Manuel Milan/iStock Editorial via Getty Images

A Value Stock

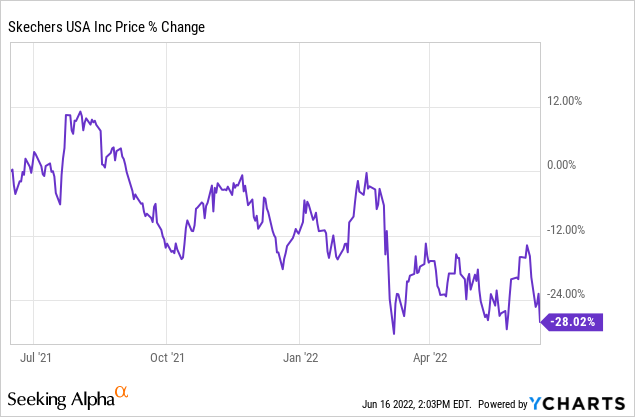

Skechers U.S.A., Inc. (NYSE:SKX) has seen its share price fall by over 28% in the past year and is now regarded as a value stock by many investors given that it is trading at a TTM P/E of around 7 to 8. Hence, I decided to take a deep dive into Skechers for my research. Through this, I found out that Skechers is a fundamentally strong company with defensive characteristics that will help it hold up well in an upcoming recession. Additionally, the company is well poised to benefit from its DTC and China expansion strategy which I will elaborate in this article. With a market cap of only $6 billion, I believe that Skechers also has a huge runway for growth and can potentially close the gap between itself and the top two sports shoes brands globally, NIKE (NKE) and adidas (OTCQX:ADDYY).

Quick Overview Of Skechers

Founded in 1992, Skechers is an American footwear and lifestyle company. Skechers has now expanded into over 180 countries globally through its 4300+ storefronts, e-commerce sites and partner retailers. Compared to traditional footwear competitors, Skechers operated in a more niche market by combining comfort and performance in their footwear, through their proprietary comfort technology. Today, the company is the 3rd largest footwear brand in the United States and also the 3rd largest sports shoe brand globally by revenue. Note that Skechers ranks as the 5th largest footwear brands but two companies ranked above it are not primarily sportswear companies.

Business Model

Skechers operates its business primarily through two methods:

- Wholesale – Sales through third party retailers

- Direct-To-Consumer (DTC) – Sales directly to consumers through Skechers’ physical stores or e-commerce platforms

Geographically, Skechers splits its operations into three key regions:

- Americas

- Europe, Middle East, Africa (EMEA)

- Asia Pacific (with China sales also disclosed separately)

Revenue Breakdown

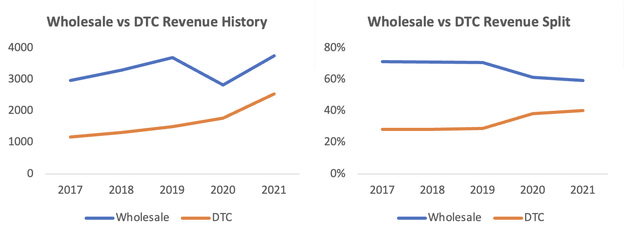

Both Skechers’ wholesale and DTC segments have been experiencing an upwards trend in the past five years, with a dip in wholesale revenue in 2020. This could be attributed to wide scale closures and bankruptcies of departmental stores due to the pandemic, and this consequently reduced sales through this channel. However in recent years, Skechers is beginning to pivot to DTC sales channels as they are higher margin and gives the company more control over their products, and this is reflected in DTC’s growing proportion of the revenue split.

Skechers Revenue Split Between DTC & Wholesale (Author’s compilations from Skechers’ Annual Reports)

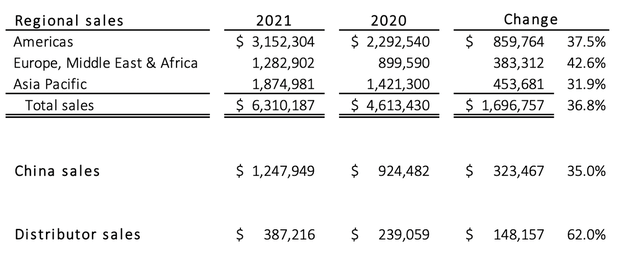

Regionally, Americas remains Skechers largest market with 50% of revenue, followed by APAC and EMEA. It is difficult to draw a clear trend here as Skechers has only recently updated its geographical segment reporting. However, all three markets have posed at least 30% growth rates y-o-y with China being a single largest market outside of America.

