GCShutter/E+ via Getty Images

This world of withering leaves and melting snow may not be a perfect world, but it’s the only real one.”― Marty Rubin

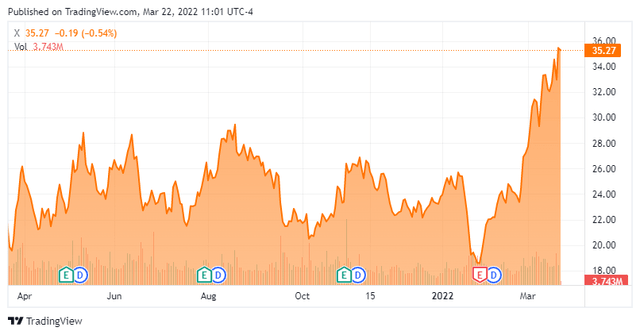

United States Steel (NYSE:X) has seen a sharp rise in its shares in recent weeks. Insiders have sold over $2.5 million worth of shares so far in March and there is also some substantial short interest currently in the stock. Signs this recent rally could fade in the weeks ahead. We attempt to answer that question via the analysis below.

X – Stock Chart (Seeking Alpha)

Company Overview:

U.S. Steel is one of the largest steel producers in North America and is based out of Pittsburgh. The company produces flat-rolled and tubular steel products, primarily for sale in North America and Europe. With the purchase of Big River Steel and the completion of their Fairfield, AL, mini mill in 2021, the company has achieved industry-best mini mill capabilities. The stock currently sells for just over $35.00 a share and sports an approximate market capitalization of $8.6 billion.

Fourth Quarter Results:

