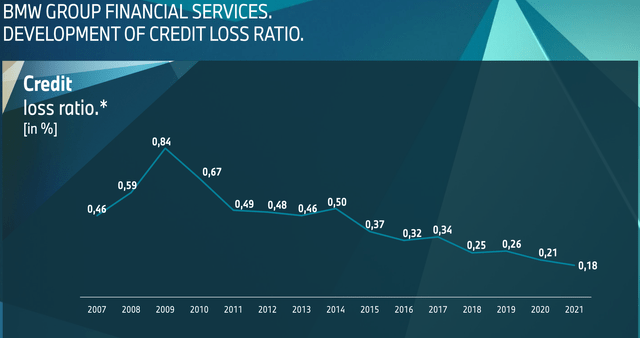

Furthermore, BMW saw its credit loss ratio to an all-time low of 0.18%, as shown below.

BMW 2022 Investor Presentation

As we can understand, the spike in the pre-owned vehicle market combined with high levels of revenue generated on lease returns sold had a positive effect on the residual value situation across the Financial Services segment during the financial year 2021.

However, is this situation sustainable? We have already seen interest rate hikes and, while the pre-owned vehicle market is still pricy, if a recession will indeed hit consumers’ pockets then we could reasonably expect it to drop, with a negative impact on BMW, depending on what retail car price it is recognizing right now to its financial services.

A certain slowdown was already seen in Q1 2022, when, during the earnings call, Nicolas Peter, BMW’s CFO reported that in the last quarter (bold mine)

In the Financial Services segment, a total of 433,000 financing and leasing contracts were concluded with retail customers in the first three months of the year. The number of new contracts was down 11.4% compared to the very strong prior year quarter. In addition to the limited availability of new vehicles due to supply issues this also reflects more intense competition in the financial services sector, particularly, in China and the US.

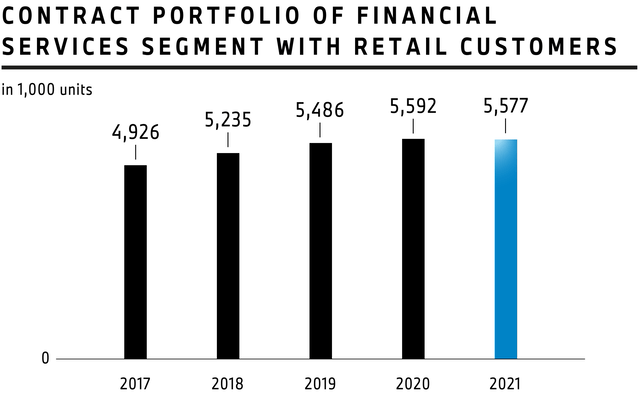

As we see from the graph below, the contract portfolio already expanded from 2017 to 2020, but with the 2021 data and the beginning of 2022 it seems as it stopped growing with the possibility of shrinking.

BMW 2021 Annual Report

If we look at these other two graphs taken from BWM 2021 Annual Report, we see that half of BMW’s sold vehicles are either financed or leased. While this trend did make BMW improve its margins, it may now become a weakness as we head into a tight credit environment where customers may just decide to pay directly their new vehicle without choosing to pay high interests on leases. In particular, BMW is clearly exposed to Europe and the Americas, where more than half of the contract portfolio comes from. These areas are currently under difficult economic headwinds that are impacting those economies more than other regions around the globe, like Japan or other Asian countries.

BMW 2021 Annual Report

Valuation

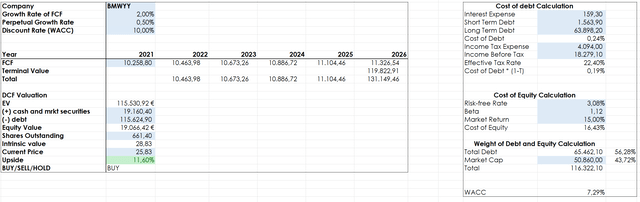

BMW seems currently cheap, with the stock trading at a 4 PE, a fwd price/free cash flow ratio of 3, a dividend yield of 8% that will be supported by a recently approved buyback plan and a strong balance sheet. With a depressed price, I would expect the company to speed up its buyback program in order to take advantage of the current bear market. While I see a potential upside, if I factor in a future recession and thus make the assumption that the compound growth rate of BMW’s free cash flow from last year to 2026 will only be 2%, then I reach a target price of $28,83 about 11,40% above the price at the time of writing. In the current market environment, this valuation doesn’t provide a margin of safety I would be comfortable with, especially having some doubts on BMW’s ability to keep its financial services branch posting the outstanding results it achieved in the past.

Author, with data from Seeking Alpha

This is why I rate the stock as a hold, waiting either for a further drop or for a clearer economic context before us that would make me increase my projected FCF growth rate.

Conclusion

BMW is a great brand that will play a major role in the premium car segment for years to come. I am learning that, even though timing the market is really hard, it is important to establish a position with a margin of safety that can factor in further downturns and unexpected economic headwinds. I usually have as a rule that the stock must be undervalued at least by 20-25%. Currently, BMW, even though it is starting to be interesting, still doesn’t offer me this margin. I will keep a close eye on the stock to see if it trades down a bit more and enters into a $20-22 range. Until then, my call is a hold.

Be the first to comment