Skechers Revenue Breakdown By Geography (Skechers Investor Presentation)

Industry Analysis & Competitive Positioning

As Skechers main products are comfort and performance footwear, they operate in the general footwear industry. This can be further broken down to two sub segments – sport shoes and athleisure. Skechers’ products can be fit into both categories as they are mainly shoes with performance-based attributes but are also commonly worn in everyday life, even beyond athletic purposes due to their comfort features.

In the sports shoe industry, Skechers faces competition from other popular names such as Nike, adidas, Puma (OTCPK:PMMAF), New Balance and Reebok. By revenue, Skechers is the third largest sports shoe brand globally, trailing behind only Nike and adidas. However, Skechers can carve a niche for itself as it is more “lifestyle” focused compared to other brands whose shoes are tailored to “commercial athletes”. This is reflected in their marketing strategies where Nike and adidas always partner with big name athletes like Michael Jordan and Lionel Messi, compared to Skechers which uses more pop celebrity endorsements.

In the athleisure industry, this consists of brands which design & sell clothing that are suitable for both exercise and everyday wear. Forbes lists these competitors as: Lululemon Athletica (LULU), Columbia Sportswear (COLM), Deckers Outdoor Corp (DECK), Under Armour (UA) and Wolverine World Wide (WWW). Out of these competitors, only Skechers’ and Deckers mainly focuses on athleisure footwear whereas its rivals have a wider catalogue of apparel.

Industry Trend 1: Growing Sports Shoes Market & Recreational Consumers

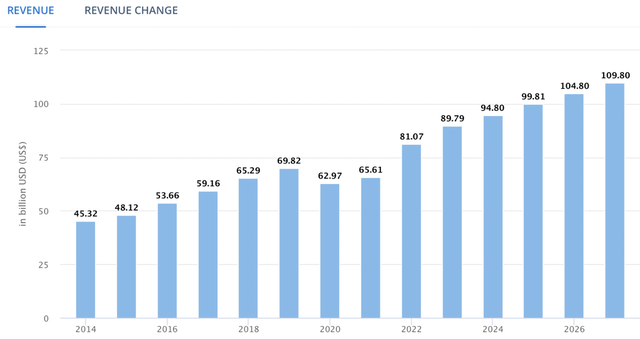

The global sports shoe market is a relatively mature industry with a 6.25% forecasted CAGR through 2027.

Global Sports Shoe Market Size Growth (Statista)

Within this industry, APAC and China markets are expected to contribute to the bulk of this growth as disposable income levels in these regions continue to rise. APAC’s market size is expected to grow at an 8.1% CAGR through 2031 whereas China’s will grow at a CAGR of 8.25% through 2027.

Additionally, according to a research paper by Fortune Business Insights, the athletic footwear industry will be dominated by recreational consumers moving forward, characterised as users who participate in sports for social or exercising reasons rather than competitive. This is further supported by an increasingly health-conscious population which will boost the demand for functional and lightweight shoes as they go about their activities. All of these sub-trends will benefit Skechers as these are their key target groups.

Industry Trend 2: Increasing Customer Preference To Athleisure Wear

Consequently as consumers seek functionality and comfort, the athleisure market is expected to grow at a stunning 25% CAGR through 2025 and this has been accelerated by the pandemic. With work from home arrangements, the pandemic had pushed consumers to purchase more comfortable apparel to improve their working environment. On the other hand, as more people took on sports to stay healthy, demand for athleisure wear grew as it can be worn interchangeably on different occasions.

Even as we are moving back to a pre-pandemic life, much of this lifestyle change has stuck with consumers. 55% of consumers today note that they are still wearing athleisure wear for more than sports. Even as people return to work, many offices are beginning to allow smart-casual dress styles and this allows for Skechers’ shoes to be worn.

