designprojects

Brief Introduction

It was not too long ago that Archer Aviation (NYSE:ACHR) pitched its narrative. Safe, fast, cheap, and reliable transportation was possible. The firm was going to achieve this with its airborne fleet of taxis.

Besides, there was an underpinning need for the service, right? Public transport was dilapidated, transport connections sketchy at best, and the great re-opening saw a flood of commuters return to work.

As COP27 progresses, John Kerry has been parading around in his jet chastising nations, non-government agencies, and academics on meaningful environmental change required to sustain mankind. Nothing could be more fitting therefore than for our battery powered flying taxi venture to find itself at a crossroads between technological change & climate sustainability.

Yet, it’s hard to persist throwing accolades at an enterprise that has hardly taken off. Previously advertised end-of-decade sales forecasts of $12B appear vestiges of the past. With calls on first revenue heading into 2024, the timing is as ambitious as the economic climate somber. Luckily, deep pockets engineered from the Atlas Crest SPAC merger are present as a viable product, let alone a market, are some ways away.

I continue to remain bearish on Archer Aviation’s prospects. With too many stars requiring alignment for this venture to print rock star numbers, it appears like a money-making venture solely for initial backers.

Corporate imagery used to promote the organization’s mission statement does little to assuage my fears that the firm is more gloss than growth.

Company Overview

For those unfamiliar with Archer Aviation, I invite you to explore the firm here. The Palo Alto based flying taxi upstart is the product of the marriage with US investment guru Ken Moelis’ investment firm Atlas Crest.

Now almost 2 years public, not a lot can be shown of the enterprise save losses and assumptions. Originally inspired by its founders with aims to free up motorways, one can only wonder whether this is a viable, long-term solution or just displacement of a growing societal problem.

The company’s plight to debottleneck highways full of 4 seat vehicles by putting into flight 5-seater flying craft appears to have multiple flaws.

The firm’s value has moved to the downside ($670M) since maintaining a $1.6B flight level just last year. With the stock price giving up roughly 50% of its value year-to-date, analysts have penned in first sales ($28M) for FY 2024. How the firm then gets to $12B by end of decade is anyone’s guess.

Losses continue to occupy front stage with little hope of this shifting anytime soon. For investors underwater, little consolation is provided by the fact that product trialing has gained some momentum.

We have also seen a leadership shake-up with Brett Adcock stepping down from the day-to-day running of the organization. Likely to be perceived as part of any normal business transition, future investors will need to fully appraise Adam Goldstein’s ability to monetize the concept as any stake in Archer Aviation is a vote of confidence on his ability to do so. In any case, while a break-up between founders is nothing new, the separation is likely to add both cost and risk to the business in the short run.

Q3 Highlights

Archer Aviation has progressed on testing of the Maker demonstrator aircraft as it prepares for a commercial future. United Airlines, whose very own Oscar Munoz sits on Archer’s board, has announced an industry first with its eVTOL Newark Liberty Airport to Downtown Manhattan Heliport.

Still in its trial stages, questions abound as to how the firm can make such a hop profitable given capacity limitations. Only high prices or high volumes gets this commercial route over the line, particularly given direct competition with a multitude of product substitutes.

Archer’s production aircraft Midnight is yet to see light of day with FAA greenlighting and a final decision on manufacturing still off in the distant future. During Q3, the organization burned roughly $90M with the lion’s share going to research and development ($47M).

That’s a natural progression for a firm trying to get off the ground but questions could be asked of the quarterly $40M spend in sales, general & administration.

Regardless, the real wild card currently held by Archer Aviation is the $600M on tap. The firm is spared any adverse interest expense effects linked to tightening of credit markets. EBITDA continues to print red ink (-$86.4M) with this accelerating into the back end of the year.

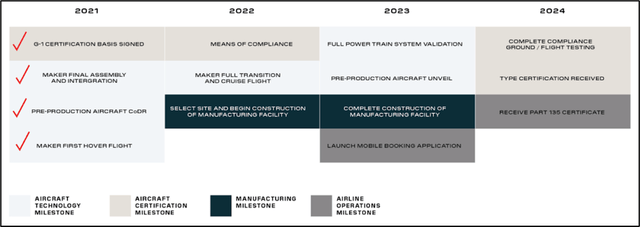

Current milestones suggest the business will have selected a manufacturing site and built it within a year. This screams schedule creep, and low industrial output while providing insights into Archer’s future business model.

Maker’s design remains quite novel with its 12 propellers attached to six booms and a fixed wing. The propellers assure both vertical lift and propulsion once the aircraft is airborne. The big question here is, what is the difference between Maker and a helicopter? Solely the battery?

Midnight – Archer’s production unit – will showcase a charging time of ~10 minutes and transport a pilot plus four passengers on select routes. Archer’s strategy of synchronizing aircraft design and FAA certification provides numerous risks. This validation process remains crucial for commercialization.

While no real final decision on manufacturing set up has been completed, the company has made inroads on site selection and discussions with local and state governments are underway. Product industrialization is starting to kick-off and the vendor base developed accordingly.

Financial Analysis

Operating expenses tallied circa $90M as mentioned previously. Hiring costs and raw materials were the major drag on company coffers. If at all any consolation to investors, year over year Q3 operating expenses were lower by $82M mainly due to a sizable decrease in stock-based compensation. (As a reminder, stock-based compensation was a staggering $123M in FY 2021).

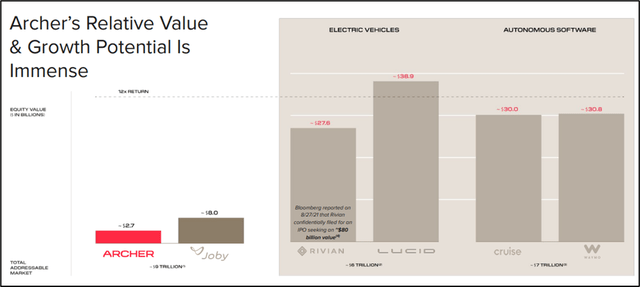

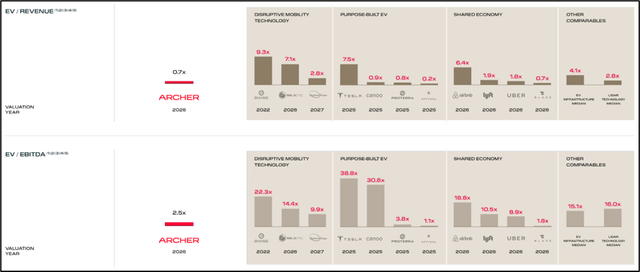

Archer’s pitch that its total addressable market is huge and its valuation low by making comparison to a bunch of overvalued EV players lays caution to the wind.

The company’s balance sheet is flush with cash (~$600M), providing the firm roughly a 2-year liquidity runway to get off the ground. While plant, property, and equipment are almost completely absent from the balance sheet, onerous cash outflows for manufacturing ramp-up are likely to be incurred into the new year.

Fortunately, the company holds little debt, shielding it against the adverse credit conditions recently witnessed as the Federal Reserve fights off eye watering inflation.

Key Takeaways

Risks are numerous for the fledgling flier. Total addressable market is unclear, the product yet to be certified, let alone industrialized and questions remain regarding consumer demand. If the aim is to debottleneck highways, doing so with small airborne helicopters appears incredibly naive.

Archer touts firm valuation as highly attractive but discounts it having a commercial business, existing market or safety-validated product.

But the mission is clear – debottlenecking road networks implies a democratization of helicopter travel, previously only the fiefdom of the rich. To achieve this, pricing would need to be competitive and volumes high (given aircraft capacity) In turn, this would imply moving a problem rather than eliminating it.

Archer Aviation’s future appears somewhat clouded. The industrialization process continues to be an unknown and while the firm has deep pockets, any large-scale industrial asset is likely to fritter that away. Valuation is tricky with the lack of a commercially viable product, little info in terms of real market and question marks on product suitability.

With capital markets seizing up under crippling inflation and macro-economic clouds on the horizon, it remains to be proven whether positive risk-adjusted returns are not more sizable elsewhere.

Be the first to comment