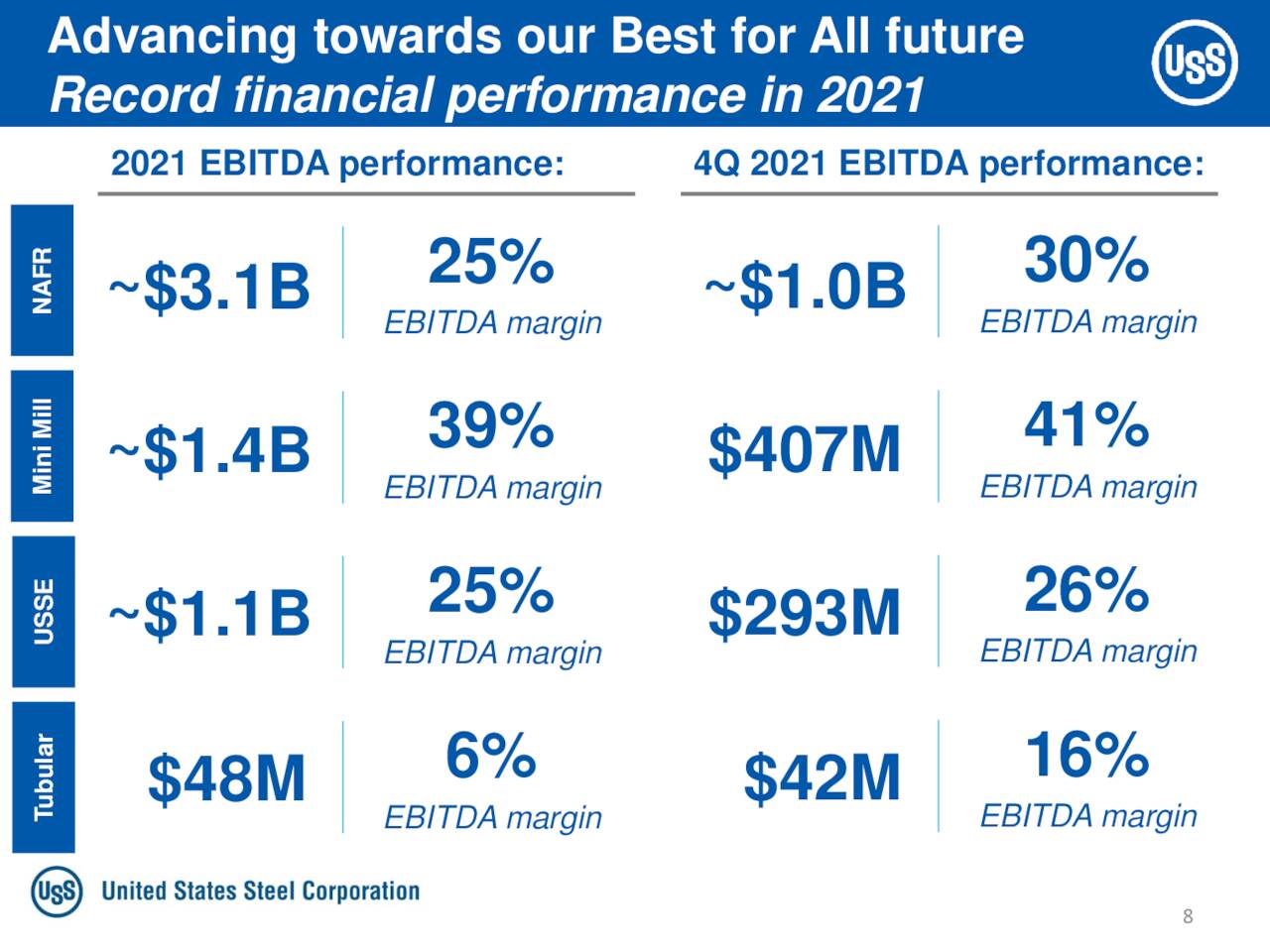

On January 27th, the company posted fourth quarter results. On a non-GAAP basis U.S. Steel earned $3.64 a share, which was approximately 60 cents a share below the consensus. Revenues rose nearly 120% from a year ago to $5.62 billion, some $270 million over expectations. Adjusted EBITDA for the quarter came in at nearly $1.73 billion.

Q4 & FY2021 Highlights (January Company Presentation)

In mid-February, the company’s CFO announced that she will soon step down even though she had been in the role less than a year. On March 17th, the company disclosed it now sees Q1 earnings in the $2.96 to $3.00 a share range. This is far below the $3.77 a share that was the analyst consensus at the time. Leadership blamed the shortfall on ‘~$150M related to the seasonal mining headwinds that occur each year in Q1, as well as increased raw material costs, and a larger than expected headwind from cautious spot market activity‘.

Despite these recent negatives, the stock has continued to advance. A primary factor in this counterintuitive move is the war in Ukraine. Morgan Stanley noted this two weeks ago when it upgraded the name from Sell to Hold and bumped its price target up ten bucks a share to $31. Morgan’s analyst noted at the time.

The current dislocation in the global steel market and rapidly increasing scrap/metallics prices may stop the ongoing steel price decline in the U.S. It may even result in steel prices bouncing from currently elevated spot levels of $1,000/st for [hot-rolled coil] due to the jump in raw material costs. U.S. Steel owns its own iron ore mines and is better positioned than peers to cope with rising commodity prices.”

The analyst also ‘expects higher raw material cost inflation for steel companies but he sees U.S. Steel coping better than peers given its vertical integration into iron ore and comparatively less exposure to electric arc furnaces.’

Seeking Alpha noted this morning that ‘Aluminum and steel stocks are surging as Australia banned alumina exports to Russia and Europe considers prohibiting Russian steel.‘

Analyst Commentary & Balance Sheet:

The analyst community is negative on the company prospects so far in 2022. So far this year, four analyst firms including Citigroup and as previously noted Morgan Stanley have Hold or Sell ratings on the stock. Price targets proffered range from $24 to $34 a share. Only GLJ Research ($42.75 price target) has reiterated a Buy rating on X so far in 2022.