Finally, this shift towards athleisure is reinforced by a study which noted that the two main decision-making factors in purchasing footwear is fit & comfort and these two are highly correlated. As a result, Skechers’ shoes should be able to benefit should they ride this growing athleisure trend and market.

Now, I will move onto three thesis as to why Skechers is a buy.

Thesis 1: Skechers’ Brand Identity Of Being A Comfortable Footwear That Is Value For Money Thrive In A Recessionary Environment

Skechers Provides A Strong & Unique Value Proposition To Customers In Terms Of Quality And Price

In terms of brand identity, Skechers is almost synonymous with comfortable and light-weight footwear. All of its designs and innovations are centred around providing a comfortable experience. Consumers who have purchased Skechers before should be familiar with lines such as “arch-fit”, memory foam the and slip-in series which embodies Skechers’ philosophy.

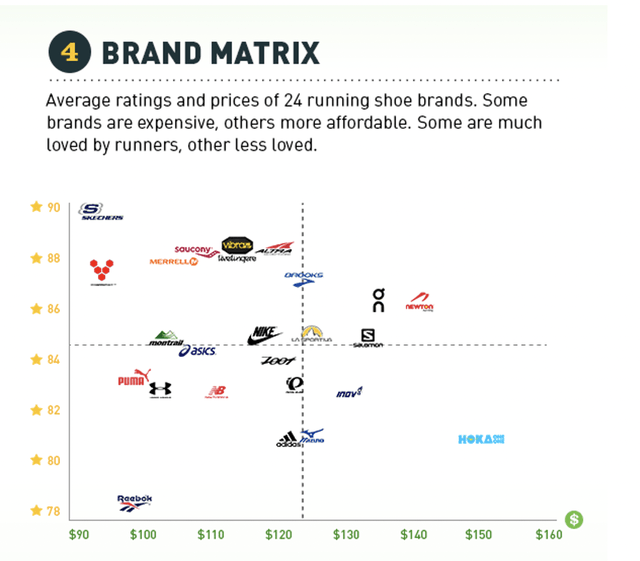

Next, Skechers’ price point is also lower than most of its competitors, yet its shoes are durable and of high quality. In a brand matrix study with 24 running shoe brands, we can see that Skechers has the lowest average price, yet the highest consumer ratings, demonstrating a high value for money proposition.

Running Shoe Brands Ranked By Price And Reviews (RunRepeat)

Turning to global brand ranking, Skechers also benefits from an intangible competitive advantage of a strong brand name and recognition as their global ranking sits among the top of both sports shoes and athleisure companies according to Comparably. Skechers only loses out to Nike, adidas and Puma which is expected as these companies have much more loyal and dedicated customers as well as fanfare from top athlete endorsements. Without any of these, Skechers is still ranked considerably high which can be attributed to their value-for-money and unique comfort value proposition to consumers.

Global Brand Rankings For Sports And Athleisure Shoes (Comparably)

Skechers Value Proposition Creates A More “Defensive” Nature During A Recession Which Allows Them To Thrive & Gain Market Share

One major worry overhanging the economy and stock market is an impending recession. We have just entered a bear market, a development further fuelling recession woes. However, I believe that due to the nature of Skechers’ shoes, they should be able to hold up well in an economic downturn from two aspects: the necessity aspect and indulgence aspect.

First, Skechers’ product lines are shoes for everyday wear, unlike other sports brands which are largely high performing athletic shoes used in fewer occasions. The former is less likely to be cut off in a recession as consumers can put on hold buying items like clothes, accessories and speciality shoes, but it would be impossible to delay purchasing new casual footwear should your shoe be falling apart. Additionally, from the last recession, we have observed that consumers tend to switch from higher tier brands to lower priced apparel and patronise more warehouse clubs. This will benefit Skechers as they have the have the best value-for-money shoes and also operate numerous warehouse and outlet stores globally.

