leungchopan/iStock via Getty Images

Investment Thesis

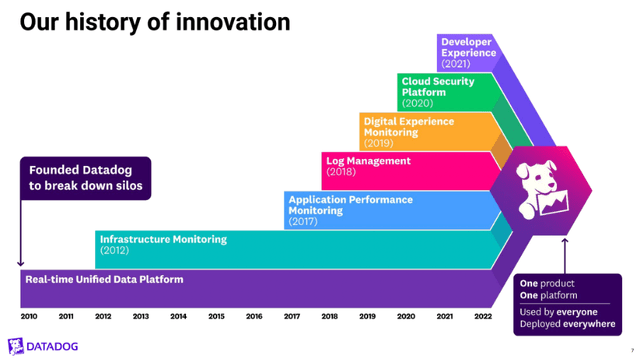

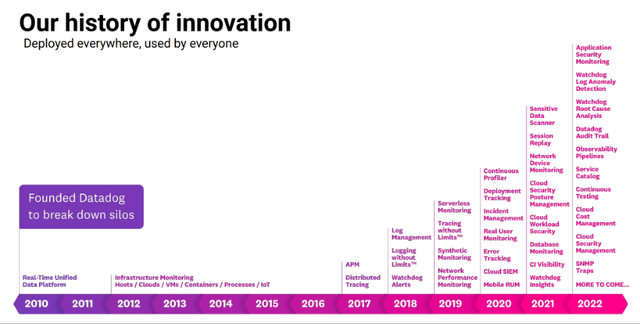

Datadog (NASDAQ:DDOG) operates an industry-leading cloud-native observability platform that provides unified, real-time observability of its customers’ entire technology stack. It was founded with the goal of breaking down silos between a businesses’ operations and its developers, since these two departments were often struggling to communicate and did not always see the same data.

Datadog November 2022 Investor Presentation

The company continues to execute extremely well, but it’s often difficult for investors without a tech background (such as myself) to fully understand its position in the industry.

Thankfully, there’s a few commonly used frameworks that rank each business within an industry, and one of the most popular in technology is the Gartner Magic Quadrant. The latest report came out in June 2022 for Application Performance Monitoring and Observability, and Datadog once again came out miles ahead of most other companies, alongside competitor Dynatrace (DT).

Datadog November 2022 Investor Presentation

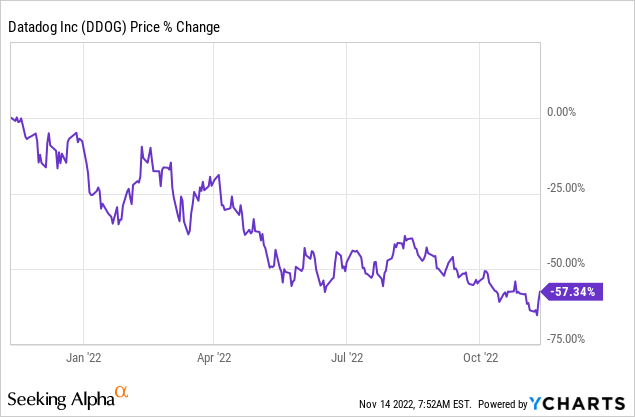

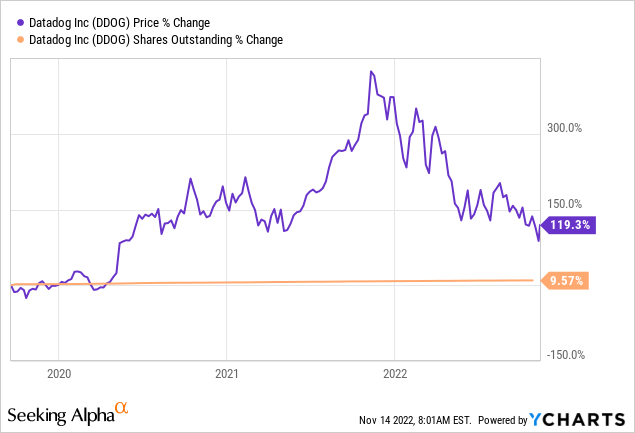

Datadog’s business has seen rapid growth over the past few years, and shareholders have been duly rewarded. Yet as all investors have been seeing, 2020 and 2021 were very friendly to technology businesses, whereas the current macroeconomic fragilities have proven challenging for many former high-fliers.

This partially explains why Datadog shares have tumbled by 57% so far over the past twelve months, and it left investors hoping for some positives when the company reported its earnings on Thursday, November 3.

So, how did Datadog do? Let’s take a look.

Datadog Q3 Earnings Overview

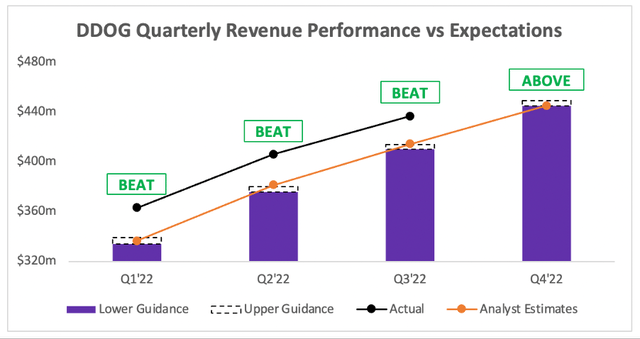

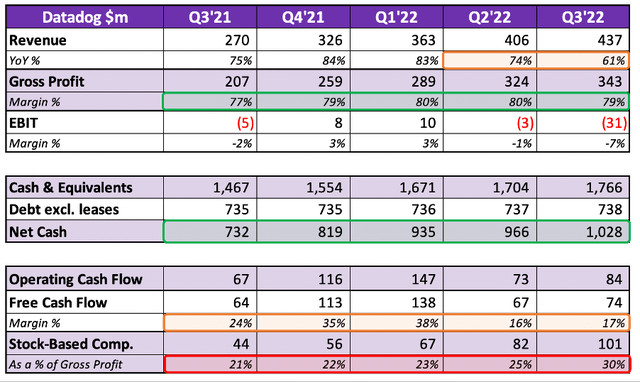

Starting from the top, Datadog’s Q3 revenue grew 61% YoY to $437m, coming in comfortably ahead of analysts’ estimates of $414m. This strong quarter continued Datadog’s impressive record of smashing past analysts’ estimates and growing at astounding rates despite the difficult macroeconomic environment.

Perhaps the most impressive part of Datadog’s Q3 results was not its revenue, but its billings, which grew 51% YoY to $466m compared to analysts’ estimates of $441m. These are an indicator of Datadog’s future revenue, and in an earnings season where bookings have been somewhat weak from ‘as-a-service’ businesses, this was a real show of strength.

As CEO and Co-Founder Olivier Pomel said on the Q3 earnings call:

Our sales pipeline is strong heading into Q4 for both new logos and new products. And we’re seeing great opportunities across customer sizes, geography and industry.

Moving onto outlook, and Datadog shareholders should know by now that this Q4 guidance will probably be comfortably beaten. That said, it still came in just above analysts’ estimates of $445m, as management guided for Q4 revenue of $445-$449m, which would imply YoY growth of 36-38%. I would not be too concerned by the apparent sharp slowdown in growth; the actual Q4 revenues will likely be much higher.

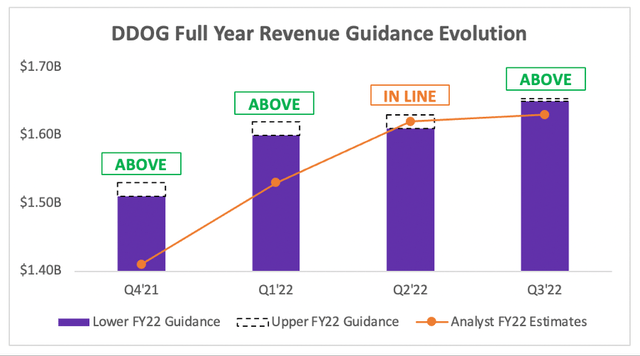

The combination of this comfortable Q3 revenue beat and stronger-than-expected Q4 guidance led Datadog to issue full year 2022 revenue guidance of $1.650-$1.654B, which implies YoY revenue growth of 60-61%, coming in ahead of analysts’ $1.63B estimates.

This was an improvement from Datadog’s Q2 earnings, when the company’s FY22 revenue guidance was only in line with analysts’ estimates – which, for a company like Datadog, is not necessarily good enough.

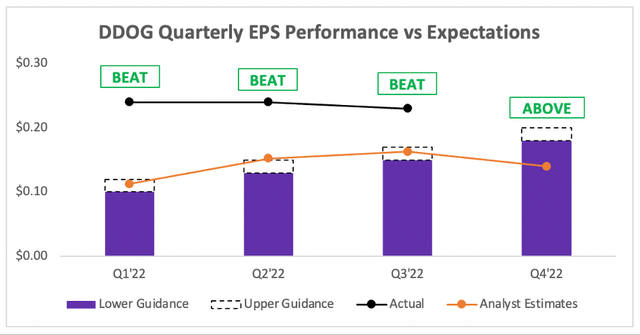

Moving onto the bottom line, and it was impressive from Datadog yet again. The company delivered adjusted EPS of $0.23, coming in ahead of analysts’ estimates of $0.16.

Even better, the Q4 guidance range of $0.18-$0.20 came in comfortably ahead of analysts’ estimates of $0.14, implying that Datadog continues to be producing margins that are ahead of Wall Street’s expectations.

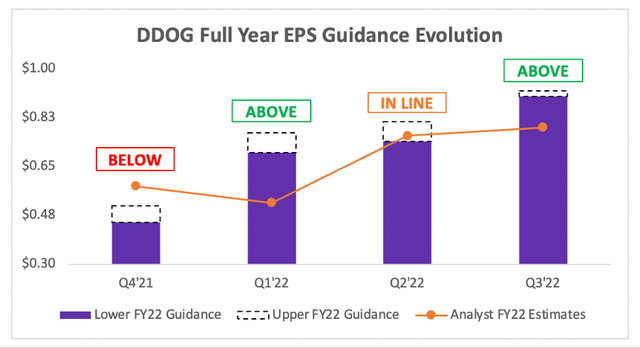

This all filters down to Datadog’s full year EPS guidance, which also came off the back of an average update last quarter. Management now expects the company to achieve EPS of $0.90-$0.92 in FY22, compared to analysts’ estimates of $0.79.

All in all, this was a strong quarter from Datadog when it came to the headline numbers. Unlike in Q2, there are zero items to pick at; everything came in ahead of management’s guidance and analysts’ expectations, with a nice raise on both the top and bottom line for Datadog’s FY22 outlook.

Customer Growth Stalls, But Upselling Remains Strong

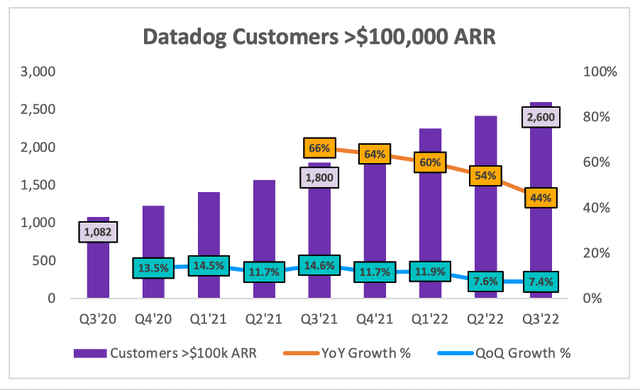

One key metric that I like to monitor with Datadog is the number of customers it has with more than $100k in annual run-rate revenue (or ARR). In fact, it was the slowdown in this growth, combined with headline numbers that were not as good as I’d hoped, that caused me to downgrade Datadog from a ‘Strong Buy’ to a ‘Buy’ in my previous article.

Looking at the graph below, that trend appears to be continuing. These large customers grew by 44% YoY to reach ~2,600 in Q3, which is still very impressive in the current environment, whilst also being a sharp slowdown compared to Datadog’s previous quarters.

Sequential large customer growth of 7.4% was even slower than in Q2, but given the carnage that I’ve seen among other reports this earnings season, I’m happy that Datadog was still able to add ~180 large customers.

Despite the slowing trends in large customers, I am far more optimistic than I was last quarter. This is driven by a few things, but in particular the billings growth of 51% YoY to $437m, which implies strong future revenue growth for Datadog even though it isn’t increasing large customer numbers as rapidly.

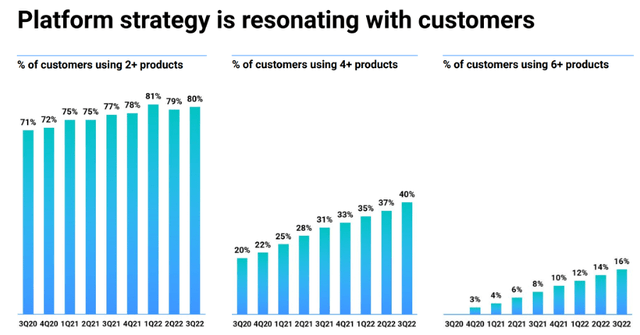

This company is able to achieve these figures thanks to its impressive ‘land-and-expand’ strategy, which was the core of my investment thesis. Once Datadog has successfully acquired a customer, and this customer starts to embed Datadog’s solutions into its business, then it becomes so much easier for Datadog to sell more and more solutions to this customer. Thankfully, this part of my thesis has been playing out.

Datadog November 2022 Investor Presentation

Aside from the fact that 80% of customers already use more than two Datadog products, the most impressive item above is the trend of customers using both 4+ and 6+ products, which reached 40% and 16% respectively this quarter.

Clearly this trend is heading upwards and shows no sign of slowing down any time soon, demonstrating that Datadog continues to upsell successfully to its existing customers – which will help to offset the slowdown in total large customers.

One of the most exciting aspects of Datadog is the company’s ability to continually create more and more solutions that its customers need, and the pace at which the company has been innovating seems to increase year after year, as shown below.

Datadog November 2022 Investor Presentation

And if you wanted some comfort that these solutions are actually useful, this is an extract from the CEO Olivier Pomel on the earnings call that’s worth taking note of:

I also want to highlight a couple of our newer products, Database Monitoring and CI Visibility. We started charging for these products three and two quarters ago, respectively, and each has already exceeded 8 figure in ARR and more than 1,000 customers. And as we are further developing them, we are confident these products will lead to a broader set of use cases for a larger set of customers over time.

Two of the newer products, Datadog’s Database Monitoring and CI Visibility, are bringing in more than $10,000,000 in ARR despite only being monetized for 9 and 6 months respectively.

Clearly, this business knows exactly how to land-and-expand.

Quick Take: Datadog’s Core Financials

It’s also worth taking a quick look at Datadog’s financials, starting with the trailing-twelve-month trends.

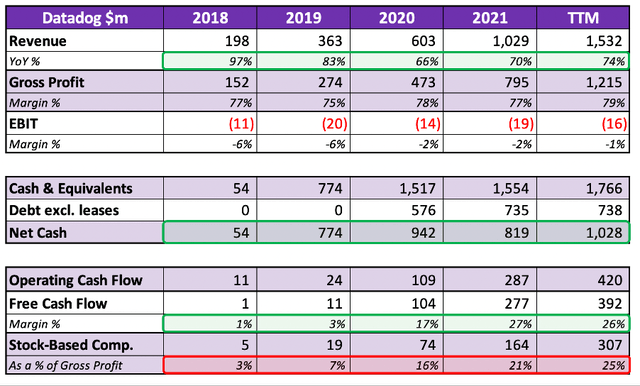

Datadog’s annual revenue growth continues to be stellar, achieving 74% YoY growth over the past twelve months, and not dipping below 66% YoY growth over the past few years – which is quite mind-blowing for a company that made over $1.5 billion in revenue over the past twelve months.

The overall financial profile of Datadog continues to be very strong, with more than $1 billion in net cash and free cash flow margins of 26%, as the company continues to print cash.

An issue that some investors will take is the fact that cash isn’t the only thing Datadog prints – the company also prints shares, and stock-based compensation continues to take up more and more of Datadog’s gross profit.

Long-term Datadog shareholders won’t be too disappointed, however, as shares have more than doubled since its 2019 IPO, with the total shares outstanding increasing by less than 10%.

Taking a look at the quarterly trend below, and I think that dilution rate may tick up over time, as stock-based compensation in Q3 made up a whopping 30% of Datadog’s gross profit. This is driven primarily by Datadog’s increase of its total headcount, and whilst I personally don’t mind stock-based compensation (since it does align employees with the long-term success of the business, and with us as shareholders), Datadog is starting to get into excessive territory. I, for one, hope this figure starts to make its way back to ~20% over the coming quarters.

The other notable item in Datadog’s quarterly financials is the revenue slowdown. Clearly this company cannot continue to grow revenue at over 60% forever, so I’m not too concerned, but investors should be aware that YoY revenue growth rates are falling pretty rapidly.

The growth rates remain extremely impressive, however, and in an investing environment where growth is hard to come by, Datadog could prove an even more attractive investment.

DDOG Stock Valuation

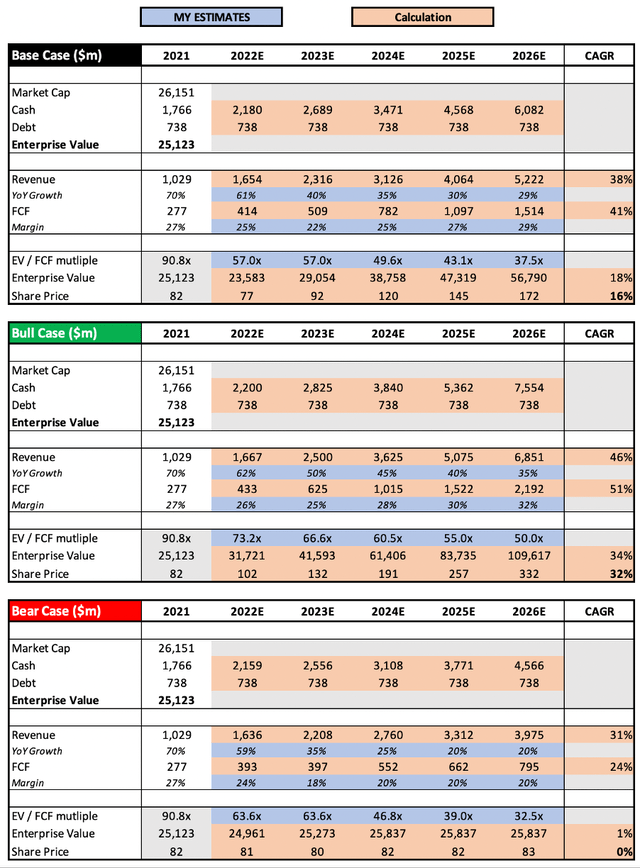

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Datadog is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

I have slightly changed my valuation model from the previous article to better demonstrate the potential upside and downside in my bull and bear case scenarios. The base case scenario remains similar, with the main change being that I have reduced my assumptions for Datadog’s free cash flow margins. The past twelve months show a slight downward trend, implying that the 2021 FCF margins may have been inflated due to unusually high demand and unsustainable scale.

The bull case scenario assumes that Datadog can continue its history of rapid growth, and given the number of successful products it continues to roll out I could certainly see this happening, achieving a revenue CAGR of 46% through to 2026. Alongside this would be greater operating leverage and margins, and Datadog would merit a higher EV / FCF multiple in 2026 due to increased potential growth for the future.

My bear case scenario effectively assumes the opposite, whereby Datadog’s growth tumbles in 2023 driven by a broad economic slowdown, and the company struggles to get back to its previously high growth rates.

Put all that together, and I can see shares of Datadog achieving a CAGR through to 2026 of 0%, 16%, and 32% in my respective bear, base, and bull case scenarios.

Bottom Line

I believe that Datadog continues to execute exceedingly well and remains miles ahead of (almost) all the competition. It has displayed once again an ability to successfully roll out and upsell new products, all whilst maintaining a gross margin that approaches 80%.

There remains the threat of a recession impacting Datadog, but I believe that this company will be a successful investment over the next decade. Given that my previous concerns of a slowdown were somewhat alleviated by strong billings this quarter, combined with the fall in Datadog’s share price, I will be upgrade my rating on Datadog from ‘Buy’ to ‘Strong Buy’.

Be the first to comment