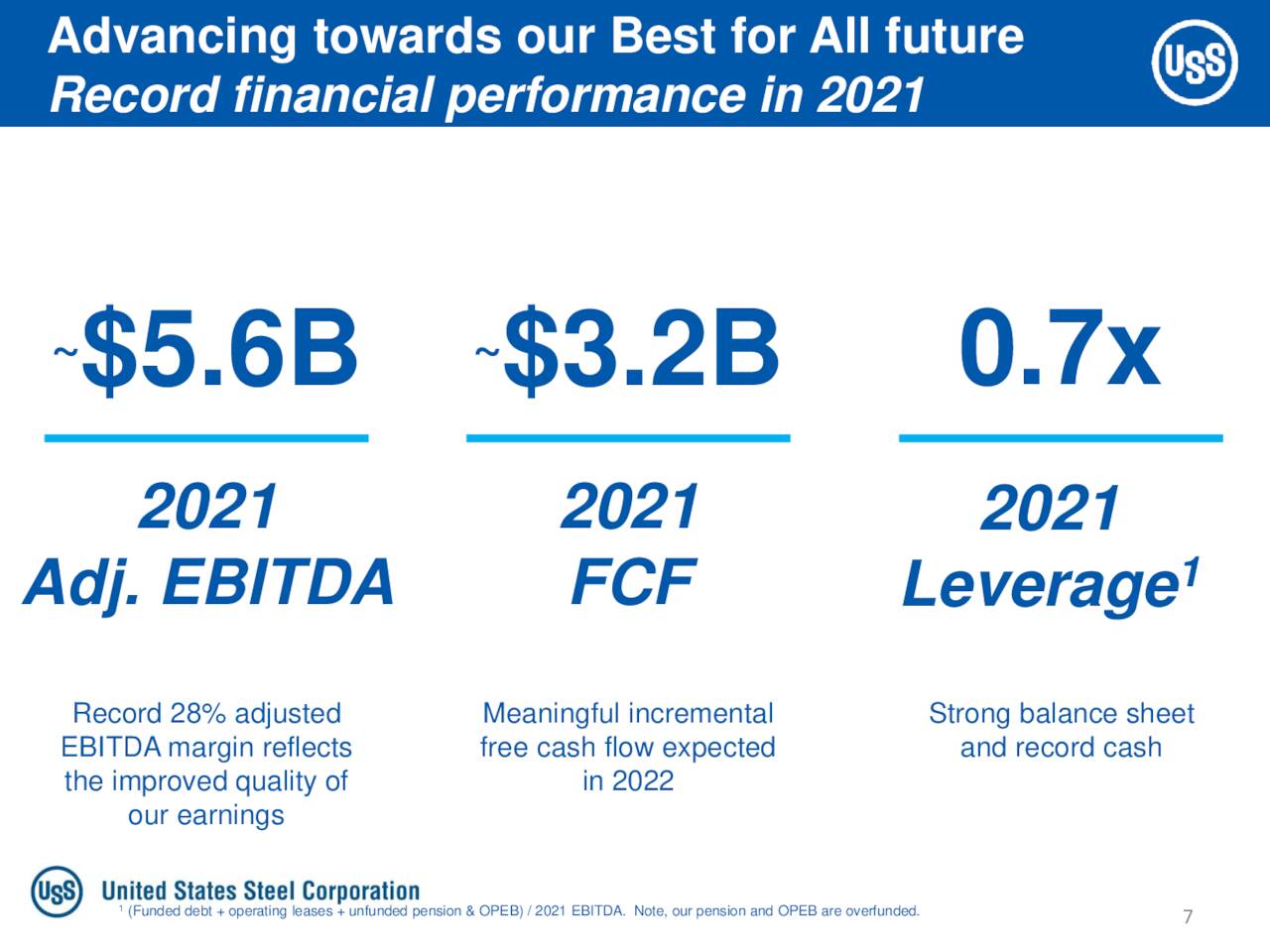

X – Balance Sheet (January Company Presentation)

Three insiders have sold just over $2.5 million worth of shares so far in March. None of them was the CFO that is resigning. This includes one company officer that disposed of nearly $2.2 million worth of stock on March 4th. This represented more than 80% of his current stake in the firm. In addition, over 15% of the outstanding float is currently sold short.