Next, we turn to the indulgence aspect. In a recession where consumers usually cut down on big ticket spending, they are still looking for more affordable items that could bring them some joy in a gloomy period. Shoes are one such guilty pleasure for consumers. In a NYT article, it is noted that as shoes are a relatively low-dollar expense (compared to electronics or cars), consumers can feel good from a new purchase without burning a huge hole in their pocket. As a result, affordable footwear is a category that does well during and moving out of a recession.

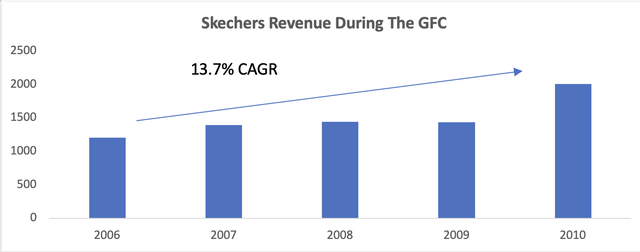

Therefore, I strongly believe that while growth rates will likely slow, Skechers will still thrive even in an economic downturn and even seize the opportunity to gain market share on other footwear giants. In the GFC, value shoemakers had managed increase market share through the recession and maintained it even as the economy recovered. Given Skechers’ strong brand name and quality of shoes, I believe they will be able to achieve a similar result. In fact, Skechers’ themselves had fared well over the past GFC with revenue continuing to grow – further solidifying its case as a defensive consumer stock.

Skechers Revenue Growth During The 2008 Great Financial Crisis (Skechers Annual Reports)

Thesis 2: Skechers Has Viable DTC Expansion Through Store & E-Commerce Growth And This Will Increase The Company’s Margins

Skechers Has A Large Avenue For Growth In Physical Store Expansion Given Its Global Operations As Well As A Robust E-Commerce Offering With Potential To Scale

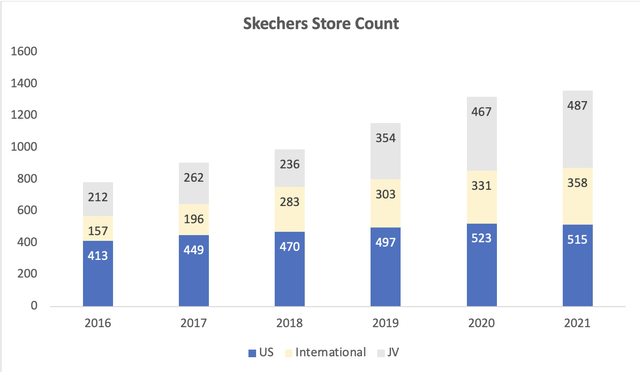

In the 1Q22 earnings call, management has reinforced that DTC is a key growth pillar and focus for Skechers. One way Skechers has been doubling down on DTC is through increasing its store count to rely less on distributors. Prior to 2021, Skechers store count has been growing at a 4Y CAGR of 14%, with greater growth observed from 2018 to 2020. International expansion seems to be a greater focus for the company, with JV and International stores growing at a 4Y CAGR of 22% and 23% respectively. JV stores are almost exclusively in international territories.

Skechers Store Count (Skechers Annual Reports)

Moving forward, I expect Skechers to be able to scale their global store expansion efficiently as they already have a physical presence in over a hundred countries. This means that Skechers already has adequate customer demand in those markets for new stores. Additionally, given that Skechers has less than 100 stores in most countries outside of US and China, this reduces the possibility of store cannibalisation.

The second aspect of DTC is through e-commerce, mainly via Skechers’ app and website. Skechers’ website should be the company’s main mode of e-commerce sales now as their app is currently only available in the United States.

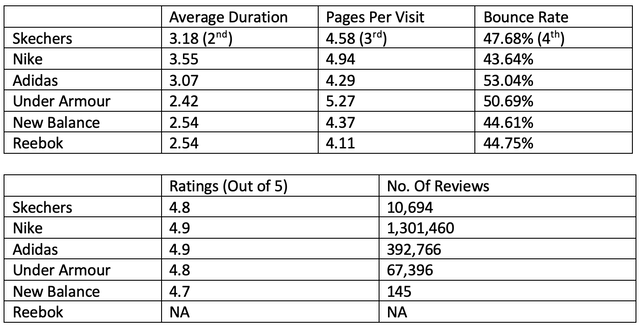

Using data from similarweb, we can see Skechers’ website scores rather well compared to other notable sports and athleisure footwear companies, only losing out to Nike on all three key metrics. On the other hand, Skechers’ mobile app has a high rating of 4.8 stars, similar its peers but is only available in the US. The app comes with an online store as well as membership and I believe that this has the potential to further improve customer loyalty to Skechers as the app is launched in more regions in accordance to the company’s DTC plans.

Skechers E-Commerce Metrics (Similarweb)

High Sales Conversion Rates Will Facilitate DTC Growth And Lead To Margin Expansion

As established, Skechers has a twin driver of growth through DTC – store expansion and e-commerce which the company is well positioned in. While Skechers may still lag behind larger players like Nike in DTC (and this is inevitable), Skechers has an advantage in terms of its sales conversion rates.

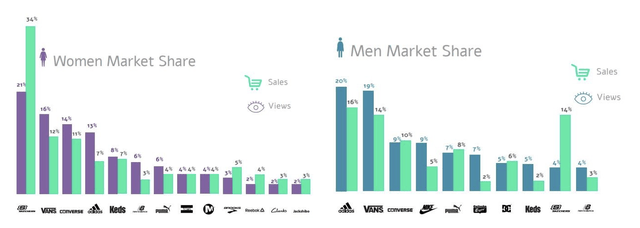

In a 2017 study on the fashion sneaker market, it was revealed that Skechers had by far the highest view-to-buy conversion rate of ~3% compared to all its competitors, with Nike and adidas at 1.2% and 1% respectively. While this market is only a subset of the greater sports shoe market, I believe that Skechers’ superior conversion rate will still hold true in other markets given that they are similar in nature & due to Skechers’ strong value proposition as mentioned in Thesis 1.

Therefore, as Skechers’ expands its DTC offerings and puts its products in front of more consumers, I believe that they will be able to see strong growth in demand due to their superior sales conversion rates.

Skechers High View-To-Buy Conversion Rate (The Market Beyond)

Finally as DTC grows, Skechers will benefit from growing margins the DTC business has a much higher margin than the wholesale segment, with gross margins at 66% and 38% for FY21 respectively.

Thesis 3: Skechers’ Astute Cultural & Political Strategy Well Positions It To Capture The Chinese Market Compared To Its Western Counterparts

Skechers’ Has Positioned Its Brand To Be Popular Among Chinese Consumers Despite Its American Origins

Another important aspect of Skechers’ growth strategy is in China, a market where growing nationalism is making it harder for western brands to gain inroads. Notably, numerous western companies like H&M, Nike and adidas faced boycotts in 2021 when they spoke up against alleged forced labour in Xinjiang. In the following month, Nike and adidas saw a 59% and 79% fall in sales respectively while local brands saw a similar magnitude in increase.

Skechers’ statement took a different tone from its foreign counterparts. It noted that the company had launched an independent investigation on force labour claims and results showed that there were no evidence found. As I have no expertise in this area, I will reserve my comments on the validity of the allegations. However, I note that what Skechers did greatly increased their goodwill amongst Chinese consumers as they showed that they were able to have an independent, fact-based opinion.

Additionally, Skechers also has a strong brand presence in China’s cultural scene. Since their entrance into China back in 2008, Skechers has been actively supporting the domestic arts and performance scene by organising and sponsoring Chinese street dance activities. Consequently, Skechers is highly regarded as an active and youthful brand and one that is supportive of China’s cultural development.

In my opinion, Skechers has nailed the China expansion strategy where many foreign brands have failed. To win the hearts and mind of the Chinese consumer, Skechers already started to build a rapport with them since their entrance & continues to be active in contributing to the development of the society. As nationalism continues to grow in China, a brand that does good for the country and people will certainly have an elevated status in a consumer’s mind.

Strong Performance In China Proves That Skechers’ Strategy Is On The Right Track

Consequently, the success of this strategy has been reflected in Skechers’ financial and operational performances. For their e-commerce website Skechers.cn, it is the third best performing Chinese DTC sneaker site by sales, with over 500 new users daily. On Tmall, China’s largest e-commerce marketplace owned by Alibaba (BABA), Skechers tops both Nike and adidas in overall user rating at 4.5 stars compared to 3.5 and 4 respectively for the other two brands. In terms of follower count, the gap between Skechers and the top two footwear brands are also much more narrower in China than in the US or globally (using global app feedback/web traffic as a proxy).

Skechers, Nike And adidas Tmall Store Ratings (Tmall)

To top this, Skechers’ China revenue grew in FY21 compared to a decline for Nike & adidas, reflecting the financial success of Skechers’ well-positioned business strategy.

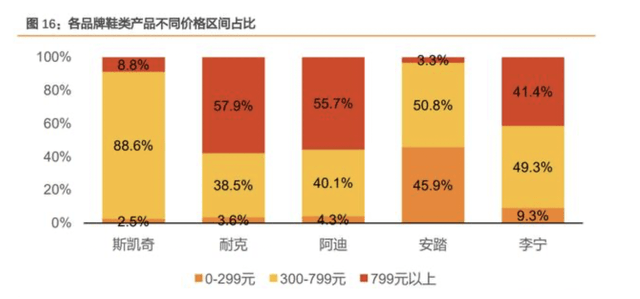

Finally, with a growing middle class in China, Skechers is also in a good position to capture the growth in consumerism as they have the widest proportion of mid-priced sports shoes in the country, even beating out local giants Li Ning (OTCPK:LNNGF) and ANTA (OTCPK:ANPDY). Hence, as income level increases in lower tier cities, Skechers will also have the strongest value proposition to consumers from a price perspective.

Skechers Vs Competitors Price Point In China (Baijiahao)

Therefore, I am extremely bullish about Skechers’ growth in China given its extremely successful business strategy and value-for-money proposition which extends to the Chinese market.

Owner-Operated Management Is A Plus

Management is always key to a company’s growth prospects. In the case of Skechers, the business is still ran by the two co-founders and I particularly like these types of businesses. Both CEO Robert Greenberg and President Michael Greenberg are founders of the company who have been with Skechers for over 30 years. This ensures that Skechers’ brand philosophy remains consistent and true to itself and that the leaders will be incentivised to grow the business responsibly since it is their creation. In total, the Greenberg family owns a combined ~5% of shares which is not very high but still supports my previous point.

Valuation

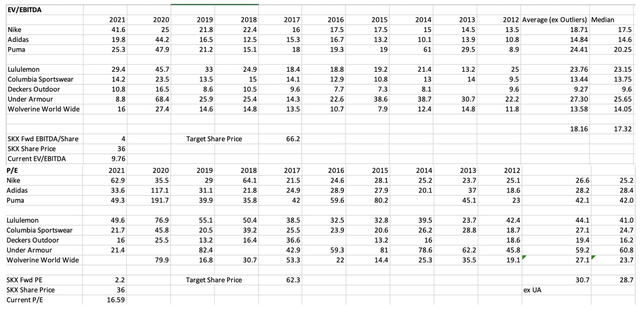

For valuation, I have combed through the 10Y historical P/E and EV/EBITDA multiples of Skechers’ sports shoes and athleisure competitors. After accounting for outliers, the following are my findings and calculations.

Skechers Comparable Companies Relative Valuations (Author’s compilations from finbox)

Using my forward EPS and EBITDA estimates as well as the lower of the average & median multiples, I obtain a blended average price of $62.3. Give a 33% MOS and Skechers’ is a buy below $43.1. At a price of $36, Skechers’ offers 73% upside with the prospect of 10-15% annual growth which is a rare value & growth company today. I will look to conduct a deep dive DCF in future for a more granular breakdown and valuation.

Conclusion

In all, Skechers is a fundamentally strong company that is now a value stock, yet one with huge growth potential. Furthermore, I believe that given Skechers’ strong value proposition to customers and nature of their shoes, it will hold up well in a recession and may even gain market share from its footwear rivals. Long term, Skechers’ DTC and China expansion is showing strong signs of promise and the company is well positioned to realise sustainable gains in these two categories.

Be the first to comment