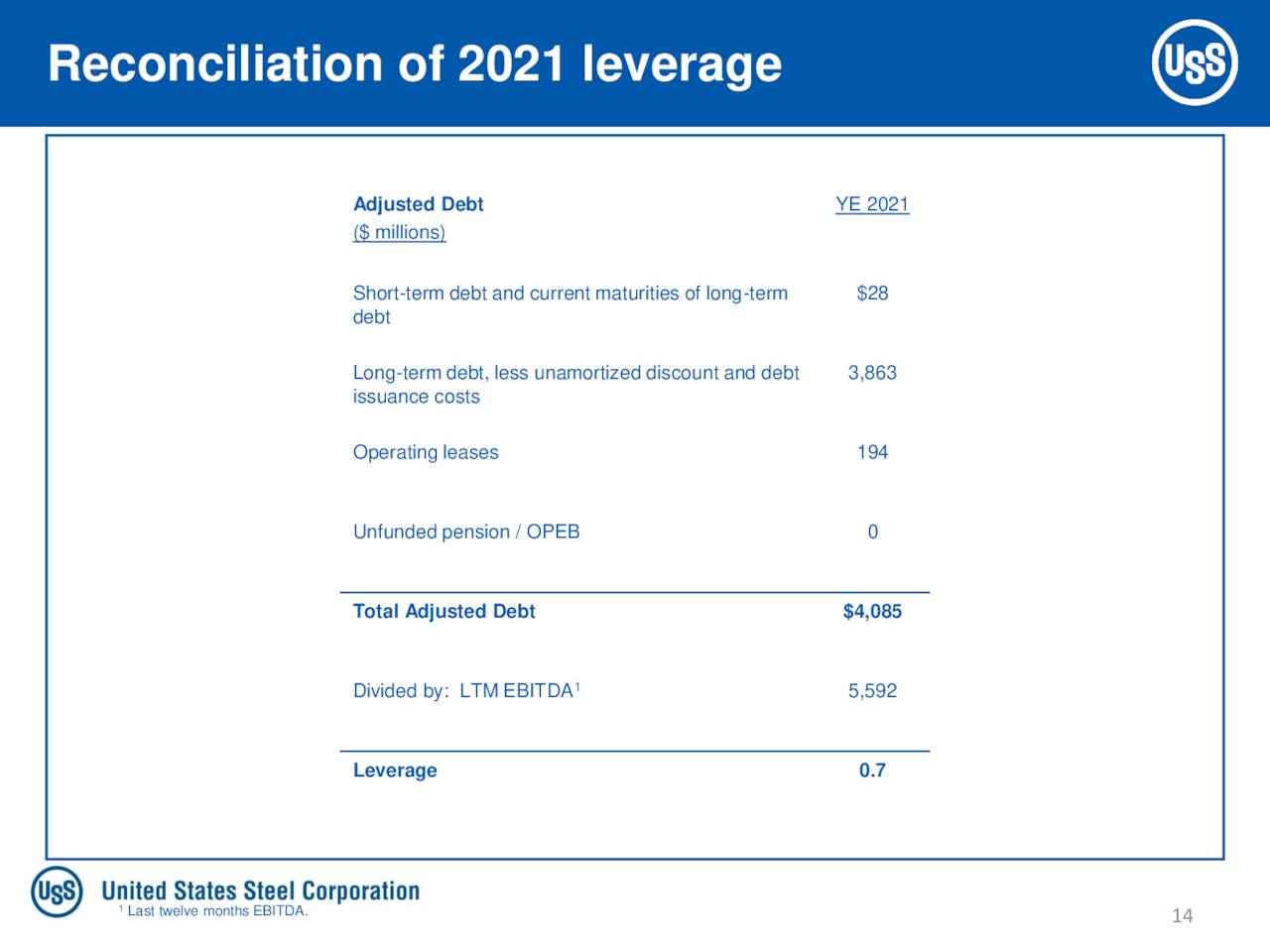

X – Balance Sheet Leverage (January Company Presentation)

The company ended 2021 with low leverage (.7X’s) on its balance sheet after producing over $3.2 billion in free cash flow in FY2021.

Balance Sheet Highlights (January Company Presentation)

Verdict:

The current analyst consensus is for U.S. Steel to make $10.40 a share of profits in FY2022 with a broad range of estimates ($7.75 to $15.50) as revenues remain flattish at just over $20 billion. Analysts see both earnings ($3.25 a share on average) and revenues ($15.5 billion) plunging in FY2023.

The stock is dirt cheap on a traditional earnings and cash flow basis. The company’s balance sheet also appears to be in rock-solid shape for a cyclical manufacturer. The question for investors is how long do good times last for the sector? U.S. Steel hemorrhaged money in FY2020, thanks largely to the pandemic, and was just over breakeven in FY2019 after making over five bucks a share of earnings in FY2018.

Despite the cheap valuation, I am not buying U.S. Steel. If/when the war ends in Ukraine or there is some sort of ceasefire, commodity stocks like Mosaic (MOS) and U.S. Steel which have benefited from the impacts of that conflict are very likely to give up a decent portion of those gains. This is why only one analyst firm has a price target above the stock’s current trading levels.

Giving alms to the rich is a luxury no beggar can afford.”― Marty Rubin

Bret Jensen is the Founder of and authors articles for The Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment